Intrinsic Value Assessment Of Match Group, Inc. (MTCH)

By Robert Leonard From The Investor’s Podcast Network | 12 April 2021

INTRODUCTION

Match Group, Inc. (“Match”) (Ticker: MTCH) is an industry leader in online dating. It is a holding company for a portfolio of over 45 brands of online dating products and services that generates nearly all revenue from user fees, with a small percentage from advertising. The most popular brands and products in its portfolio include Tinder, Match.com, OkCupid, PlentyOfFish, and Meetic.

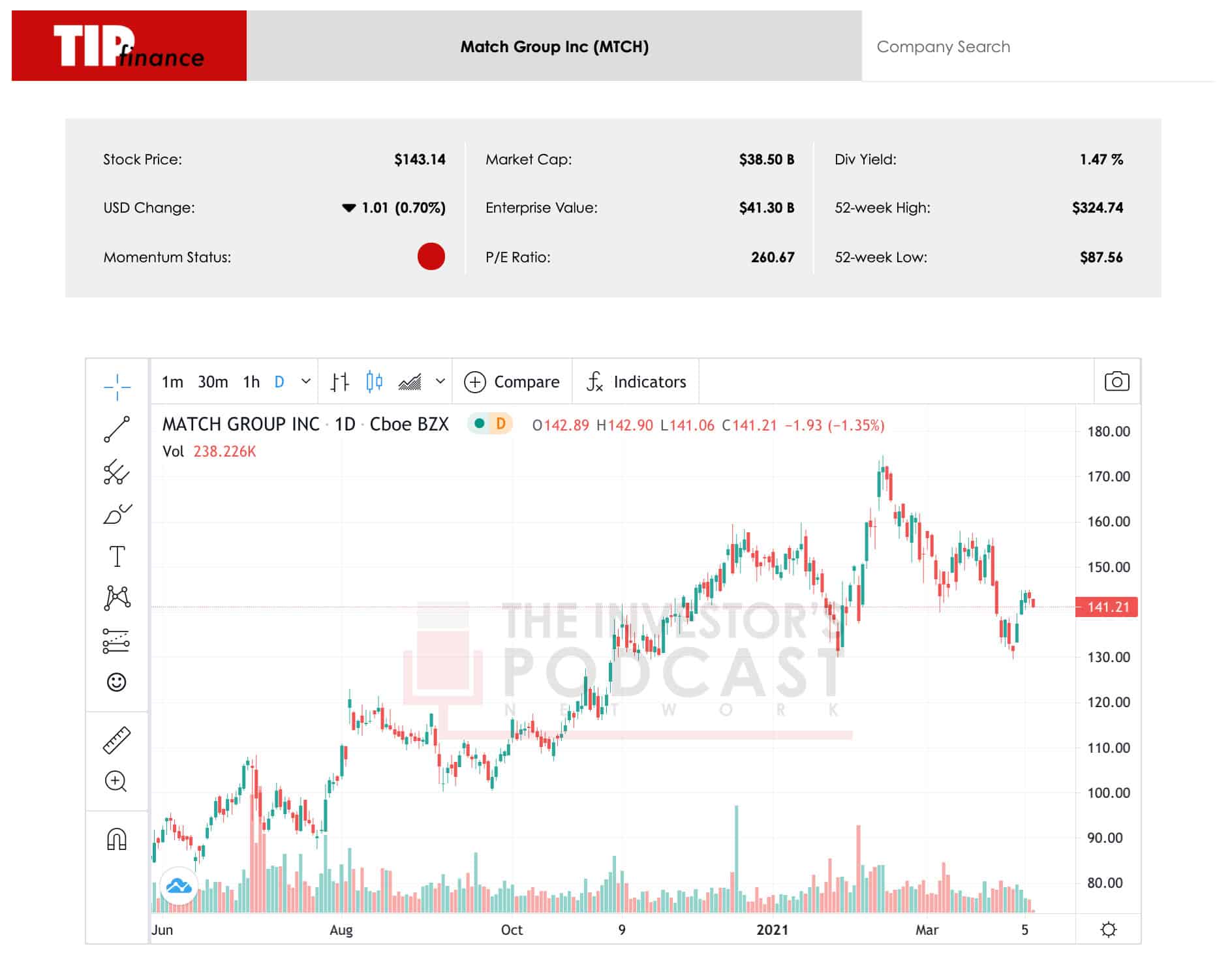

At the time of writing, Match’s market capitalization is about $38.5 billion and its revenue and cash flows for the 2020 fiscal year $2.4 billion and $760 million, respectively. Currently trading at $143.14, the stock has hit a 52-week low of $87.56 and a 52-week high of $174.68.

I personally have been fascinated by the business model of online dating platforms and services for some time now. Being of the generation I am, I have been able to see firsthand the growth of online dating and services such as Tinder, Hinge, and OkCupid. Years ago, it was quite clear to me that the trend towards online dating was only going to get stronger. Today, I want to do a deep-dive into one of the industry leaders in this space to see if there is a potential investment opportunity to take advantage of this trend.

The question is, at today’s price of $143.14, is Match’s stock undervalued?

INTRINSIC VALUE OF MATCH GROUP, INC.

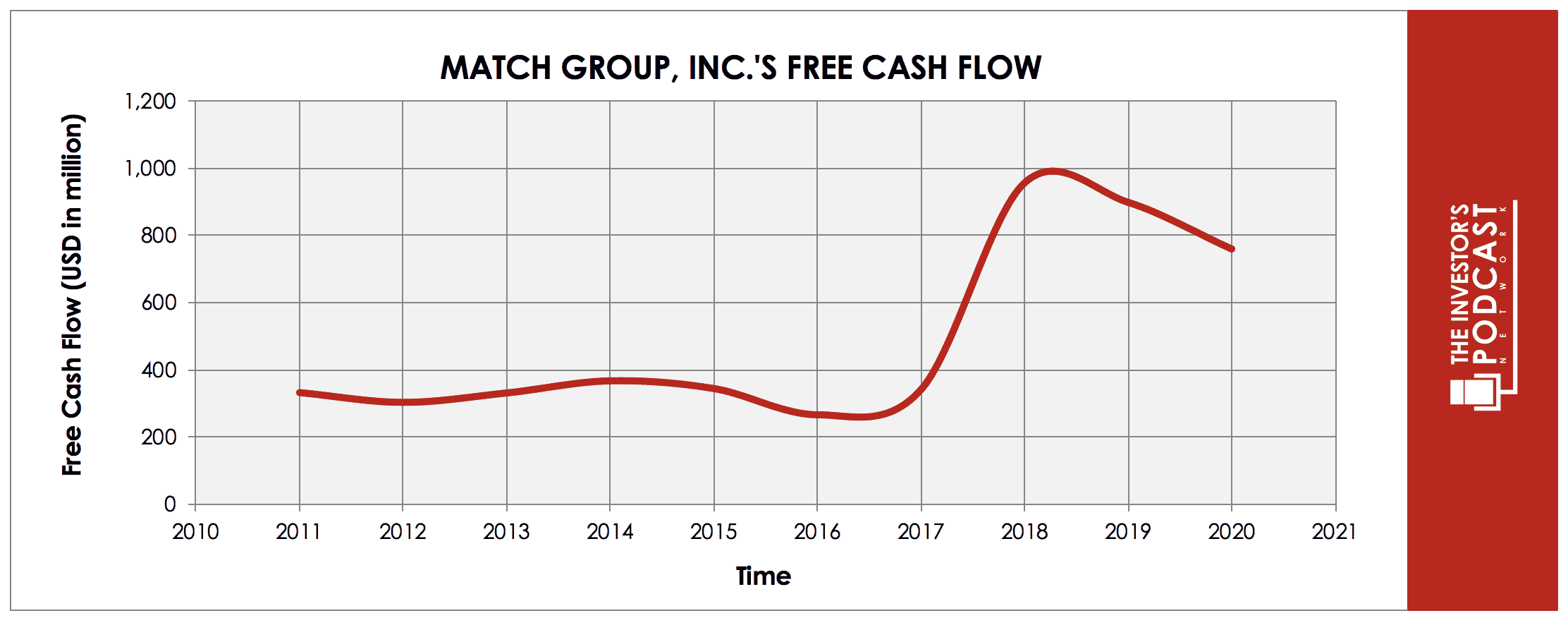

When it comes to valuation of Match, it is an interesting company. It is often valued as a tech company, but is quite profitable and generates a lot of free cash flow, unlike many tech companies we see in the market today.

At its core, it is a software company with a SaaS business model and its margins illustrate this. It is not uncommon for Match to have gross margins of 73-80%, as well as free cash flow margins of 30-35%.

Its profitability and cash flow generation makes it a good candidate for using a DCF model, but the market often awards it a lofty valuation and elevated multiples, which make the company appear expensive on a traditional basis, using a DCF model.

Let’s take a look at a DCF model for Match.

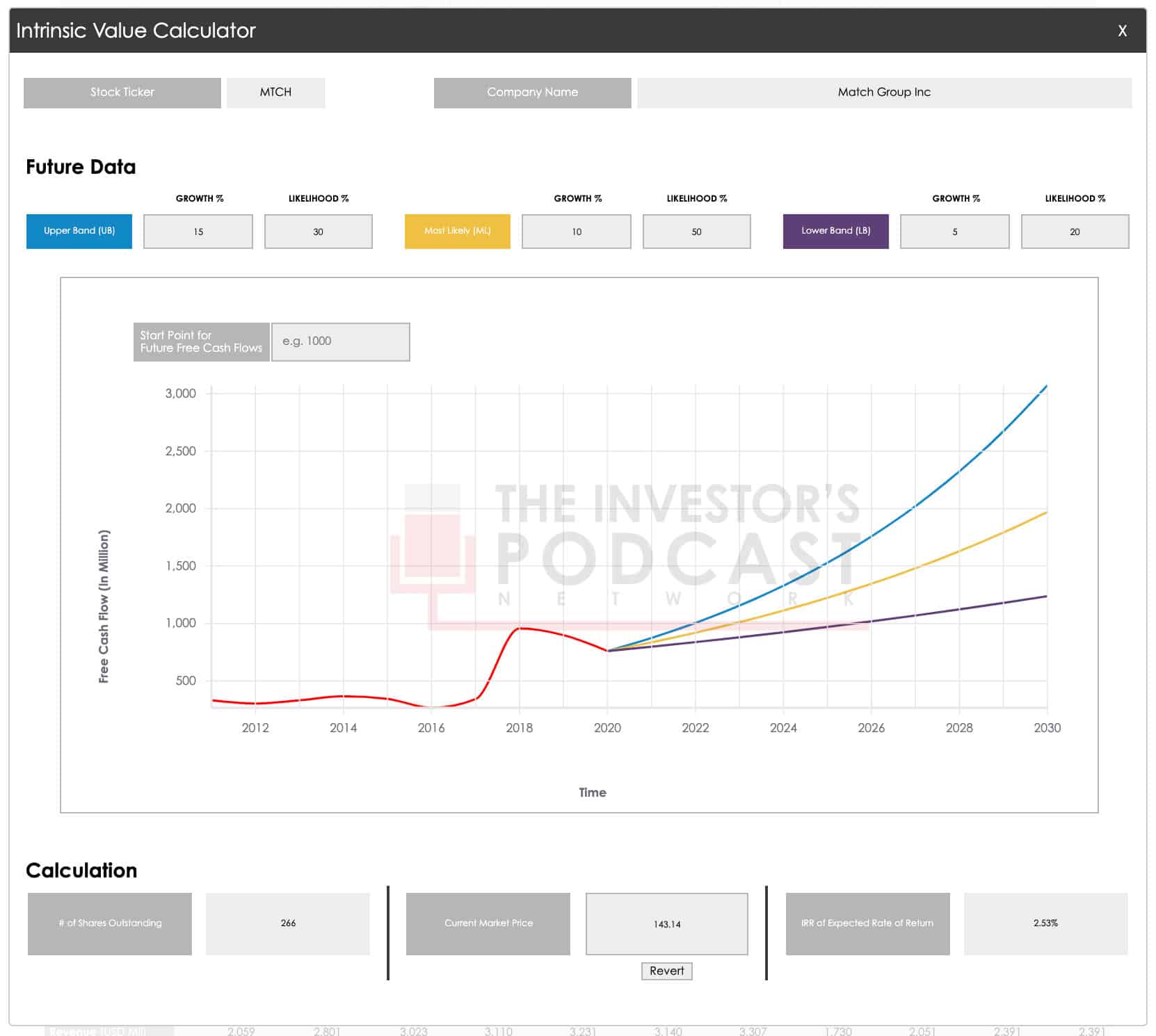

This DCF model was run in our TIP Finance tool with three potential outcomes for Match’s free cash flow being modeled. Each free cash flow outcome was modeled with an independent percent chance of occurring, which was used to arrive at the expected annual rate of return over the next 10 years at today’s price.

For the Upper Band (“UB”), a 15% growth rate was assumed with a 30% chance of occurring. For the Most Likely (“ML”), a 10% growth rate was assumed with a 50% chance of occurring. For the Lower Band (“LB”), a 5% growth rate was assumed with a 20% chance of occurring. At today’s price, that results in an expected annual rate of return over the next 10 years of 2.53%.

Admittedly, the growth and likelihood percentages used in the model above are quite optimistic. They’re attainable, and realistic, but they certainly are not very conservative. Even with optimistic input variables, the stock is only priced to return about 2.53% over the next decade.

We can also use multiples to come to a relative valuation for Match. This approach does not give you a specific expected annual return, as a DCF model can, but what it can give you is a general idea as to whether or not the company is overvalued, undervalued, or fairly valued, when compared to its own historical norms and the S&P 500.

The 5-year average Price/Earnings ratio for Match is 52.9x, while it currently stands at 72.8x. For Price/Sales, the 5-year average is 3.5x and today it stands at 14.8x. On a free cash flow basis, the 5-year average is 24.8x, while today it is at 44.0x. By looking at this quick comparison of today’s valuation multiples versus 5-year averages, we can see that Match is not technically “cheap”. What if we compare it to the S&P 500?

It doesn’t get much better. The S&P 500 currently trades at 28.9x, 3.0x, and 17.1x, for Price/Earnings, Price/Sales, and Price/Cash Flow, respectively.

In addition to comparing Match’s current valuation to its own historical averages and the S&P 500, we could also compare it to its industry average. However, the issue with this approach for Match is that there aren’t really any viable industry comparisons. One might argue that it is a tech company and could be compared appropriately to other tech companies. I would disagree.

Is a tech company that produces enterprise software the same as a company that produces online dating software? They’re similar, but each company’s products have a different type of end consumer, which changes the risk profile and future outlook. Changes in risk profile and future prospects have a large effect on the valuation multiples companies receive.

Match does have one publicly traded competitor — Bumble, Inc. However, Bumble is a very newly-public company and is about ⅙ the size of Match. These characteristics also make it difficult for an apples-to-apples comparison.

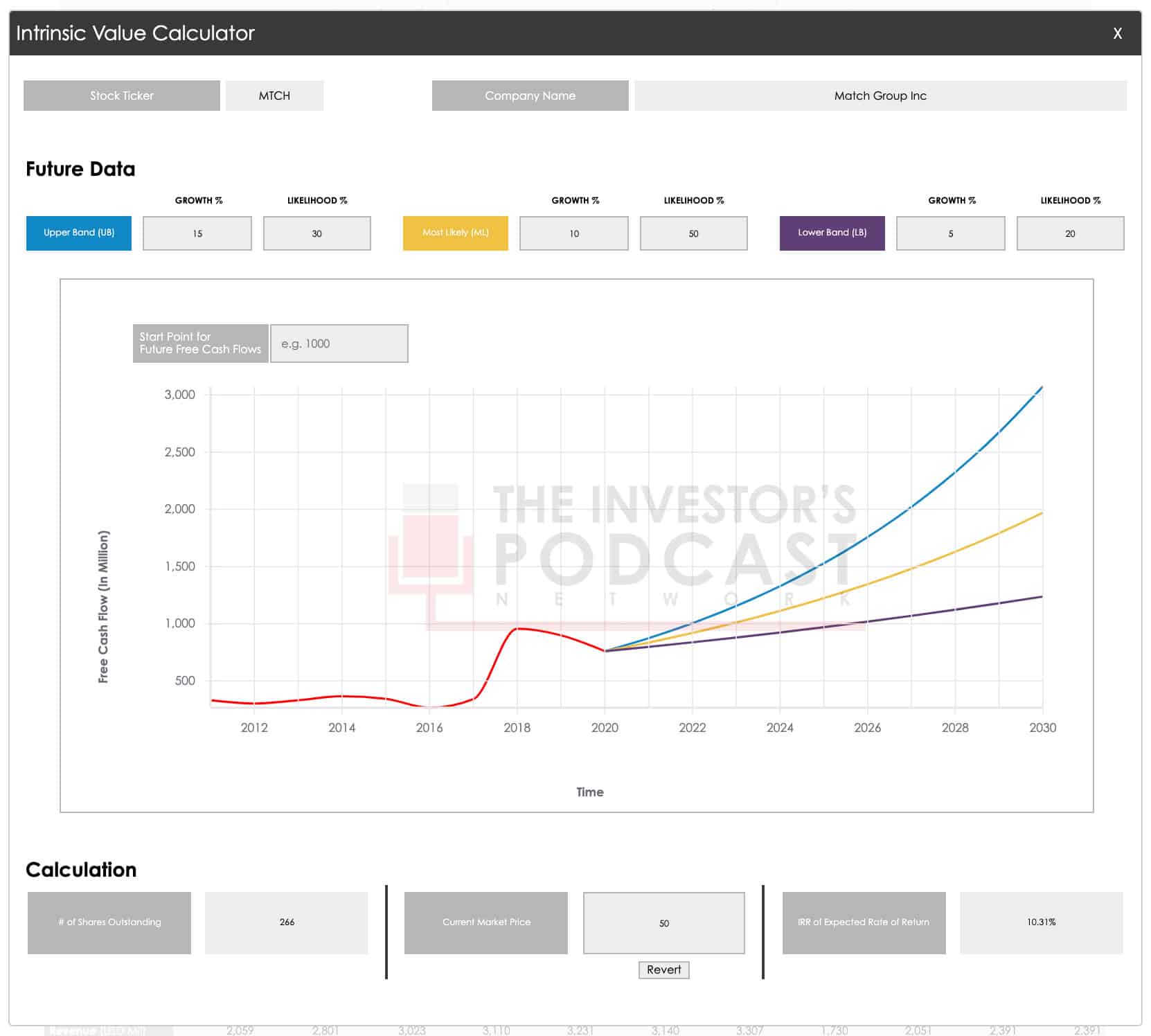

Let’s take a look at a second DCF model. We will review how price impacts returns, and why price is so important. We will circle back to this at the end of the research report in the Summary section below.

In this model, we held all assumptions constant from the first model. However, rather than keeping the purchase price constant, at the current market price of $143.14, we’re going to adjust our purchase price to $50, approximately the price you could have purchased Match stock at during March 2020 lows.

In our initial model, our calculated expected annual return was 2.53% at today’s market price. When we adjust the purchase price to $50, the expected annual return jumps to 10.31%!

You might be saying, “well, hindsight is 20-20”. If you are, you’re right in a sense, but more importantly, what I’m illustrating with this price example is that the price you pay is very important. I’m not saying that you’ll always be able to time market lows. In reality, no one can time the market.

However, what I hope I am helping you see is that, with a bit of patience, you may be able to wait for a pullback in a stocks price, whether it is Match or a different company, before you buy in, which can significantly impact your returns.

MATCH’S COMPETITIVE ADVANTAGES AND OPPORTUNITIES

Match fell quite short for me on the valuation. It also falls short for me on its future opportunities, but does have a few competitive advantages to grow off of. Here Match’s competitive advantages:

- Market share/market dominance. Buffett has said there are few things he likes investing in more than monopolies. Well, Match is about as close to a monopoly as you can legally get. It has a stronghold on the online dating industry and typically tries to acquire anything in its way, with Bumble being the exception. This makes it difficult for any new entrants to compete or steal market share from Match. It’s not impossible, but its market share and market dominance certainly makes it difficult for potential entrants and competitors to dethrone Match.

- Brands. As part of its market dominance, Match has nearly every major well-known brand in the online dating industry in its portfolio (again, Bumble as the exception). If you ask nearly anyone which online dating apps they’re familiar with, almost everyone would be a Match subsidiary. When it comes to meeting people online, whether it’s due to safety or effectiveness, people use apps with brands they know and trust.

- Network effects. This is arguably Match’s strongest competitive advantage. An online dating platform inherently requires a network effect to scale and be successful. If you are using a dating app, but very few other people in your area are, it’s not very valuable in terms of meeting anyone — it has a weak network effect. However, as an app’s user base grows and more people in your area are using it, it becomes more valuable, and you are incentivized to use it, too — illustrating a strong network effect. Match still has a little room to grow in this respect, but it already has the largest network effect in the industry, giving it a significant competitive advantage over competitors and new industry entrants.

The competitive advantages above are real advantages Match holds, although they are all quite related and could all disappear at the same time. These competitive advantages could be made less worrisome by large opportunities ahead. However, I don’t see major opportunities for Match ahead. That’s not to say it doesn’t have any opportunities, as it does have a few that we’ll talk about below, but they’re not business- or future-changing opportunities.

- Doubling down on what works. A lot of successful business leaders talk and write about how important it is for businesses to double down on what works — put more time, energy, and money into what is actually working. We even talk about this a lot internally here at TIP. This is an opportunity for Match. It has a business that has been around for a while that is working well. To put it simply, they need to continue doing what they’ve been doing, and continue trying to do it even better. This is an opportunity for the business, and investors, as management finds ways to continue to make the business more efficient, profitable, and convert better.

- Better conversions. On the surface, Match’s user base is growing strongly. However, it’s shown in the details that most of these users are free users and Match hasn’t been doing a great job of converting them to paid users. Match’s user growth is good, but there is a big opportunity for it to improve its sales tactics and improve its conversion rates. If it is able to materially improve its conversion rates, this could be a big growth opportunity for Match.

- Acquisitions. It’s no secret that Match is a serial acquirer. It has developed a few brands in house and grown them, but overall, the majority of the major brands in its portfolio have come from acquisitions. I expect it will be difficult for new brands to grow to a large enough size that an acquisition would make a material impact on Match’s business, but over time, if it is able to add smaller brands consistently, it could add up to a large growth driver for Match.

- Additional services. If you used Match’s products/services five years ago and compared it to today, you’d notice it has added a lot of different services to its platforms. There is going to be a point in which Match can’t add any more paid services to its platforms without over saturating it. However, I don’t believe it has hit that point yet and there are opportunities to add new services to increase revenue.

- Broad online dating growth. This is the opportunity that turned me on to Match in the first place. It’s not always just about the company itself — it’s sometimes the tailwinds from trends that propel companies to new heights. Years ago, online dating was very taboo and frowned upon. Today, it’s the norm, and I suspect the trend towards online dating will continue. If it does, there are few companies better positioned to benefit from that trend than the industry leader — Match.

RISK FACTORS

Although Match has competitive advantages and opportunities ahead, it is not without risks that could negatively impact the company and/or prove our financial models to be inaccurate. The major risks for Match going forward are:

- Valuation. We discussed this at length above in the Intrinsic Value of Match Group, Inc. (MTCH) section. This isn’t necessarily a risk for the business of Match itself, rather it is a risk for investors considering starting a position in Match at today’s prices.

- Bumble/competition. In a few of these risks, we’ll be somewhat going against some of the competitive advantages discussed above. It is true, Match has market share, brand, and network effect competitive advantages. However, that doesn’t completely remove the risk of current, and future, competition. Bumble is about ⅙ the size of Match, so it doesn’t pose an immediate threat, but it is growing, and could become an issue in the future.

- Lack of acquisition opportunities. Furthermore, what could be troublesome for Match is that Bumble declined Match’s acquisition attempt. Bumble chose to go it alone and try to compete with Match, which they’ve done successfully, and even recently IPO’ed. Formerly, new entrants to this industry likely felt they couldn’t compete with the behemoth of Match, so they would opt to sell rather than compete and fail. Bumble proved to future industry entrants that it is possible to compete against Match. This could not only increase Match’s competition, but also reduce its opportunities for acquisitions.

- Lack of stickiness and switching costs. There is very little stickiness and switching costs for users of Match’s dating apps. A user can switch between dating apps simultaneously without noticing much difference. On the brightside, if a user leaves one of Match’s dating apps for a different dating app, it is likely going to another one of Match’s subsidiaries, given its broad reach. However, as more competitors rise and platforms like Bumble become more popular, there could be an issue for Match with its lack of stickiness and switching costs.

- Fake profiles. There has been a rising concern of fake profiles on dating sites. This significantly hurts the users experience and could turn them off from the platform altogether. In addition to news reports and court cases surrounding this idea, I have heard anecdotally from users of Match’s platforms that this is a massive issue and significantly dilutes the user experience. Even when opting for a paid subscription, fake profiles dominate the benefits you’re receiving as a paid user. Meaning, you’re paying for fake profiles — not a great user experience.

- Issues with online dating. Online dating platforms are heavily dominated by males, with nearly 2-3x as many males on dating apps as females. This often causes dissatisfaction amongst male users. To further the issue, the females that are on the platform are often victims of harassment. Almost half of female online dating app users have reported that other users would continue to contact them after they have stated they were not interested. Of course, this doesn’t lead to a pleasant user experience for either gender, but furthermore, it causes females to leave the platform. As females leave the platform, generally speaking, there will be less incentive for males to join. Then, rather than network effects working for Match, they begin to work against them.

- Freemium model. Match’s user growth is often touted in financial headlines. However, when you dive into the details of this, its growth is predominantly driven by free users. Free users are valuable in the sense that they could convert to paid customers in the future, but until then, the growth in user base isn’t massively valuable. Match has had a growing issue with converting free users to paid. This could be because its freemium model is failing — its free offering may be “too good” and users may not feel they need to pay for the additional services. The freemium model works quite well in the gaming industry, but it might not be the right solution for online dating.

SUMMARY

Match is a conglomerate software company made up of a portfolio of the world’s most well-known online dating brands. It has margins and free cash flow generation like a tech company, but it is not without risks.

It is possible that Match successfully doubles down on what works, gets better at converting free users into paying subscribers, acquires up and coming dating apps, adds new revenue-generating services, and benefits from the overall trend and growth in online dating.

However, it is also possible that investors realize Match’s valuation is quite lofty, Bumble becomes more of a threat, new competitors hit the market and choose to not be acquired by Match, users bounce from platform to platform due to no switching costs, fake profiles and issues with online dating get worse, and the free features of online dating sites continue to be “enough” for most users, making it difficult for further monetization.

After reading this investment report, you’re probably wondering – do I buy Match’s stock? Well, it’s not quite that simple, and of course, I cannot give specific investing advice, but I will walk you through how I am personally thinking about Match as an investment.

I often talk about how I was so wrongly approaching value investing when I first got started. I thought I was a value investor by strictly buying companies that looked “cheap” based on my DCF models. I assumed, if my DCF models said the stock was cheap, it was a buy, and I was buying an “undervalued company”. I quickly learned this was not true value investing and that just because I input my assumptions into the DCF model, that didn’t mean they were right or that the market would agree with me.

But remember, that is purely quantitative and does not take into consideration the future of the business and its qualitative aspects. What I did wrong early in my investing career was exactly that — I did not look at non-financial aspects of the business, nor did I try to think logically about the future of the company and its industry.

Having learned from those experiences and growing as an investor over the past eight years, I now spend significant time considering the future prospects of a business and its industry. With companies I analyzed previously, I was often more concerned about the company-specific risks than I was with the industry. In the case of Match, I am more concerned with the company-specific risks than I am with the industry.

When it comes to the online dating industry, I tend to believe the trend and move towards online dating will continue, and likely grow. I’m interested and intrigued by a potential investment opportunity taking advantage of that trend. However, I am not so confident that Match is going to be the clear winner here. I’m mainly worried about its current valuation. At a significantly lower price than it trades at today, with no deterioration in its business model or the industry’s future prospects, I might be interested in investing in Match.

The other piece I consider when thinking about Match as an investment is opportunity cost. It is not enough to simply analyze a company in a vacuum and make an investment decision. Investors must compare their expected return of one investment to that of another option available. Your dollar can only be invested in one place at a time — choosing the optimal place for that dollar to be invested is equally as important, if not more important.

Lastly, along with the current valuation, I am looking at the current momentum of Match’s stock. According to our TIP Finance Momentum tool, Match is currently red, meaning it has negative momentum. This tells me the stock may trend downwards in the near future and there may be a better buying price on the horizon. Momentum is no guarantee, but it can help investors avoid buying as the stock continues to fall.

The bottom line is that Match operates in an industry I am very interested in and has strong tailwinds pushing it forward. However, the company itself has risks that I am quite uncomfortable with, mainly its valuation. Should the contract to levels in which I believe there is a margin of safety, without any material negative change to its business model or the industry, I would then consider entering a position in Match. Until then, for me personally, Match will remain on my watchlist in the TIP Finance tool, with email notifications on.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclosure: The author, Robert Leonard, as of this writing, of the companies mentioned, only holds a long position in Square, Inc. (SQ), with no intentions of initiating a position in any other company mentioned in this article within the next 72 hours. The article was written by himself, and it expresses his own opinions. He is not receiving compensation for it (other than from The Investor’s Podcast Network). He has no business relationships with any company whose stock is mentioned in this article. The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock. Robert is not a financial advisor. Please always do further research and do your own due diligence before making any investments.