Intrinsic Value Assessment Of The RMR Group Inc. (RMR)

By Ladislao Zichy Thyssen From The Investor’s Podcast Network | 23 June 2020

INTRODUCTION

The RMR Group Inc. is an asset manager with over $32 billion of assets under management. Their primary business model is managing the day-to-day activity of publicly-traded REITs. The RMR Group Inc. earns fees through an AUM fee as well as an incentive fee for outperforming the REIT indexes. The RMR Group Inc.’s stock price is $30.33 and has a market capitalization of $940 million. This company trades at nearly 20% last fiscal year’s free cash flow even though it has $377 million in cash with no debt in its balance sheet. The RMR Group Inc.’s profit last year was $76 million resulting in a PE of 13.

The recent poor performance of the stock seems to be discounting the structural change expected to occur in the commercial real estate market. Furthermore, a drop in revenue is expected over the coming few years as incentive fees stay near zero. However, given the strong fundamentals of this business, the expected return for the coming years is 14.4%.

- Business Overview

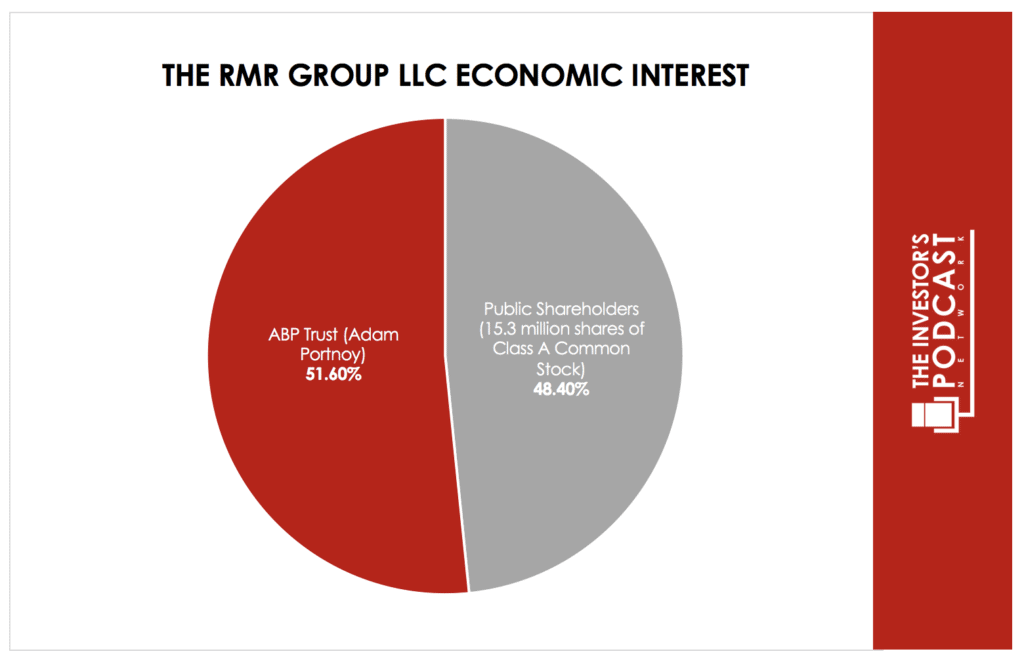

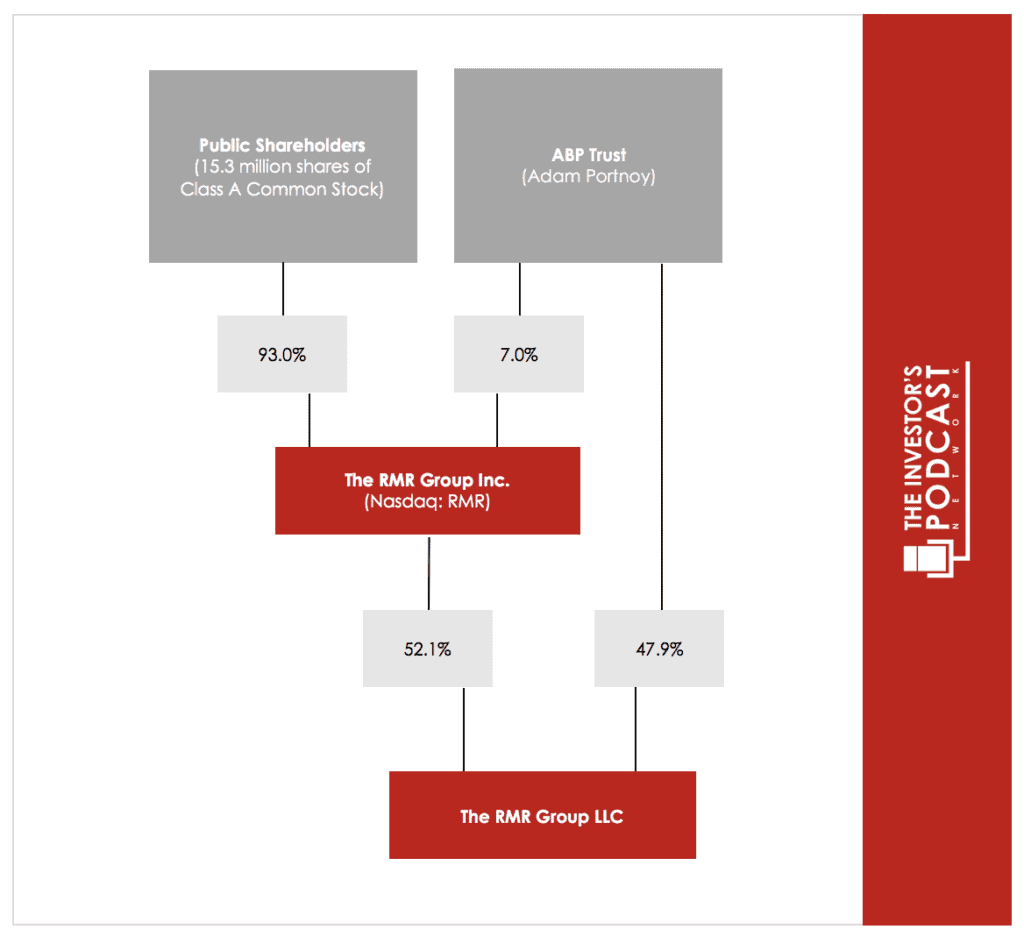

The RMR Group Inc. operates several businesses in the real estate industry through its 52% stake in The RMR Group LLC. For accounting purposes, it consolidates The RMR Group LLC financials and reports as if it owns 100% of the business. This inflates the revenue and free cash flow reported to The RMR Group Inc.’s shareholders. The net income is accurate as the minority interest is paid toward the end of the income statement. Thus, remember that The RMR Group Inc. would own 52% of the stated cash flow or assets. Below is an illustration of the ownership that can be found in The RMR Group Inc.’s May presentation.

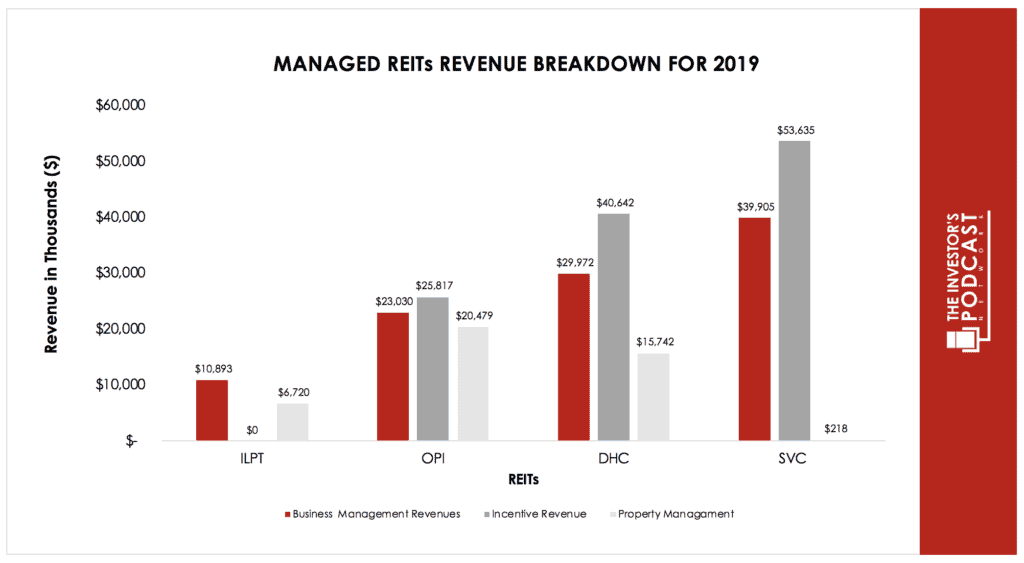

The most crucial division for The RMR Group LLC is its Managing REITs. They manage four REITs with exposure to hotels, senior living, industrial, logistics, and offices. The four publicly-traded REITs are Service Property Trust (SVC), Diversified Healthcare Trust (DHC), Office Property Income Trust (OPI), and Industrial Logistics Properties Trust (ILPT). The RMR Group Inc.’s role includes “implementing investment strategies and managing day to day operations, subject to supervision and oversight by each Managed Equity REIT’s board of trustees.” The RMR Group Inc. provides the employees for the REITs as the only employees of the REITs are the trustees. Every cost expensed on behalf of managing the REITs is generally reimbursable.

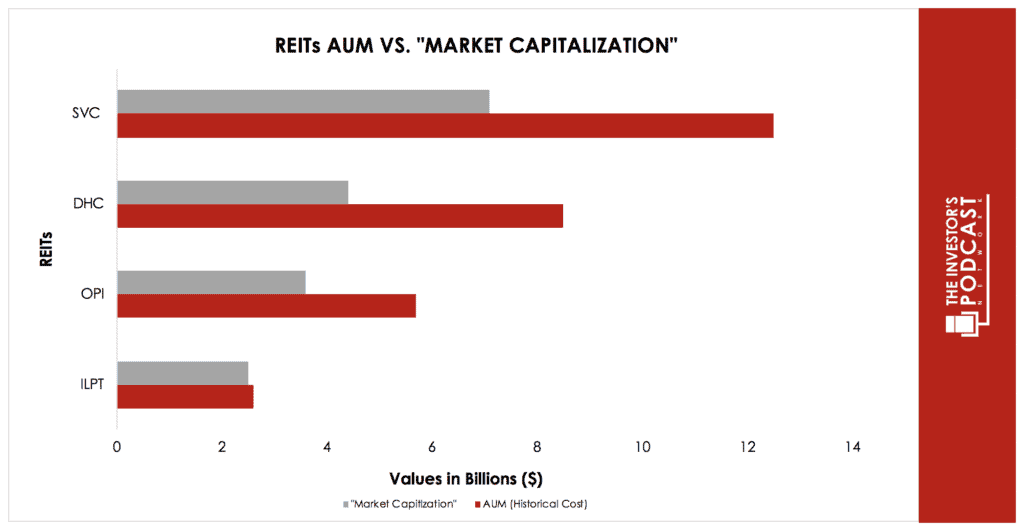

The RMR Group Inc. gets paid 50 basis points of the lesser of: the historical cost of transferred real estate assets or average “market capitalization” of the REIT. In the 10k filing, “market capitalization” is defined as the value of the outstanding shares and the value of the preferred equity as well as the value of the consolidated debt. The RMR Group Inc. can also earn an incentive fee equal to 12% of the REITs’ outperformance compared to its industry-predetermined REIT benchmark.

Since this incentive fee can be worth over 100% of the AUM, there is a cap at 1.5% of the “market capitalization” of the REIT. The RMR Group Inc. also manages some of the individual properties of its “Managed REITs.” The management’s fee is equal to 3.0% of the gross rents collected from tenants. In the fiscal year ending September 2019, this division earned $267 million in revenue, with $120 million in incentive fees. This figure does not include reimbursement costs.

The second division of The RMR Group LLC is called the “Managed Operators.” The RMR Group LLC assists several companies with financing, evaluating business opportunities, general business oversight, human resources, etc. The three main clients include Five Star Senior Living, a publicly-traded US-based senior living company with over 260 locations, Sonesta, an operator of over 70 hotels, and Travel Center America, a publicly-traded US firm with over 260 travel centers along with the US Interstate Highway System. These firms earned The RMR Group Inc. over $26 million last year. The fee structure for these companies is usually 0.6% of their monthly revenue. These firms also reimburse the salaries of executives that The RMR Group Inc. employs to help run these companies. This often results in around 80% of the executive’s salaries being refunded. The “Managed Operators” must agree to renew the services of The RMR Group Inc. every year. However, they have to pay 2.875 times the annual management fee should they choose not to renew.

Finally, The RMR Group LLC has an advisory and fund management division. This segment produced revenues of $5 million, which was a growth of 45% from 2018. This division includes the RMR Real Estate Income Fund (RIF), a real estate securities mutual fund. Through Tremont Advisors, The RMR Group LCC manages TRMT, a firm specializing in commercial real estate finance. The RMR Group LLC acquired this advisory in 2016 but has waived the first years of fees as they had not deployed all the capital of the fund.

- Recent Developments

In the most recent earnings call, management announced its intention to keep its dividend stable. At the current stock price, the yield would be 5%. The RMR Group Inc. will be able to sustain this with its current free cash flow generation.

Management also announced that rent collection has been strong, with 90% of their tenants paying rent in April. The exception to this has been SVC. In April, they have collected only 40% of the rent due. SVC owns mostly retail properties and hotels. Still, in the first quarter, the firm made enough free cash flow to cover its interest expense.

Management also announced that RIF was authorized by shareholders to deploy $150 million into the commercial mortgage market. Banks and other financial lenders have temporarily reduced their credit to these clients as they calculated the damages to their loan books due to Coronavirus.The RMR Group Inc. has leveraged its connection with a large institutional investor that agreed to create a JV worth $680 million. This massive injection of capital will increase the AUM of ILPT, and thus the revenue The RMR Group Inc. reports.

Adam Portnoy, the controlling shareholder and CEO, has mentioned that he expects the recession to last until 2021. He aims to deploy the $377 million buying “one in a generation” opportunities.

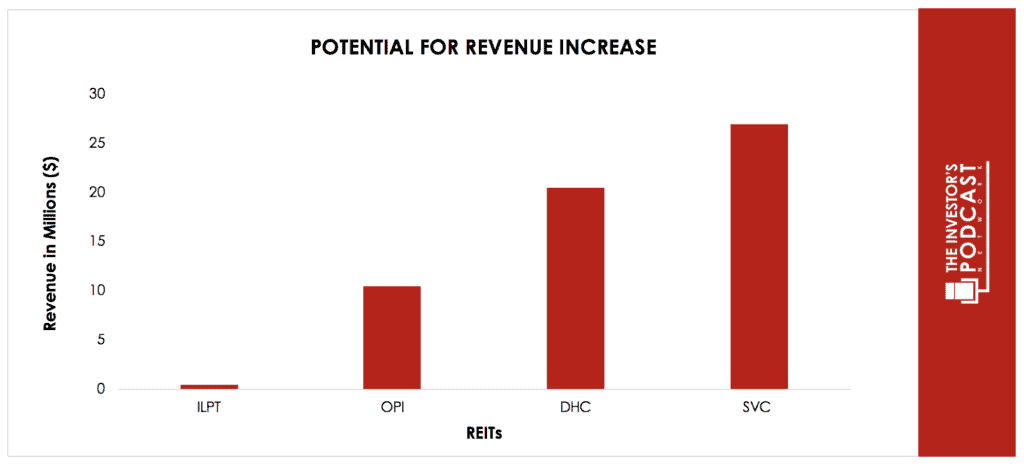

In the financial quarter ending on March 31, 2020, the assets of The RMR Group Inc.’s “Managed REITs” traded significantly below their historical cost. Should they rebound upward, then revenue could increase by over $55 million.

THE INTRINSIC VALUE OF THE RMR GROUP INC.

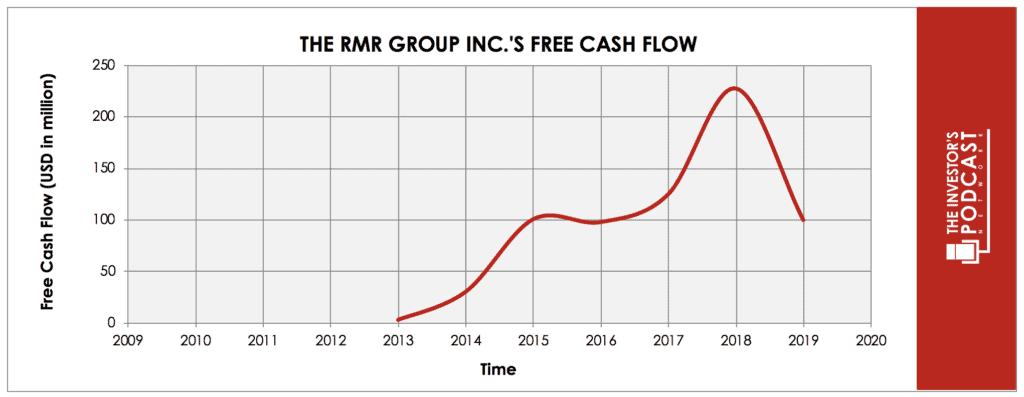

The value of any company is the discounted future value of its cash flows. For the fiscal year ending September 2019, the free cash flow was $197 million. I have reduced this figure substantially to $100 million for the graphic illustration because incentive fees will probably be impaired for the next few years.

The chart above illustrates that the company has been growing steadily since its public listing in 2015. Assets under management have grown from $21 Billion in 2015 to $32 Billion in 2020. In recent years, free cash flow has been especially strong because the incentive fees have been higher than $100 million.

The graph above demonstrates three reasonable scenarios for the future.

The worst scenario at a 15% probability envisions free cash flow shrinking by 3% a year. This scenario assumes that the “Managed REITs” will shrink in size as the market for commercial real estate stays below pre-COVID-19 levels due to the changes in consumer behavior. This would result in several of the “Managed REITs” selling their assets. The RMR Group Inc.’s “Managed Operator,” Five Star Senior Living, is distressed. This scenario assumes it goes bankrupt, and The RMR Group LLC permanently loses this $9.4 million client. In this scenario, incentive fees will rarely be paid as The RMR Group Inc. is unable to beat the REIT indexes. In 2029, the free cash flow would be $74 million, which is two thirds less than it was in 2019. Revenue from base management fees would stay suppressed, given that the REITs would trade substantially below their book value.

The probability of the base case is 55%. The base case assumes that the free cash flow will increase by around 5% per year, reaching approximately $163 million. In this conservative scenario, the company would be producing substantially less free cash flow than it was in 2019. The prices of the “Managed REITs” should rebound from their lows, increasing free cash flow between $10 to $20 million. Still, this would mean that most of the REITs would trade substantially below the historical cost of their assets. The incentive fees would average around $50 million over the long term, which is below their last five years.

The best scenario envisions free cash flow growing by 10% per year. This scenario assumes that the REITs “market capitalizations” recovers in the ensuing years and stays above the historical costs of the buildings they own. This would increase the annualized base management fees paid by the “Managed REITs” by $40 million to $55 million. The best scenario also envisions that incentive fees average around $100 million per year over the long term. Over the past three years, they have averaged around $106 million. Furthermore, The RMR Group Inc. has over $377 million in cash with no liabilities. They have signed a capital commitment of $100 million in an open-end fund, which The RMR Group LLC manages. Management has stated that they are inclined to use this money to acquire assets at prices that come in once in a generation. They have also said that they are interested in expanding into multifamily units. The multiple growth opportunities combined could result in much higher free cash flows then projected.

THE COMPETITIVE ADVANTAGE OF THE RMR GROUP INC.

The RMR Group Inc. has various competitive advantages outlined below:

- Long-term Contracts. Around 85% of The RMR Group Inc.’s revenue comes from evergreen contracts that need to be renewed in about 20 years. These long-term contracts will provide stable revenue while limiting the downside risks of this stock. For the trustees of the “Managed REITs” to break these long-term agreements, they will have to fork out the deal’s present value. If the trustees elect to break the contract early because of poor performance, only ten years’ worth of payments is due. Currently, the estimated value should all these clients breach their agreements is about $2.3 billion. For “Managed Operators,” the cost of breaking or not renewing the management deal is 2.88 times the annual payment to The RMR Group LLC. These contracts are renewed at the end of each calendar year.

- Most Costs at RMR Group are reimbursable. The RMR Group Inc. has signed deals with its clients, whereby almost all of the costs it expenses as a result of the client are reimbursable. This agreement ensures that most of The RMR Group Inc.’s revenue will end up as profit. Furthermore, in the case of “Managed Operators,” 80% of the executives’ salaries are reimbursed.

- Long Cash Position. The RMR Group Inc. currently sits on a $377 million cash position. Many commercial real estate companies are in distress because of the lockdown. Banks and other financial lenders have temporarily reduced the availability of liquidity while assessing Coronavirus’ impacts on their books. As a result, the CEO of The RMR Group Inc. believes that he will have a one in a generation opportunity to buy assets cheaply. The company could deploy nearly $300 million and still have enough working capital to function.

- Controlling Shareholder is Part of Several Client Boards. The RMR Group LLC’s controlling shareholder serves as the chair of the board of trustees of each of the Managed Equity REITs and as a managing trustee of each “Managed REIT.”The RMR Group LLC’s controlling shareholder owns the following related parties

-

- Controlling interest in Sonesta

- 3% of Five Star Senior Living (board seat)

- 5% TRMT

- 4% of TA (board seat)

RISK FACTORS

- Single Shareholder Controls the Company. Adam Portnoy owns around 52% of The RMR Group LLC through his various investment vehicles. This enables Portnoy to ignore minority shareholders should he choose to. The RMR Group Inc. has done transactions that could be in conflict of interest. For example, the headquarters of The RMR Group Inc. is owned by Mr. Portnoy. Portnoy also owns large stakes in a few of the “Managed REITs” that The RMR Group Inc. currently manages. Furthermore, The RMR Group Inc., through The RMR Group LLC, has committed about $100 million to a fund where Mr. Portnoy has invested $200 million. The RMR Group LLC is the managing director of this fund.

- Tax Receivable Agreement. The RMR Group Inc. agreed to a tax deal with ABP Trust- the vehicle through which Adam Portnoy controls The RMR Group LLC. They have structured a deal such that the tax basis is increased, resulting in a lower tax liability. The agreement stipulates that 85% of the savings produced through this agreement are paid to ABP Trust. The RMR Group Inc. is unable to get reimbursed if they pay ABP Trust more than the realized tax savings. Currently, this liability’s book value is around $34 million.

- Major Revenue Stream is Potentially Temporarily Impaired. The Incentive Business Management fee requires that total return per share be positive over a three-year measuring period. Many REITs are trading at 30% to 50% below their highs. If the stocks don’t experience a positive return for shareholders, this significant revenue source will be gone for a few years. Over the last four years, these incentives fees were worth $389 million (Before minority interest of 48%).

OPPORTUNITY COSTS

There are various investment opportunities on the market today to compare this investment to. First, one could invest in the ten-year treasury bond, which is producing a 0.74 % return. Inflation is currently about 1.2% (excluding energy); Thus, the yield on treasuries is negative. Another potential investment is buying a low-cost index fund that tracks the S&P 500. Currently, the S&P 500 Shiller P/E ratio is 29.11. As a result, the U.S. Stock market can expect around a 3.4352% annual return.

MACRO FACTORS

In recent months, the Federal Reserve has lowered the interest rates near to zero. This should increase the value of commercial real estate as the cost of debt goes down. Many REITs will be able to refinance their massive mortgages at much lower rates, thereby increasing their profits. This will result in a positive development for The RMR Group Inc. as increases in REIT’s earning power will deliver higher incentive fees for The RMR Group Inc. Another development in the macro-environment has been the Coronavirus. The ensuing lockdown is causing a global recession, which will end up hurting The RMR Group Inc. Many people and companies decided not to pay their rents in March and April of this year. This has decimated the cash flows of many REITs, including that of SVC (only 40% of commercial rents were collected). Finally, the last macro event is the potential change in consumer behavior.

Coronavirus has forced many people to work from home. The movement to work from home may permanently impair commercial real estate as people work and shop from home. Should this development continue, many companies that cater to office and retail stores could suffer. People’s increased use of technology such as Zoom, Slack, and Google Hangout may reduce the need to travel thereby, hurting hotels. Finally, COVID 19 has decimated the elder population living in senior living facilities. The RMR Group Inc. makes around $10 million from Five Star Senior Living, which is currently in distress.

SUMMARY

The RMR Group Inc. offers a relatively safe investment with an expected return of 15.2%. Most of the company’s revenue is protected through its 20-year evergreen contracts. At current stock prices, the historic incentive revenue can be worth over 15% of the firm’s market capitalization. The drawback of this stock is corporate governance; one shareholder controls the company.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.