Intrinsic Value Assessment Of Schloss Wachenheim (SWA.DE)

By Christoph Wolf from The Investor’s Podcast Network | 01 February 2020

INTRODUCTION

Schloss Wachenheim AG is a producer and supplier of sparkling wine. Its products include sparkling, semi-sparkling and carbonated sparkling wines, non-alcoholic beverages for children, non-sparkling wines from Italy and Romania, as well as other wine-based beverages.

The roots of this company can be traced back to 1888. Since then, the company has grown organically by acquisitions, and in 1996, also by merging with another sparkling wine company. Its main markets are Germany, France, and Eastern Europe.

Although Schloss Wachenheim AG is a business that is simple, profitable, and easy to understand, the stock price movement has been rather lackluster during the last years. Today, the stock price stands at €15.80– which is barely higher than three years ago.

This article aims to examine if there are deeper reasons for this lack of investor enthusiasm – or if investors currently simply prefer glamour tech stocks over boring but stable businesses, hereby overlooking and undervaluing a good company.

THE INTRINSIC VALUE OF SCHLOSS WACHENHEIM AG

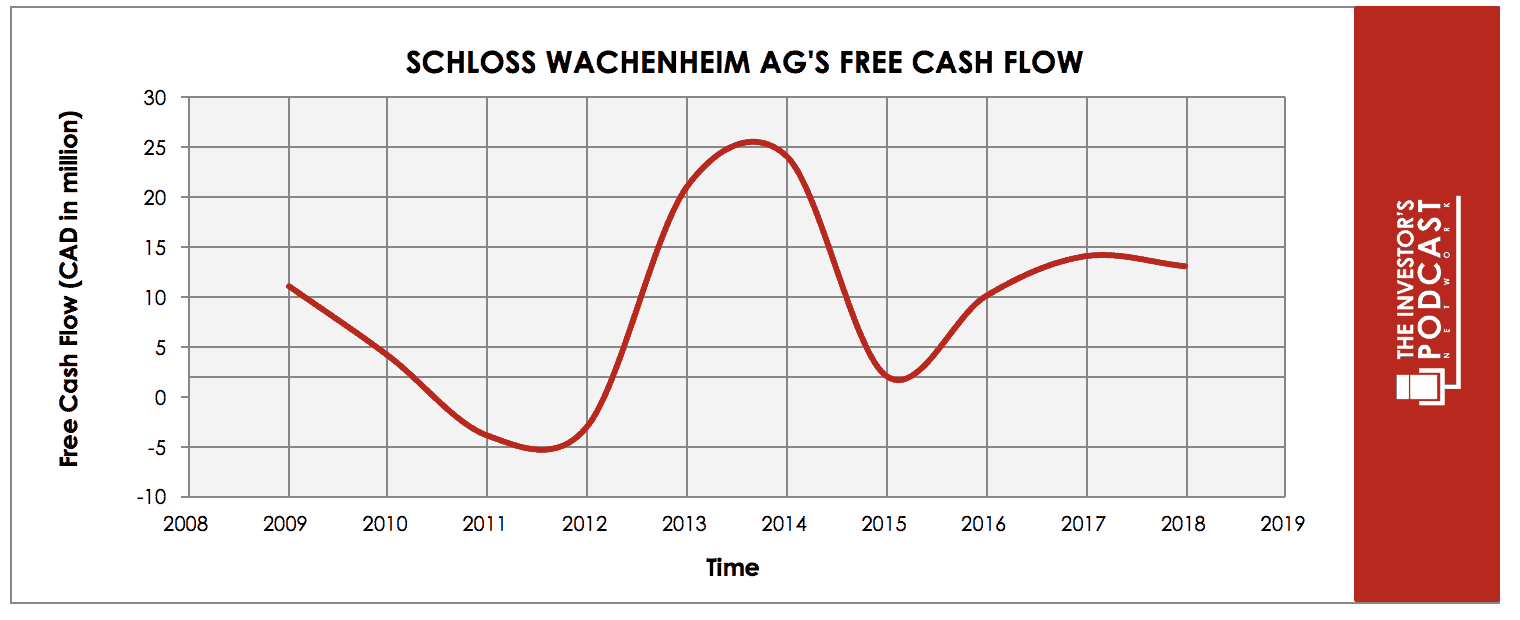

To determine the value of Schloss Wachenheim AG, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of Schloss Wachenheim AG’s free cash flow over the past years.

As one can see, the cash flows have been quite volatile. While the company’s revenue also fluctuates, the main reason for this variance lies in its sensitivity to labor and production costs. Especially grape prices, which vary quite much every year, thus having a strong effect on Schloss Wachenheim AG’s cost base. Because of this volatility, we will use a conservative estimate for Schloss Wachenheim AG’s future cash flows.

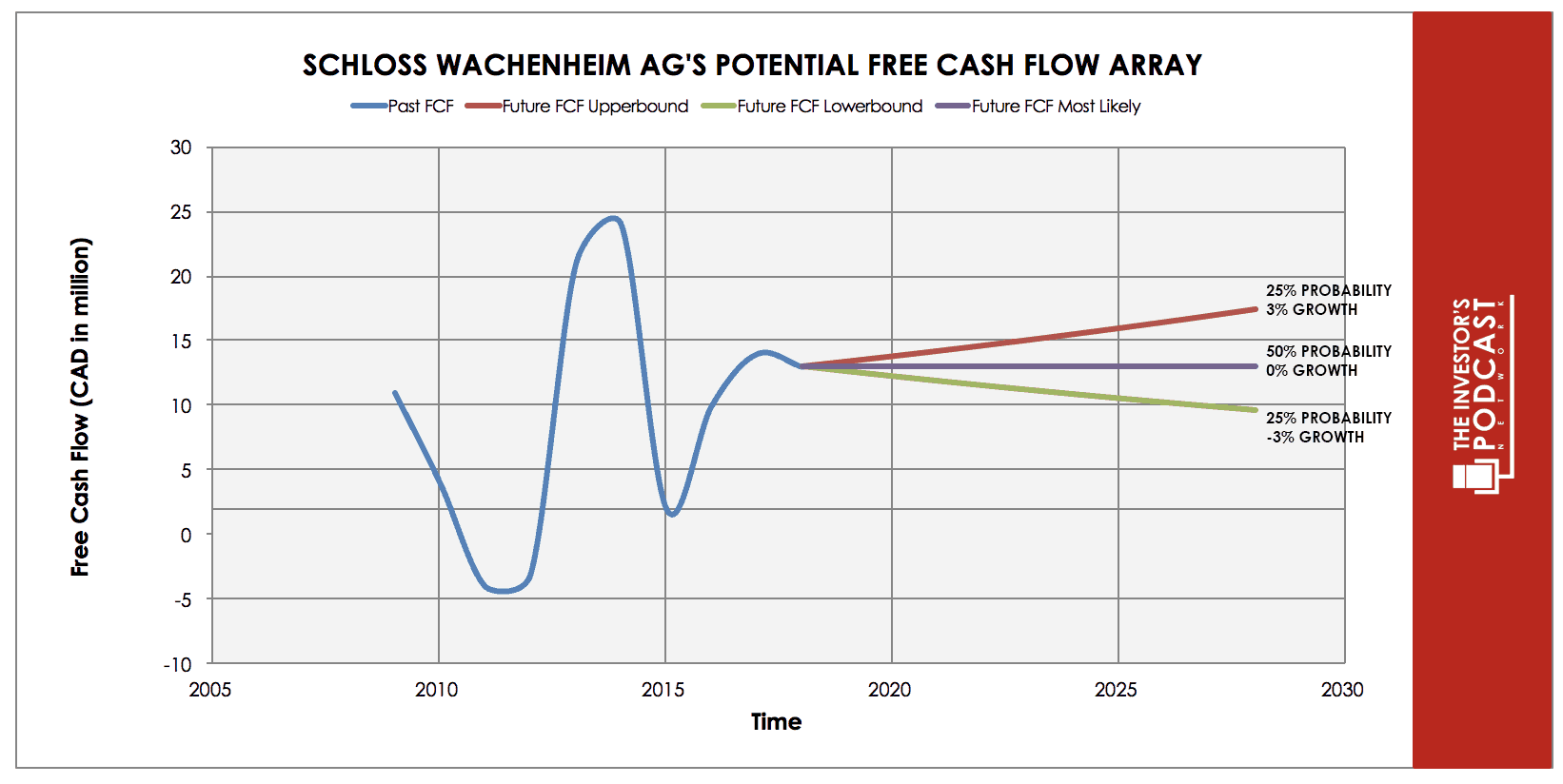

Each line in the above graph represents a certain probability for occurring. The upper growth rate of 3% is based on the minimum sales growth of sparkling wine during the last decade. We estimate this at a 25% chance. As most probable, we consider zero change in cashflow and assign a probability of 50%. The worst case is assumed to be a decline of 3% annually, which might be caused by a severe recession, resulting in customers cutting down on luxuries such as wine. We estimate the chance for this happening at 25%.

Assuming these growth rates and probabilities are accurate, Schloss Wachenheim AG can be expected to yield a 9.4 % annual return at the current price of $15.80. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF SCHLOSS WACHENHEIM AG

Schloss Wachenheim AG possesses some unique advantages that should allow it to be successful in the future:

- Simple and Understandable Business. Schloss Wachenheim AG mostly produces and distributes sparkling wine. This is a simple, predictable, and easy to understand business. Since people will still buy and drink sparkling wine in the foreseeable future, the demand for Schloss Wachenheim AG’s products is almost guaranteed. Also, no major disruption can be expected soon.

- Slow Consistent Growth. This is no high-tech company designing flashy electronics. This is a simple business that has been growing organically and by means of careful acquisition and a merger throughout the years.

- Mostly Insulated from Tariffs. While all global companies suffer by protectionism and tariffs, Schloss Wachenheim AG mostly produces and sells its wares in its home markets. Yes, exports are also an important part of its sales, but after all, this company seems only modestly affected by protectionism.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of Schloss Wachenheim AG to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 1.72% return. Considering the bond is completely impacted by inflation, the real return of this option is likely barely positive. Currently, the S&P 500 Shiller P/E ratio is 31.7. According to this valuation metric, the US Stock market is priced at a 3.2% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The wine industry has a very long tradition and still grows at a stable and quite predictable rate. While in Europe – Schloss Wachenheim AG’s main market – the volume of still wine sold has been almost flat during the last decade, and sparkling wine volume increased slightly more than 1% annually. Despite these low numbers, revenue growth rates were nevertheless about 3% and 4%, respectively, due to increased prices per bottle of wine sold.

For the future, this trend should continue, such that the revenue generated by wine and sparkling wine sales can be expected to increase at or slightly above the rate of economic growth.

RISK FACTORS

There are several risks that might limit growth prospects:

- Dependency on Grape Prices. Grape prices are a huge part of Schloss Wachenheim AG’s costs and therefore have a big impact on the company’s margins. As recently as 2017, a poor grape harvest led to sharply higher grape prices, resulting in lower earnings for Schloss Wachenheim AG.

- No Management Compensation Published. The company does not disclose the salaries and other compensation payments for its upper management. This is possible for firms listed in Germany if at least 75% of its shareholders agree. Although several minority shareholders have complained about this secrecy, management shows no intention to change this confidence-limiting procedure.

- Reliance on Positive Consumer Confidence. Sparkling wine is, after all, a luxury, not a necessity. If the consumer climate in Schloss Wachenheim AG’s home markets declines, customers can easily cut back on its products or switch to cheaper alternatives, such as beer, cheap wine, or other low-price alcoholic beverages. This would reduce Schloss Wachenheim AG’s revenue and margins.

SUMMARY

Schloss Wachenheim AG’s main strength is that it is a simple and easy to understand business. It has slowly and consistently grown, and one can reasonably expect robust demand for its products long into the future. While there is some dependency on the economy – in a downturn, consumers buy less and cheaper products, which would affect both Schloss Wachenheim AG’s sales and margins – even in a major recession, people will still drink alcohol.

On the flip side, the company has no control over grape prices, and management’s refusal to disclose its own compensation does not instill trust.

Overall, the risks and downsides seem nevertheless limited, such that the expected annual return of 9.4% seems comparatively rewarding.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.