10 TOP HIGH DIVIDEND STOCKS IN JUNE 2019 WITH SAFE YIELDS UP TO 8.7%

By Bob Ciura from Sure Dividend

This article examines securities in The Sure Analysis Research Database with:

- Yields of 5% or greater

- Dividend Risk Scores of C or better

With yields between 5% and 8%, these securities all offer high dividends (or distributions). And with Dividend Risk Scores of C or better, they don’t suffer from the usual excessive riskiness of truly high yielding securities. Stocks with Dividend Risk Scores of A and B were given preference in the top 10 list, to place focus on the highest-quality dividend stocks first.

In other words, these are safe, high yield income stocks for you to consider adding to your retirement or pre-retirement portfolio.

10. WESTROCK CO. (WRK)

- Dividend Yield: 5.1%

WestRock Company is a paper and packaging solutions provider. In its current form, WestRock is the result of the 2015 merger of Rock-Tenn and MeadWestvaco. Today, it operates two major segments: Corrugated Packaging (~64% of revenue) and Consumer Packaging (~36% of revenue). WestRock has a market capitalization of nearly $10 billion.

In late April, WestRock reported (4/30/19) fiscal 2019 second-quarter results. Revenue of $4.6 billion increased 15% from the same quarter last year. However, adjusted earnings-per-share declined 3.6% for the quarter, as revenue growth from acquisitions, price increases, and a favorable product mix were more than offset by cost inflation, lower containerboard volumes, and economic downtime. Revenue was also negatively impacted by the winding down of Land and Development segment sales.

WestRock’s future growth will be fueled by its recent $4.9 billion acquisition of KapStone Paper and Packaging Corp., which will expand the company’s corrugated packaging segment. The acquisition boosted sales by $776 million last quarter.

WestRock absorbed additional debt to finance the acquisition. The company held a net-debt-to-EBITDA ratio to 3.9x after the merger, and has set a goal to reduce the leverage ratio to a range of 2.25x to 2.50x this year. Cost cuts will help the company pay down debt. WestRock generated $70 million of run-rate synergies last quarter and expects to produce a total of $200 million in annual synergies by the end of fiscal 2021.

On one hand, this is likely to be another strong year thanks to the full-year impact of the implemented price hikes and the synergies from the acquisition of KapStone. On the other hand, there are increasing concerns over high inventories in the container board market right now and a surge in the global supply of containerboard products in upcoming years. This helps explain the 40% plunge of the stock of WestRock in the last 12 months amid almost record earnings.

Assuming WestRock achieves its debt reduction and cost savings goals, the dividend appears secure. WestRock has an expected dividend payout ratio of 45% for fiscal 2019. This should provide enough room for modest dividend increases to continue in the years ahead.

9. UNIVERSAL CORPORATION (UVV)

- Dividend Yield: 5.1%

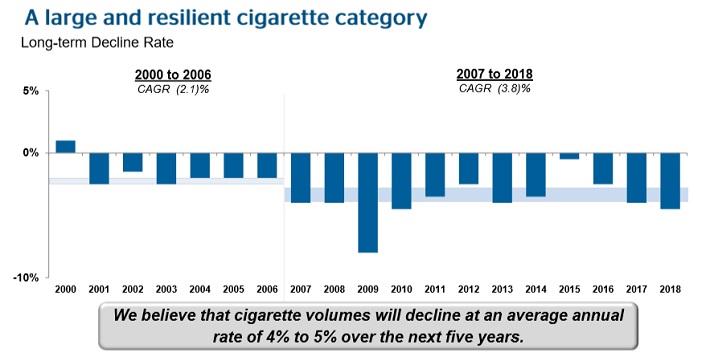

Universal Corporation is a tobacco leaf supplier to many of the world’s top tobacco product manufacturers. The company is the wholesale purchaser and processor of tobacco that operates between farms and the companies that manufacture cigarettes, pipe tobacco, and cigars.

Universal Corporation reported its fourth fiscal quarter earnings results on May 22. The company generated revenues of $672 million during the quarter, which was 10.6% more than the revenues that Universal Corporation generated during the previous year’s fourth quarter. This was an especially strong rate of revenue growth for a normally slow-growth company. However, Universal Corporation’s net earnings declined slightly during fiscal 2019, compared to the prior year, as net profits totaled $104 million in 2019 versus $106 million in 2018.

Universal’s earnings-per-share totaled $4.11 during the most recent fiscal year, which was marginally less than the earnings-per-share of $4.14 that Universal achieved during the previous year. Universal Corporation’s adjusted earnings-per-share, which back out one-time items such as the impact of tax reform, rose 12% compared to the previous year, totaling $4.45.

The market remains relatively unimpressed with Universal’s results. Shares of the stock have declined 15% in the past 12 months, and Universal trades with a P/E multiple in the low double-digits. The over-arching concern for Universal is the decline in smoking. The tobacco industry has been struggling with falling smoking rates in the U.S. for years. Indeed, recent data from market research firm Nielsen showed cigarette industry volume fell 11.2% in the 4-week period ending on May 18.

Moreover, cigarette sales dollars were down 6.9% for the 4-week period. Adding to the uncertainty is the potential for further regulatory efforts, such as the possibility of raising the legal smoking age in the U.S. from 18 to 21.

Universal has an impressive dividend history. The company has increased its annual dividend payout for 48 consecutive years. Universal recently raised its quarterly dividend to $0.76 per share. On an annual basis, Universal’s dividend payout of $3.04 represents a projected payout ratio of 65% for the current year, which indicates a sustainable dividend payout. For now, the dividend appears secure, but investors should closely monitor Universal’s future earnings reports to make sure the company remains in sound financial condition.

8. WESTERN DIGITAL (WDC)

- Dividend Yield: 5.3%

Western Digital is a technology hardware manufacturer. It produces data storage products, such as hard disk drives (HDDs) and solid-state drives (SSDs). Western Digital is also engaged in the flash memory business. The stock has a market capitalization of approximately $14.4 billion.

In late April (4/29/19) Western Digital reported financial results for its fiscal 2019 third quarter. Revenue of $3.7 billion declined 27% versus the same quarter the previous year. While revenue was roughly in-line with analyst expectations, adjusted earnings-per-share of $0.17 came in well below the consensus estimate of $0.47.

Client Devices revenue fell 27% from the previous quarter, due to weak handset demand and lower flash pricing, while Client Solutions revenue declined 15%. However, Data Center Devices & Solutions generated 16% sequential revenue growth for the quarter.

Technology trends change rapidly, and the storage industry is highly volatile. Fortunately, Western Digital holds a top position in the HDD industry, with Seagate Technologies as its only major competitor. It also has a strong position in SSDs, thanks to its flash memory exposure.

Western Digital’s major growth initiative was the $19 billion acquisition of SanDisk in 2015, which gave Western Digital huge exposure to the flash storage market. However, global oversupply of flash memory has caused pricing weakness in recent quarters. Western Digital expects fiscal fourth-quarter (the company has an unusual fiscal calendar) revenue of $3.6 billion to $3.8 billion, substantially below the $5.1 billion of revenue in the fiscal 2018 fourth quarter. On the other hand, storage products are required for many technological items like personal computers, storage devices, and cloud storage solutions. Demand for data storage is only going to rise in the years ahead.

Based on expected earnings-per-share of $6.10 for fiscal 2019, and a current dividend payout of $2.00 per share, Western Digital has a projected dividend payout ratio of 32.8%. With a forecasted dividend payout ratio of approximately one-third of adjusted EPS, Western Digital’s dividend appears to be secure.

7. ABBVIE INC. (ABBV)

- Dividend Yield: 5.6%

AbbVie is a pharmaceutical giant with over $32 billion in annual revenue. AbbVie was spun off from Abbott Laboratories (ABT) in 2013. Today, AbbVie is a huge company on its own, with a market capitalization of $114 billion.

AbbVie’s therapeutic areas are centered on Immunology, Oncology, and Virology. AbbVie has had great success as an independent company. Since the spin off, AbbVie generated compound annual revenue growth of 11.7% and adjusted EPS growth above 20% per year.

However, the biggest concern for AbbVie is the increasing competition facing its flagship drug Humira, the best-selling pharmaceutical product in the world. Humira is AbbVie’s biggest seller, by a wide margin, accounting for 41% of the company’s total first-quarter revenue.

Humira is facing biosimilar competition in Europe, and AbbVie has had to significantly cut prices to preserve its market share. This caused Humira revenue to decline by 23% in the international markets last quarter. Fortunately, Humira sales increased 7.1% in the U.S. last quarter. Still, Humira will face biosimilar competition in the U.S. starting in 2023, which poses a continued risk.

AbbVie has addressed this risk by investing heavily in its pipeline. This investment has paid off, as AbbVie has a robust product pipeline. AbbVie expects non-Humira product sales to exceed $35 billion by 2025.

Source: Investor Presentation

The company expects to generate adjusted EPS of $8.78 for 2019. This would represent 11% year-over-year growth.

Growth in these areas will greatly help offset any losses from biosimilar competition to Humira. Plus, Humira is expected to remain the market leader in the U.S. for the next few years, while AbbVie is working on new and improved drugs that target the same indications as Humira. Two of these drugs, called upa and risa, will likely come to the market in 2019 for their first indications.

AbbVie’s late-stage pipeline continues to deliver for investors. Last quarter, AbbVie received regulatory approval in the U.S. and Japan for Skyrizi. It expects to receive approval in Europe in the near future. AbbVie has high expectations for Skyrizi—it believes the plaque psoriasis medication has potential to be a multi-billion product by annual sales. Skyrizi is the 12th new product or major indication approval for AbbVie in the last five years.

It also received Breakthrough Therapy Designation and Priority Review from the FDA for Venclexta in Front Line chronic lymphocytic leukemia. Venclexta has already shown great promise, as sales more than doubled last quarter to $151 million. AbbVie has a balanced portfolio of next-generation products that will lead it into the future.

Lastly, the stock has a current dividend yield of 5.3%, a very high yield resulting from both a declining share price and the company’s high rate of dividend growth. AbbVie is a Dividend Aristocrat, and its dividend growth has accelerated in recent years. The February 2019 dividend payment was raised 11.5% from the previous level. The previous year, AbbVie raised its May 2018 dividend by 35%, and its February 2018 dividend by 11%.

We believe AbbVie’s dividend is highly secure, as discussed in greater detail in the video below.

6. INVESCO LTD. (IVZ)

- Dividend Yield: 6.0%

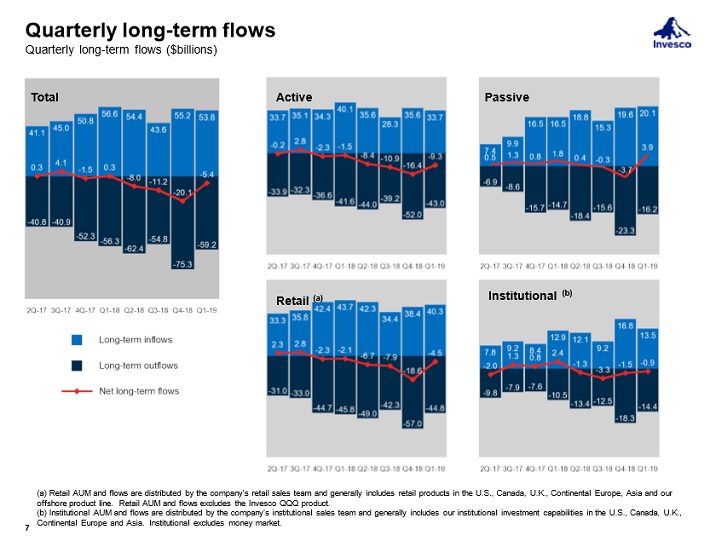

Invesco is a global investment management firm. It has more than 7,000 employees and serves customers in more than 150 countries. Invesco ended the most recent quarter with assets under management, or AUM, of $954.8 billion.

In late April (4/25/19) Invesco reported financial results for the 2019 first quarter. For the quarter, net revenue declined 7.4% from the same quarter last year. Adjusted EPS declined 16.4% year-over-year. AUM declined significantly as 2018 drew to a close, due in large part to global stock market volatility. Fortunately, AUM has recovered in 2019. Through March 31st, Invesco’s AUM has increased 7.5% year-to-date.

Source: Earnings Slides

This bodes well for Invesco’s future quarterly results. The company’s recent strategic investments should also help it return to positive EPS growth. Invesco is investing heavily in growth, mainly through acquisitions.

First, Invesco acquired OppenheimerFunds for ~$5.7 billion. The deal was for $4 billion in preferred shares and 81.9 million Invesco shares. This acquisition is expected to boost earnings-per-share by ~18% in 2019. Acquiring OppenheimerFunds will grow Invesco’s AUM to $1.2 trillion, making it the 6th-largest U.S. retail investment management company.

Invesco also acquired the ETF business from Guggenheim Investments for $1.2 billion. Invesco also made a significant investment in financial technology with its acquisition of Intelliflo, a leading technology platform for financial advisors that supports approximately 30% of all financial advisors in the U.K. Overall, we conservatively expect 5% earnings growth annually for Invesco over the next five years.

Invesco ranks well in terms of dividend safety with an expected payout ratio of 53% for fiscal 2019. This should allow the company to continue increasing its dividend on an annual basis going forward. Invesco also has a strong balance sheet, with a credit rating of ‘A’ from Standard & Poor’s.

5. ENTERPRISE PRODUCTS PARTNERS LP (EPD)

- Distribution Yield: 6.2%

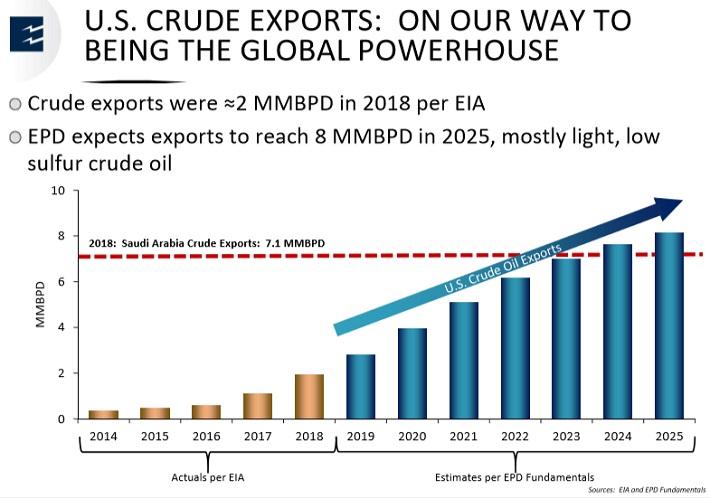

Enterprise Products Partners is the largest energy Master Limited Partnership based on market capitalization. Enterprise Products is a midstream MLP, with services including storage and transportation of oil and gas.

Its assets include approximately 50,000 miles of pipelines, 260 million barrels of storage capacity for NGL (Natural Gas Liquids), crude oil, and other refined products; and 14 billion cubic feet of natural gas storage capacity.

On 5/1/19, Enterprise Products reported first-quarter 2019 financial results. Distributable cash flow jumped 18% year-over-year to a record $1.6 billion, providing 1.7x distribution coverage. EBITDA also surged by 17% to $1.63 billion. Meanwhile, gross operating margin overcame headwinds from the temporary closure of the Houston Ship Channel to gain 35% year-over-year. These strong results were largely driven by record volumes in its crude marine terminals and continued robust growth in crude volumes from the Permian Basin (expected to reach 700k bbl/day in 2019).

Future growth will come from new projects. For example, Enterprise Products has started construction of the Mentone cryogenic natural gas processing plant in Texas, which will have the capacity to process 300 million cubic feet per day of natural gas and extract more than 40,000 barrels per day of natural gas liquids. The facility is expected to begin service in the first quarter of 2020.

Exports are another growth catalyst. Demand for liquefied petroleum gas and liquefied natural gas, or LPG and LNG respectively, is growing at a high rate across the world, particularly in Asia.

Source: Analyst Conference

Enterprise Products’ total crude oil, NGL, petrochemical, and refined products exports currently exceed 1.6 million barrels per day. The company expects continued growth in export capacity through 2025. Overall, we expect 4% annualized growth from Enterprise Products Partners over full economic cycles.

In terms of safety, Enterprise Products Partners is one of the strongest midstream MLPs. It has credit ratings of BBB+ from Standard & Poor’s and Baa1 from Moody’s, which are higher ratings than most MLPs. It also had a distribution coverage ratio of 1.5x in 2018 and 1.7x in Q1 2019, leaving plenty of room for distribution increases. Enterprise Products has tremendous competitive advantages, primarily its vast network of assets. It would be enormously costly to build out a network of pipelines and terminals large enough to compete with Enterprise Products.

Enterprise Products’ high-quality assets generate strong cash flow, even in recessions. As a result, Enterprise Products has been able to raise its distribution to unitholders for 59 quarters in a row.

4. ALTRIA GROUP INC. (MO)

- Dividend Yield: 6.3%

Altria Group is a tobacco products giant. Its core tobacco business holds the flagship Marlboro cigarette brand. Altria also has non-smokable brands Skoal and Copenhagen chewing tobacco, Ste. Michelle wine, and owns a 10% investment stake in global beer giant Anheuser Busch Inbev (BUD).

In late April (4/25/19) Altria reported first-quarter earnings. Revenue, net of excise taxes, declined 6.0% for the quarter, due primarily to falling shipment volumes. Adjusted earnings-per-share declined 5.3% for the first quarter.

Altria’s key challenge going forward will be to generate growth in an era of falling smoking rates. Consumers are increasingly giving up traditional cigarettes, which on the surface poses an existential threat to tobacco manufacturers.

Source: 2019 CAGNY Presentation

Fortunately, Altria made significant investments in new product categories, to continue growing in a post-cigarette world. Altria recently announced a $1.8 billion investment in Canadian marijuana producer Cronos Group.

Altria purchased a 45% equity stake in the company, as well as a warrant to acquire an additional 10% ownership interest in Cronos Group at a price of C$19.00 per share, exercisable over four years from the closing date. Separately, Altria invested nearly $13 billion in e-vapor manufacturer JUUL Labs for a 35% equity stake in the company, valuing JUUL at $38 billion. Altria reaffirmed its guidance for 2019 full-year adjusted diluted EPS to be in a range of $4.15 to $4.27, which would be 4% to 7% growth from 2018.

The video below examines Altria’s dividend safety in detail.

3. AT&T INC. (T)

- Dividend Yield: 6.4%

AT&T is a major telecom with operations in the United States and Latin America. AT&T provides a variety of telecommunications services including video, broadband, and wireless service, along with content platform WarnerMedia and satellite TV provider DirecTV. AT&T generates $170 billion in annual revenue.

In late April (4/24/19) AT&T reported first-quarter financial results. Revenue of $44.8 billion increased 18% from the year-ago quarter, primarily driven by the Time Warner acquisition.

Adjusted earnings-per-share of $0.86 rose 1.2% from the same quarter a year ago. Revenue growth was heavily offset by rising expenses and a higher share count. AT&T’s core mobility segment grew revenue by 2.9% for the quarter, thanks to 179,000 net postpaid smartphone customer additions during the quarter.

Debt reduction remains a priority for AT&T, in light of the massive acquisitions of Time Warner and DirecTV in recent years. As of the most recent quarter, net debt stood at $169 billion, with a net debt to adjusted EBITDA ratio of 2.8x. The company reiterated its expectation to reduce its leverage ratio to 2.5x by year-end.

AT&T’s major growth catalyst going forward is media content, driven by the $81 billion acquisition of Time Warner Inc., which owns multiple media brands, including TNT, TBS, CNN, and HBO. Time Warner also owns a movie studio and sports rights across the NFL, NBA, MLB, and NCAA.

The company anticipates free cash flow to be in the $26 billion range, with low single-digit adjusted EPS growth. The dividend payout ratio is anticipated to be below 60% for 2019, which indicates a secure dividend.

Also, AT&T has paid increasing dividends for 35 consecutive years, making the company a member of the exclusive Dividend Aristocrats Index. The Dividend Aristocrats are a group of S&P 500 stocks with 25+ years of rising dividends.

The video below examines AT&T’s dividend safety in detail.

2. TANGER FACTORY OUTLET CENTERS (SKT)

- Dividend Yield: 8.4%

Tanger Factory Outlet Centers is a Real Estate Investment Trust. Tanger operates, owns, or has an ownership stake in a portfolio of 40 shopping centers. Properties are located in Canada and 20 U.S. states, totaling approximately 14.4 million square feet, leased to over 500 different tenants. Tanger has enjoyed sustained high portfolio occupancy for many years.

Tanger released 2019 first-quarter results on May 6th, and announced funds from operations (FFO) of $0.57 per share, a decrease of 5% compared with $0.60 per share in the same quarter last year. Although Tanger maintained its high portfolio occupancy at 95.4% in the first quarter, this was still a year-over-year decline from the 95.9% level during the same quarter in 2018. Net operating income (NOI) for the consolidated portfolio declined 0.5% for the quarter. The company also sold four noncore outlet centers for total gross proceeds of $130.5 million during the quarter.

Occupancy is expected to decline somewhat in 2019 to a range of 94.0% to 94.5%, due to anticipated store closures by certain tenants. Fortunately, the company has maintained an occupancy rate of 95%+ for 25 consecutive years.

The dip in occupancy this year will negatively impact the company’s AFFO, but Tanger will still be able to cover its hefty dividend payment.

Tanger has a current dividend payout of $1.42 per share annually, which represents a current yield of 8.4%. This is a very high yield and is clearly attractive for income investors. The biggest concern with a yield this high is sustainability. Fortunately, Tanger appears to have a secure dividend payout.

The company is expected to generate AFFO-per-share of $2.25 for 2019. With an expected dividend payout of $1.47 per share, Tanger’s expected 2019 dividend payout ratio is 65%. This is a manageable payout ratio, which leaves room for modest annual hikes. For example, in February Tanger raised its dividend by 1.4%.

1. ENERGY TRANSFER LP (ET)

- Distribution Yield: 8.7%

Energy Transfer is a midstream oil and gas Master Limited Partnership, or MLP. Energy Transfer’s business model is storage and transportation of oil and gas. Its assets have total gathering capacity of nearly 13 million Btu/day of gas, and a transportation capacity of 22 million Btu/day of natural gas and over 4 million barrels per day of oil.

On May 8th, 2019 Energy Transfer reported Q1 results for the period ending March 31st, 2019. The first quarter was a record performance for the company across multiple measures. For the quarter, the company reported $2.8 billion of adjusted EBITDA and $1.66 billion of distributable cash flow, both of which set records for Energy Transfer.

Adjusted EBITDA increased 40% year-over-year, while distributable cash increased 39% from the year-ago quarter, backed by impressive performance across all business segments. NGLs, refined products, and crude segments continued to benefit from rising gas demand. In all, Energy Transfer generated $856 million of distributable cash flow in excess of distributions paid to unitholders in the first quarter.

Energy Transfer has an attractive lineup of new projects which will fuel the company’s growth. For example, Energy Transfer announced it will construct a seventh natural gas liquids (NGL) fractionation facility at Mont Belvieu, Texas, with 150,000 barrels per day of capacity. Fractionator VII is scheduled to be operational in the first quarter of 2020 and is fully subscribed by multiple long-term contracts.

The company is also progressing with plans on a Bakken pipeline optimization project, which is expected to start up in 2020. And, Energy Transfer is currently expanding its Permian Express pipeline system by an additional 120,000 barrels per day. The Permian Express 4 expansion is expected to be in-service by the 2019 third quarter.

Growth from project expansions and new projects fuels Energy Transfer’s optimistic outlook for 2019.

The company’s new projects will help secure its attractive 8% distribution. Energy Transfer anticipates a distribution coverage ratio of ~1.7x to ~1.9x for 2019, which is better than average for an MLP. In Q1, the company reported distribution coverage of over 2x.

We believe Energy Transfer is capable of delivering distributable cash flow per share of around $2.20 for 2019. Using this estimate, units trade for a price-to-DCF ratio of 6.4. We believe fair value for Energy Transfer is a price-to-DCF ratio of 8, which gives a fair value price estimate of $18.

If the company’s valuation multiple expands to a price-to-DCF of 8 over the next five years, this will boost its total returns by 4.6% per year.

Energy Transfer trades with an 8.7% yield and is likely to compound its per-unit intrinsic value at about 3% per year over full economic cycles. Adding this all together, we believe that Energy Transfer can deliver long-term total returns above 16% per year.

– – – – –

This article by Bob Ciura was originally published at Sure Dividend