THE INTRINSIC VALUE OF PERSIMMON PLC

By Jakob Bruhn from The Investor’s Podcast | 22 October 2018

Introduction

Persimmon PLC (ticker: XLON:PSN) is a British construction company that develops and sells residential properties in England, Scotland and Wales. The firm’s market cap is £6.9 billion. Its revenue and free cash flow for the previous financial year were £3.42 billion and £806 million, respectively. It trades at a P/E of and P/CF of ~9. The stock has fluctuated around a high of £29.14 and currently trades at its 52-week low of £22.00. Is Persimmon PLC undervalued at the current price?

The Intrinsic Value of Persimmon PLC

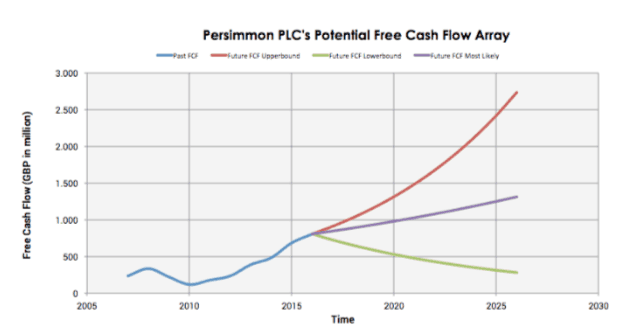

To determine the intrinsic value of Persimmon PLC, we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings, which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Persimmon PLC’s free cash flow for the past ten years.

The company’s free cash flow has grown at respectable levels over the last ten years at an annualized rate of 13.2%. To determine Persimmon PLC’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

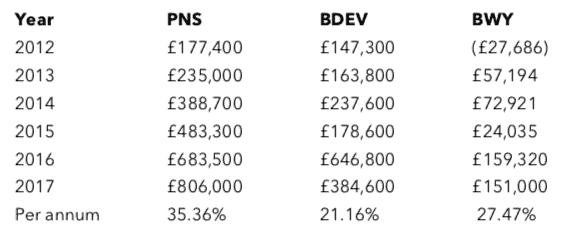

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The reasoning behind each of the three scenarios are explained in more depth in the section “Macro Factors”, since one should appreciate the economic and political factors’ influence on Persimmon PLC’s future performance.

The upper-bound line represents a 13% growth rate, which is its 10-year average per annum growth rate. Since such rate was achieved in a favourable business cycle marked by a general upswing, which one shouldn’t rely on going forward, this has been assigned a mere 10% probability of occurrence.

The middle growth line represents a 5% growth rate. This has been assigned a 60% probability, as it’s in line with the last few years’ revenue growth of 8% – a period marked by more normalized conditions than what the upper-bound line represents.

The lower-bound line represents a -10% decline. This scenario stipulates that Persimmon PLC deteriorate rather significantly given the cyclical characteristics of the business. This scenario has been assigned a 30% probability of occurrence given where we’re currently at in the credit cycle.

Assuming these potential outcomes and corresponding cash flows are accurately represented, Persimmon PLC might be priced at a 13.3% annual return if the company can be purchased at today’s price. Now, let’s discuss the macro factors that underlie these growth assumptions.

Macro Factors

Before delving into a discussion of Persimmon PLC’s competitive advantage, we should outline the factors that drive the housing market in general, and more importantly the construction of new homes. In conjunction with one another, the below factors seem to dictate the demand for home development and are thus vital in terms of understanding the inputs used in the intrinsic value assessment.

- Interest levels and credit availability

- Political conditions and initiatives

- General debt levels

- Income growth

- Demographical tendenciesThe list makes intuitive sense, as they centre on the fundamental driver of the home construction market, namely whether or not the Brits can afford to move into the homes that developers such as Persimmon PLC construct.With the benefit of hindsight, we can account for the latest cycle.The low interest level has been the primary reason behind the sector’s upswing. In addition, the political program Help to Buy, where first-time buyers received aid for the down payment on a property, accelerated borrowing and thus home construction.The combination of easy access to capital (credit availability) as well as political hand-outs have driven house prices north at a rate of 4% per annum since 2009, cf. below chart from Tradingeconomics.com:

House price increases are a godsend for home developers, as their units can be sold at higher prices, but the properties aren’t more costly to construct. This combination has resulted in high margins, as we shall uncover later. The developers – and shareholders alike – have, in other words, hence been favoured in the past cycle. Though the government continues to support the construction of new homes, prudence should keep us from counting on as favourable an environment going forward.

To emphasize how conditions have changed and address a few of the risks of such a cyclical stock, a few negative trends should be mentioned. For instance, according to BBC, the Brits’ household expenses are currently exceeding their income, which means citizens are financing their spending from their savings or borrowed money. BBC also mentions that the devaluation of the Pound Sterling puts pressure on the purchasing power and income level. The Guardian states that the British household debt level has reached the same heights we saw before the 2007 crisis. In length, it says arrears on electricity, water and heat has increased with 12% during the past five years, indicating the Brits are living beyond their means. Is this the beginning of a larger downturn? It could be, which explains why the upper- bound scenario was assigned such a low probability while the lower-bound scenario was deemed more likely with a 30% probability.

Yet, there are some positives too, which are especially beneficial to Persimmon PLC. The government continues to be pro-construction, as the politicians within Palace of Westminster had an ambition to build 300,000 new homes in 2017, 83,000 more than the 217,000 that actually got constructed. In length, this report concludes that developers haven’t been able to meet the demand. Combined with another report’s projection that there is a need for the construction of 210,000 homes annually from now until 2039, indicates a favourable supply-demand dynamic. The government is motivated to address this need, which is evident in its Housing White Paper. It outlines how the housing market should be reformed in a way that boosts the construction of new homes. The plan included i.e. a reduction of the stamp duty in November 2017 so first-time buyers would be enticed to enter the housing market. In addition, the government promised to allocate an additional £10 billion to aforementioned Help to Buy program.

In short, though we shouldn’t expect a double-digit growth rate, it seems fair to assume that the sector – and, as we shall argue, especially the low-

cost segment – will prosper going forward, as the most important aspect is still in the developers’ favour: the market is not saturated. On the contrary, it seems like the demand for newly built homes exceeds the supply.

As mentioned, our research suggests that home developers in the low-cost segment will benefit most from the government’s political initiatives. Theresa May and her government primarily support the construction of new homes for the middle and lower class as well as first-time buyers. The prime minister says on p. 5-6 of aforementioned white paper: “The fact is that housing is increasingly unaffordable – particularly for ordinary working class people who are struggling to get by. […] The starting point is to build more homes […] so that more ordinary working families can afford to buy a home.” Developers with a focus on the low-income segment – such as Persimmon PLC – should thus be able to fill the order books despite a shift towards less favourable conditions, since affordable housing has (according to Theresa May) to be built to house Britain’s lower and middle class. In length, our theory suggests that companies that are constructing lower-cost properties are better protected against a downturn.

To summarize the discussion on macro factors, we do recognize that Persimmon PLC has thrived for the past 10 years thanks to an environment we should not expect will extend into the future, which is why the upper- bound growth rate is assigned a mere 10% probability. Yet, we do assume there is quite a bit of runway still given a seemingly favourable demand- supply dynamic and political backing. We hence assign a 60% probability to our steady 5% growth scenario. Yet, we appreciate the effect a financial recession would have on a cyclical stock such as this, which is why we have assigned a 30% probability to the 10% annual decline scenario.

Now that we have covered the major factors’ effects on home developers’ performance, we will compare Persimmon PLC with its competitors in an attempt to better assess its competitiveness.

Competitors and Persimmon PLC’s Competitive Advantage

As mentioned, Persimmon PLC is targeting lower and middle class families and first-time buyers. For our competitor analysis, we are thus disregarding companies that do not focus on the low-income segment, as we surmise that companies such as Telford Homes PLC with a unit price (the average price a home is sold for) of £527,000, Crest Nicholson Holdings PLC

(£388,000) and Abbey PLC (£336,075) are targeting a different group of aspiring homeowners. In length, we chose to focus on companies whose average unit price is around the “affordable housing” definition of £250,000.

In the end, two competitors more or less matched the thesis: the market leader, Barratt Developments PLC (BDEV) with £4.82 billion in revenue and an average unit price of £275,200, and the market follower, Bellway PLC (BWY) with £2.73 billion in revenue and an average unit price of £260,354. Persimmon PLC’s homes are selling for £213.321 on average, hence making it the cheapest option for aspiring homeowners.

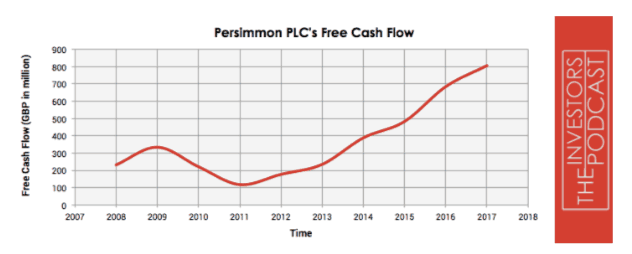

As the following table underscores, the sector has been very prosperous for the past five years with high double-digit growth in free cash flows.

Though all companies have performed very well, it is worth noting that Persimmon PLC outperformed the competitors with 8-14%.

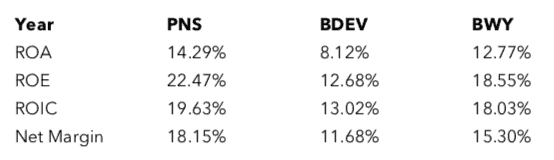

Measured on a set of profitability metrics, Persimmon PLC is coming out on top too, cf. the below list of 5-year averages for all three companies.

It seems like Persimmon PLC is the highest growing and most profitable business in the low-price segment despite having the lowest unit prices.

These figures lead us to believe that 1) Persimmon PLC is a well-run business with a strong management team, and 2) the company appears to benefit from a cost advantage; a valuable moat when one’s offerings are tailored to a price-conscious target group.

To elaborate on point 1) regarding Persimmon PLC’s management team, let’s discuss the company’s capital allocation strategy. Thanks to the growth and profitability figures outlined above, Persimmon is bathing in cash. From 2016 to 2017 alone, the company increased its cash position by 43%, from £913 million to £1.3 billion. For the past four years, Persimmon PLC has increased its cash position by 59% per annum. In addition, all debt is paid, which is why Persimmon PLC’s long-term debt amounts to just £356 million. Generally speaking, the company showcases a strong balance sheet with £3 billion in net assets.

That Persimmon is a cash-generative machine is evident in its Capital Return Plan. In 2012, management swore to return about £6 per share between 2012-2021. They have just increased that amount to £13, of which £6 has already been paid (shareholders can thus expect to receive £7 in dividends during the next 3 years). We are thus led to believe that management is shareholder friendly and runs the business efficiently.

Persimmon PLC’s operational efficiency is substantiated when we turn to point 2) regarding the business’ cost advantage. As mentioned, the numbers above indicated that Persimmon PLC’s profitability is above average. It seems it is a position Persimmon PLC nurtures, since the business has a keen focus on cost management and efficiency programs according to the 2017 annual report (p. 16). The program entails initiatives such as cash-efficient land replacement processes (acquiring land in attractive locations on deferred payment terms), own brick manufacturing and shorter build periods than competitors thanks to their Space4 construction method (more information on said method is found on p. 34 of the 2017 annual report).

In short, since Persimmon PLC’s homes are the cheapest option on the market, we believe Persimmon PLC’s value proposition is attractive to the price-conscious segment. Persimmon PLC is determined to keep that position, which is evident in its tight cost control. This sharp cost focus has

resulted in sector-beating operational efficiency, which has rewarded shareholders with excess cash to be distributed via the Capital Return Plan.

Persimmon PLC’s Risks

Various risks are embedded in the macro review above. A recession will surely hurt and undoubtedly hit this sector more than less cyclical ones. Yet, if you believe Theresa May’s must-and-shall thesis regarding new homes in Britain, Persimmon PLC seems like a better protected developer thanks to the above-mentioned political support.

In addition, the uncertainty regarding Brexit’s influence on the country’s economy is worth mentioning. If the government goes back on its promise to help Persimmon PLC’s potential customer group (including the Help to Buy program), this will obviously handicap these aspiring homeowners, which in turn will hurt Persimmon PLC. Interest rate rises, reduced credit availability, increases in material prices, legislation regarding wage increases for blue-collar workers etc. are also worth highlighting.

The reader is referred to p. 23-27 of the 2017 annual report where these risks and others are outlined.

Opportunity Costs

Whenever an investment is considered one must compare it to any alternatives to weigh up the opportunity cost. At the time of writing 10-year treasuries are yielding 3.2% if we take inflation into account the real return is likely to be closer to 1.2%. The S&P 500 Index is currently trading at a Shiller P/E of 33.5, which is 102.5% higher than the historical mean of 16.6. Assuming reversion to the mean occurs, the implied future annual return is likely to be -3%. Persimmon PLC, therefore, appears to offer a more attractive return for investors at present, but other individual stocks may be found which offer a similar return relative to the risk profile.

Conclusion

To recap the above analysis, we wish to highlight the following key points:

• Though it seems like the past cycle’s tailwind is winding down, the British government has demonstrated that it is motivated to solve the country’s housing problem through various initiatives. Initiatives, which Persimmon

is particularly well-positioned to benefit from due to its focus on the low- income segment (lower and middle class families and first-time buyers).

- Home developers can currently not meet the demand, which creates an attractive supply-demand dynamic. In addition, independent reports estimate that by 2039 there is a need for 210,000 new homes per year, which – in theory – should ensure Persimmon PLC a runway for years. However, the investor must be aware that a recession is a wildcard that could force a cyclical business like Persimmon PLC to its knees.

- Mr. Market is currently pricing Persimmon – which has grown its free cash flows at 35% per annum over the last 5 years and 18% in 2017 – as a zero- growth company. An intrinsic value assessment that sums together three potential scenarios suggests that Persimmon PLC might be priced at a 13.3% annual return if the company can be purchased at today’s price.

- The management team is shareholder friendly, evident in its Capital Return Plan, which circulates around the distribution of the £1.3 billion that sits on the balance sheet – a cash position that the company has increased by 59% per annum during the last 4 years.

- Persimmon PLC’s operational efficiency is sector-beating, evident in higher margins and returns on capital. For these reasons, we conclude that Persimmon PLC’s benefits from a cost advantage.In short, our snapshot of Persimmon PLC is as follows: a practically debt- free, two-digit growth story with sector-beating margins, a shareholder- friendly management team that targets a customer group who enjoys political support, is offered on the market for a P/E and P/CF around ~9. There are all sorts of risks involved, and the stock is cyclical so though it is trading at a 52-week low, we cannot rule out that the stock will plummet further.Disclaimer: The authors do not hold ownership in any of the companies mentioned at the time of writing this article.

– – – – –

Jakob Bruhn is part of The Investor’s Podcast writing team, and has his own value investing blog dhandho.dk.