Intrinsic Value Assessment Of Addvantage Technologies (AEY)

By Christoph Wolf From The Investor’s Podcast Network | 03 February 2019

INTRODUCTION

ADDvantage Technologies Group is a small-cap company with two operating segments. The cable TV part is the legacy business. They sell new, surplus, and refurbished cable television equipment to cable television operators. This business unit has been in steady decline and has just been sold, and the deal is expected to be finalized in Q3 2019. The Telco segment provides new and used telecommunication networking equipment and makes up their new business. ADDvantage Technologies Group started this segment by acquiring Nave in 2014, followed by the takeover of Triton in 2016.

As the company has recently reported a large loss and it is yet unclear if ADDvantage Technologies Group will succeed with this completely new business model, the stock has crashed to only $1.43. Is ADDvantage Technologies Group a bargain or will the company not succeed with the turnaround?

THE INTRINSIC VALUE OF ADDVANTAGE TECHNOLOGIES GROUP

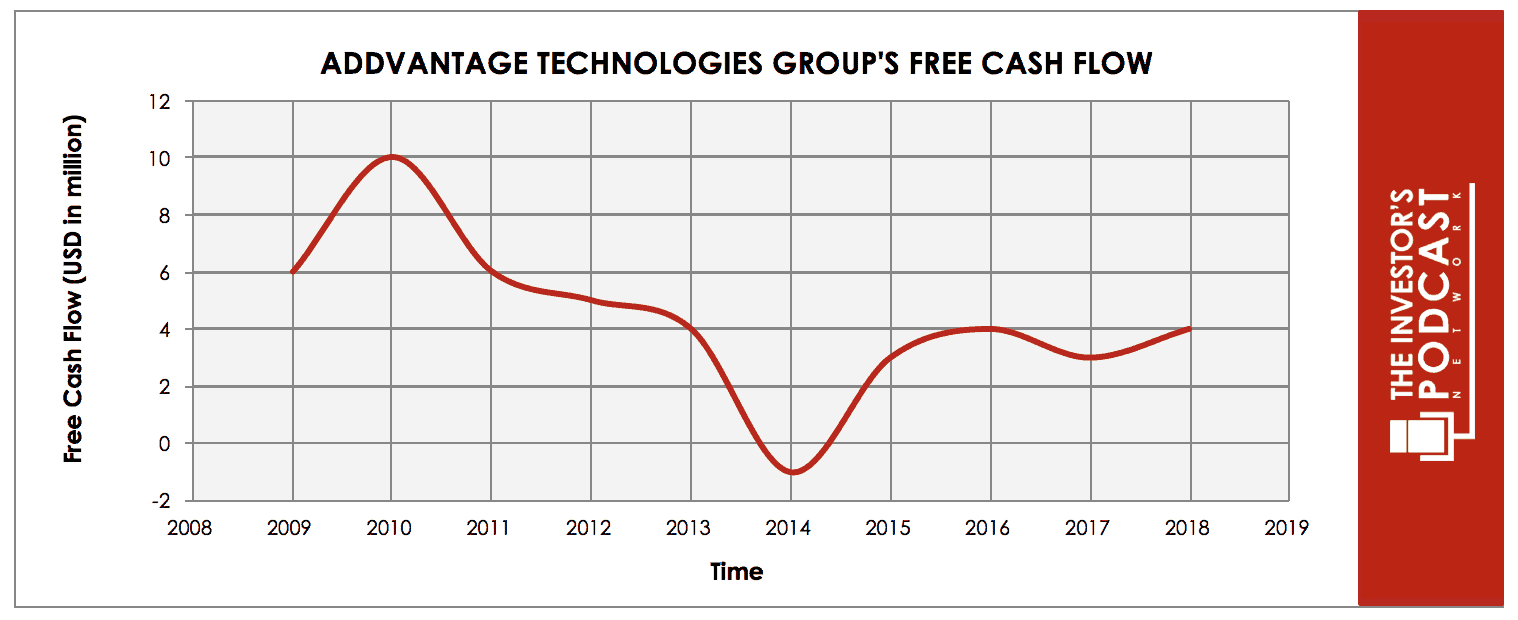

To determine the value of ADDvantage Technologies Group, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of ADDvantage Technologies Group’s free cash flow over the past years.

Except for 2014, the free cash flow has been consistently positive and stable. Then, how come the company reported a large net loss recently? This loss was due to several non-cash factors such as goodwill impairment in the cable TV segment, provisions of obsolete inventory, and deferred payments due to the two acquisitions.

Since negative earnings should not be dismissed and there is much uncertainty with this business, we will err on the safe side when estimating the future cash flows.

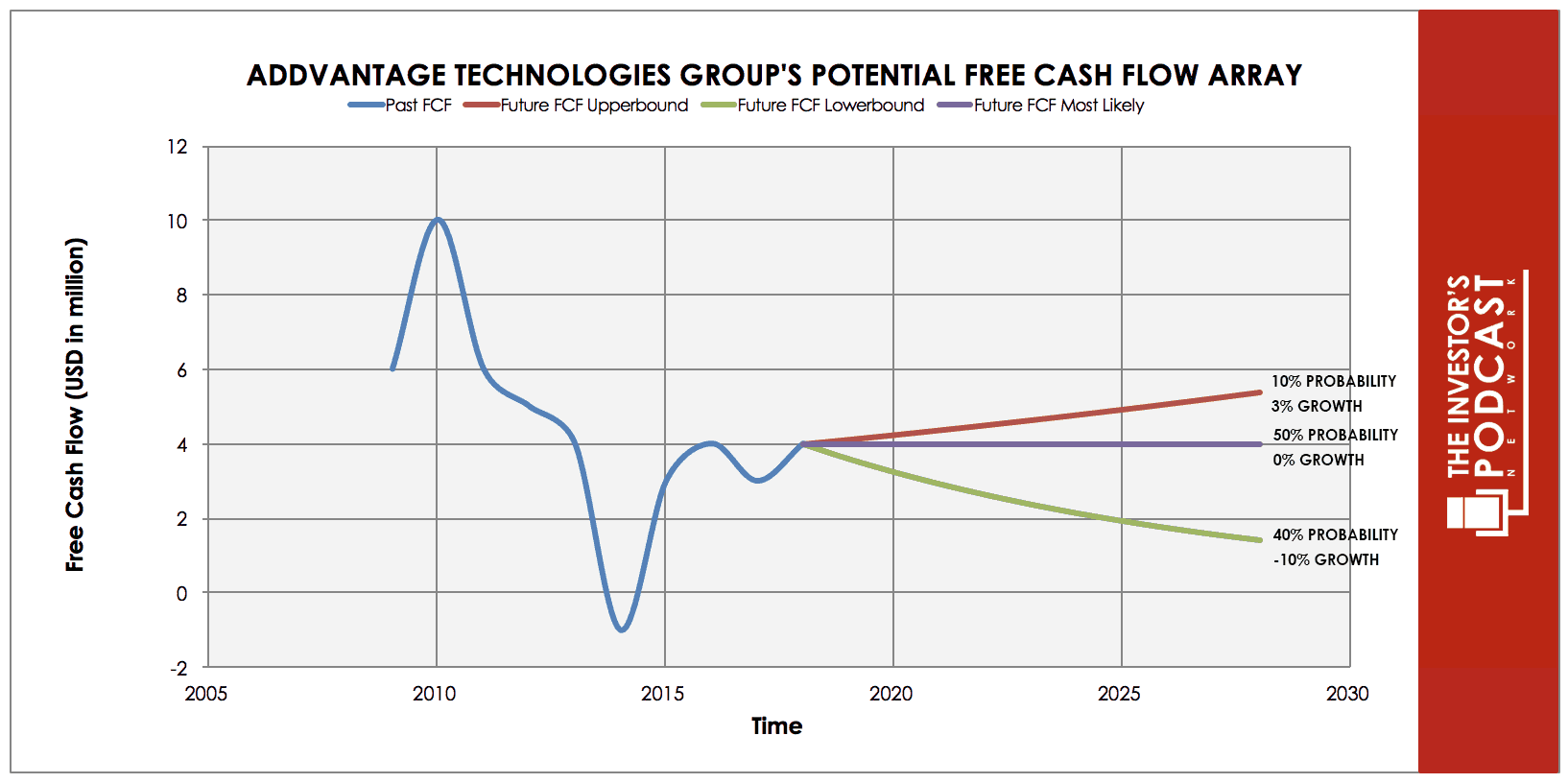

Each line in the above graph represents a certain probability for occurring. We assume a 10% chance for the upper growth rate of 3% per year. The most likely scenario of zero growth is assigned a 50% chance. We denote a 40% chance to the possibility of a 10% annual contraction.

Assuming these growth rates and probabilities are accurate, ADDvantage Technologies Group can be expected to give a 24.3 % annual return at the current price of $1.43. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF ADDVANTAGE TECHNOLOGIES GROUP

ADDvantage Technologies Group possesses some unique advantages that should allow it to be successful in the future:

- Positive effects of Nave acquisition. In 2014, Nave Communications was bought to kick-off ADDvantage Technologies Group’s Telco business. While this caused many costs and problems, the company has now been fully integrated and grows nicely. ADDvantage Technologies Group also plans to lower costs at this division by moving Nave’s inventory management and order fulfillment to Huntsville, Alabama. The existing facility in Baltimore will be subleased. All of this will reduce operating costs.

- Synergies of Triton acquisition. In 2016, ADDvantage Technologies Group bought Triton, which significantly improved the footprint in the Telco segment. While ADDvantage Technologies Group had to downvalue equipment because of this acquisition (which in accounting terms reduced their earnings), the synergies only now start to improve ADDvantage Technologies Group’s business.

- Vast recent cashflow injection. ADDvantage Technologies Group sold its Broken Arrow property in Oklahoma for $5 million in late 2018, making ADDvantage Technologies Group debt-free. Currently, the company is divesting its cable TV business for another $10.3 million. This cash gives ADDvantage Technologies Group many possibilities and should cushion any problems with the integration of Triton.

- Consistently cash-flow positive. While earnings have recently turned negative, the company has consistently produced free cash flow throughout the last decade (with one small exception in 2014). While the negative earnings should not be completely ignored, this mismatch is mostly an accounting issue. Earnings turned negative because of a $1.2 million goodwill impairment in the cable TV segment, provisions of obsolete inventory, and deferred payments due to the two

- Experienced and good management. Having worked as interim-CEO before, Joseph Hard was named permanent CEO at the end of 2017. He has vast experience from his former work as vice president of services at AT&T, as well as management positions at Gordman Networks and Aero Communications. His experience combined with ADDvantage Technologies Group’s history of prudent management – low debt, not overpaying for acquisitions – improve the chances to turn around ADDvantage Technologies Group’s business.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of ADDvantage Technologies Group to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 2.65% return. Considering the bond is completely impacted by inflation, the real return of this option is likely only marginally positive.

Also, investment in the U.S. stock market does not offer significantly higher returns. Based on the S&P 500 Shiller P/E (“CAPE”) ratio of 29.7, the U.S. stock market is priced at a 3.34% yield. By adjusting the CAPE ratio for fluctuations in the profit margins, John Hussman developed the even more reliable MAPE-ratio. Based on this indicator, expected S&P 500 total returns are negative for the next twelve years. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

As the cable TV segment has been in constant decline, ADDvantage Technologies Group’s management was forced to reorganize the company by focusing on the Telco segment. While ADDvantage Technologies Group has already found another niche with Telco, the business of selling old and new telecommunications equipment does not exactly sound exciting, which also explains the low stock price. Since boring businesses are often successful businesses, this lack of enthusiasm for Wall Street might give an opening to value-conscious investors.

The planned 5G expansion in the wireless space by all major U.S. telecommunication carriers should give ADDvantage Technologies Group also a great opening into a new addressable market. To take advantage of this possibility, ADDvantage Technologies Group has recently launched a new wireless infrastructure services business.

RISK FACTORS

Several risks might limit the growth prospects of ADDvantage Technologies Group:

- Disruption due to the selling of a legacy ADDvantage Technologies Group’s legacy cable TV segment has been in steady decline and was recently sold off completely. The company has now to run a completely different business based on the Telco business. It is yet not clear if the company will manage to successfully transform itself in this new business environment.

- Risk of further impairments. ADDvantage Technologies Group’s inventory can easily become obsolete, requiring further write-downs. This is especially a risk because of the two recent acquisitions. Still, the acquisition of Nave in 2014 is complete, so there should no larger write-ups to be expected. The 2016 Triton acquisition is nevertheless not finished, so the possibility of write-downs of goodwill, intangibles, and inventory cannot be dismissed. The Triton acquisition also requires ADDvantage Technologies Group to make additional deferred All of these issues can or will eat into ADDvantage Technologies Group’s earnings.

- Risk of overpaying for acquisitions. Because of the sale of the Broken Arrow property and its cable TV business, ADDvantage Technologies Group is currently flush with cash. While this is surely a good thing, there is the risk that management makes bad decisions because of this available money. The need to invest and “do something” might prompt them to overpay for acquisitions or use the money for other shareholder value- destroying means. Since management seems thoughtful and responsible, this risk can be considered small.

SUMMARY

ADDvantage Technologies Group is currently in the process of completely reorganizing its business. Not surprisingly, this causes many problems and costs, and it is yet not clear if the company will be successful in the new area of the Telco segment. Although earnings have turned negative recently, the company has been consistently able to produce positive free cash flows.

While surely not without risk, the signs so far look rather encouragingly – which makes the projected annual return of 24.3% seem appealing. Since the risk of a failure of the turnaround is nevertheless existing, investors are well-advised to do further research before buying this stock.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.