Intrinsic Value Assessment Of Advanced Energy Industries Inc. (AEIS)

By David J. Flood From The Investor’s Podcast Network | 11 July 2018

INTRODUCTION

Advanced Energy Industries Inc. is an American-based technology company whose principal business involves the development of power and control technologies used in the manufacture of semiconductors, flat panel displays, data storage systems, solar cells, and architectural glass. The firm’s market cap currently stands at around $2.40 Billion and its revenues and free cash flows for the previous financial year were approximately $671 Million and $174 Million respectively. The company’s common stock has fluctuated between a high of $95 and a low of $57 over the past 52 weeks and currently stands at around $61. Is Advanced Energy Industries Inc. undervalued at the current price?

THE INTRINSIC VALUE OF ADVANCED ENERGY INDUSTRIES INC.

To determine the intrinsic value of Advanced Energy Industries Inc., we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Advanced Energy Industries Inc.’s free cash flow for the past ten years.

As one can see, the company’s free cash flow has fluctuated over the past decade due to the cyclicality in the semiconductor industry and variances in capital spending. Despite this, the firm’s free cash flow has grown at an annualized rate of around 29% over the previous decade. To determine Advanced Energy Industries Inc.’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of possible outcomes for future free cash flows in the graph below.

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents a 14% growth rate which the author has used instead of Advanced Energy Industries Inc.’s 29% growth rate for the last ten years. This is because companies can seldom maintain such a high growth rate for prolonged periods. This growth rate has been assigned a 10% probability of occurrence to account for a number of factors including the rapid rate of change and high levels of competition found in the semiconductor industry and the fact that the imposition of trade tariffs by the U.S. government is likely to impact the firm’s operations.

The middle growth line represents an 8% growth rate which is based on the firm’s historical revenue growth for the previous ten years. This has been used as earnings tend to revert toward this rate of growth as a company matures. This scenario has been assigned a 50% probability of occurrence in light of the potential risks outlined above.

The lower bound line represents a -10% rate in free cash flow growth and assumes that the company suffers a contraction in earnings due to competitive and cyclical pressures, the loss of major clients, and the negative impact of trade tariffs. This growth rate has been assigned a 40% probability of occurrence.

Assuming these potential outcomes and corresponding cash flows are accurately represented, Advanced Energy Industries Inc. might be priced at an 8% annual return if the company can be purchased at today’s price. We’ll now look at another valuation metric to see if it corresponds with this estimate.

Based on Advanced Energy Industries Inc.’s current earnings yield, which is the inverse of its EV/EBIT ratio, the company is currently yielding 10.72%. This is above the firm’s 10-year historical median of 8% and the Global Electronic Components Industry median average of 4.22% suggesting that the company may be undervalued relative to its historical and industry comparisons. Finally, we’ll look at Advanced Energy Industries Inc.’s free cash flow yield, a metric which assumes zero growth and simply measures the firm’s trailing free cash against its current market price. At the current market price, Advanced Energy Industries Inc. has a free cash flow yield of 6.81%.

Taking all these points into consideration, it seems reasonable to assume that Advanced Energy Industries Inc. may currently be trading below fair value. Furthermore, the company may return around 8% at the current price if the estimated free cash flows are achieved. Now, let’s discuss how and why these estimated free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF ADVANCED ENERGY INDUSTRIES INC.

Advanced Energy Industries Inc. has various competitive advantages outlined below.

- Critical Role in The Supply Chain. Advanced Energy Industries Inc. occupies a critical role in the supply chain for the semiconductor industry.

Figure 1: Source: Advanced Energy Industries Inc., Spring 2018 Investor Presentation

Since the firm’s products are vital for the manufacturing process, they can outperform the Global Electronic Components Industry on a number of key metrics which can be seen in the chart below.

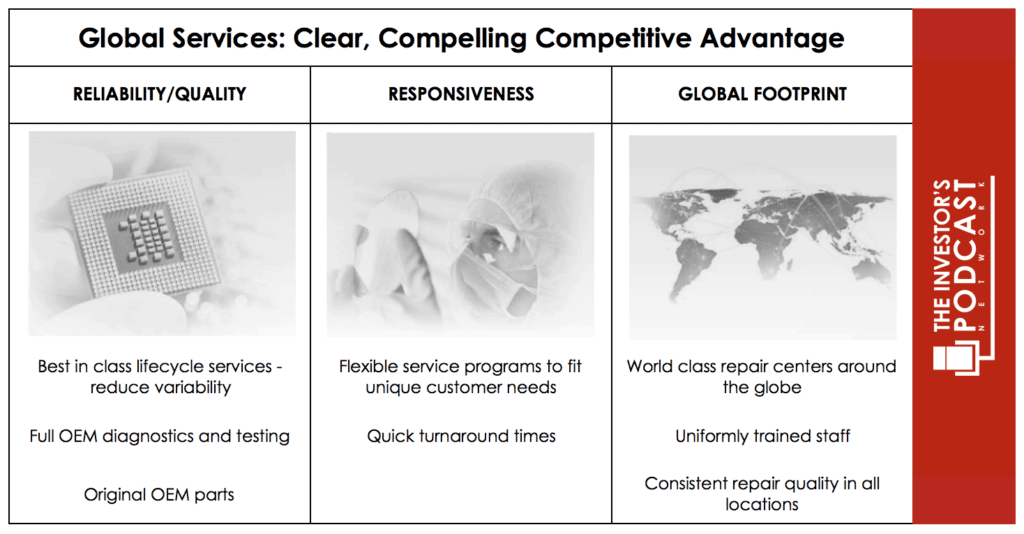

- Global Services Network. Advanced Energy Industries Inc. has established a Global Services Network in order to provide its customers with comprehensive local repair service and customer support. This services network provides the company with preventative maintenance opportunities and allows it to ensure that its customers do not incur the significant costs of system downtime.

Figure 2: Source: Advanced Energy Industries Inc., Spring 2018 Investor Presentation

- Intangible Assets. Advanced Energy Industries Inc. possesses a portfolio of patents which includes 121 United States patents and 91 foreign issued patents. This portfolio of patents enables the company to protect its intellectual property and defend its market-leading

ADVANCED ENERGY INDUSTRIES INC.’S RISKS

Now that Advanced Energy Industries Inc.’s competitive advantages have been considered, let’s look at some of the risk factors that could impair my assumptions of investment return.

- While Advanced Energy Inc. has a broad client base of around 280 OEM’s and 1,600 end users, it still derives a significant proportion of its revenues and earnings from a small number of companies within the industry. In 2017, the firm’s ten largest customers accounted for around 70% of sales with Applied Materials Inc. and Lam Research accounting for 33.5% and 23.1% respectively. A loss of one or more of these customers would likely impair the company’s future financial performance.

- The Semiconductor Industry is subject to a rapid rate of change where game-changing technologies can emerge which have disruptive effects. There is no guarantee that Advanced Energy Industries Inc. will not, at some point in the future, be subject to such disruptive forces which could lessen the value of its intangible assets or render its intellectual property obsolete.

- At present, Advanced Energy Industries Inc.’s primary manufacturing facility is based in Shenzhen, China. The company is therefore at increased risk from the imposition of trade tariffs by the U.S. Government which could result in rising import costs and a subsequent weakening of the firm’s competitive advantage. Depending on the final regulations imposed, management has stated that they may elect to move some of their manufacturing operations to the U.S. which may also increase costs due to higher labor wage demands and regulatory obligations.

OPPORTUNITY COSTS

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At the time of writing, 10-year treasuries are yielding 2.82%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of 31.8 which is 88.2% higher than the historical mean of 16.8. Assuming reversion to the mean occurs, the implied future annual return is likely to be -2.6%. Advanced Energy Industries Inc., therefore, appears to offer a much better return for investors at present, but other individual stocks may be found which offer a similar return relative to the risk profile.

MACRO FACTORS

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns.

At present, the S&P is priced at a Shiller P/E of 31.8. This is 88.2% higher than the historical average of 16.8 suggesting markets are at elevated levels. U.S. unemployment figures are at a 30-year low suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 202.80% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

Advanced Energy Industries Inc. operates in a highly competitive industry which is subject to rapid rates of change. The Semiconductor Industry, from which the firm derives around 70% of its revenues, is also subject to cyclical pressures which may impact demand for the company’s products and services. The rising risk of a global trade war may also materially impact the firm’s future economic performance.

Figure 3: Source: Advanced Energy Industries Inc., Spring 2018 Investor Presentation

There are, however, numerous future growth opportunities for the company which includes emerging technologies such as Autonomous Vehicles, Augmented & Virtual Reality Technology, and the IOT (Internet of Things). Assuming the firm can maintain its record of innovation through sufficient R&D spending, its long-term future looks favorable at present.

With regards to Shareholder friendliness, Advanced Energy Industries Inc. has been returning value to shareholders in the form of share repurchases while maintaining its R&D operations to ensure the development of new technologies. In 2015, the Board of Directors authorized a program to repurchase $150 Million worth of common stock. In 2017, this program was extended to December 2019 with $70 Million remaining for the authorized repurchase of shares.

In summary, Advanced Energy Industries Inc. is likely to face some near-to-mid-term pressures from both the cyclicality of the semiconductor industry and the rising costs associated with the rapidly escalating trade war. The company appears well positioned to withstand these pressures with no debt to speak of and around 50% of its assets comprising of cash and equivalents. Its long-term future appears favorable at present with multiple growth opportunities in view.

Based on the conservative assumptions used in the free cash flow analysis, Advanced Energy Industries Inc. may return around 8% at the current market price.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.