Intrinsic Value Assessment Of American Express (AXP)

By Christoph Wolf From The Investor’s Podcast Network | 06 January 2018

INTRODUCTION

American Express is a very successful company with a long history. But it has recently struggled to adapt to a rapidly changing landscape in the business of financial transactions. As a result, both its revenue and profit peaked in 2014. What lies ahead for American Express, and is it undervalued at its current stock price of $99?

American Express is a unique financial company which has been led by its well-known CEO Kenneth Chenault for the last sixteen years. While the company is mostly known for its credit cards and traveler cheques, it differs in one important point from other credit card companies like Visa or MasterCard. While these two competitors mostly make money by collecting fees for providing the financial architecture used for financial transactions, American Express additionally also owns the loans. Therefore, it also features many elements of a traditional bank – and indeed American Express is officially registered as a bank since 2008.

THE INTRINSIC VALUE OF AMERICAN EXPRESS

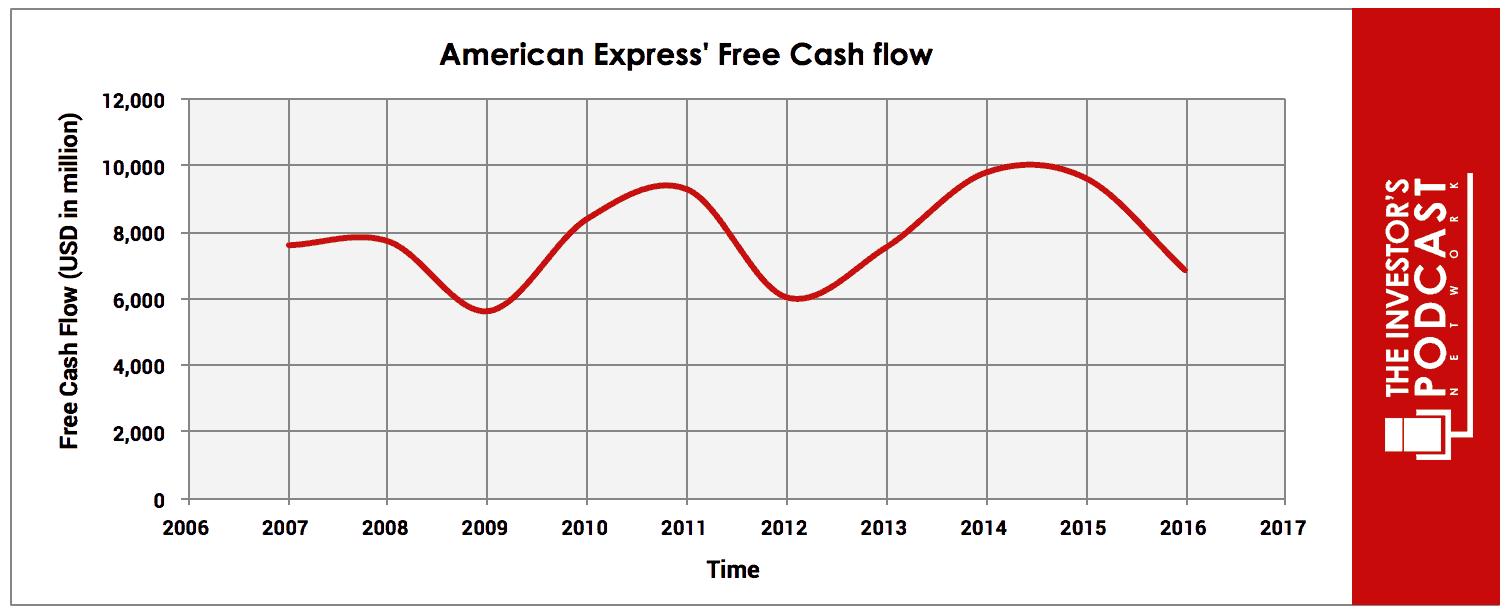

To determine the value of American Express, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of American Express’ free cash flow over the past ten years.

As one can see, the results oscillate around a slowly rising long-term mean value. To model the expected future cash flow, we will use a conservative estimate.

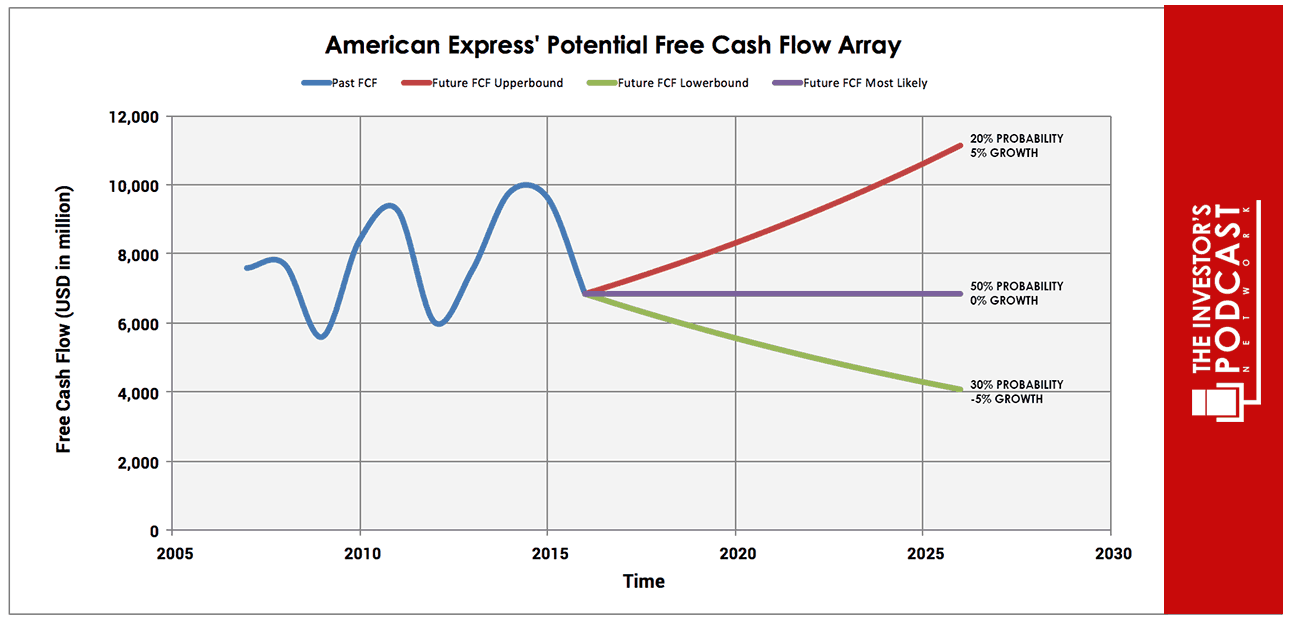

Each line in the above graph represents a certain probability for occurring. We assume a 20% chance for the upper growth rate of 3% per year, a 50% chance for an annual growth of 0%, and a 30% chance for the worst-case scenario of -5% annual growth.

Assuming these growth rates and probabilities are accurate, American Express can be expected to give a 6.2% annual return at the current price of $99. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF AMERICAN EXPRESS

American Express possesses several advantages:

- American Express is a very strong and trusted brand. For many clients, it is even a status symbol to use an “Amex card.” This premium branding is actively reinforced by the company – by offering special gold or platinum cards to important clients and by providing unique deals and bonus offers.

- Management. Kenneth Chenault has been an outstanding CEO, and even after his recent departure, the strong corporate culture can be expected to continue.

- Closed-loop business model. In contrast to Visa or MasterCard (which both only provide the architecture for transactions – an “open loop” model), American Express also owns the loans, making it a “closed-loop” model. It, therefore, has two sources of revenue and also has more control and information over the complete process and its clients.

RISK FACTORS

The risks for American Express are impossible to overlook in the new era for banks and credit card companies. Here is a list of the most important headwinds:

- Increasing “traditional” competition. The credit business gets more and more crowded and competitive resulting in lower margins. Besides the long-time competition by Visa and MasterCard (which are both several times larger than American Express), traditional banks like JPMorgan or Bank of America are now also major players in the credit card business.

- New competition. Several new players have entered the business field that American Express is operating in. These include PayPal, Alibaba’s Alipay, Tencent’s Tenpay, Apple Pay, as well as multiple smaller Fintech All of these companies change and shape the way that we buy things and use credit – and nobody can yet predict, how the future will eventually look like.

- Creative destruction: All industries can be disrupted by innovation – popularly called “creative destruction.” A company like American Express is affected as well. The blockchain is expected to change the landscape of traditional banking, and new cryptocurrencies can send and process payments a lot fatter and more importantly cheaper than traditional companies.

- Loss of Costco exclusivity arrangement. From 2004-2016, American Express had a special deal with Costco, a retailer. During this time, Costco had accepted credit cards solely from American Express. When this exclusive deal ended in favor of Capital One and MasterCard, American Express’s revenue decreased by about 5%.

- Strong focus on the S. While American Express cards are routinely accepted in the U.S., in the rest of the world, its cards can often not be used for payment. This makes the company vulnerable to a worsening U.S. economy and limits its growth possibilities.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of American Express to other ideas. First, one could invest in the ten-year treasury bond which is producing a 2.5% return. Considering the bond is completely impacted by inflation, the real return of this option is likely below 1%. Currently, the S&P 500 Shiller P/E ratio is 32. As a result, the U.S. Stock Market is priced at a 3.1% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The banking and credit card sector is currently experiencing a major disruption– both because of old and new market players. While in the short term, the business model of American Express should continue to work. In the medium and longer term, it is very hard to predict. At this moment, nobody knows how the finance and credit system will work in the future.

SUMMARY

American Express is a unique company, but its future is quite hard to predict since the financial landscape is undergoing a major change. The jury is still out whether this model will also work in the future. American Express is a strong company with the traditional advantages of a well-establish financial company. However, despite the temporary jump in the trailing twelve-month free cash flow that was not included in the first graph, the risks are piling up and a much more conservative approach with the basis of the end of the financial year of 2016 should instead be used. Given the assumptions outlined in this article, an expected annual return of 6.2% seems like a relatively fair value.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.