Intrinsic Value Assessment of Acco Brands Corporation (ACCO)

By Christoph Wolf From The Investor’s Podcast Network | 11 August 2023

INTRODUCTION

ACCO Brands Corporation is a global leader in designing, manufacturing, and marketing office products and academic supplies. The company offers a diverse range of well-known brands like AT-A-GLANCE, Swingline, Mead, and Five Star, catering to the needs of consumers and businesses worldwide. ACCO focuses on providing innovative and functional solutions that increase productivity and organization in workplaces and educational environments. They operate through a multi-channel distribution network, including e-commerce platforms, retail stores, office supply chains, and wholesalers, ensuring broad market reach. ACCO emphasizes sustainability by implementing responsible sourcing, energy-efficient manufacturing, and eco-friendly product designs, while also supporting educational programs and philanthropic efforts.

Having reached an all-time high of almost $43 in 1998, the stock has been on a volatile downward trend since and now stands at only $6.02. Is this depressed valuation a bargain or a value trap?

INTRINSIC VALUE OF ACCO

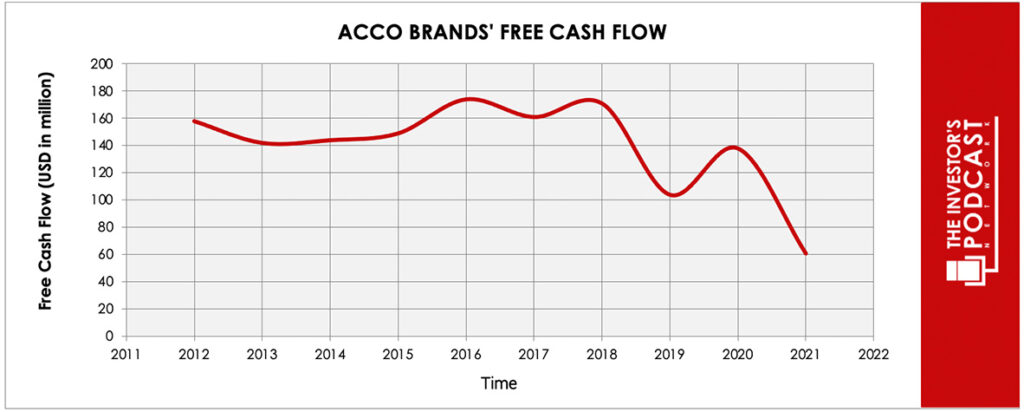

To determine the intrinsic value of ACCO, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of ACCO’s free cash flow over the past years.

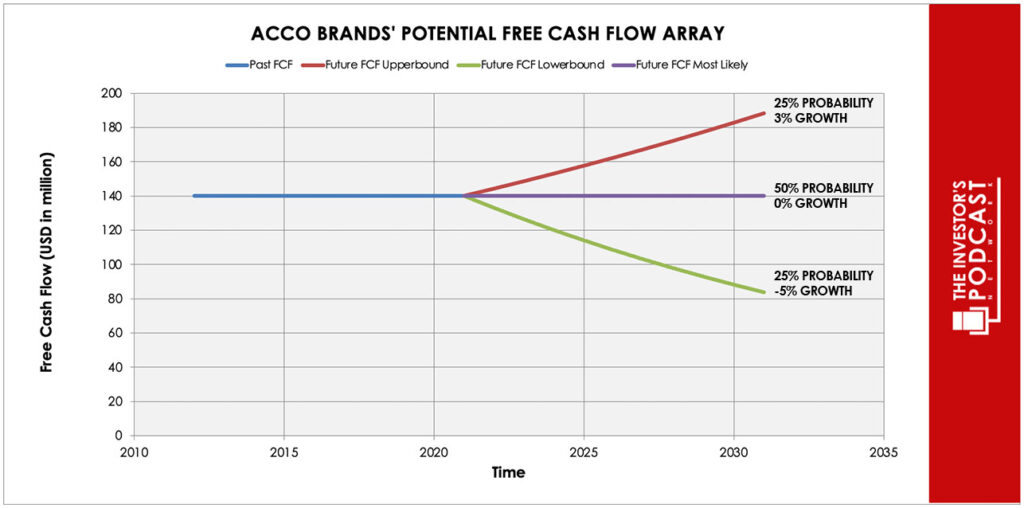

As one can see, the free cash flow is quite volatile and has recently turned downwards. To construct a model of the intrinsic value of ACCO, we will use the ten-year average of the FCF-values as starting point. Based on this value, we then assume three different scenarios for the future.

Each line in the above graph represents a certain probability of occurring. Due to the company’s recent headwinds, a conservative estimate is used. We assume a 10% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 40% probability.

Even with these conservative assumptions, ACCO can be expected to give a 22.5% annual return at the current price of $6.05. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF ACCO

ACCO Brands Corporation possesses several competitive advantages.

- Commitment to sustainability and social responsibility. ACCO Brands has a strong commitment to sustainability and social responsibility. The company incorporates environmental considerations, including responsible sourcing, energy-efficient manufacturing processes, and eco-friendly product designs. Additionally, ACCO supports educational programs and philanthropic initiatives, contributing to the improvement of communities.

- Diverse portfolio of recognized brands. ACCO has a diverse portfolio of well-known and trusted brands in the office products and academic supplies industry. Brands like AT-A-GLANCE, Swingline, Mead, and Five Star have a strong market presence and customer loyalty. This extensive brand portfolio gives ACCO a competitive edge by offering a wide range of products that cater to various customer preferences and needs.

- Multi-channel distribution network. ACCO has built a robust multi-channel distribution network that spans e-commerce platforms, retail stores, office supply chains, and wholesalers. This broad and diversified distribution strategy enables ACCO to reach a wide range of customers across different geographic regions. By leveraging multiple distribution channels effectively, ACCO expands its market reach and maintains a competitive advantage over competitors with more limited distribution networks.

When looking at various investment opportunities in the market today, let’s compare the expected return of ACCO to other ideas. First, one could invest in the ten-year treasury bond which produces a 3.93 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 31.9. As a result, the US Stock market is priced at a 3.13% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

ACCO operates within a macro environment characterized by technological advancements, evolving work and learning environments, sustainability considerations, and global factors. Rapid technological changes, such as digitalization and e-commerce, impact the industry, forcing ACCO’s adaptation through digital platforms and innovative products. Shifting work and learning environments, including remote work and online education, require ACCO to align its offerings with the demand for digital collaboration tools and flexible organizers.

ACCO’s commitment to sustainability, responsible sourcing, and eco-friendly designs positions the company favorably in an environment where environmental considerations are increasingly important. Additionally, globalization and trade dynamics shape ACCO’s operations and market opportunities, requiring the navigation of trade policies and geopolitical events.

RISK FACTORS

ACCO faces several risks in its business operations.

- Technological disruptions. Rapid technological advancements pose a significant risk to ACCO, if the company fails to adapt and leverage emerging technologies effectively. Failure to anticipate and respond to digitalization, e-commerce, and changing consumer preferences for digital products and solutions may result in lost market share and reduced competitiveness.

- Intense competition. The office products and academic supplies industry is highly competitive, with numerous players competing for market share. Since the firm’s products are highly commoditized, there are very little switching costs.

- Brand perception and reputation. As a company that relies heavily on brand recognition and customer trust, ACCO faces the risk of negative brand perception or damage to its reputation. Any product quality issues, recalls, or instances of poor customer service can result in a decline in customer loyalty and negatively impact ACCO’s brand reputation, leading to potential loss of market share and revenue.

- Reliance on retail partnerships. ACCO has established partnerships with various retail channels to distribute its products. However, changes in the retail landscape, such as store closures, bankruptcies, or shifts in consumer shopping habits towards online platforms, could disrupt ACCO’s distribution network and limit its access to customers.

SUMMARY

As a potential investor in ACCO stock, there are multiple advantages. ACCO’s diverse portfolio of well-known brands, coupled with its focus on innovation and adaptation to changing work and learning environments, positions the company to capture market share and benefit from the demand for office products and academic supplies. ACCO’s commitment to sustainability and responsible practices also aligns with growing environmental considerations, potentially attracting socially conscious consumers and investors.

But there are also many risks such as technological disruptions that could impact its ability to adapt to digitalization and changing consumer preferences. Additionally, negative brand perception and intense competition pose risks to ACCO’s financial performance and market share.

If investors believe that ACCO can continue to remain competitive in this challenging landscape, the expected annual return of 22.5% looks highly rewarding, but investors should also not ignore the immense risks before buying the stock.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.