Intrinsic Value Assessment of ADT Inc (ADT)

By Christoph Wolf From The Investor’s Podcast Network | 19 July 2023

INTRODUCTION

ADT, formerly American District Telegraph, is a leading provider of security and alarm systems for residential, commercial, and industrial customers, where the largest revenue share comes from the commercial segment. The company has a long history and was created in 1874 in Baltimore, Maryland in the US. They offer a range of services in the US and Canada to help protect properties and ensure the safety of individuals and assets.

ADT’s business primarily revolves around the installation, monitoring, and maintenance of security systems, including intrusion detection, video surveillance, access control, and fire detection. The company also provides professional monitoring services through their network of monitoring centers, which operate 24/7 to ensure prompt response to security events.

With a focus on advanced technology and innovation, ADT continues to evolve its offerings to meet the ever-changing security needs of its customers.

ADT was listed as a public company in 2018 with an initial value of $14 per share. Since then, the stock performance has plummeted and the stock currently trades at less than half its initial value, namely $6.56.

Can investors expect a turnaround of its shares or are there valid concerns that underpin this low stock price?

INTRINSIC VALUE OF ADT

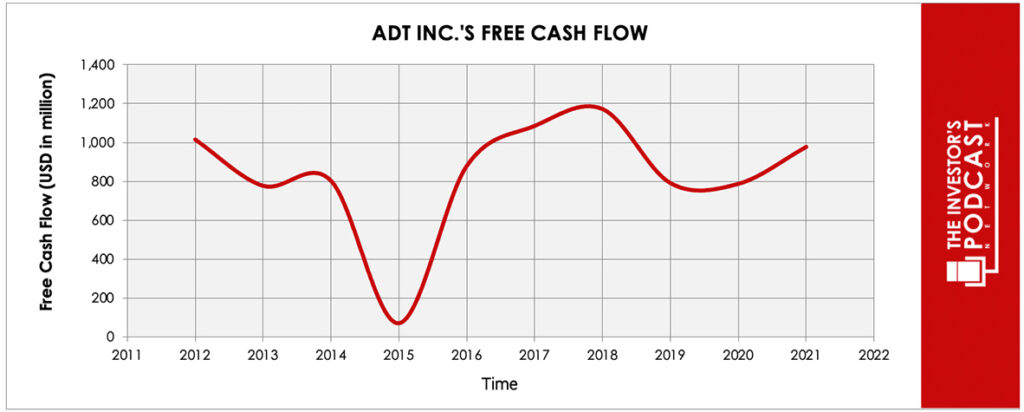

To determine the intrinsic value of ADT, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of ADT’s free cash flow over the past years.

As one can see, the free cash flow is quite volatile. To construct a model of the intrinsic value of ADT, we will therefore use the ten-year average of the FCF-values as starting point. Based on this value, we then assume 3 different scenarios for the future.

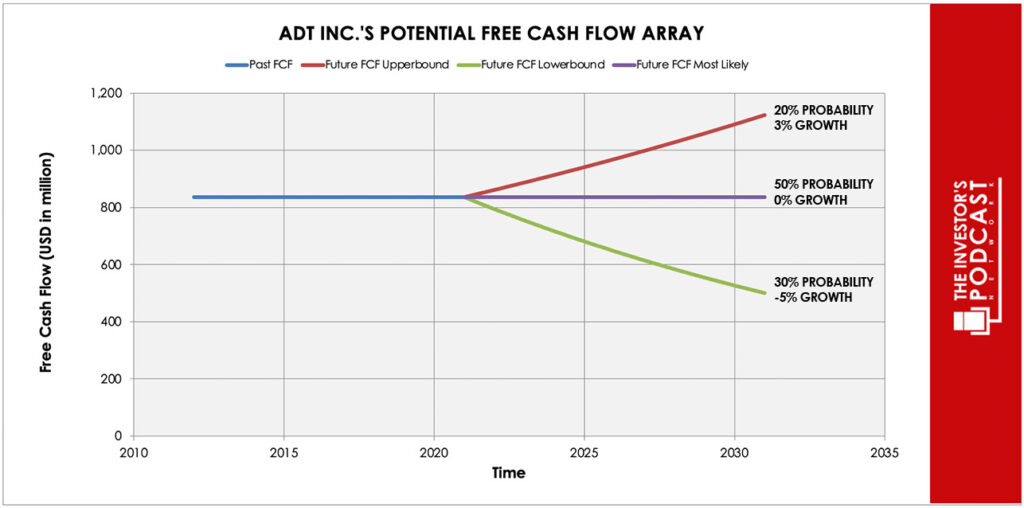

Each line in the above graph represents a certain probability for occurring. Due to the company’s low profitability, a conservative estimate is used. We assume a 20% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 30% probability.

Even with these conservative assumptions, ADT can be expected to give a 12.9% annual return at the current price of $6.56. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF ADT

- Comprehensive product offerings. ADT offers a wide range of security solutions that cater to various needs and requirements. Whether it’s residential, commercial, or industrial security, ADT provides a huge number of services such as intrusion detection systems, video surveillance, access control, fire detection, and alarm monitoring. Their expertise and diverse offerings allow customers to find tailored security solutions that address their specific requirements.

- Professional monitoring services. One of ADT’s key advantages are its professional monitoring services. ADT’s monitoring centers operate 24/7, ensuring continuous surveillance and immediate response to security events. In the event of an intrusion, fire, or other emergencies, ADT’s trained professionals can quickly assess the situation, notify the appropriate authorities, and dispatch emergency personnel if necessary.

- Established reputation and reliability. ADT has a long history in the security industry, with over 145 years of experience. During this time, ADT has built a strong track record of delivering quality service and has become a trusted name in the industry. Choosing ADT means partnering with a company that has a proven track record, extensive expertise, and a commitment to customer satisfaction.

When looking at various investment opportunities in the market today, let’s compare the expected return of ADT to other ideas. First, one could invest in the ten-year treasury bond which produces a 3.8 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 31.4. As a result, the US Stock market is priced at a 3.18% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The security industry is influenced by several factors and prone to vast and sudden changes. Rapid advancements in technology, including smart home automation, artificial intelligence, cloud computing, and IoT devices, have a significant impact on the industry. The security industry is also subject to various regulations and standards aimed at protecting consumer privacy, data security, and ensuring compliance.

Economic conditions also play a role in shaping the security industry. Fluctuations in the overall economy, consumer spending power, and business investments can influence the demand for security services. Finally, the security industry is highly competitive, with several companies offering similar products and services. ADT operates in an environment where competitors vie for market share, innovation, and customer loyalty.

In summary, ADT must adapt to technological changes, comply with regulations, navigate economic fluctuations, and stay competitive in the market to thrive in the security industry.

RISK FACTORS

- Shaky fundamentals. One risk of ADT’s financials is its high debt load, which could impose significant interest and debt servicing costs. Additionally, ADT’s recent lack of profitability raises concerns about its ability to generate sustainable earnings and improve its financial position, potentially impacting investor confidence and its ability to meet debt obligations.

- Privacy and data security breaches. ADT’s security systems often involve the collection and processing of sensitive data, including video footage and personal information. While ADT takes privacy and data security seriously, there is always a risk of unauthorized access or data breaches, making ADT liable for the resulting damage.

- False alarms. ADT’s security systems are designed to detect and respond to security threats. However, false alarms can be triggered by user error, system malfunctions, or external factors, leading to unnecessary disruptions and potential penalties. This can weaken ADT’s reputation and as result threatens to lose customers.

SUMMARY

There are multiple chances for investors thinking about buying ADT’s stock. The company operates in the growing security industry, which presents long-term prospects due to increasing awareness of security needs and technological advancements. Additionally, ADT’s established reputation, comprehensive range of services, and focus on innovation position it well to capitalize on market demand and generate healthy returns for investors.

But there are also many risks that one should be aware of. ADT’s debt load is high, and it has failed to make a profit in most of the last years. The security industry also faces intense competition and ADT is susceptible to economic fluctuations and changes in consumer spending patterns.

If investors believe that these risks can be overcome, then the expected annual return of 12.9% looks very rewarding. Otherwise, investors are advised to stay on the sideline and monitor the company’s future performance.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.