Intrinsic Value Assessment of CULP Inc (CULP)

By Christoph Wolf From The Investor’s Podcast Network | 19 June 2023

INTRODUCTION

CULP is a textile company that specializes in the design, manufacturing, and marketing of upholstery fabrics and mattress fabrics. Dating back to 1972, CULP has established itself as a leader in the global textile industry. The company offers a wide range of innovative and high-quality fabrics that are used in residential and commercial furniture, bedding, and other related applications.

CULP operates globally, serving customers in various countries around the world, including the US, Canada, China, and several European countries. The company operates through two primary segments: The mattress fabrics segment CULP Home Fashions, which focuses on providing fabrics for residential furniture and bedding markets, and CULP Upholstery Fabrics for residential and commercial furniture.

Having reached an all-time high of almost $38 in 2016, the stock has fallen sharply since then due to much lower consumer demand caused by unfavorable macroeconomic conditions. Is its current price of only $4.91 a bargain or are there convincing reasons for this depressed valuation?

INTRINSIC VALUE OF CULP

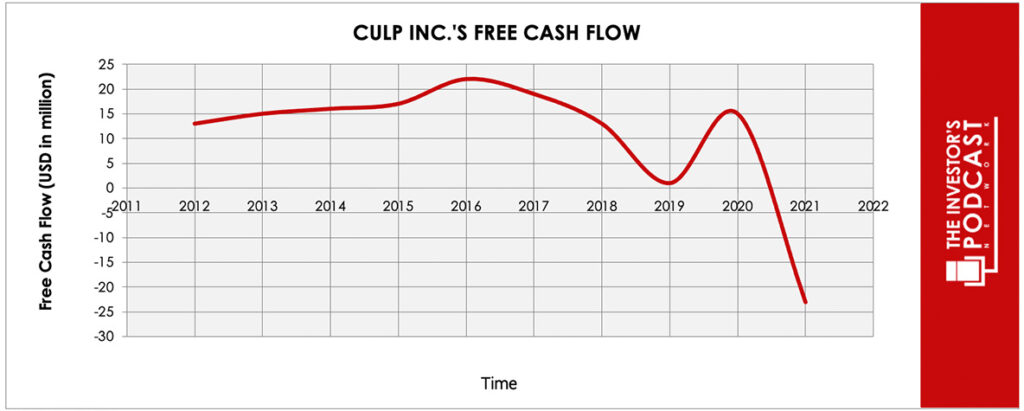

To determine the intrinsic value of CULP, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of CULP’s free cash flow over the past years.

As one can see, the free cash flow is quite volatile and has recently turned sharply negative. To construct a model of the intrinsic value of CULP, we will use the ten-year average of the FCF-values as starting point. Based on this value, we then assume 3 different scenarios for the future.

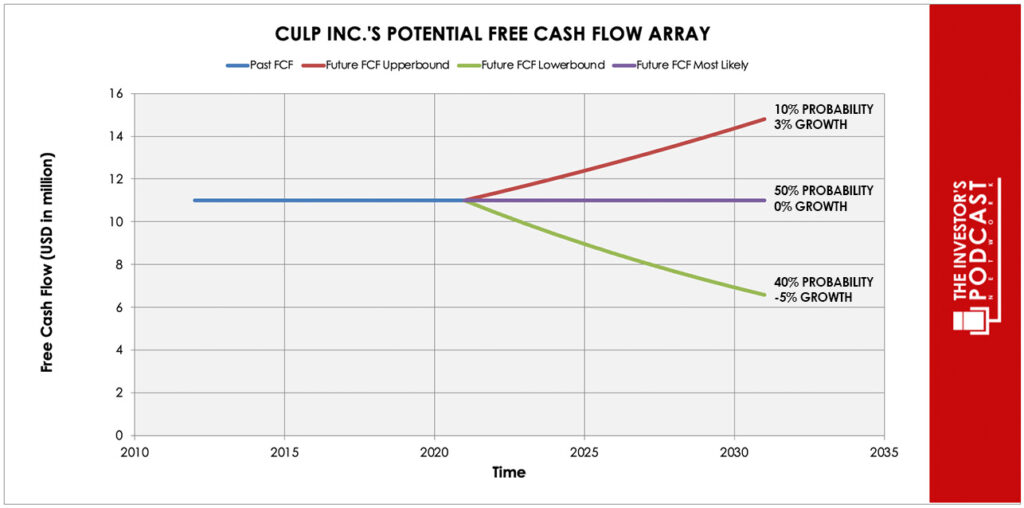

Each line in the above graph represents a certain probability for occurring. Due to the company’s recent headwinds, a conservative estimate is used. We assume a 10% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 40% probability.

Even with these conservative assumptions, CULP can be expected to give a 16.8 % annual return at the current price of $4.91. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF CULP

CULP possesses some unique advantages that should allow it to be successful in the future.

- Strong Brand Reputation: CULP has established a solid and longtime reputation in the textile industry for its commitment to high quality, innovation, and customer satisfaction. The company’s trusted brand name gives it a competitive edge, as customers often choose CULP for its reliability and reputation for delivering superior products.

- Broad Product Portfolio. CULP offers a wide and diverse range of high-quality products, including upholstery fabrics, mattress fabrics, and sewn covers. This extensive product portfolio allows the company to appeal to various customer needs and preferences, providing them with a wide selection to choose from.

- Vertical Integration. CULP oversees almost all the different stages of its supply chain. The company has control over its manufacturing processes, the sourcing of raw materials and distribution. This allows greater efficiency, better quality control and more flexibility in meeting customer demands.

- Strong balance sheet. The company has a relatively low level of long-term debt. This allows CULP to have more flexibility in managing its financial obligations and invest in growth opportunities. Secondly, the company maintains a healthy amount of cash and cash equivalents, which provides liquidity and the ability to meet short-term obligations.

When looking at various investment opportunities in the market today, let’s compare the expected return of CULP to other ideas. First, one could invest in the ten-year treasury bond which produces a 3.8 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 30.6. As a result, the US Stock market is priced at a 3.27% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The textile and upholstery industry is influenced by factors such as changing consumer preferences, fashion trends, and economic conditions. The competitive landscape is robust, with several players vying for market share, both domestically and internationally. Technological advancements play a crucial role in shaping the industry, affecting manufacturing processes, product design, and innovation. Sustainability and environmental considerations are increasingly important, with a growing emphasis on eco-friendly materials and responsible sourcing. CULP operates within this evolving environment, adapting to market trends, leveraging technology, and meeting the demands of conscious consumers to maintain its competitive position.

RISK FACTORS

- Adverse macroeconomic conditions. CULP is currently facing the headwind of lower consumer spending caused by adverse macroeconomic conditions. The combination of rising unemployment and high inflation rates has led to reduced purchasing power and cautious consumer behavior. This presents a challenge for CULP as it has experienced decreased demand for its products.

- Dependency on raw material costs. CULP’s business is strongly dependent on the availability and cost of raw materials such as fibers and chemicals. Changes in commodity prices can impact the company’s profitability.

- Intense competition. The textile industry is highly competitive, with numerous players vying for market share. CULP faces competition from both domestic and international companies such as Interface Inc., Crypton LLC., Mayer Fabrics and others, which can affect its pricing power and market position.

- Changing consumer preferences and trends. Consumer preferences for fabrics, colors, and designs can change over time and vary in different regions. CULP must stay ahead of emerging trends and adapt its product offerings accordingly to meet evolving customer demands.

SUMMARY

As an investor considering CULP stock, it’s important to weigh the potential positives and negatives of the company. Some key positives of the company include its long-standing presence in the market, established customer relationships, and a strong reputation for quality and innovation. Additionally, CULP benefits from its vertical integration and global sourcing capabilities.

However, there are several challenges to consider. Currently, the company is in survival mode, because consumers have less cash to spend and so CULP’s sales have plummeted. The industry is highly competitive, with pricing pressures and the need for continuous product differentiation. The company is also exposed to market risks, including economic fluctuations, changing consumer spending patterns and supply chain disruptions.

If investors believe that the company can ride out the current storm of sharply reduced demand, the expected annual return of 16.8% looks very rewarding – especially since most other headwinds have existed throughout the history of the company and CULP has always navigated them successfully.

If on the other hand investors think the company`s current problems pose a serious risk to the survival of the company, they are advised to stay away.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.