Intrinsic Value Assessment of Ford (F)

By Christoph Wolf From The Investor’s Podcast Network | 12 July 2023

INTRODUCTION

Ford Motor Company is one of the world’s largest and oldest automotive manufacturers and was established in 1903. The company operates in the automotive industry, designing, manufacturing, and selling a wide range of vehicles, including cars, trucks, SUVs, and electric vehicles. Ford’s business includes several well-known brands, such as Ford, Lincoln, and Mustang. The company operates globally, with a presence in major markets around the world. Ford has a diverse product portfolio, which allows it to sell to various customer segments. It also invests heavily in technological advancements such as electric and autonomous vehicles. Despite facing industry challenges and disruptions, Ford remains a prominent player in the automotive sector, focusing on innovation, sustainability, and meeting customer demands.

Having reached an all-time high of over $37 in 1999, the company had to be bailed out during the 2008 financial crisis and its stock dropped below $1. Since then, its shares have recovered, and they now trade at $15.35. Does this price still offer good value for investors, or should they be cautious?

INTRINSIC VALUE OF FORD

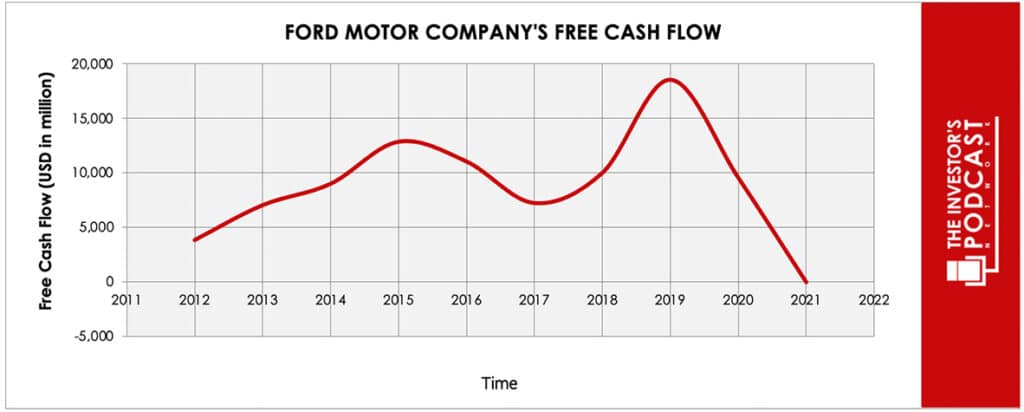

To determine the intrinsic value of Ford, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business.

Below is a chart of Ford’s free cash flow over the past years.

As one can see, the free cash flow is very volatile and has recently even turned negative. These current problems reflect both the write-downs the company had to undertake, and the large amount of capital required for the shift to electric vehicles. To construct a model of the intrinsic value of F, we will use the ten-year average of the FCF-values as starting point. Based on this value, we then assume three different scenarios for the future, which are kept very conservative due to the recent uncertainty.

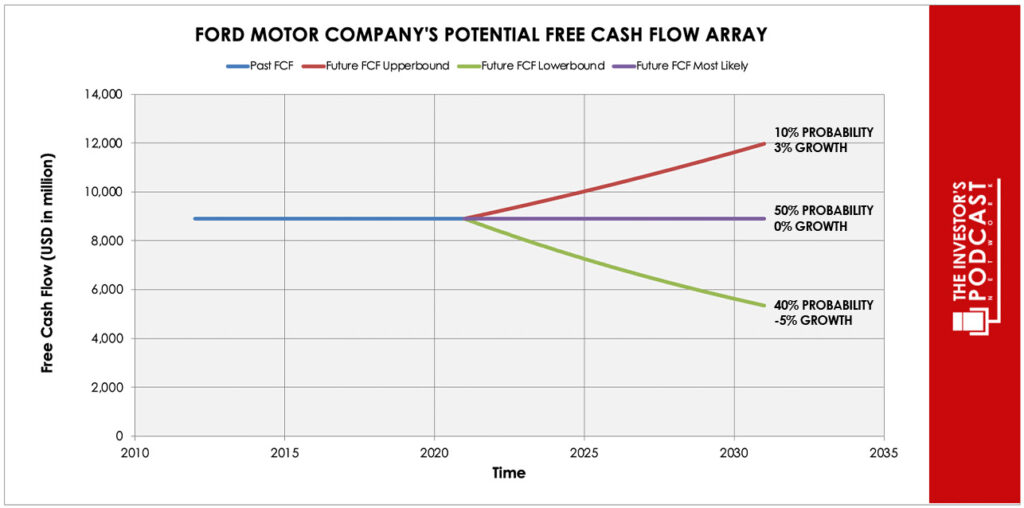

Each line in the above graph represents a certain probability for occurring. We assume a 10% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 40% probability.

Even with these conservative assumptions, the company can be expected to give a 12.7% annual return at the current price of $15.35.

Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF FORD

Ford possesses some unique advantages that should allow it to be successful in the future.

- Strong brand. Ford enjoys strong brand recognition and has established itself as one of the most well-known automotive brands globally. The company’s legacy, reputation, and iconic models like the Ford Mustang contribute to this. This recognition helps Ford attract customers, build loyalty, and maintain a competitive edge in the market.

- Focus on higher-margin vehicles. Ford has a strategic focus on higher-margin vehicles such as the F-15 and Super Duty Truck, which contributes to increased profitability and improved financial performance.

- Diverse product portfolio. The company offers a diverse and wide range of vehicles that appeal to various customer preferences and needs. From compact cars to trucks, SUVs, and electric vehicles, Ford’s product portfolio spans multiple segments and provides options for different market segments.

- Innovation and technological advancements. Ford places a strong emphasis on innovation and technology within its vehicles. The company’s commitment to technological advancements, including electric and autonomous vehicles, enables the company to stay at the forefront of industry trends and meet the evolving expectations of customers.

When looking at various investment opportunities in the market today, let’s compare the expected return of Ford to other ideas. First, one could invest in the ten-year treasury bond which produces a 3.94 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 31. As a result, the US Stock market is priced at a 3.23% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

Ford operates in a dynamic and complex macro environment shaped by multiple elements. Economic factors such as GDP growth, consumer spending, and interest rates impact Ford’s sales and revenue. Government regulations on safety, emissions, and fuel economy require compliance and investment in R&D.

Technological advancements in electric vehicles, autonomous driving, and connectivity drive industry changes. Trends towards sustainability and environmental concerns shape customer demands. Market dynamics, including consumer preferences and competitive forces, impact Ford’s strategies and market positioning. Navigating these complex factors is essential for Ford’s success and sustainable growth.

RISK FACTORS

- Shift to electronic vehicles (EVs). The automotive industry is currently undergoing a significant transition towards EVs. While Ford has made substantial investments in EV development, this shift poses large risks in terms of high upfront costs, potential supply chain challenges, technological difficulties, and uncertainty regarding consumer adoption rates.

- Pension obligations. Ford has significant legacy pension and healthcare obligations, which can impact its financial flexibility and require ongoing funding commitments. Managing these obligations presents a unique challenge for Ford compared to some of its competitors who may have different pension structures or lower legacy costs.

- Strong competition. The automotive industry is highly competitive, with numerous global and regional players vying for market share. Ford faces competition from traditional automakers, as well as new entrants in the electric and autonomous vehicle space.

- Economic and market factors. Ford’s financial performance is influenced by economic conditions, including factors such as GDP growth, interest rates, consumer spending, and consumer confidence. Economic downturns or recessions can lead to reduced vehicle sales and negatively impact Ford’s revenue.

SUMMARY

Ford presents an appealing opportunity for potential stock investors due to its strong position in the EV market, with the company making significant investments in this sector and gaining traction with its electric models.

Additionally, Ford’s recent strategic initiatives, including cost-cutting measures and a focus on higher-margin vehicles, indicate the potential for improved profitability and long-term growth, making it an attractive choice for investors seeking value and potential upside.

On the other hand, investing in Ford stock also carries inherent risks, such as the volatility of the automotive industry and the company’s dependence on factors like consumer demand, competition, and regulatory changes. Additionally, Ford faces the ongoing challenge of transitioning its business model to embrace electric and autonomous vehicles, which may result in significant costs and potential disruptions to its operations.

If investors believe that Ford can navigate the recent challenge regarding the transition to EVs, the expected annual return of 12.7% looks rewarding for such a well-known and established company. But before buying stock, investors are strongly advised to dig deeper into the risks of this transformation in the automotive industry.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.