Intrinsic Value Assessment of Heartland Express (HTLD)

By Christoph Wolf From The Investor’s Podcast Network | 27 March 2023

INTRODUCTION

Heartland Express (HTLD) is an irregular route truckload carrier operating shipping lanes throughout the US. Its brands include Heartland Express, Millis Transfer, Smith Transport, and soon also CFI. The company’s focus lies on medium to short haul regional freight, offering shippers industry-leading on-time service.

Since its initial public offering in 1986, HTLD has grown from about $20 million in revenue to become one of the largest, most profitable, and most successful truckload carriers in the US. It has been ranked 18 times by Forbes Magazine as one of the Top 200 Best Small companies in America, while the Logistics Management Magazine considered it one of the Best Truckload Carriers in America 18 times during the last 20 years. In 2022 Newsweek named it one of America’s Most Trustworthy Companies.

Despite operating in a quite volatile business, HTLD is a very stable company. On the downside, this stability comes with rather small sales growth over the last ten years. While in 2013 revenue was $587 million, this had only grown to $607 million in 2021 and $968 million in 2022. But as a flipside to this comparably slow growth the company has been profitable the whole time, has low debts levels and has steadily grown its book value per share from $4.67 in 2013 to $10.84 9 years later – an annual increase of almost 10%.

The stability of the company is also reflected in its consistent stock price advance, which went from $0.41 in 1986 to $16.46 today – an annual gain of 10.5% excluding dividends.

But this predictability has ended abruptly in 2022, when the company announced its plan to acquire the Contract Freighters non-dedicated U.S. dry van and temperature-controlled truckload business and CFI Logistica operations in Mexico (“CFI”) from TFI International, Inc. (“TFI”) for $525 million dollars.

The combined company will be the 8th largest truckload fleet and 3rd largest irregular route, asset-based truckload carrier in the U.S. with an estimated annual revenue of approximately $1.3 billion and expected annual operating cash flow of about $260.0 million. For comparison, HTLD had $607 million of revenue and an operating cash flow of $123 million in 2020. The company expects large synergies and aims to repay all of the incurred indebtedness within four years after closing the deal. If this can indeed be achieved, this acquisition should vastly increase the heft and success of HTLD.

On the other hand, this deal comes with a $100 million revolving credit availability and up to $450 million in term loans to finance the takeover – a hefty sum for a company with a market capitalization of $1.3 billion.

Since both risk and potential reward have increased due to the acquisition, it is important to ask whether HTLD is still a good and stable business to invest in or if the added risk is too large to make it a sound investment.

INTRINSIC VALUE OF HTLD

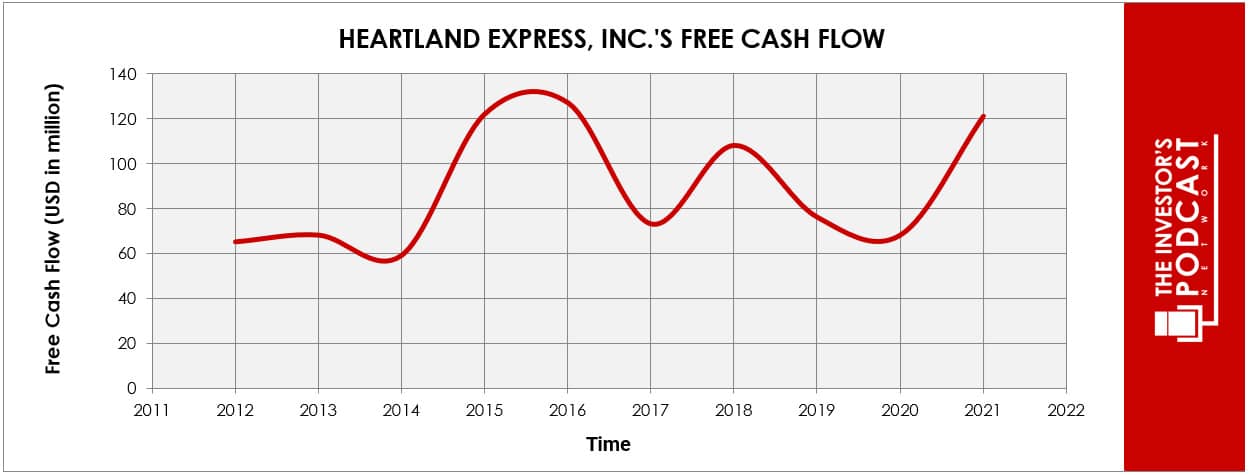

To determine the value of HTLD, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of HTLD’s free cash flow over the past years.

While being slightly volatile, the free cash flow looks relatively solid, but due to the added risk of the acquisition of CFI we will use a conservative estimate for HTLD’s future cash flows.

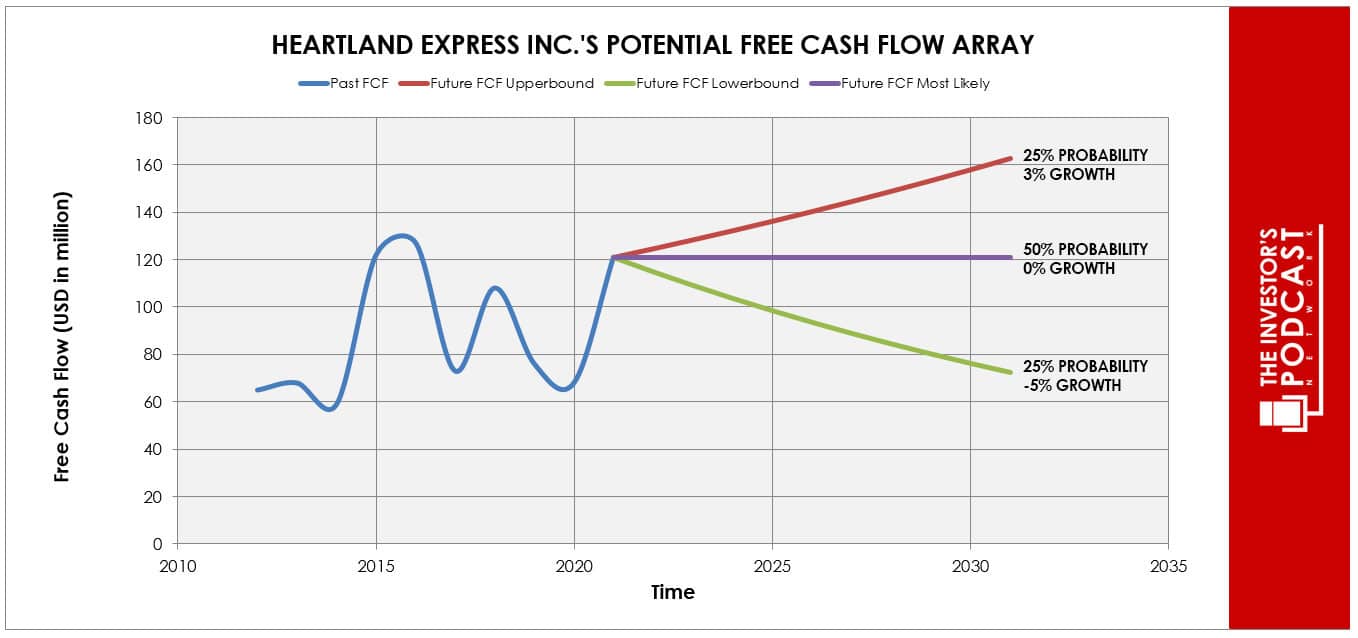

Each line in the above graph represents a certain probability for occurring. We assume a 25% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst case scenario, which is based mainly on the risk that the expected positive effects of the takeover will not materialize as predicted, is an annual decline of 5% and is assigned a 25% probability.

Assuming these growth rates and probabilities are accurate, HTLD can be expected to give a 8.3 % annual return at the current price of $15.8. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF HTLD

HTLD possesses some unique advantages that should allow it to be successful in the future:

- Good reputation. HTLD prides itself with on-time pickup and delivery and has a very positive reputation. It has earned multiple customer service and operational awards, like the FedEx Express Core Carrier of the Year (11 years in a row), the FedEx Express Platinum Award (99.99% On-Time Delivery on 40,000+ pick-ups and deliveries) as well as multiple other awards from Transplance, Tosca, Unilver, DHL, and many more.

- Acquisition of CFI. This vastly increases the company’s scale. It will be the 8th largest truckload fleet and 3rd largest irregular route, asset-based truckload carrier in the U.S. with estimated pro forma revenue of approximately $1.3 billion, estimated annual operating cash flow of a $260.0 million and estimated pro forma total assets of about $2.0 billion. The plan is to achieve repayment of all indebtedness within four years after closing of the deal.

- Size. Heartland Express has thousands of trailers throughout the nation ready to be loaded, as well as an impressive fleet of trucks. Combined with its excellent reputation, this allows customers to move their cargo throughout the country fast and reliably.

When looking at various investing opportunities in the market today, let’s compare the expected return of HTLD to other ideas. First, one could invest in the ten-year treasury bond which is producing a 3.5 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 28.2. As a result, the US Stock market is priced at a 3.55% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

HTLD operates in a volatile and competitive business and is highly dependent on the state of the US economy. These unpredictabilities make planning particularly hard for management even in normal times– and are even more complex in the current situation due to the CFI acquisition. Still, the company has managed to remain profitable throughout the Covid-19 pandemic, which should at least partly reassure investors.

RISK FACTORS

There are several risks that might limit the growth prospects of HTLD:

- Risks due to the acquisiton of CFI. To finance the deal, HTLD will take on $550 million of debt. If the expected synergies do not materialize as fast as expected, repayment could take much longer than the planned 4 years, which would cripple HTLD’s balance sheet and might reduce its financial flexibility.

- Cyclical and political risk. HTLD is operating in a cyclical industry and is strongly affected by the state of the US economy. It is also dependent on regulations of freight traffic, which is highly political and unpredictable. Unfortunately, these forces are mostly out of HTLD’s hands, which makes planning for the future a hard task.

- Intense competition. The US truckload industry is very competitive and consists of thousands of carriers of varying sizes. HTLD not only competes for the business itself, but also for the increasingly sparse supply of truck drivers.

SUMMARY

HTLD is an interesting investment with both risk and reward. While the company has historically been very stable and has successfully navigated downturns before, the big new unknown is the CFI acquisition.

If everything goes as planned, the company will become a major and very successful player in the truckload industry. If on the other hand the synergies do not materialize as fast as expected, HTLD’s increased debt load could become a huge burden and limit the company’s prospects.

Before investing in HTLD, investors are well advised to investigate the company and especially the effects of the CFI acquisition in more detail.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.