Intrinsic Value Assessment of HP Inc. (HPQ)

By Christoph Wolf From The Investor’s Podcast Network | 07 August 2023

INTRODUCTION

HP Inc. is a multinational technology company with a diverse portfolio of products and services. Founded in 1939 by William Hewlett and David Packard, HP has grown into one of the world’s leading technology companies. Its business is primarily focused on two main segments: personal systems and printing.

In the former segment, HP designs, manufactures, and distributes personal computing devices, including desktops, laptops, tablets, and other related peripherals. Their computers have earned a reputation for reliability and performance and the company does business with a wide range of customers. In the Printing segment the company offers a comprehensive range of printing solutions, including printers, scanners, and related software and services. The brand has maintained a strong presence in the printing industry and continues to innovate with new printing technologies.

Throughout its history, HP has focused on research and development, driving technological advancements. This has allowed HP to stay competitive and maintain a leading position in the market. With an extensive global reach and a strong brand reputation, HP remains a key player in the technology industry. Its products and services have widespread recognition and presence, serving millions of users worldwide.

Over the decades, HP’s stock had its ups and downs but overall performed very nicely. Its current stock price of $33.04 is still almost as high as its all-time high of almost $39 reached in 2022. Is this price now too high to buy the stock or is this price justified?

INTRINSIC VALUE OF HP

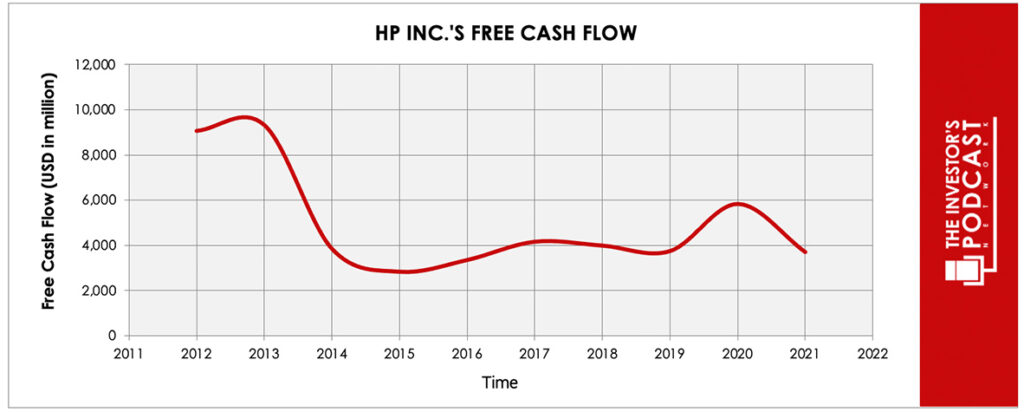

To determine the intrinsic value of HP, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of HP’s free cash flow over the past years.

As one can see, the free cash flow has been relatively constant since 2014. It is therefore reasonable to use the last value in 2022 as starting point for our FCF-model. Based on this value, we then assume three different scenarios for the future.

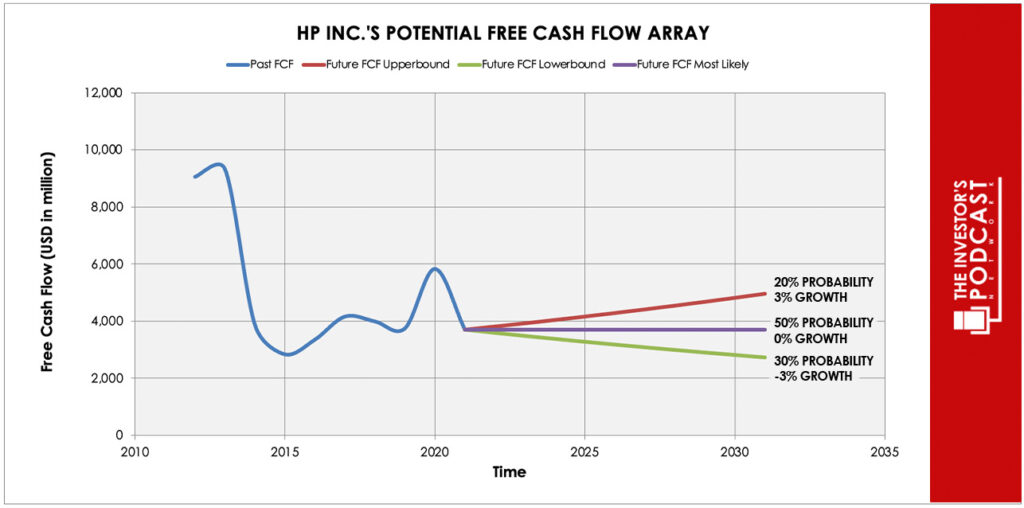

Each line in the above graph represents a certain probability for occurring. Due to the company’s recent headwinds, a conservative estimate is used. We assume a 20% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 3% and is assigned a 30% probability.

Using these assumptions, HP can be expected to give a 9.7% annual return at the current price of $33.4. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF HP

- Brand and trust. HP’s brand and trust have been solidified over the decades through its uncompromising commitment to produce reliable, high-quality products. Consumers and businesses alike have come to trust HP, as its brand is synonymous with innovation, performance, and reliability.

- Diverse product portfolio. With a diverse product portfolio containing personal computing devices like laptops, desktops, and tablets, as well as printing solutions such as printers and related software, HP does business with various customer segments in multiple markets.

- Research and development. HP’s focus on research and development (R&D) has been a cornerstone of its success. Investing significant resources in technological advancements, HP consistently remains ahead of the curve, delivering cutting-edge products with the latest features and technologies.

- Global reach and distribution network. HP efficiently reaches and serves markets worldwide. With well-established distribution channels and strategic partnerships, the company manages to ensure that its products are readily available to consumers and businesses everywhere in the world.

When looking at various investment opportunities in the market today, let’s compare the expected return of HP to other ideas. First, one could invest in the ten-year treasury bond which produces a 3.87% return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 31.8. As a result, the US Stock market is priced at a 3.14% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

HP operates within the rapidly changing and highly competitive technology industry. The fast pace of technological advancements, coupled with constantly changing consumer preferences, presents both immense challenges and promising opportunities for the company.

Navigating this ever-changing business environment requires a strong focus on R&D. The global scope of its operations expose the company to various geopolitical and economic risks, such as currency fluctuations and supply chain disruptions. In response to growing environmental concerns and societal expectations, HP is committed to implementing ecological practices and highlighting a positive corporate image.

The recent surge in remote work and digital transformation has also reshaped the demand for HP’s personal computing and printing products. In this dynamic environment, HP’s ability to use its diverse product portfolio, build upon its strong brand, and prioritize sustainability is key to thriving in the technology industry.

RISK FACTORS

- Intense competition. HP faces intense competition in the highly competitive technology sector, where numerous established players and emerging companies compete for market share. This includes major technology giants and agile startups, creating pricing pressures, reduced profit margins, and challenges in maintaining or expanding HP’s market presence.

- Market and technological changes. With the technology industry’s rapid pace of technological advancements, HP faces the risk of certain products or technologies quickly becoming obsolete. To maintain relevance in the market, HP must continually invest in R&D, ensuring its products stay up-to-date and align with the evolving needs of customers.

- Global economic conditions. Global economic conditions significantly impact HP’s business. Economic downturns and fluctuations in currency exchange rates are huge risks for the company, since these economic challenges can lead to reduced consumer and business spending on technology products, potentially decreasing HP’s revenue and profitability.

SUMMARY

As a potential investor in HP, you can find promising opportunities in the company’s diverse product portfolio, which spans both personal computing and printing segments. With its strong brand reputation and commitment to R&D, HP has the potential to leverage technological advancements, making it an attractive prospect for long-term growth.

But one should also not overlook the risks. Intense competition in the technology industry may lead to price pressures and challenges in maintaining market share. Additionally, rapid technological advancements could render certain products or technologies obsolete, impacting demand for HP’s offerings and requiring continuous investment in R&D to stay competitive.

If investors believe that the company can continue to be as successful as in the past, the expected annual yield of 9.7% looks attractive for such a well-known iconic company, but one might also consider waiting until its stock price has fallen a little more from its recent all-time high.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.