Intrinsic Value Assessment of Intel Corporation (INTC)

By Christoph Wolf From The Investor’s Podcast Network | 18 May 2023

INTRODUCTION

Intel Corporation is a global technology company that specializes in the design, manufacturing, and sale of semiconductor chips and related products. Founded in 1968, Intel has become a leader in the semiconductor industry, with a wide history of innovation and technological advancements. The company’s processors power a wide range of devices, from personal computers and servers to embedded systems. Intel’s success is due to its consistent focus on research and development, thereby pushing the boundaries of chip performance and efficiency. Intel has played an important role in driving the digital revolution, delivering groundbreaking technologies and architectures that have transformed the computing landscape. Today, Intel continues to drive innovation in areas such as artificial intelligence, autonomous vehicles, and edge computing.

Having reached an all-time high of over $75 in 2000 during the dot-com bubble, the stock had subsequently crashed to below $14 and has since then slowly recovered. In 2021, the stock had reached $67 dollars again. However recently, the price has collapsed due to reduced global chips demand. The stock currently stands at only $29.80.

Is this reduced price a great entry level for investors or do the risks justify the lowered valuation?

INTRINSIC VALUE OF INTEL

To determine the intrinsic value of Intel, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business.

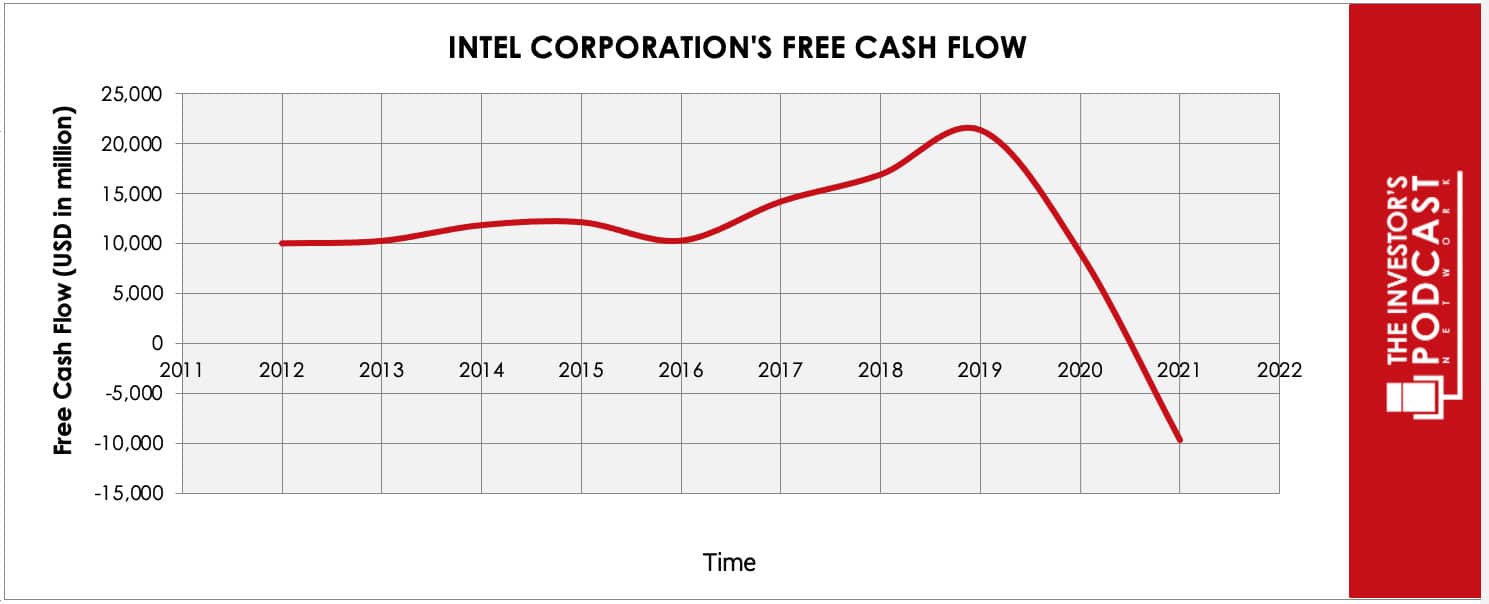

Below is a chart of Intel’s free cash flow over the past years.

As one can see, Intel’s free cash flow is very volatile and has recently turned sharply negative. This is due to the cyclical business in the semiconductor industry. To construct a model of the intrinsic value of INTC, we will use the ten-year average of the FCF-values as starting point. Bases on this value, we then assume 3 different scenarios for the future:

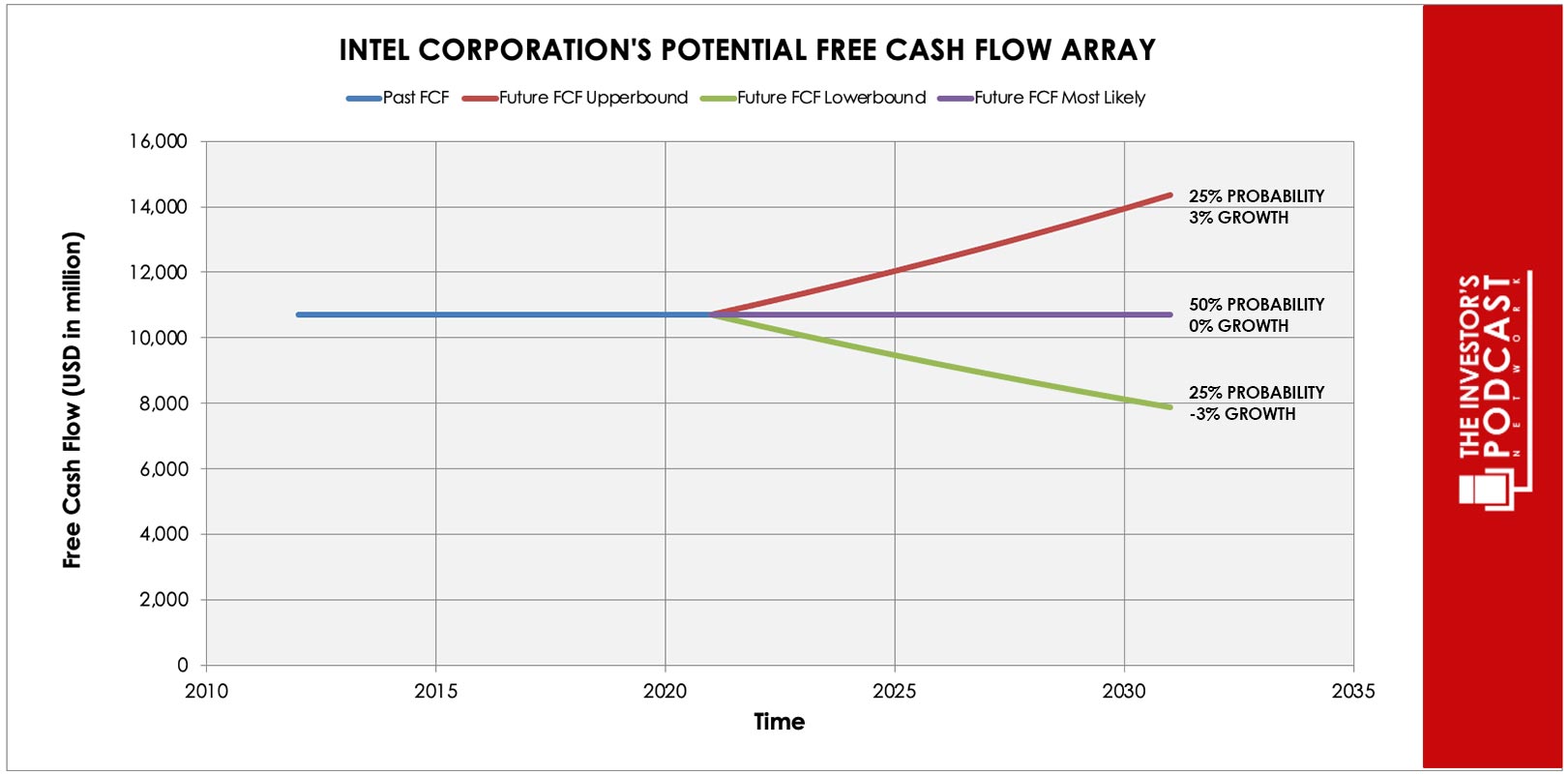

Each line in the above graph represents a certain probability for occurring. We assume a 25% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 3% and is assigned a 25% probability.

Assuming these growth rates and probabilities are accurate, INTC can be expected to give a 7.6 % annual return at the current price of $29.80. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF INTEL

Intel possesses some unique advantages that should allow it to be successful in the future:

- Brand and technology leadership. Intel is known for high-quality products and possesses a strong and trusted brand. The company invests significant amounts in research and development to develop and leverage the latest technologies and manufacturing processes, which allows it to produce chips with higher performance and efficiency than their competitors.

- Size and economies of scale. As one of the largest chip manufacturers in the world, Intel benefits from economies of scale. This enables them to lower production costs and achieve higher margins. Additionally, their size and global presence allow them to quickly respond to market changes.

- Vertical integration. Intel is capable of covering the entire value chain in-house, from wafer manufacturing to chip production to software and driver development. This gives them greater control over the quality of their products and enables them to quickly respond to customer requirements.

- CHIPS act. The CHIPS Act (Creating Helpful Incentives to Produce Semiconductors), is a law recently passed by the US government. It provides funding for semiconductor research and manufacturing, as well as incentives for companies to build and modernize semiconductor facilities in the US. As one of the largest semiconductor companies, Intel can expect to profit vastly from this new law.

When looking at various investing opportunities in the market today, let’s compare the expected return of Intel to other ideas. First, one could invest in the ten-year treasury bond which is producing a 3.5 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 28.9. As a result, the US Stock market is priced at a 3.55% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The semiconductor industry is characterized by rapid technological advances, intense competition, and high investment in research and development.

It drives technological advancements and fuels the global economy. Companies in the semiconductor business operate in a highly competitive landscape, which forces them to constantly innovate to meet the increasing demands for faster, smaller, and more efficient chips. The industry is characterized by significant investments in research and development, as well as advanced manufacturing processes. Semiconductor companies sell to various sectors, including consumer electronics, automotive, telecommunications, and industrial applications. With the rapid emergence of cutting-edge technologies like artificial intelligence, the Internet of Things or 5G, the semiconductor industry is expected to produce continuous growth and transformative breakthroughs.

RISK FACTORS

There are several risks that might limit the growth prospects of Intel:

- Volatile demand. The global demand for semiconductors is very volatile and subject to strong fluctuations, especially due to changes in the global economic situation. This can lead to revenue fluctuations and inventory overhangs.

- High investment costs. The production of semiconductors requires significant investments in research and development as well as in production facilities and equipment. This can lead to high fixed costs, which can result in lowered sales and margins.

- Strong competition. The semiconductor industry is highly competitive, and Intel faces a variety of competitors including Samsung, TSCM, and AMD. New competitors can quickly enter the market and gain market share.

- US-China conflict. The ongoing trade and technology war between the US and China has already affected many technology companies, including Intel. US and China may continue to impose tariffs and restrictions on each other’s goods and services, which could lead to reduced demand for Intel’s products in China, one of its biggest markets.

- Growing global protectionism. Besides the US-China rivalry, many other countries have also been adopting protectionist measures in recent years, which could affect Intel’s ability to sell its products in these markets.

SUMMARY

INTC is an interesting investment idea. The company has a strong brand and a long history of reliable and well-known products. On the downside, the semiconductor industry is very capital-intensive and prone to highly cyclical demand. Recent geopolitical tensions further add to the risks of the company.

For investors willing to accept these uncertainties, the predicted annual return of 7.6% looks rewarding. Due to the cyclicality, investors should be prepared to hold the stock for a longer time period before the rewards might be realized.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.