Intrinsic Value Assessment of LyondellBasell NV (LYB)

By Christoph Wolf From The Investor’s Podcast Network | 28 July 2023

INTRODUCTION

LYB, or LyondellBasell NV, is a multinational chemical company. While the firm was only created in 2007, its predecessor companies date back to 1953.

It is one of the largest plastics, chemicals, and refining companies in the world. LyondellBasell operates across multiple segments, including 1) Olefins and Polyolefins which deal with chemicals needed for everyday applications like automobiles, durable goods or food packaging, 2) Intermediates and Derivatives which produce and manufacture chemicals used in various applications, and 3) Technology and Refining.

The company’s operations include the production and marketing of a wide range of chemicals, plastics, and related products, serving customers in the consumer, automotive, and industrial sectors. LyondellBasell’s focus on innovation, research, and development contributes to its competitiveness in the market. As a key player in the chemical industry, LYB’s continued growth and performance are influenced by global economic conditions, supply and demand dynamics, and regulatory changes.

While the US operations had to file for bankruptcy in 2009, the company has nicely recovered since then. Its current stock price stands at $90.70. Is this a good entry level for investors?

INTRINSIC VALUE OF LYB

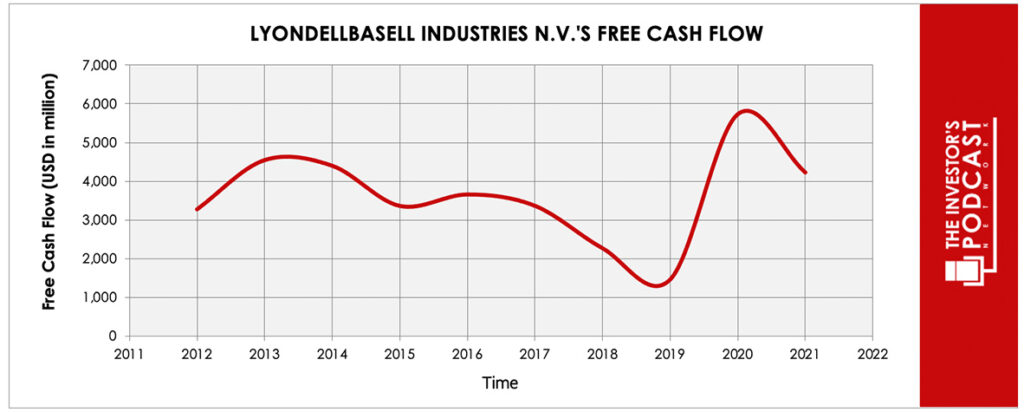

To determine the intrinsic value of LYB, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of LYB’s free cash flow over the past years.

While the cash flow is volatile – which is normal for a chemical company – it is not unreasonable to use the latest value as starting point for our model. Based on this value, we assume three different scenarios for the future.

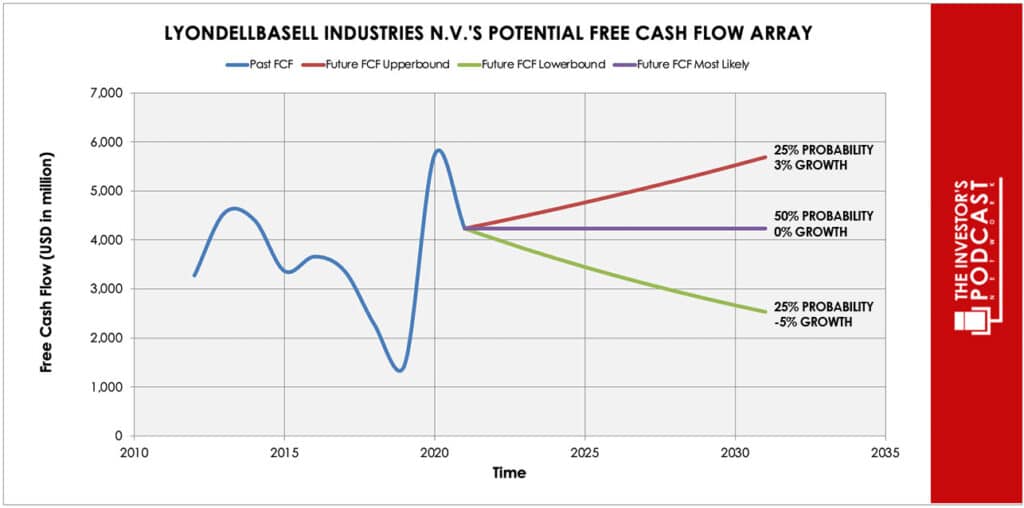

Each line in the above graph represents a certain probability for occurring. We assume a 25% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 25% probability.

Using these assumptions, LYB can be expected to give a 13.5 % annual return at the current price of $90.70. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF LYB

- Scale and global presence. As one of the largest chemical companies in the world, LYB benefits from economies of scale and an extensive global presence. This allows the company to access diverse markets and customer segments, maximizing its reach and distribution capabilities.

- Diverse product portfolio. LYB offers a wide range of products, including ethylene, propylene, polyethylene, polypropylene, and various other chemicals and plastics. Its diverse products are sold to multiple industries, reducing reliance on specific markets and providing the company with more stability and flexibility.

- Strong position in the olefins and polyolefins market. LYB is a leading producer of olefins and polyolefins. These fundamental building blocks are used in diverse applications such as packaging, automotive components, and construction materials. This robust position sets LYB apart from competitors in the chemical industry due to the essential role of these products in numerous applications.

When looking at various investment opportunities in the market today, let’s compare the expected return of LYB to other ideas. First, one could invest in the ten-year treasury bond which is producing a 3.8 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 31.7. As a result, the US Stock market is priced at a 3.27% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

LyondellBasell operates in the complex and dynamic chemical industry, having to deal with global supply chains, strict regulations, and ever-changing customer demands. As a global player, the company faces diverse economic conditions, geopolitical risks, and currency fluctuations, presenting both opportunities and challenges across various regions. Commodity price volatility and economic uncertainty are significant challenges.

To maintain its competitive position, LYB focuses on research, innovation, and sustainable practices in a highly competitive market. By strategically adapting to market dynamics and emphasizing continuous innovation, LYB aims to thrive in this dynamic business environment.

RISK FACTORS

- Commodity price volatility. LYB’s business heavily relies on raw materials like crude oil and natural gas, and fluctuations in commodity prices can impact the company’s input costs. Just recently, several German chemical companies like BASF, Covestro or Evonik learned this the hard way, when cheap Russian oil and gas was suddenly cut off to them due to the Ukraine war. While LYB has mostly avoided a similar fate because of its location in the US, this episode highlights that this risk is real.

- Economic uncertainty. As a global player, LYB is exposed to various economic conditions in different regions. Economic downturns or uncertainties in key markets can lead to reduced demand for chemicals and plastics, affecting the company’s revenue and growth prospects.

- Exposure to petrochemical market. As one of the largest producers of olefins and polyolefins, LYB relies on raw materials derived from crude oil and natural gas. The volatility of the petrochemical market, influenced by factors like global oil prices, geopolitical events, and supply-demand imbalances is a major risk for the company’s business.

SUMMARY

Investing in LYB stock offers the chance to gain exposure to a leading player in the chemical industry with a strong position in the olefins and polyolefins market. The company’s diverse portfolio and global presence present opportunities for potential growth and long-term value for investors.

But there are also many risks such as the exposure to the volatility of the petrochemical market. Economic uncertainties and fluctuating commodity prices can also negatively affect LYB’s business.

While investing in the chemicals sector is always somewhat risky due to the cyclical business, investors could surely do worse than choosing LYB, since the company is a big, diverse, and well-known global player in the chemical industry. The expected annual return of 13.5% looks rewarding. Before buying the stock, investors are still advised to evaluate the near-term outlook of the chemical industry.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.