Intrinsic Value Assessment of DNOW Inc (DNOW)

By Christoph Wolf From The Investor’s Podcast Network | 03 July 2023

INTRODUCTION

DNOW, or DistributionNOW, is a global provider of energy and industrial products, solutions, and services. The company caters to various sectors such as oil and gas, mining, power generation and manufacturing. With a comprehensive product offer including pipes, valves, fittings, and instrumentation, DNOW meets the diverse needs of its customers worldwide. Their value-added services include technical expertise, project management, inventory management, and logistics support. Operating through an extensive network of sales and distribution centers across North America, Europe, Asia, and the Middle East, DNOW ensures prompt and reliable service. Their strong reputation and client relationships make them a trusted partner in delivering quality, safety, and sustainability.

DNOW was spun off from NOV (National Oilwell Varco) in 2014. Having reached an all-time high of almost $38 shortly after, the stock has since declined and now stands at only $10.10. Is this low current price a bargain or are there convincing reasons for this depressed valuation?

INTRINSIC VALUE OF DNOW

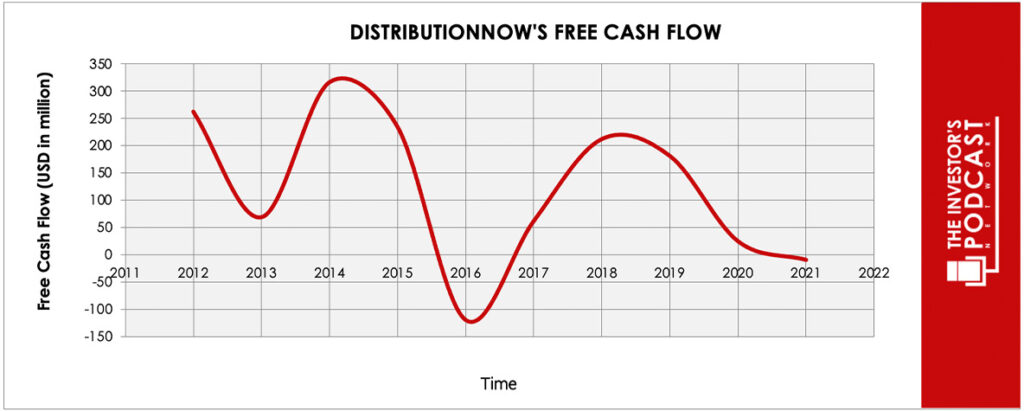

To determine the intrinsic value of DNOW, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of DNOW’s free cash flow over the past years.

As one can see, the free cash flow is quite volatile and has recently turned negative. To construct a model of the intrinsic value of DNOW, we will use the ten-year average of the FCF-values as starting point. Based on this value, we then assume three different scenarios for the future.

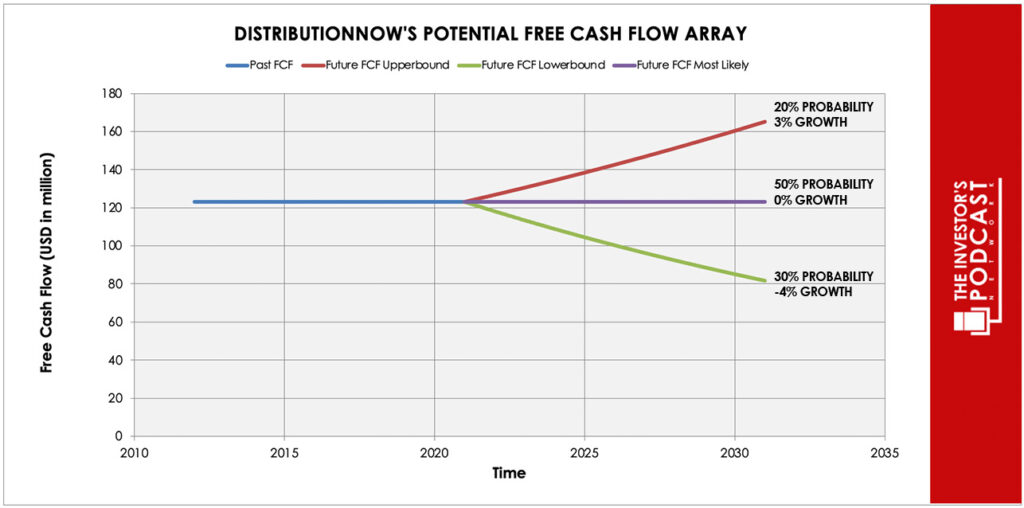

Each line in the above graph represents a certain probability for occurring. Due to the volatility in the free cash flow, a conservative estimate is used. We assume a 20% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 4% and is assigned a 30% probability.

Even with these conservative assumptions, DNOW can be expected to give a 9.7 % annual return at the current price of $10.10. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF DNOW

DNOW possesses some unique advantages that should allow it to be successful in the future.

- Extensive product offering. DNOW possesses a vast inventory of energy and industrial products, providing a one-stop solution for customers’ needs. Their comprehensive range includes pipes, valves, fittings, instrumentation, electrical products, and safety equipment. This extensive product offering allows DNOW to serve as a single source for diverse requirements, which eliminates the need for customers to use multiple suppliers.

- Value-added services. DNOW goes beyond product distribution by offering a range of value-added services. These services include technical expertise, equipment customization, project management, inventory management, and logistics support. By providing these additional services, DNOW increases customer satisfaction, improves operational efficiency, and differentiates itself from competitors who only focus on product supply.

- Global network and distribution. DNOW operates through a strategically located network of sales and distribution centers worldwide. This large footprint enables them to efficiently serve customers on a global scale. Their well-established infrastructure guarantees prompt delivery, reduces lead times and ensures reliable access to products and services across different regions.

- Strong industry relationships. DNOW has established long-standing relationships with major oil and gas companies, independent operators, drilling contractors, refineries, and other industrial customers. Through its commitment to quality, safety, and sustainability, DNOW has earned the trust and loyalty of its clients.

When looking at various investing opportunities in the market today, let’s compare the expected return of DNOW to other ideas. First, one could invest in the ten-year treasury bond which is producing a 3.8 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 30.5. As a result, the US Stock market is priced at a 3.28% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The macroeconomic business environment of DNOW can be described as complex.

Fluctuations in oil and gas prices, geopolitical events and volatile supply and demand situations shape the energy market, impacting customer behavior, and market conditions. Global economic conditions, including economic growth, inflation rates, interest rates, and currency exchange rates, play an important role in determining customer spending patterns, capital investments, and project activity in the energy and industrial sectors. Then there are technological advancements, such as digitalization, automation, and data analytics, which are transforming the industry and as a result require DNOW to consistently stay up to date.

Environmental and sustainability considerations create demand for eco-friendly solutions and renewable energy alternatives. while geopolitical and trade factors, including tariffs and political instability, impact global operations and market opportunities for DNOW.

RISK FACTORS

- Market volatility. DNOW’s business is closely tied to the energy industry, which is famous for its market volatility. Fluctuations in oil and gas prices, changes in global demand, geopolitical factors and regulatory shifts can significantly impact DNOW’s revenue and profitability. Adverse market conditions may lead to reduced customer spending, project cancellations, and lower demand for their products and services.

- Global economic conditions. DNOW’s operations span multiple regions, making them vulnerable to global economic conditions. Economic downturns, recessions, and currency fluctuations can adversely affect customer spending and investment in energy and industrial sectors. Reduced capital expenditures, project delays, and financial constraints of customers can impact DNOW’s sales and profitability.

- Competitive landscape. DNOW operates in a highly competitive market, facing competition from both established players and new entrants. Other distributors, manufacturers, and service providers offer similar products and services, posing a risk of price pressure and market share erosion. DNOW must continuously differentiate itself through innovation, value-added services, and superior customer relationships to stay ahead of the competition.

SUMMARY

Chances for a potential investor in DNOW’s stock lie in the company’s extensive product offering, value-added services, and strong industry relationships, which position them as a trusted partner in the energy and industrial sectors. Additionally, DNOW’s global network and distribution capabilities provide opportunities for growth and market expansion.

On the downside, the risks for a potential investor in DNOW’s stock include exposure to the volatility of the energy market and its dependency on global economic conditions, which can impact customer spending and demand for their products and services. Furthermore, competition within the industry and supply chain disruptions pose risks that could potentially affect DNOW’s market position and its success.

If investors believe that these downsides are manageable, the expected annual return of 9.7% seems rewarding.

If on the other hand investors are wary of the uncertainty that comes with investing in the volatile oil and gas sector, they should look for safer investments.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.