Intrinsic Value Assessment of ODP Corporation (ODP)

By Christoph Wolf From The Investor’s Podcast Network | 1 June 2023

INTRODUCTION

ODP Corporation, formerly known as Office Depot, is a leading provider of business services, products, and digital workplace technology solutions. Going back to 1986, the company operates through its subsidiary Office Depot, a well-known brand in the office supplies business. ODP offers a wide range of products including office supplies, furniture, technology products and printing services to businesses of all sizes. In addition to its retail presence, the company provides business-to-business (B2B) solutions, including managed print services, IT services, and workspace optimization.

ODP continuously expands its e-commerce capabilities and invests in technology-driven solutions to support the changing needs of businesses.

Having reached an all-time high of over $445 in 2006, the stock has fallen sharply during the 2008 financial crisis and has since then been sluggish. Is its current price of $41.10 a bargain or are there convincing reasons for this depressed valuation?

INTRINSIC VALUE OF ODP

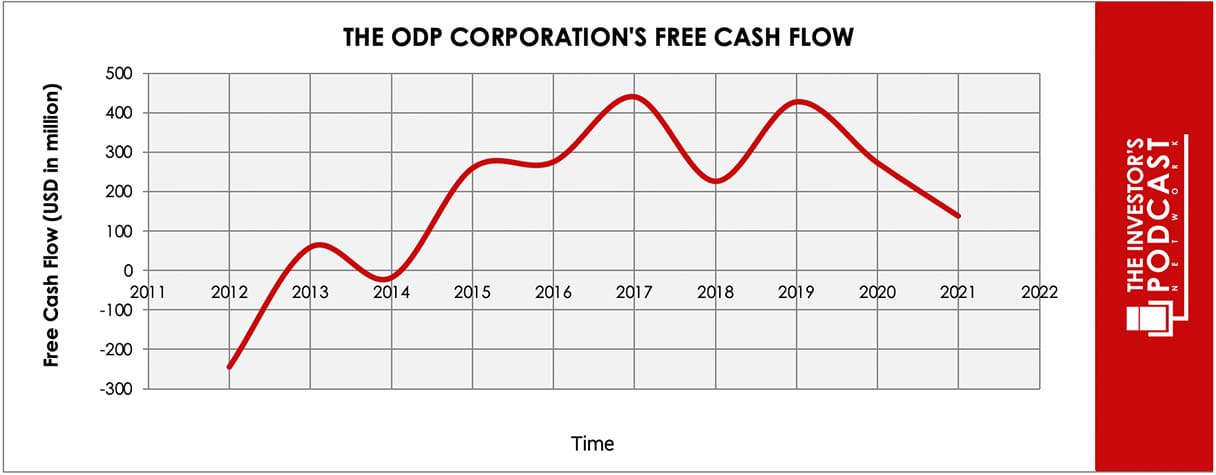

To determine the intrinsic value of ODP, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business.

Below is a chart of ODP’s free cash flow over the past years.

As one can see, the free cash flow is very volatile. To construct a model of the intrinsic value of ODP, we will therefore use the ten-year average of the FCF-values as starting point. Based on this value, we then assume three different scenarios for the future:

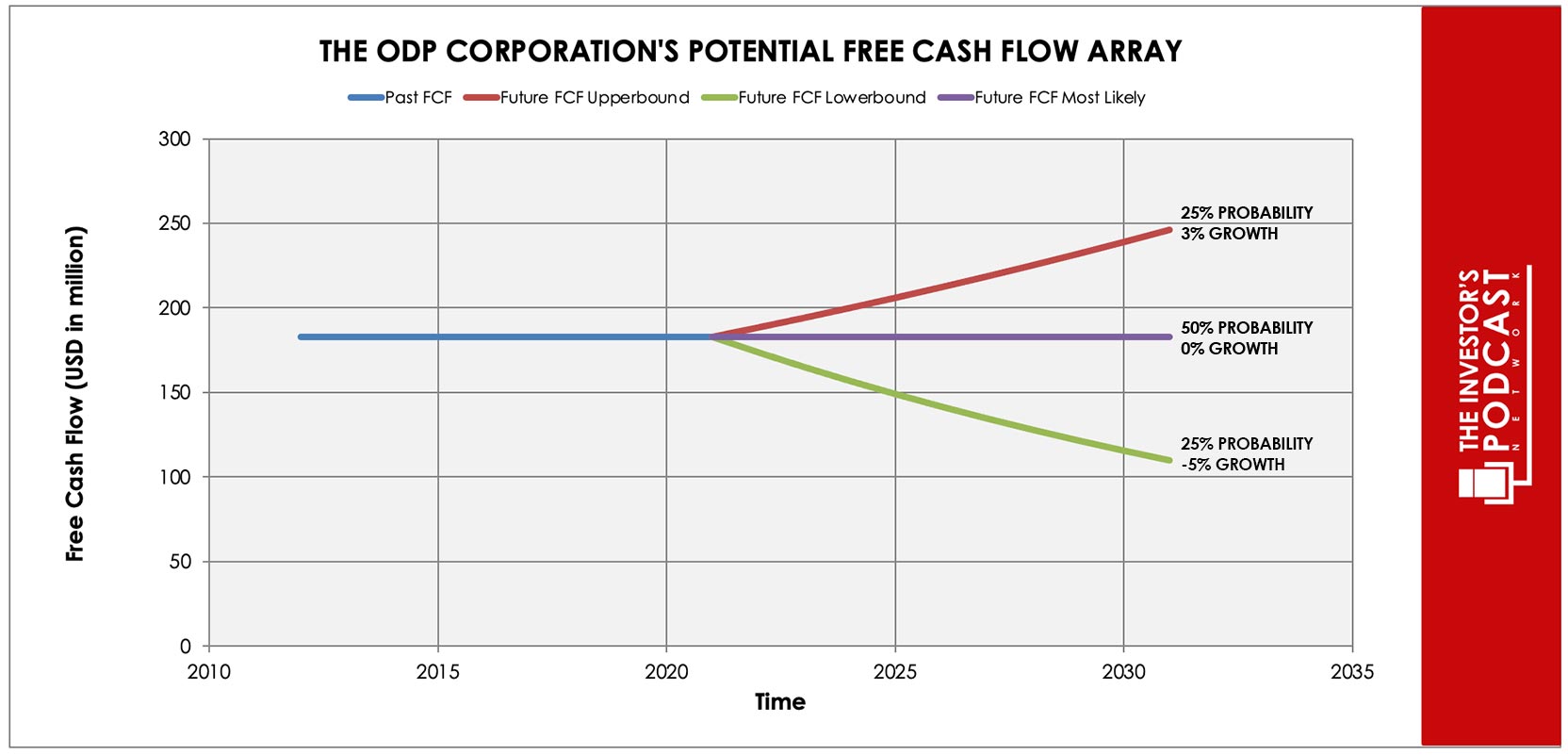

Each line in the above graph represents a certain probability of occurring. We assume a 25% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 25% probability.

Assuming these growth rates and probabilities are accurate, ODP can be expected to give a 8.4% annual return at the current price of $41.16. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF ODP

ODP possesses some unique advantages that should allow it to be successful in the future:

- Large product and service portfolio. ODP offers a wide range of products and services to meet the diverse needs of businesses. By offering a large selection of office supplies, furniture, technology products, and professional services, the company provides a one-stop solution for organizations seeking efficient and affordable workplace solutions. This extensive portfolio allows ODP to cater to a broad customer base and capture a large share of the market.

- Strong distribution network. ODP has an established and reliable distribution network consisting of retail stores, online channels, and delivery capabilities. This extensive reach ensures easy access to products and services for customers. By offering multiple shopping options and delivery methods the company allows its customers flexibility and guarantees customer satisfaction.

- Brand recognition and customer loyalty. The Office Depot brand is well-known and trusted among businesses of all sizes, resulting in business and customer loyalty. ODP’s focus on delivering high-quality products, personalized services, and innovative solutions adds to the close relationship with its customers.

When looking at various investing opportunities in the market today, let’s compare the expected return of ODP to other ideas. First, one could invest in the ten-year treasury bond which is producing a 3.7 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 29.3. As a result, the US Stock market is priced at a 3.41% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

ODP operates in a very competitive market, facing competition from both traditional office supply retailers and online marketplaces.

One crucial factor is especially the shift to digital technology and e-commerce. The increasing reliance on online shopping and digital solutions has prompted ODP to adapt and enhance its e-commerce capabilities to meet evolving customer preferences. Another big change is the rapid shift to remote work, which was accelerated by the COVID-19 pandemic, resulting in potentially less demand for office supplies.

Additionally, economic conditions and consumer spending patterns have a strong impact on the demand for office supplies and business services. Geopolitical factors, trade policies, and regulatory changes can also influence the company’s global operations, its supply chain and access to foreign markets.

To be successful today and in the future, ODP must navigate these macroenvironmental factors and so maintain its competitive edge.

RISK FACTORS

- Technological disruption. The rapid advancement of technology and digital transformation can disrupt the traditional office supplies industry. Changes in customer preferences, such as increased digitalization and a shift to remote work, may affect the demand for physical office supplies and impact ODP’s sales.

- Strong competition. The office supplies industry is highly competitive, with both traditional retailers and online marketplaces competing for market share. Increased competition can exert pressure on pricing, profit margins, and sales.

- Economic conditions. ODP’s business is influenced by macroeconomic factors such as GDP growth, consumer spending, and business confidence. Economic downturns or recessions can lead to reduced demand for office supplies and business services, negatively impacting the company’s revenue and profitability.

- Supply chain disruptions. ODP relies on a complex global supply chain to produce its products and fulfill customer orders. Disruptions in the supply chain due to geopolitical tensions or trade disputes can disrupt this process and drive up costs and production and delivery time.

SUMMARY

ODP has historically run a relatively simple business model. Providing office supplies to corporations and other customers is nothing that gets a typical investor’s heart racing. As a result, ODP’s stock price has been sluggish since 2006.

On the plus side, ODP runs a solid and simple business and has a long history of reliably providing office supplies. While there has been strong competition before, ODP has managed this challenge admirably.

The biggest threat to ODP’s business model is the switch to digital technology and e-commerce, which might be a major disruption of the business. The increased shift to remote work, which was accelerated by the COVID-19 pandemic, could also lead to less demand for office supplies and therefore lower ODP’s revenue.

For investors willing to accept these uncertainties, the predicted annual return of 8.3% looks comparatively rewarding. But before buying the stock, investors are strongly advised to dig deeper into the risks of digital transformation.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.