Intrinsic Value Assessment of Omnicom Group (OMC)

By Christoph Wolf From The Investor’s Podcast Network | 19 August 2023

INTRODUCTION

Omnicom Group is a global leader in the advertising, marketing, and communications industry. The company was founded in 1986 and is headquartered in New York City in the US. With a diverse portfolio of agencies spanning various disciplines, Omnicom offers a wide range of services to its clients, including advertising, public relations, branding, and digital marketing solutions. The company’s strong network of agencies allows it to provide integrated and innovative marketing campaigns designed to meet the unique needs of each client.

Omnicom’s is known for its commitment to creativity, strategic thinking, and cutting-edge technology, which has enabled it to maintain its position as one of the largest and most influential marketing communications companies in the world. Through its collaborative approach and emphasis on delivering measurable results, Omnicom continues to shape the landscape of modern advertising and drive success for its clients.

At $82.55, OMC’s stock price stands close to its recent all-time high. Is this price warranted or should investors wait for a lower price before buying?

INTRINSIC VALUE OF OMNICON GROUP

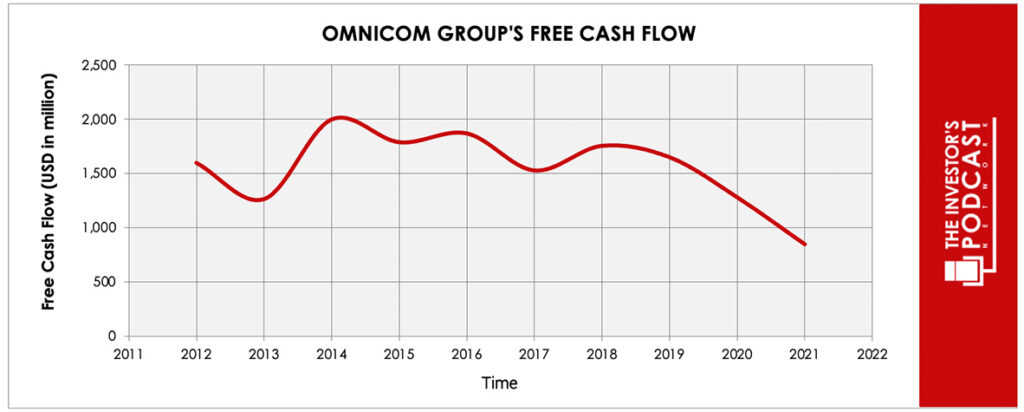

To determine the intrinsic value of OMC, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of OMC’s free cash flow over the past years.

As one can see, the free cash flow has recently turned downwards. To construct a model of the intrinsic value of OMC, we will take the ten-year average of the FCF-values as starting point and use conservative estimates for the future cash flows to account for the recent decline. Based on this value, we then assume three different scenarios for the future.

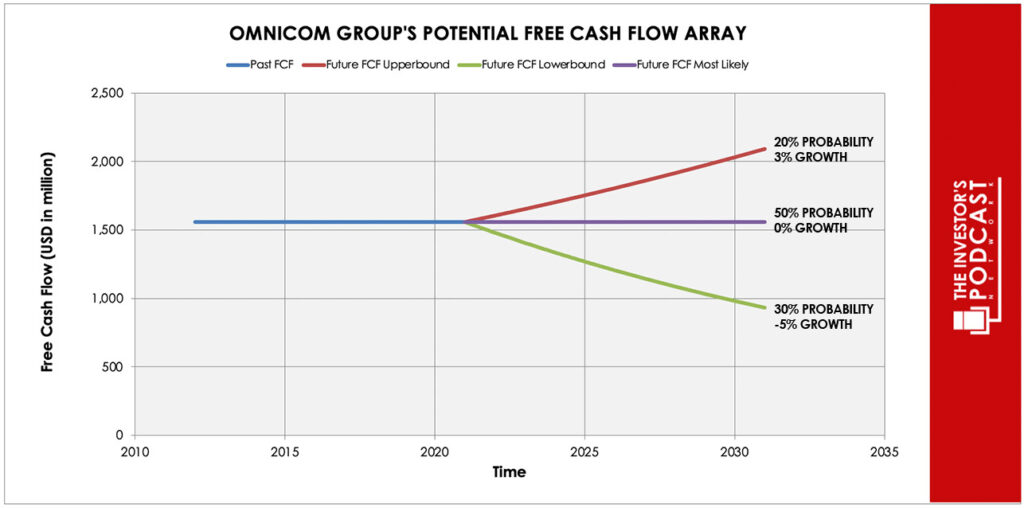

Each line in the above graph represents a certain probability for occurring. Due to the company’s recent headwinds, a conservative estimate is used. We assume a 20% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 30% probability.

Even with these conservative assumptions, OMC can be expected to give a 7.6% annual return at the current price of $82.55. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF OMC

OMC possesses several competitive advantages, including unique strengths that differentiate the company from its competitors. Here are four competitive advantages of OMC.

- Industry expertise and reputation. Omnicom has a long-standing presence in the advertising and marketing industry and a strong reputation for its expertise and quality of work. Its vast experience allows the company to understand market dynamics and consumer behavior, enabling the creation of effective campaigns for clients.

- Integrated solutions and resources. OMC’s diverse portfolio of specialized agencies covers various marketing disciplines, including advertising, public relations, digital marketing, and more. This integrated approach allows the company to provide comprehensive marketing solutions under one roof, streamlining the process for clients and ensuring a smooth execution of campaigns.

- Global reach and local insight. With operations in multiple countries and regions, Omnicom benefits from a global reach that few competitors can match. This extensive presence provides the company with valuable local insights and cultural understanding, which are critical for creating successful campaigns tailored to specific markets.

- Extensive client base and deep industry expertise. Omnicom Group’s extensive client base and deep industry expertise provide them with unmatched insights into diverse markets and consumer behaviors. This advantage enables them to create highly targeted and effective marketing campaigns and keep long-term partnerships.

When looking at various investment opportunities in the market today, let’s compare the expected return of OMC to other ideas. First, one could invest in the ten-year treasury bond which produces a 3.93 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 31.9. As a result, the US Stock market is priced at a 3.13% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

Omnicom Group operates in the dynamic and highly competitive advertising and marketing industry. This landscape is shaped by rapid technological advancements and the increasing shift towards digital advertising channels. With the rise of social media, mobile devices, and data analytics, OMC faces the challenge of staying at the top of digital innovation to meet clients’ evolving needs. Moreover, economic fluctuations and global events can significantly impact client spending and demand for marketing services, making the business environment vulnerable to economic uncertainties.

Amidst these challenges, OMC benefits from its extensive global network and diverse portfolio of specialized agencies, using its deep industry expertise to create innovative and targeted marketing campaigns for a wide range of clients worldwide.

RISK FACTORS

OMC faces several risks in its business operations. Here are three key risks for OMC:

- Economic downturn. Omnicom’s business is sensitive to economic cycles. During periods of economic downturn or recession, the marketing budget of companies is often the first item to go. This makes OMC especially vulnerable to such an event.

- Digital disruption. Rapid advancements in technology and the shift towards digital advertising present both opportunities and challenges for Omnicom. Failure to adapt to the evolving digital landscape or capitalize on emerging marketing channels could result in losing relevance with clients and consumers.

- Client loss or consolidation. Omnicom’s revenue heavily relies on client relationships and contracts. The loss of a major client or a trend towards industry consolidation, where clients consolidate their marketing services with a single agency, could have adverse effects on Omnicom’s revenue and financial performance.

SUMMARY

Investing in OMC stock offers the opportunity to gain exposure to the advertising and marketing industry, which has the potential for growth as companies seek to enhance their brand visibility and engage with consumers effectively. Additionally, with Omnicom’s established position in the market, extensive client base, and diversified services, an investor may benefit from the company’s ability to navigate industry challenges and capitalize on emerging opportunities.Bottom of Form

However, there are also many risks. The advertising and marketing industry is highly volatile and subject to economic downturns or shifts in client spending patterns. Additionally, client loss or consolidation in the highly competitive market may pose risks to OMC’s revenue and financial stability.

If investors believe that the company can continue its successful history, the expected annual return of 7.6% looks rewarding, but before buying the stock, investors might dive deeper into the details of the advertising and marketing industry.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.