Intrinsic Value Assessment of Pilgrim’s Pride Corp (PPC)

By Christoph Wolf From The Investor’s Podcast Network | 5 June 2023

INTRODUCTION

Pilgrim’s Pride Corporation (PPC) is a leading poultry company engaged in the production, processing and distribution of fresh, frozen and value-added premium chicken products.

With operations in the US, Mexico, Europe, and Asia, PPC serves customers in the retail, catering and industrial sectors. The company operates a vertically integrated business model, which allows it to control the complete chicken production and distribution process that includes breeding, hatching, processing and distribution. PPC has also expanded into the pork industry through the acquisition of Tulip Ltd., a leading pork processor and supplier based in the UK. This strategic move allows PPC to diversify its product portfolio and increase its share in the protein market. PPC’s pork market currently represents about 10% of their sales.

Through its strong brand portfolio, which includes Pilgrim’s, Gold’n Plump, and Just Bare, PPC offers a wide range of high-quality chicken products to meet diverse consumer preferences.

Regarding the performance of its stock, it can be said that it is quite volatile. Having reached an all-time high of slightly over $40 in 2007, the company had a near-death experience during the 2008 financial crisis and filed for bankruptcy in 2008. One year later, it emerged from bankruptcy protection and has since regained much lost ground. Currently, the stock is trading at $22. Is this price a good entry level for investors or is the price too high for the business?

INTRINSIC VALUE OF PPC

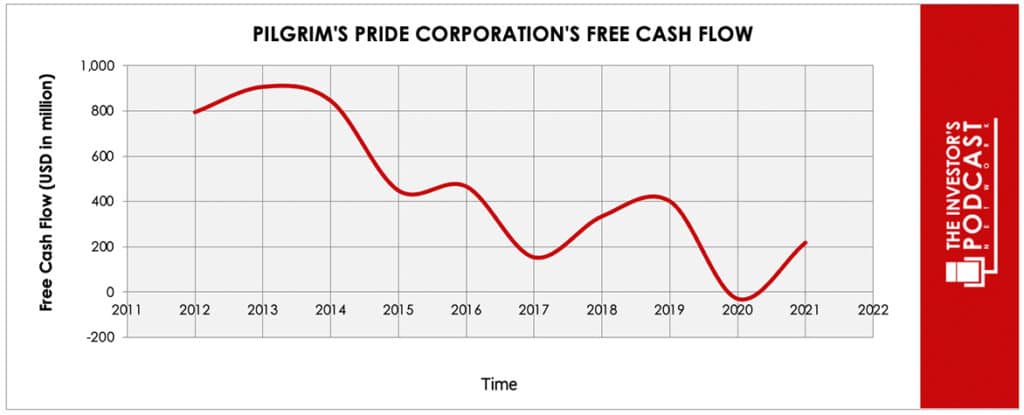

To determine the intrinsic value of PPC, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of PPC’s free cash flow over the past years.

As one can see, the free cash flow is quite volatile. To construct a model of the intrinsic value of PPC, we will use the ten-year average of the FCF-values as starting point. Based on this value, we then assume three different scenarios for the future.

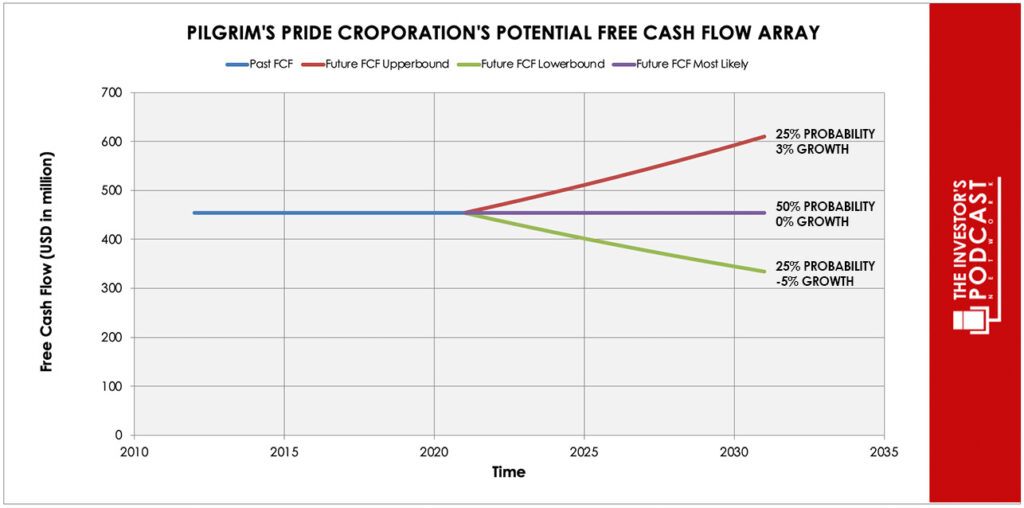

Each line in the above graph represents a certain probability for occurring. We assume a 25% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 3% and is assigned a 25% probability.

Assuming these growth rates and probabilities are accurate, PPC can be expected to give a 7.4 % annual return at the current price of $22. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF PPC

PPC possesses some unique advantages that should allow it to be successful in the future:

- Vertical integration. PPC’s vertically integrated business is probably its biggest advantage. This model allows it to control and optimize every stage of the chicken production and distribution process, which enhances efficiency, quality control, and cost management.

- Strong brand portfolio. PPC has a portfolio of well-known and trusted brands, including Pilgrim’s, Gold’n Plump, and Just Bare. These brands have a reputation for high-quality chicken products, providing a competitive advantage in attracting and keeping customers in the retail and foodservice sectors.

- Global footprint. With operations in the United States, Mexico, Europe, and Asia, PPC has a widespread presence in the most important poultry markets. This global footprint allows the company to serve diverse customer bases, capture market opportunities, and navigate changing consumer preferences in different regions.

- Operational excellence. PPC focuses on operational efficiency and continuous improvement in its production processes. Through investments in advanced technologies, streamlined supply chains and optimized logistics, PPC can deliver products efficiently, minimize costs, and maintain consistent product quality.

When looking at various investing opportunities in the market today, let’s compare the expected return of PPC to other ideas. First, one could invest in the ten-year treasury bond which is producing a 3.6% return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 29.3. As a result, the US Stock market is priced at a 3.4% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

As PPC is operating in the global agricultural and poultry industry, the company’s operations are subject to fluctuations in commodity prices, including feed costs, which can affect the company’s profitability. Economic conditions also play a crucial role, as consumer spending patterns and purchasing power impact the demand for poultry products. Also, regulatory factors, such as food safety regulations and trade policies affect PPC’s ability to operate in different markets and sell to international customers. PPC also faces the challenge of sustainability and environmental concerns, as the industry is under increasing pressure to address issues related to animal welfare and environmental impact. Overall, this business environment is quite challenging, often unpredictable and requires constant adaptation to stay on top.

RISK FACTORS

There are several risks that might limit the growth prospects of PPC:

- Volatile commodity prices. PPC is exposed to price fluctuations in feed ingredients, such as corn and soybean meal, which are key components of poultry feed. Fluctuations in commodity prices can impact PPC’s production costs and profitability.

- Market competition. PPC operates in a highly competitive market, facing competition from other poultry producers, both domestically and internationally. Intense competition can lead to pricing pressures and affect PPC’s market share and profitability.

- Disease outbreaks and supply chain disruptions. The poultry industry is susceptible to disease outbreaks, such as avian influenza, which can impact production volumes and disrupt the supply chain. Additionally, disruptions in logistics and transportation can affect PPC’s ability to produce and deliver its products efficiently.

- High debt load. The company has a significant amount of debt on its balance sheet, which can create financial challenges and increase interest expense. High debt levels can limit PPC’s financial flexibility and ability to invest or withstand economic downturns.

- Changing consumer demands. Shifts in consumer preferences, such as a growing demand for plant-based alternatives or changing dietary trends, can affect the demand for traditional poultry products. Due to its global presence, this is especially tricky for PPC, since the demands of consumers vary strongly in different regions of the world.

SUMMARY

PPC is an interesting investment idea. On the one hand, the business is relatively easy to understand and has a long history of success, which is highlighted by PPC’s well-known and trusted brands. The company’s largest competitive advantage is its vertical integration, which gives it strong control over the complete business process. It is also safe to assume that chicken products will remain in strong demand for the foreseeable future.

On the downside, its global presence makes the business hard to run efficiently, since customer preferences vary wildly in the world and can change quickly. Global supply chains and global distribution are also hard to manage. Due to its relatively large debt load, the company might have problems adapting quickly if the market situation changes.

For investors willing to accept these difficulties, the predicted annual return of 7.4% looks rewarding for such a rather easy to understand business.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.