Intrinsic Value Assessment Of Solaris Oilfield Infrastructure Inc. (SOI)

By Ladislao Zichy Thyssen From The Investor’s Podcast Network | 13 July 2020

INTRODUCTION

Solaris Oilfield Infrastructure Inc. is a premium innovative oil supplier in the US fracking industry with a market capitalization of $330 million. Its main business is renting out mobile proppant storage, a surprisingly high margin business. Solaris Oilfield Infrastructure Inc.’s shares currently trade at $7.27, implying a price-to-free-cash-flow of 2.67 times. This pessimistic view is driven by the collapse of the fracking industry in the US. The market is pricing this company as if it were extremely distressed when, in reality, it has an ironclad balance sheet with no long-term debt and $55 million in cash. The company recorded net incomes of $42 million and $52 million in 2018 and 2019. Should the US fracking industry stage a modest rebound, Solaris Oilfield Infrastructure could return 16.4% annually in the ensuing years.

Solaris Oilfield Infrastructure LLC began in 2014 when a group of investors purchased a manufacturing company in Texas. Over the following years, they built Solaris Oilfield Infrastructure into one of the US’ largest mobile proppant storage companies. They developed a superior patented product and grew their market share from near zero to about ⅓ of the US market. In 2017, the original investors created Solaris Oilfield Infrastructure Inc., a holding company with a 65% stake in Solaris Oilfield Infrastructure LLC, and listed the shares. The original investors retained around 20% of the shares in Solaris Oilfield Infrastructure LLC, with the current management owning about 17%.

Solaris Oilfield Infrastructure LLC’s primary business is renting its high-tech mobile proppant systems. Generally, proppant is sand that is used to keep induced hydraulic fractures open. This then allows franking companies to extract oil or gas from the ground.

Solaris Oilfield Infrastructure LLC’s business is involved in the completion phase of well-development. Currently, Solaris Oilfield Infrastructure LLC has 166 mobile proppants systems with a utilization rate of around 67% (2019) while it estimates its competitors are approximately 45% (2019). In 2019, the revenue from this unit was $144 million. The cash operating costs of this rental revenue were $9.7 million, with depreciation costs of $32 million. Solaris Oilfield Infrastructure mobile proppant systems can store more proppant, unload trucks 50% faster and are more automated — requiring fewer people to operate them. This allows Solaris Oilfield Infrastructure to charge a 20% premium. Solaris Oilfield Infrastructure LLC calculates that the savings its product produces are around $200,000 per month, with Solaris Oilfield Infrastructure LLC keeping about 25% of the savings.

Solaris Oilfield has taken its proppant storage technology and implemented it for chemical storage on fracking sites. This business is currently in the infancy with just 13 mobile chemical storage systems. This innovation aims to disrupt the chemical storage industry in the same way the proppant storage did.

Solaris Oilfield Infrastructure LLC’s second business consists of providing on-site technical support as well as last-mile proppant delivery. The technical crew teaches the clients workers how to operate Solaris Oilfield Infrastructure LLC’s mobile storage systems. The crew also mobilizes and sets up the storage system that Solaris Oilfield Infrastructure LLC operates. This business segment reported revenues of $63 million, with costs of $76 million. This business is necessary to compliment the rental division. Solaris Oilfield Infrastructure LLC has cut some of the costs from this segment relative to revenue. (Some of these costs should probably be attributed to the rental business.)

The third business that Solaris Oilfield Infrastructure LLC operates is a transloading facility called the Kingfisher Facility. A transloading facility is one that moves goods from one mode of transportation into another. In 2018, Solaris Oilfield Infrastructure LLC constructed a rail-to-truck facility in Oklahoma. It unloads proppant from rails to trucks to service the SCOOP/STACK fracking basin. This business has already returned most of the capital invested in it. In 2019, revenue was unusually high at $32 million because of a contract cancelation. It reported costs of around $4 million for the division. In 2018, revenue was $8 million, with costs of 3.1 million.

- Recent Developments

The current collapse of the oil market has had a significant impact on Solaris Oilfield Infrastructure LLC. The industry that Solaris Oilfield Infrastructure operates is expected to shrink between 60% to 80% next quarter but is expected to recover in the coming quarters. Management has announced that it has laid off 50% of its workforce. This measure was taken to lower operating costs by 50% as a result of the depressed market. Management also reported that utilization for its systems had dropped around 6% quarter over quarter. Management stated that it would put into storage some of their mobile proppant systems. The storage costs are nearly zero, and the systems can be quickly redeployed.

For the first quarter, Solaris Oilfield Infrastructure LLC reported a $48 million impairment charge related mostly to their Kingfisher Facility. The culprit was that transloading revenue dropped 93% year over year. The company expects free cash flow to still be positive for the year at around $40 million. They already earned 11 million in free cash flow for the first quarter. Earnings are expected to be negative, but the dividend is expected to be maintained. Management reassured shareholders that it has over $55 million in cash and an undrawn credit facility worth an additional $50 million.

THE INTRINSIC VALUE OF SOLARIS OILFIELD INFRASTRUCTURE INC. (SOI)

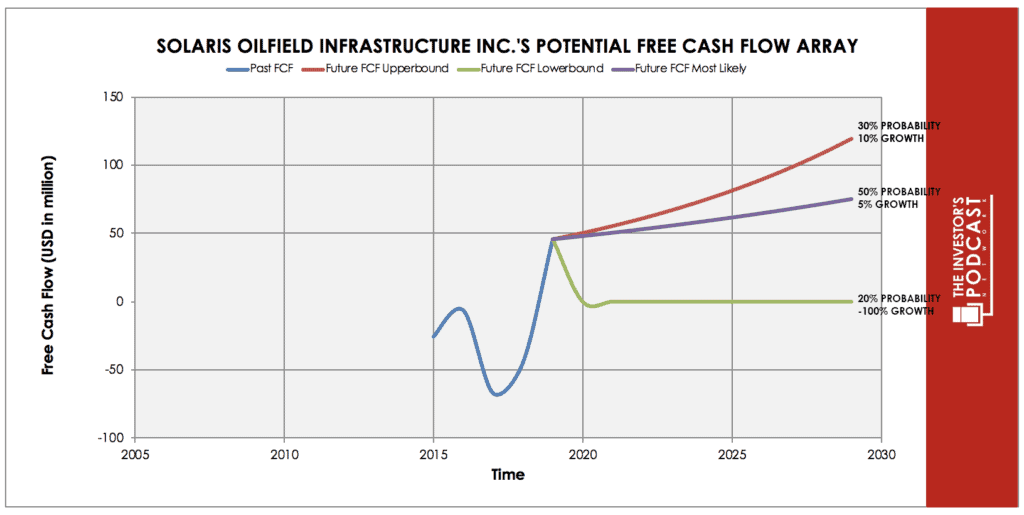

The value of any company is the discounted future value of its cash flows. For the free cash flow scenarios, I decided to make the base case for 2020, about half of 2019’s actual free cash flow of $80 million. Thus, 2019 was modeled as if it were $46 million to normalize earnings over the foreseeable future.

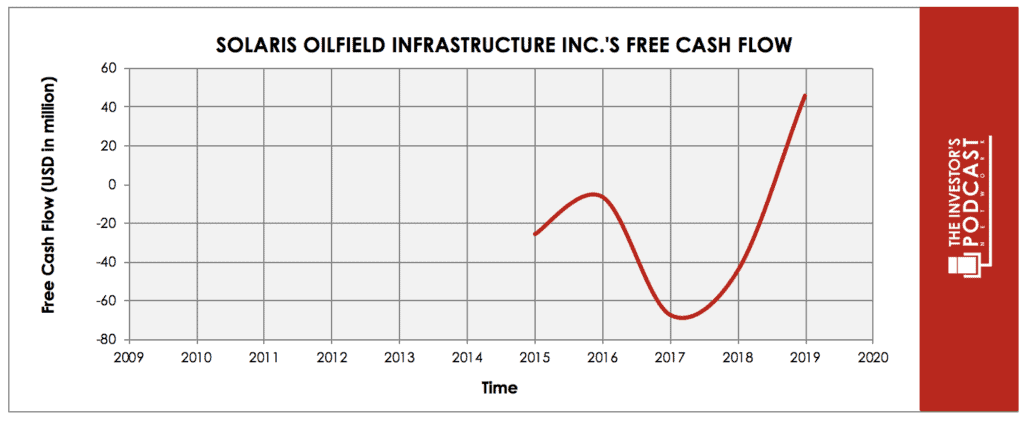

As one can see from the graph above, the company reported yearly negative free cash flows for most of its existence. The capital was needed to build up the mobile proppant storage systems as the company grew market share. Operating cash flow in 2014 increased from $2.5 million to $116 million in 2019. Capital expenditure is expected to be significantly lower now that no new systems will be built. The life expectancy of these systems is around 15 years, with the fleet being all brand new.

The graph above shows the three different scenarios envisioned. In the worst-case scenario at a 20% probability, I assume Solaris Oilfield Infrastructure goes bankrupt. In this scenario, Wall Street decides that it will no longer fund fracking in the US. This would mean that new wells would not become operational, causing a massive revenue shortfall. In reality, in a very pessimistic scenario, fracking would be significantly smaller, and shareholders would probably get money due to the healthy balance sheet ($1.20 of net cash per share), and low operating costs of the rental business.

In the base case at a 50% probability, Solaris Oilfield Infrastructure would slowly grow 5%. This would come from a partial rebound in the US fracking industry. By 2029, the firm would produce free cash flows of just $75 million (still down $5 million from its peak.) The mobile chemical business would slowly gain market share but would not grow as quickly as the mobile proppant business had. An increase in competition from other suppliers would drive margins down as others create compatible technology to Solaris Oilfield Infrastructure LLC.

In the best case, at a 30% probability, revenue would bounce back rapidly. It would grow at 10% on the back of strong US fracking growth. Innovations in the fracking industry would allow companies to profitability operate within the $30 to $50 barrel range. This would further be compounded by the growth in the chemical storage business found in every fracking site. The free cash flow ten years from now would be about 50% above the 2019 level. The company would continue to innovate and thereby increase its market share.

THE COMPETITIVE ADVANTAGE OF SOLARIS OILFIELD INFRASTRUCTURE INC. (SOI)

The Solaris Oilfield Infrastructure Inc. has various competitive advantages outlined below:

- Mobile Storage Technology. Solaris Oilfield Infrastructure LLC operates highly technological mobile storage units that are patent protected until 2032. This technology reduces its clients’ net operating costs by around $150,000.

- SOI LLC Real-Time Inventory Management Offering. Inventory management is critical in the fracking business. The cost of downtime for a fracking crew is around $5,000 to $6,000 per hour. A lack of proppants usually causes downtown. Each fracking crew requires about 40 to 60 trucks of sand per day. So, Solaris Oilfield Infrastructure LLC purchased a company called Railtronix. Their technology was merged into the Solaris Oilfield Infrastructure LLC’s system, allowing clients to track the proppant they buy from the mine site to the oil well. Solaris Oilfield Infrastructure LLC app seamlessly displays all the information regarding shipping, storage, and utilization for each fracking development.

- Strong Balance Sheet. Many of the companies that operate in the oil industry are heavily leveraged. One of Solaris Oilfield Infrastructure LLC’s competitors, Hi-Crush, has declared bankruptcy. Solaris Oilfield Infrastructure LLC has zero long term debt and over $55 million in cash. This should allow Solaris Oilfield Infrastructure LLC to gain market share as competitors disappear.

RISK FACTORS

- Environmental Regulation. In the US, the Democratic Party has stated that they would like to ban or severely restrict fracking use. The Democratic Party is expected to win the elections in November. It is unlikely that they will ban fracking, given the resulting job losses and capital destruction. It is more likely that new environmental regulation will be enacted, which will increase fracking costs and permanently make the industry smaller.

- Business focuses on the completion phase of well-development. Almost all of Solaris Oilfield Infrastructure LLC’s revenue is derived from new well developments. New fracking developments are down about 60% – 80% between April to June. If new fracking wells are not constructed, Solaris Oilfield Infrastructure LLC business will be significantly impaired. Solaris Oilfield Infrastructure LLC‘s management is looking to diversify away from just the completion phase of well-developments.

- Management Control & Corporate structure. The “original investors” with the management own around 37% of Solaris Oilfield Infrastructure LLC. This gives them significant flexibility regarding how they operate their business. This concentration in voting power can be detrimental for public shareholders who won’t have sway over the company’s affairs. Furthermore, conflict of interest may arise between public shareholders and these private investors. Solaris Oilfield Infrastructure has a substantial tax receivable liability with the shareholders who own the 35% stake in Solaris Oilfield Infrastructure LLC. The deal stipulates that Solaris Oilfield Infrastructure Inc. will pay these shareholders 85% of the tax savings it experiences when buying back these shareholders’ shares. Currently, this liability is estimated to be around $62 million.

OPPORTUNITY COSTS

Solaris Oilfield Infrastructure LLC currently has a trailing dividend yield of around 8%. The management has stated that it will keep its dividend stable as it expects its free cash flow to be positive. The opportunity cost of this investment would be other “attractive” investments, such as buying the ten-year Treasury or purchasing the SPDR S&P Oil & Gas Explore & Production. The ten-year Treasury currently yields around 0.69%, while the ETF that tracks the US’s oil and gas industry yields about a trailing 2.83%.

MACRO FACTORS

The most important macro story affecting Solaris Oilfield Infrastructure LLC is the oil market. In March, Russia and Saudi Arabia increased production as they engaged in a price war. In the meantime, oil demand collapsed significantly due to the shutdown in the global economy. This eventually caused the price of WTI to become negative as oil storage was filled to the brim. Many US fracking companies require that oil prices be above $30 to $40 a barrel to break even. This means that at current prices, only some fracking basins are profitable. This has dampened the demand for new wells in America, causing fracking suppliers’ businesses to contract sharply. Many franking companies have declared chapter 11 bankruptcy to reorganize their capital structure. However, fracking companies will need to build new wells in order to maintain current production levels. Fracking well’s productions go down between 30% to 50% per annum.

Recently, OPEC+ has agreed to temporarily cut over nine million barrels of oil in production to balance out the market. The strong rebound demand in oil consumption has also helped oil stay around $40 a barrel. There is speculation that some OPEC+ members may start to “cheat” their quotas as many of them desperately need money. This could see the price of oil drop significantly.

Another macro event that affects Solaris Oilfield Infrastructure LLC is that the Federal Reserve has begun quantitative easing. They have also purchased some junk bonds lowering the high yield spreads. This means that many fracking companies will be able to borrow money at cheaper rates than otherwise. This could help reinvigorate interest in Wall Street to fund fracking operations.

SUMMARY

Solaris Oilfield Infrastructure Inc. offers investors interested in the US fracking industry strong expected returns of 16.4%. The current share price implies that this company has a greater than 40% chance of bankruptcy. This is despite the strong balance sheet and low operating costs in this business. The technological superiority of Solaris Oilfield Infrastructure LLC’s product should allow it to survive the downturn and thrive once the US fracking industry rebounds.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.