Intrinsic Value Assessment of SpartanNash (SPTN)

By Christoph Wolf From The Investor’s Podcast Network | 06 October 2023

INTRODUCTION

Founded in 1917, SpartanNash is a prominent player in the grocery distribution and retail industry in the United States. Over the decades, the company has evolved and expanded its services to become a leading provider of grocery products and supply chain solutions.

SpartanNash primarily operates as a distributor, serving a diverse customer base that includes grocery stores, independent retailers, military commissaries, and more. Through its distribution network, it offers a wide range of food and non-food products to meet the demands of its customers.

SpartanNash also has a retail division that owns and operates various grocery retail stores, including supermarkets and military commissaries. This vertical integration allows the company to have a significant presence in both the distribution and retail segments of the food industry.Top of Form

SpartanNash started trading on the NASDAQ in August 2000 and during this time has traded as low as less than $1 in 2002 and as high as more than $35 in 2022. Currently the price stands at $21.92. Is this a good entry level for investors?

INTRINSIC VALUE OF SPTN

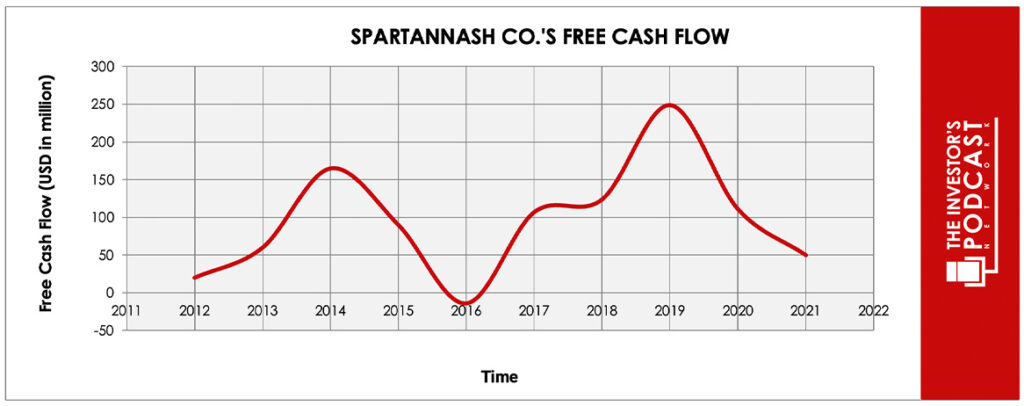

To determine the intrinsic value of SPTN, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of SPTN’s free cash flow over the past years.

As one can see, the free cash flow is quite volatile and has recently turned sharply negative. To construct a model of the intrinsic value of SPTN, we will use the ten-year average of the FCF-values as starting point. Based on this value, we then assume three different scenarios for the future.

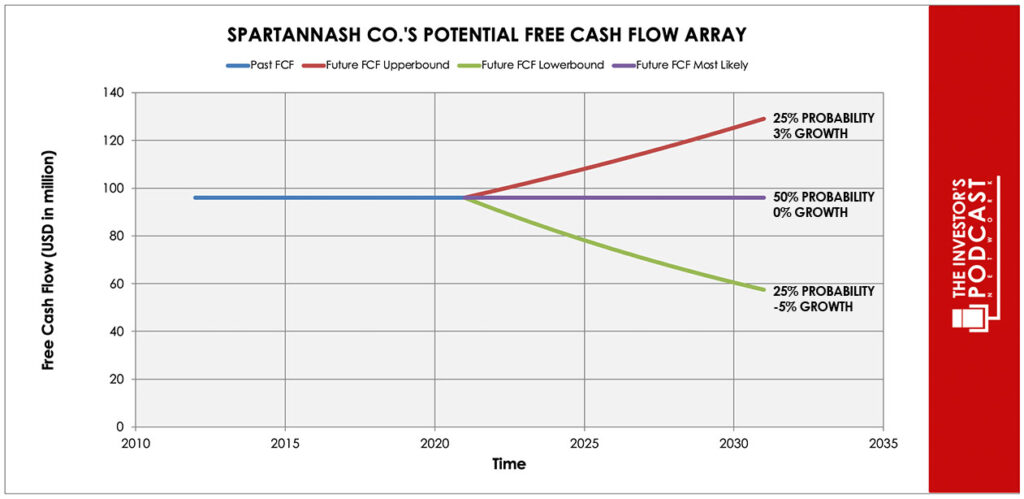

Each line in the above graph represents a certain probability for occurring, where we use a conservative estimate. We assume a 25% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 25% probability.

Assuming these estimates are correct, the expected annual return of SPTN’s stock is 11.6% annually.

Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF SPTN

SPTN possesses some unique advantages that should allow it to be successful in the future.

- Vertical integration. SPTN’s ownership and operation of its retail stores, including supermarkets and military commissaries, provide a significant advantage. This vertical integration allows the company greater control over the supply chain, product offerings, and customer experience which can be used for cost efficiencies and a more seamless shopping experience.

- Diverse customer base. SPTN serves a wide range of customers, including grocery stores, independent retailers, and military commissaries. This diverse customer base can spread risk and revenue streams, making the company less reliant on any single segment, and enhancing its stability.

- Local market knowledge: Operating stores and serving communities in various regions provides SPTN with valuable local market knowledge. This insight allows them to tailor their product offerings and marketing strategies to meet the specific needs and preferences of consumers in different areas, enhancing customer satisfaction and loyalty.

When looking at various investing opportunities in the market today, let’s compare the expected return of SPTN to other ideas. First, one could invest in the ten-year treasury bond which produces a 4.64% return. As alternative, one could also invest in the US stock market. Currently, the S&P 500 Shiller P/E ratio is 29.5. As a result, the US Stock market is priced at a 3.39% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

SpartanNash operates in the US grocery distribution and retail industry. This industry is marked by continuous change and several influencing factors. First and foremost, changing consumer preferences are a driving force. Shoppers increasingly seek convenience, fresh and organic products, and the option of online grocery shopping, influencing product offerings, store formats, and customer experiences.

Competition is intense, with national retail chains, regional players, and e-commerce giants vying for market share. This competitive landscape requires ongoing innovation, cost-effective operations, and differentiation strategies to stand out in the crowded market.

Supply chain challenges are also prevalent. The industry faces disruptions from various sources, including weather events, supply shortages, fluctuating commodity prices, and the need for efficient logistics and distribution systems. Additionally, the growth of e-commerce, economic conditions, consumer spending patterns, and technological advancements complicate this challenging business environment even further.

RISK FACTORS

- Competition. The grocery industry is highly competitive, with both traditional retailers and online giants competing for market share. Increased competition can lead to pricing pressures and reduced profit margins.

- Changing consumer preferences. Shifting consumer preferences, including a growing demand for healthier, organic, and locally sourced products, can require adjustments to product offerings and store layouts. Failing to adapt to this shift can result in reduced sales and market share – but at the same time this adaptation is costly.

- Exposure to military commissaries. The company operates and supplies products to military commissaries, which are subject to government budgets and regulations. Changes in government spending, policies, or budgetary constraints can negatively impact the company’s revenue and operations in this segment.

SUMMARY

Potential investors in SpartanNash find opportunities in the company’s diverse customer base and vertical integration, which includes both grocery distribution and retail operations. This integrated approach should provide stability and the potential for synergies.

But there are also multiple risks to highlight. The grocery industry is highly competitive and rapidly evolving, which can lead to pricing pressures and margin fluctuations. Additionally, supply chain disruptions, changing consumer preferences, and the need to adapt to e-commerce trends pose additional challenges. While the expected annual return of 11.6% looks rewarding, investors are advised to dig deeper into the multiple headwinds the company might be facing before buying the stock.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.