Intrinsic Value Assessment of Tutor Perini (TPC)

By Christoph Wolf From The Investor’s Podcast Network | 12 April 2023

INTRODUCTION

Tutor Perini (TPC) is a civil, building, and specialty construction company offering various general contracting and design-build services to both private and public companies. While the company also operates in targeted international markets, most of its business is conducted in the US. TPC, which dates back to 1894, focuses on large, complex projects.

The firm is vertically integrated, which allows it to offer services throughout the whole array of infrastructure processes, such as contracting, pre-construction planning, and comprehensive project management services. Their projects include high-speed rail, airport terminals, subways, military defense facilities, highways, tunnels, and many more. About 2/3 of their revenue comes from public sources, such as federal, state, and local governments.

Its operations are split into three operating units:

The civil segment, which is the largest and most profitable part of the business, focuses on public works construction, replacement, and reconstruction of infrastructure across the US.

The building segment provides services to specialized building markets for private and public works customers, such as hospitality and gaming, transportation, commercial offices, government facilities, and others.

The specialty contractors segment specializes in projects including electrical, mechanical, plumbing, heating and other systems for civil and building construction projects. This unit is comprised of several subsidiary companies that allow TPC to operate as a full-service contractor, which gives it more control over scheduled work, project delivery, cost, and risk management.

Revenue of the three units was roughly split into 0.45, 0.3, and 0.25 in 2021. The civil segment is not only the largest, but also the highest-margin segment. It contributed to almost all of the company’s income in 2021.

TPC’s stock price has been very volatile. Its highest ever value of about $75 was reached just before the financial crisis in July 2007. Since then, the stock price has been on a rollercoaster and now stands at a depressed value of only $5.7.

The reason for this extremely depressed valuation lies in the low profitability of the company and its volatile results.

Does the low valuation make up for the risks?

INTRINSIC VALUE OF TPC

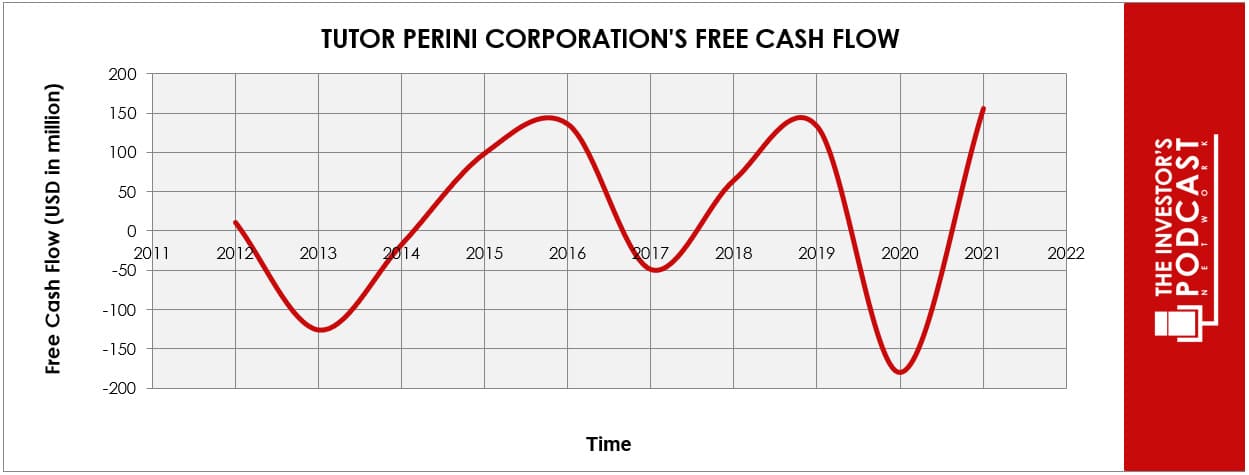

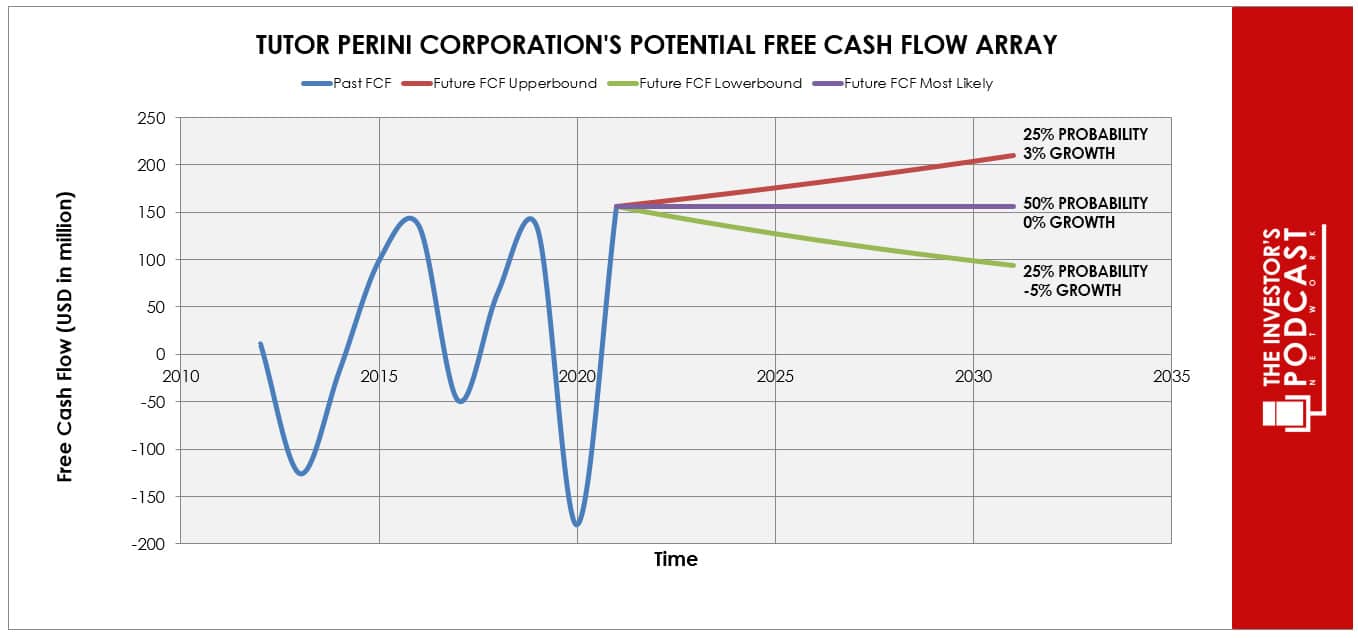

When determining the intrinsic value of a company, the general approach is to use the company’s history of free cash flows. Unfortunately, this only yields limited insight into TPC.

As one can see, the FCF is very volatile and therefore it is not advisable to use the last value as a starting point for the valuation.

Instead, we take the average FCF-value of the last 10 years, which equals $24 million. Based on this average value, we use a 25% probability for the upper growth rate of 7% per year. This high value is based on the huge chances provided by the $1.2 trillion Bipartisan Infrastructure Law.

The baseline scenario of 2% is based on the historical average annual FCF growth rate and is assigned a 50% probability. The worst case assumed is a decline of 5% and is given a 25% probability.

Assuming these growth rates and probabilities are accurate, TPC can be expected to give an 8.3 % annual return at the current price of $5.7 Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF TPC

TPC possesses some unique advantages that should allow it to be successful in the future:

- Solid business model. According to the American Society of Civil Engineers, the US faces $2.59 trillion in infrastructure needs over the next 10 years. This mind-boggling amount shows just how critical infrastructure is now and will be in the future. It is hard to imagine that TPC will ever run out of work. This can also be seen in the company’s backlog, which stood at $7.9 billion at the end of 2022. Even better, $4.4B (or 56%) of this backlog is in the civil segment, which is their highest margin business section.

- Chances due to the $1.2T Bipartisan Infrastructure Law. This law, which was passed and signed in 2021, includes $550 billion in new incremental spending for improvements to the surface-transportation network and enhancements to core infrastructure, as well as $650 billion in funding for existing spending programs of multiple current and future infrastructure projects. This huge amount will be spent over the next 10 years and much of it is expected to be in markets that Tutor Perini is operating in. This is an immense opportunity for additional projects for the company.

- Depressed valuation. The current price/book value stands at 0.22 and its price/sales ratio is only 0.08. While TPC has been cheap most of the time, the current valuation has become even more depressed than normal.

- Vertical integration. By acquiring various business entities specializing in electrical, mechanical, plumbing, HVAC and other services, the company has become ever more vertically integrated, which gives it a competitive advantage in the construction of civil and building infrastructure projects.

- Experience. The company has over 125 years of experience in successful project execution. When looking at various investing opportunities in the market today, let’s compare the expected return of TPC to other ideas. First, one could invest in the ten-year treasury bond which is producing a 3.31 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 28.3. As a result, the US Stock market is priced at a 3.5% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

Infrastructure is a truly immense business. According to one estimate, the US alone faces $2.59 trillion in infrastructure needs over the next 10 years. That being said, most infrastructure is financed by the public purse – and the various governments on the federal and local level are notoriously short of cash. As a result, the US has massively underinvested in infrastructure during the last decades. The $1.2 trillion Infrastructure Investment and Jobs Act, which was passed by Congress and signed by President Biden in 2021, aims to address this problem. Tutor Perini can expect to profit from this vast additional investment.

RISK FACTORS

There are several risks that might limit the growth prospects of TPC:

- Low margins. TPC often works on fixed-price contracts. If a project gets more expensive than planned, the company makes a loss. This is especially problematic at the moment because of the comparably high inflation, which raises TPC’s costs. This results in overall low profitability. The company tries to minimize this risk at least partially by using also fixed prices for work of its subcontractors.

- Political risks. Revenue derived from federal, state and local government customers was 66% of the total revenue in 2021. While the dependency on public clients seems currently not to be problematic because of the huge chances due to the $1.2 trillion Bipartisanship Infrastructure Law, this might change in the future. The amount that public bodies spend on infrastructure is a very political and not necessarily economic question. This dependency on the government’s will to spend is and additional risk for TPC.

- Competition. The infrastructure business is highly competitive with numerous operators in the market, which all compete for contracts and employees. That being said, this risk is somewhat minimized for TPC, since the company primarily targets larger and more complex projects. Due to greater capabilities and resources required to perform such work, the number of competitors is lower compared to smaller contracts.

SUMMARY

TPC is a very interesting company. On the one hand, the business model looks sound – infrastructure will always be needed. This can be clearly seen in the current backlog of $7.9 billion. Additionally, the $1.2 trillion Bipartisanship Infrastructure Law poses a unique opportunity for the company.

The downside is primarily the company’s low profitability. Infrastructure projects are very capital intensive and can easily get above schedule. Since TPC often uses fixed price contracts, this is a huge and results in the the low margins.

While the profitability is surely an issue, the expected annual return of 8.3% should adequately compensate for this risk.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.