Intrinsic Value Assessment of United States Steel Corp (X)

By Christoph Wolf From The Investor’s Podcast Network | 07 July 2023

INTRODUCTION

U.S. Steel Corporation is a leading steel producer based in the United States. The company operates in the four segments North American Flat-Rolled, Mini Mill, U. S. Steel Europe, and Tubular Products, offering a wide range of steel products for diverse industries. U.S. Steel is involved in the production, manufacturing, and distribution of flat-rolled and tubular steel products, serving sectors such as automotive, construction, energy, and manufacturing. The company’s operations include mining raw materials, processing them into steel, and delivering finished products to customers. The company has a long history ranging all the way back to 1901 and aims to be a leader in sustainability, innovation, and delivering high-quality steel solutions to its customers.

Having reached an all-time high of almost $200 just before the financial crisis in 2008, the stock had then fallen sharply to below $20 in 2009. Since then, it had ups and downs, but remained overall almost flat and now stands at $24.12. Is this price now a good value or should investors stay clear?

INTRINSIC VALUE OF X

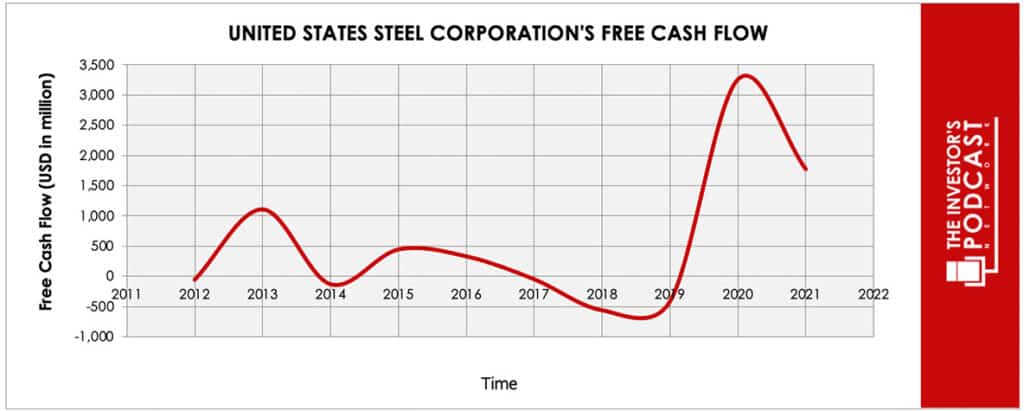

To determine the intrinsic value of X, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of X’s free cash flow over the past years.

As one can see, the free cash flow is quite volatile and has recently turned sharply higher. Since this high current value should not be used as a starting point for a FCF-analysis, we will instead use the ten-year average of the FCF-values. Based on this average value, we then assume three different scenarios for the future.

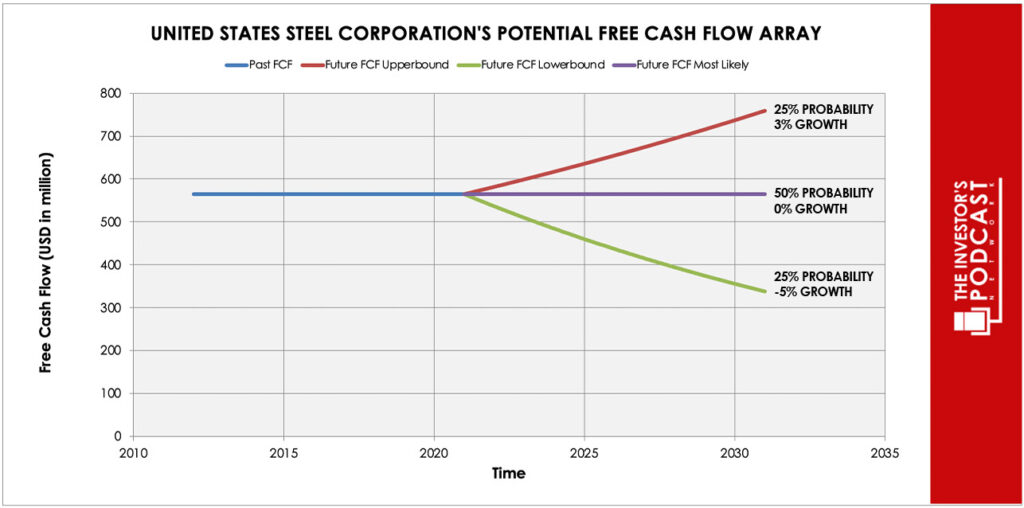

Each line in the above graph represents a certain probability for occurring. Since the steel business is highly commoditized and also very depending on the world economy, we will use a conservative estimate. We assume a 25% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 25% probability.

Using these conservative assumptions, X can be expected to give an 8.8 % annual return at the current price of $24.12. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF X

X possesses some unique advantages that should allow it to be successful in the future.

- Integrated supply chain. The company’s integrated supply chain includes mining raw materials, processing them into steel, and delivering finished products. This integration provides greater control over the production process, ensuring reliable access to raw materials and efficient manufacturing capabilities.

- Diverse product portfolio. Steel offers a diverse and vast range of steel products, including flat-rolled products and tubular products. The company sells to various industries such as automotive, construction, energy, and manufacturing. This diverse product portfolio allows the company to serve multiple sectors, reducing dependency on any single industry and providing opportunities for growth and revenue stability.

- Strong industry reputation. Steel has a long-standing presence dating back till 1901 and a strong reputation in the steel industry. The company’s history, expertise, and commitment to quality have earned the trust and loyalty of customers.

- Focus on sustainability. U.S. Steel places a significant emphasis on sustainability and environmental issues. The company has made commitments to reduce its environmental footprint, improve energy efficiency, and promote responsible production practices. This focus on sustainability aligns with the growing demand for eco-friendly solutions and allows U.S. Steel to differentiate itself from its competitors.

When looking at various investing opportunities in the market today, let’s compare the expected return of X to other ideas. First, one could invest in the ten-year treasury bond which is producing a 3.7 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 30.6. As a result, the US Stock market is priced at a 3.27% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The global steel industry is characterized by intense competition, fluctuating steel prices, and cyclical demand. The company’s performance is closely linked to the health of the global and domestic economies, with factors such as GDP growth, industrial production, and construction activity influencing steel demand.

U.S. Steel must also navigate a complex regulatory landscape that includes environmental compliance, worker safety, and trade policies. Then there are technological advancements in automation, digitalization, and advanced manufacturing techniques, which are transforming the industry. The growing emphasis on sustainability and environmental concerns presents another challenge, which require U.S. Steel to adopt energy-efficient processes, reduce emissions, and use recycling to address these aims.

Finally, the availability and pricing of key raw materials like iron ore and metallurgical coal impact U.S. Steel’s cost structure and profitability.

RISK FACTORS

- Market volatility and cyclical demand. The steel industry is subject to market volatility and cyclical demand patterns. Economic downturns, changes in consumer spending and shifts in industry dynamics can lead to fluctuations in demand for steel products. U.S. Steel’s financial performance is sensitive to these market conditions, potentially impacting its revenue and profitability.

- Strong competition. Steel operates in a highly competitive market, facing competition from both domestic and international steel producers. Price competition, technological advancements, and the emergence of substitute materials can pose challenges to the company’s market share and pricing power.

- Regulatory and environmental compliance. Steel must comply with various regulatory requirements related to environmental standards, worker safety and trade policies. Non-compliance or changes in regulations can lead to penalties, increased operating costs, and potential disruptions to operations.

- Raw material costs and supply disruptions. U.S. Steel’s operations rely on key raw materials such as iron ore and metallurgical coal. Fluctuations in the prices of these inputs, as well as supply disruptions due to factors like transportation constraints or geopolitical events, can impact production costs and overall profitability.

SUMMARY

Investing in U.S. Steel’s stock offers ownership of a trusted and long-running company. The steel sector plays a vital role in multiple parts of the economy and has the potential to benefit from infrastructure development and economic growth. However, especially the cyclical nature of the steel industry and its sensitivity to economic conditions make an investment in the company a bet on the state of the world economy.

If investors believe that the world economy will remain resilient, strong demand for steel products can be expected. The company should be a beneficiary of this, making X a lucrative investment. In this scenario, the expected annual return of 8.8% can easily turn out even higher. If on the other hand, investors consider the risks and uncertainties to large, they should stay clear of the company.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.