Intrinsic Value Assessment of Westlake Chemical Partners LP (WLKP)

By Christoph Wolf From The Investor’s Podcast Network | 19 September 2023

INTRODUCTION

Westlake Chemical Partners LP is engaged in the petrochemical industry. It operates as a subsidiary of Westlake Chemical Corporation, a leading producer and marketer of chemical and plastic products. WLKP’s main business involves owning, operating, and acquiring ethylene production facilities and related assets in various locations within the United States.

Ethylene is a key building block in the production of various plastics and chemicals. Westlake Chemical Partners provides ethylene to its parent company and other customers through long-term supply agreements. The company’s business model is centered around stable cash flows and a focus on maintaining and optimizing its ethylene production facilities.

The “LP” in WLKP stands for “Limited Partnership,” which is a special business structure often used in the energy business. Especially important for investors is that limited partnerships like WLKP typically distribute most of their earnings to their partners in the form of dividends to maintain their tax advantages and compliance with their partnership agreements.

Throughout its lifetime of ten years as separately listed entity, WLKP has been relatively stable and now stands at $22.22. Is this an attractive price for potential investors?

INTRINSIC VALUE OF WLKP

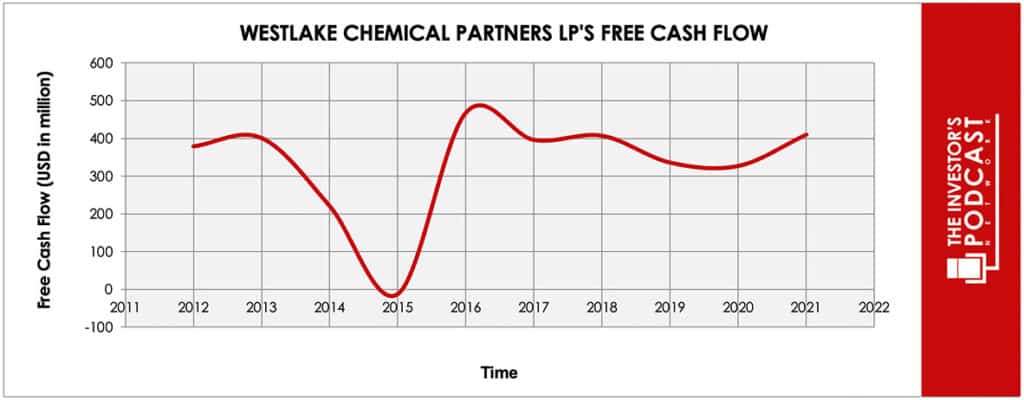

To determine the intrinsic value of WLKP, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of WLKP’s free cash flow over the past years.

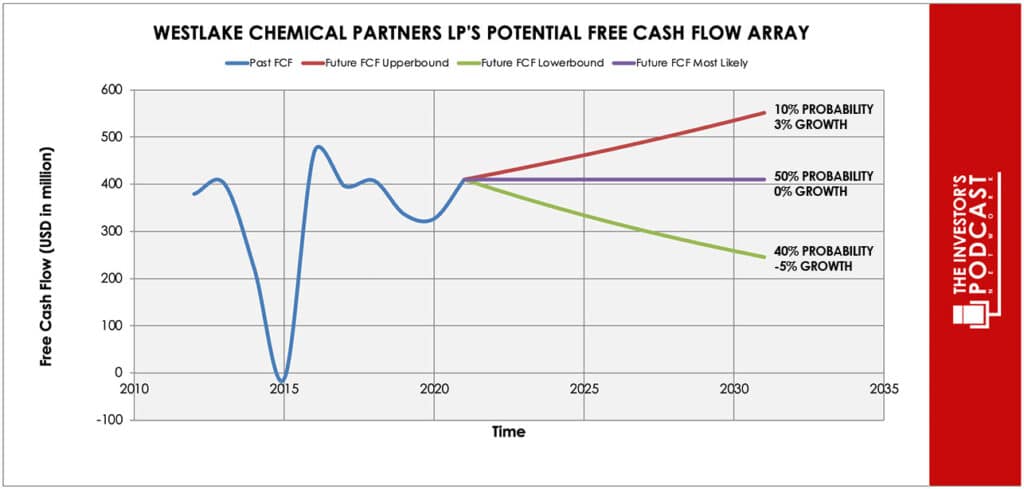

To construct a model of the intrinsic value of WLKP, we will use the last FCF-value as starting point. Based on this value, we then assume three different scenarios for the future.

Each line in the above graph represents a certain probability for occurring, where we use a conservative estimate. We assume a 10% probability for the upper growth rate of 3% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 40% probability.

Even using this conservative estimate, the expected annual return is an astonishing 50.4%. This is obviously too optimistic.

As conservative alternative we propose to take the current dividend yield of 8.5% as expected minimum annual return. This seems valid since the dividend has consistently grown over the last 10 years and has always comfortably been covered by the free cash flows.

Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF WLKP

WLKP possesses some unique advantages that should allow it to be successful in the future.

- Stable cash flows and dividend income. WLKP’s business model is designed to generate stable cash flows through long-term supply agreements with its parent company, Westlake Chemical Corporation, and other customers. This should result in consistent and potentially attractive dividend income for investors, making it interesting for income-focused investors.

- Tax benefits. Investing in a limited partnership like WLKP offers tax benefits primarily due to pass-through taxation. Income, deductions, and losses pass through to individual investors, often resulting in lower tax rates compared to traditional corporations.

- Exposure to petrochemical industry. For investors seeking exposure to the petrochemical industry, WLKP provides an opportunity to invest in a company that operates in this sector. Petrochemicals are integral to various industries, including plastics, chemicals, and manufacturing, which offer growth potential as the global economy expands.

When looking at various investment opportunities in the market today, let’s compare the expected return of WLKP to other ideas. First, one could invest in the ten-year treasury bond which is producing a 4.3% return. As alternative, one could also invest in the US stock market. Currently, the S&P 500 Shiller P/E ratio is 30.6. As a result, the US Stock market is priced at a 3.26% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

WLKP operates in the petrochemical industry, which is shaped by several critical factors. It’s heavily influenced by commodity price fluctuations, particularly in crude oil and natural gas, which directly affect production costs and pricing for petrochemical products. Government regulations and environmental standards play a significant role, impacting operations, and requiring compliance adjustments.

The industry’s health is tied to global economic conditions, with economic growth driving demand for petrochemicals. The complex global supply chains for raw materials and distribution are vulnerable to geopolitical tensions and disruptions. Technological advancements and a growing emphasis on sustainability and ESG practices are reshaping the sector, while energy market shifts can have implications for petrochemical companies like WLKP.

RISK FACTORS

OMC faces several risks in its business operations. Here are three key risks for OMC:

- Risks because of LP structure. Investing in a limited partnership (LP) comes with risks including limited control, complex tax implications, potential limited liability, less liquidity, varying dividend distributions, differing regulatory standards, and limited investor protections compared to investing in a common stock.

- Dependency on Westlake Chemical Corporation. WLKP relies heavily on its relationship with Westlake Chemical Corporation, its general partner and primary customer. Any changes in this relationship, including changes in supply agreements or business strategies, can negatively affect WLKP’s financial stability and distributions to its investors.

- Commodity price risk. WLKP’s financial performance is closely tied to the prices of ethylene and related petrochemical products. Fluctuations in commodity prices can impact the partnership’s revenue and profitability. Economic downturns or oversupply in the petrochemical market can lead to lower prices, affecting WLKP’s earnings and distribution levels.

SUMMARY

For potential investors, WLKP offers the opportunity to access stable cash flows and attractive dividend income due to its business structure as LP and long-term supply agreements. Additionally, its presence in the petrochemical industry provides exposure to a sector central to various industries, offering growth potential as the global economy expands.

But investing in WLKP also presents multiple risks, including exposure to commodity price fluctuations in the petrochemical industry, and dependence on Westlake Chemical Corporation as a primary customer. Furthermore, the complexity of limited partnerships can result in complex tax issues and limited control for investors.

For investors interested in reliable and steady dividend income, the expected annual minimum dividend yield of 8.5% at the current price of $22.22 looks attractive. But besides this positive, investors should not expect a strong appreciation of WLKP’s price since the price has been quite stable. This investment should be considered more as a bond than a common stock.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.