Intrinsic Value Assessment Of CSS Industries (CSS)

By Christoph Wolf From The Investor’s Podcast Network | 20 August 2018

INTRODUCTION

CSS Industries is a small-scale company in the consumer products industry. Its business is divided into three categories: Seasonal products (which are only sold during seasonal events such as Christmas, Easter, or Valentine’s Day), gift products (which are bought for certain special occasions such as weddings, childbirth, anniversaries, or graduation), and craft products (including articles used for craft activities, i.e., sewing patterns, ribbons, trims, buttons, or knitting needles). It sells its products mostly to mass market retailers.

Since CSS Industries’ business model is under threat and shrinking, the company had to rely increasingly on acquisitions to support its operations. That said, the company has mostly avoided to take on debt to finance these takeovers and still has a solid balance sheet. Considering that CSS Industries’ stock price has fallen from a high of $40 in 2017 to only $15 today, is this a bargain or will the company go out of business soon?

THE INTRINSIC VALUE OF CSS INDUSTRIES

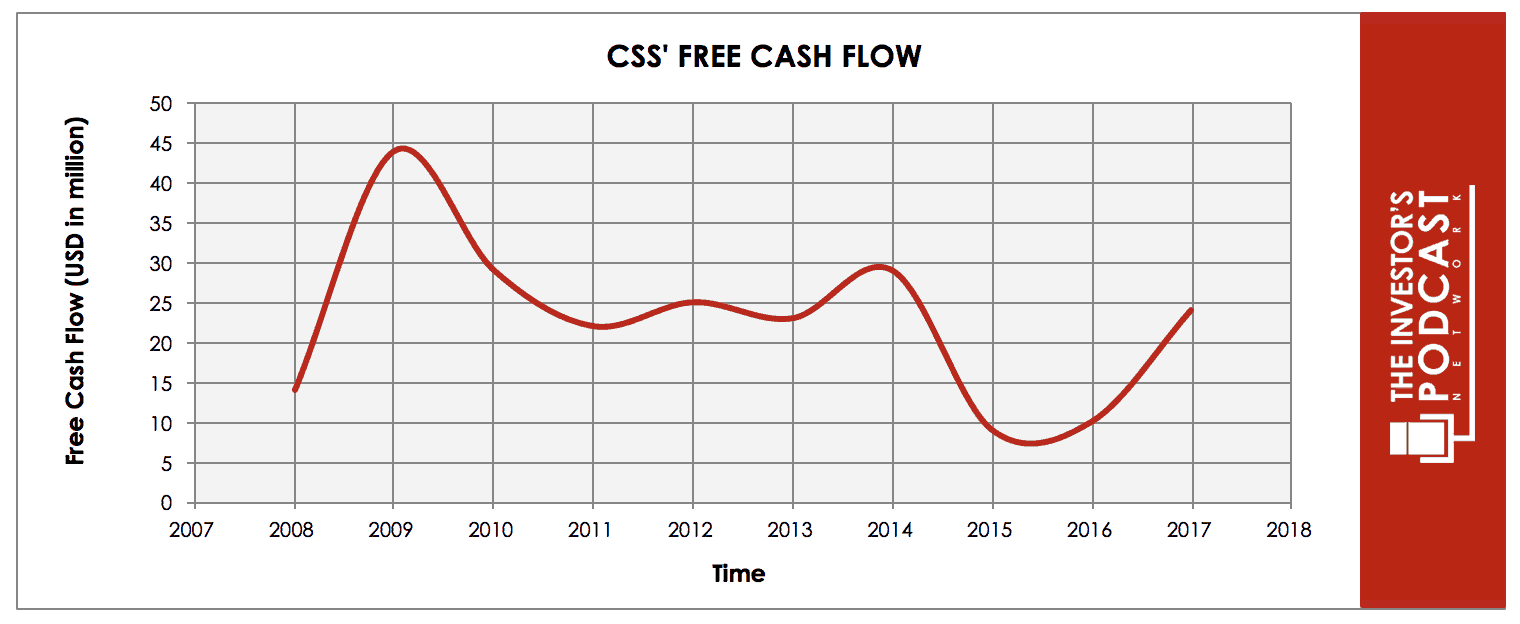

To determine the value of CSS Industries, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of CSS Industries’ free cash flow over the past years.

Not only does the cash flow look volatile, but also revenue is significantly lower than ten years ago. Since this is clearly a vulnerable company, we will err on the safe side and use a very conservative estimate for CSS Industries’ future cash flows.

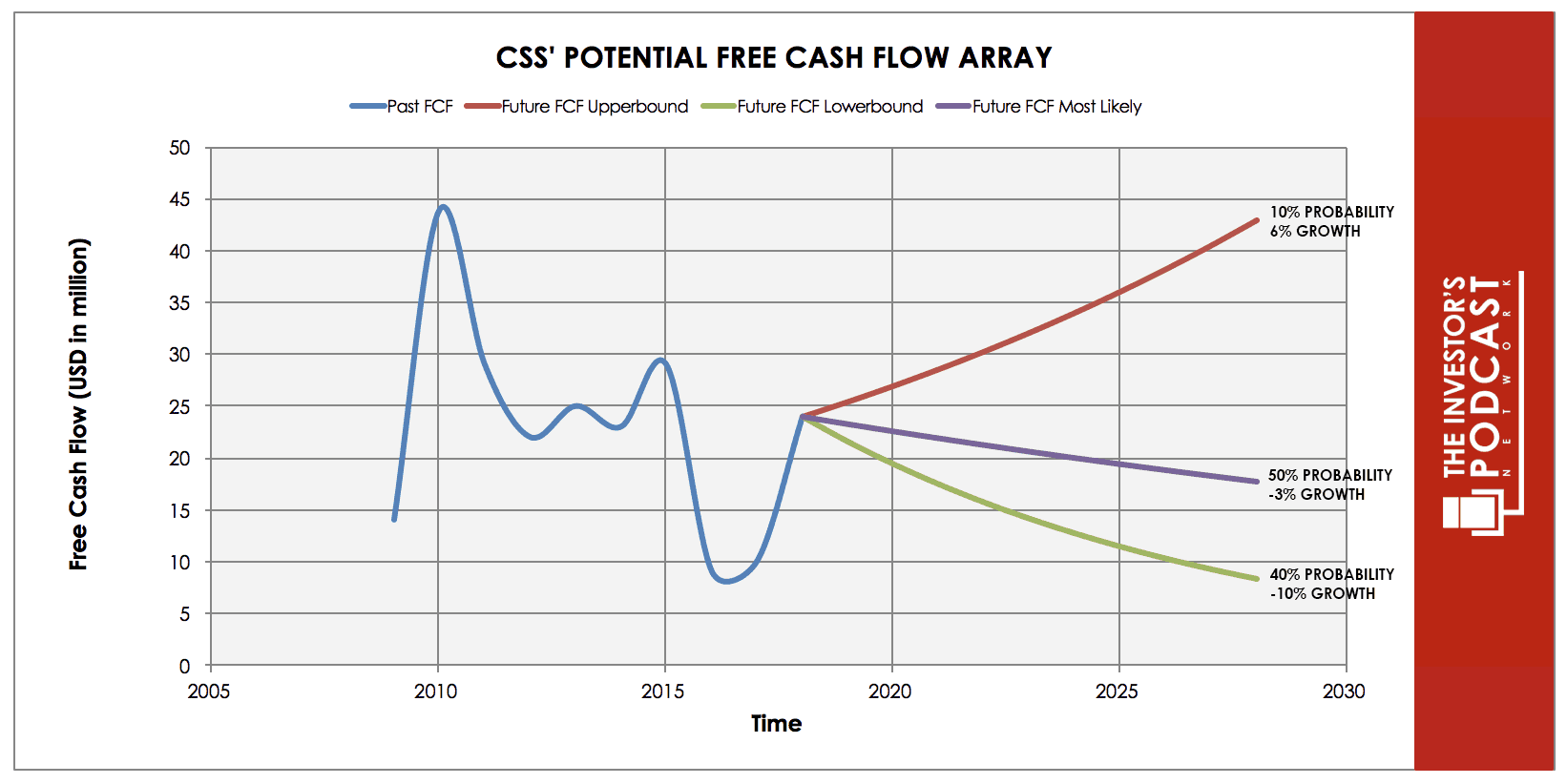

Each line in the above graph represents a certain probability for occurring. We assume a 10% probability for the upper growth rate of 6% per year, which is the average annual growth rate between 2008 and today. The most likely scenario of a 3% growth contraction is based on a conservative outlook of in a challenging industry is assigned a 50% probability. Finally, we denote a 40% probability of a 10% annual growth contraction that is based on the continued problems with the core business model.

Assuming these growth rates and probabilities are accurate, CSS Industries can be expected to give a 13.5% annual return at the current price of $15. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF CSS INDUSTRIES

CSS Industries possesses some unique advantages that should allow it to be successful in the future:

- Product Breadth. Due to its wide range of products, the retail customers of CSS Industries can use a single vendor for their seasonal, gift, and craft requirements. This is a significant reason to stay loyal to the company and constitutes a high barrier of entry for competitors.

- Monopoly in the Legacy Home Sewing Industry. Having acquired the McCall Pattern Company in 2016 and Simplicity Creative Group in 2017, CSS Industries now owns all four legacy American sewing pattern brands (Vogue and Butterick being the other two).

- Strong Balance Sheet. Despite its multiple problems and several acquisitions during the last years, CSS Industries’ balance sheet remains very solid. The debt-equity ratio is only 0.17, current assets are almost twice the total liabilities, and the current ratio has been above 3 for the complete last decade. Even the quick ratio is comfortably above 1. Since CSS has always managed to achieve significant free cash flow, almost all acquisitions could be financed by its cash flow and the company did not have to take on debt.

RISK FACTORS

Several risks might limit the growth prospects of CSS Industries:

- A Shrinking Core Business Model. CSS Industries’ main business has steadily shrunk during the last decade. Most of its products are rather simple everyday items, which can be cheaply and easily produced. This low barrier of entry results in multiple small and large competitors. Since most of CSS’ products are small, unbreakable, and don’t go bad, they can also be conveniently sent by post, further lowering the bar for its rivals.

- Competition from Independent Sewing Pattern Companies. Due to the internet, barriers to entry are much lower today for independent designers. Instead of sending out patterns by mail, these can now be cheaply sold online and printed out by customers. The competitors’ products are also often easier to use and require a lower level of knowledge compared to CSS’ patterns.

- Possible Problems to Integrate the Acquired Companies. Since other companies often bring a different corporate culture, CSS might experience difficulties to integrate these efficiently.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of CSS to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 2.86% return. Considering the bond is completely impacted by inflation, the real return of this option is likely only marginally positive. Also, an investment in the U.S. Stock Market does not offer significantly higher returns. Since the S&P 500 Shiller P/E ratio is currently 32.7, the U.S. Stock Market is priced at a 3.06% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The consumer product industry is currently undergoing a major shift – especially with regards to distribution. Amazon and an ever more globalized and connected world change the game completely, and it is very hard to see where this trend will culminate in the future. Customers increasingly order and buy online, and the products that CSS offers are especially easy to ship. As a result, there are multiple competitors worldwide, and the barrier to entry is very low. Gladly, CSS is at least partly shielded from this threat, since it mostly does not sell directly to the end user, but mostly to large retail customers.

SUMMARY

CSS is an intriguing company. On the one hand, the company has an impressive range of products, remains highly profitable, and features very solid finances. Its product breadth gives the company a competitive advantage since its retail customers can order multiple items from just one vendor. On the other hand, its core business has consistently shrunk, and its products have a very low barrier to entry for competitors – both regarding production and distribution. CSS had to increasingly rely on acquisitions to at least slow its decline in sales.

While the expected annual return of 13.5% seems very appealing at first glance, investors are well-advised to examine the company and its prospect including the challenging market environment more closely before investing.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in CSS at the time of writing this article.