Intrinsic Value Assessment Of Edwards Lifesciences Corp. (EW)

By David J. Flood From The Investor’s Podcast Network | 16 November 2017

INTRODUCTION

Edwards Lifesciences Corp. is an American medical equipment company which specializes in the manufacture of artificial heart valves and hemodynamic monitoring. Having been owned by Baxter International Inc., the company was spun-off in 2000 and has since then traded as an independent publicly held company. Edwards Lifesciences Corp. is currently a member of the Fortune 500 list with a market cap of $22 Billion. Its revenues and free cash flows for the previous financial year were around $2.96 Billion and $487 Million respectively. The company’s common stock has fluctuated between a low of $81 and a high of $121 over the past 52 weeks and currently stands at around $104. Is Edwards Lifesciences Corp undervalued at the current price?

THE INTRINSIC VALUE OF EDWARDS LIFESCIENCES CORP.

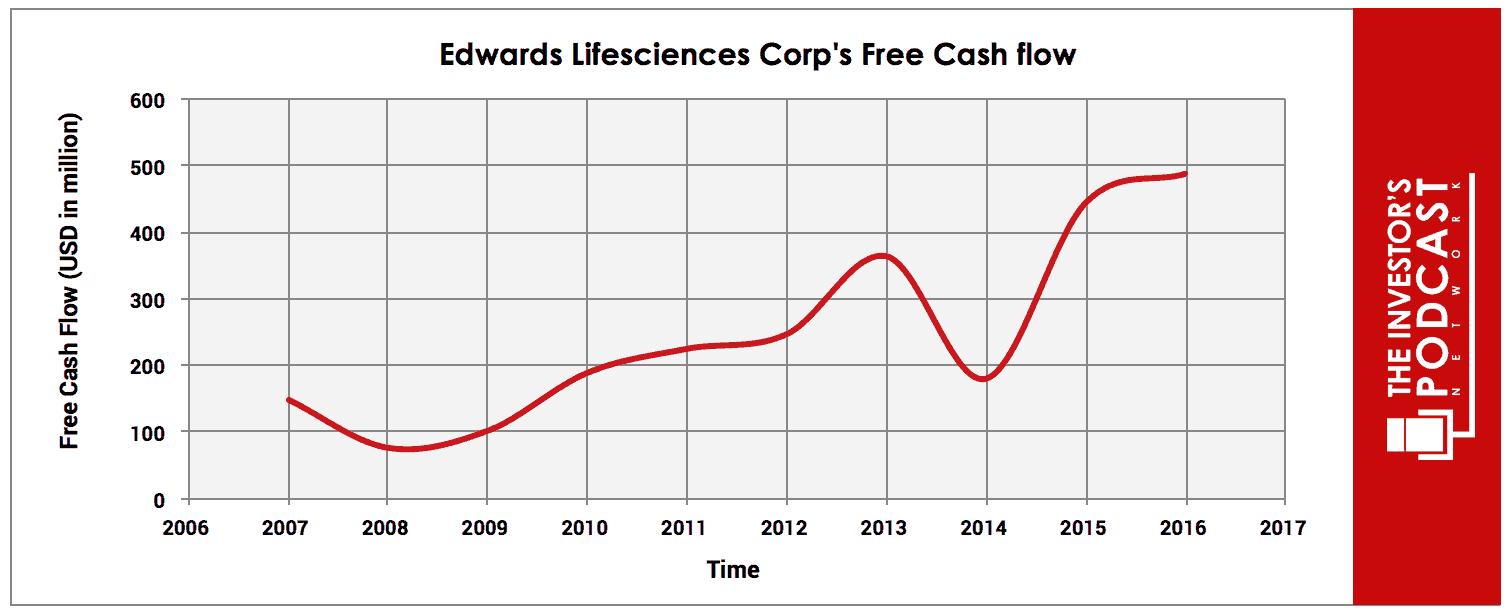

To determine the intrinsic value of Edwards Lifesciences Corp., we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Edwards Lifesciences Corp.’s free cash flow for the past ten years. Readers should note that an amendment has been made to account for a one-time litigation settlement payment of $750 Million made to Edwards Lifesciences in FY2014 by Medtronic PLC.

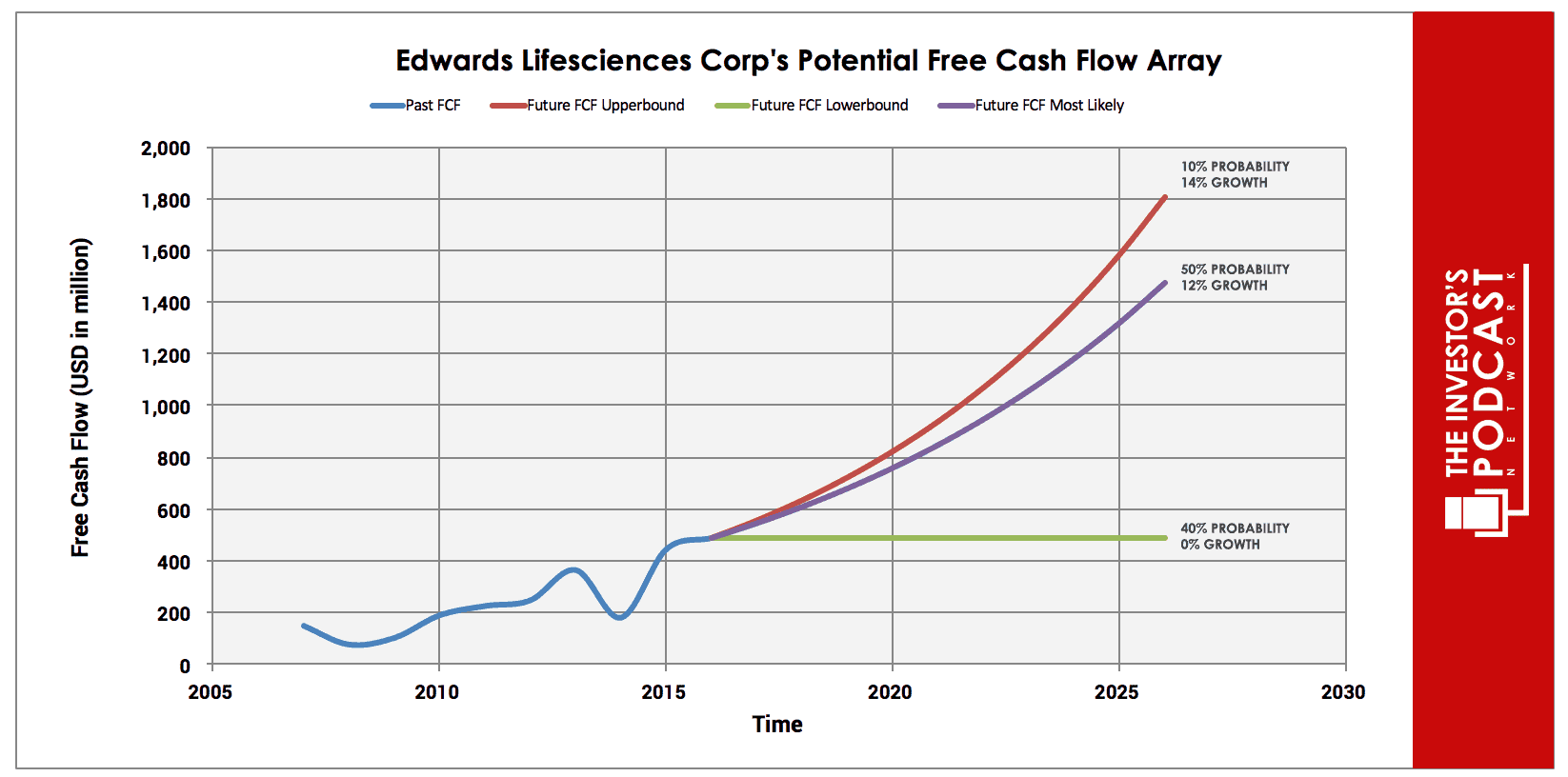

As one can see, the company’s free cash flow has been on a strong upward trend, growing at an annual rate of over 14% for the past ten years. This growth has been driven by both an increase in demand for the company’s products, and through numerous accretive acquisitions. To determine Edwards Lifesciences Corp.’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents a 14% growth rate, which is in line with the historical rate of growth in free cash but more importantly expected to materialize following the company’s current strategy. This has been assigned a 10% probability of occurrence since the company is facing increasing headwinds from a new entrant, Boston Scientific Corp., and established competitors such as Medtronic PLC.

The middle growth line represents a 12% growth rate. This is based on the 10-year historical revenue growth rate. Revenues tend to be far more stable than earnings and as such offer a more realistic assumption for estimates. For this reason, it has been given a 50% probability of occurrence.

The lower bound line represents a 0% growth rate in free cash flow growth and has been assigned a 40% probability of occurrence. This lower bound rate assumes that the company’s future free cash flow growth is impacted by both a narrowing of growth opportunities as the law of larger numbers results in lower market growth, and by an increased intensity in competition. Assuming these potential outcomes and corresponding cash flows are accurately represented, Edwards Lifesciences Corp. might be priced at a 2.0% annualized return if the company can be purchased at today’s price. We’ll now look at another valuation metric to see if it corresponds to this estimate.

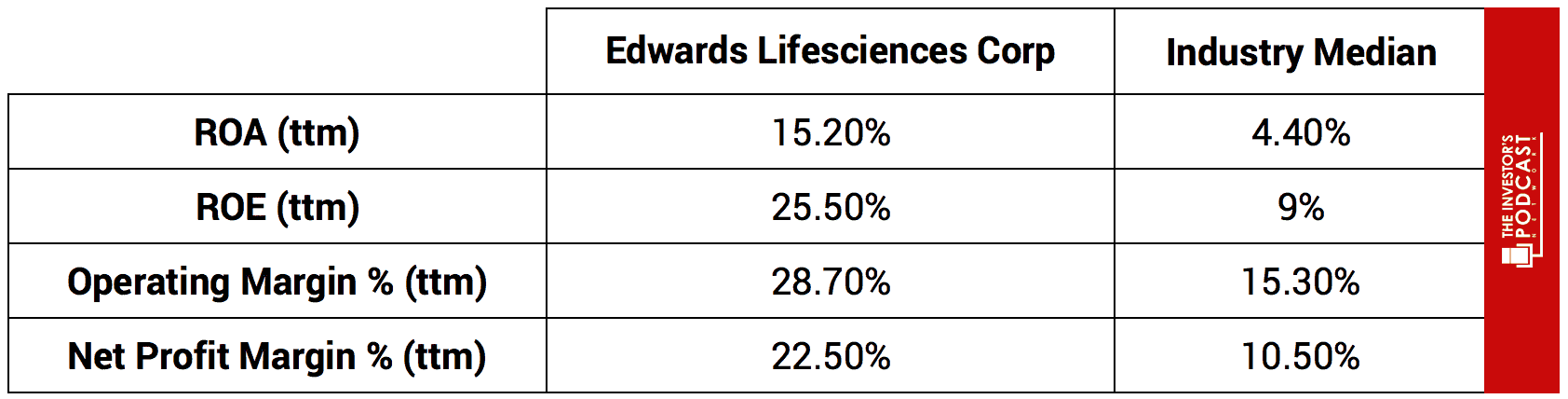

Based on Edwards Lifesciences Corp.’s current earnings yield, which is the inverse of its EV/EBIT ratio, the company is projected to return around 4.25%. This is below the firm’s historical median average of 4.50% but above the industry median of 0.94% suggesting that the company is overvalued relative to its historical average but potentially undervalued relative to the industry. Furthermore, on a simple P/E basis, Edwards Lifesciences Corp. currently trades at 30.3x versus an average of 42.2x for the ‘Medical Devices’ industry. Finally, we’ll look at Edwards Lifesciences Corp.’s PEG ratio, a metric useful for estimating the fair value of growth companies, to see how it fairs. At present, the company’s PEG ratio stands at 1.33. This is above a fair value of 1, meaning that the firm is most likely overvalued.

Taking all these points into consideration, it seems reasonable to assume that Edwards Lifesciences Corp. is trading at a premium to fair value at present. Furthermore, the company may return around 2% at the current price if the estimated free cash flows are achieved. Now, let’s discuss how and why these free cash flows could be realized.

THE COMPETITIVE ADVANTAGE OF EDWARDS LIFESCIENCES CORP.

Edwards Lifesciences Corp. has various competitive advantages outlined below:

- Intangible Assets. Edwards Lifesciences Corp. possesses a large portfolio of intangible assets including patents and trademarks. According to the company’s latest annual report, they own 2,700 issued United States patents, pending United States patent applications, issued foreign patents, and pending foreign patent applications. These intangible assets allow the company to outperform its competitors on several key metrics outlined below.

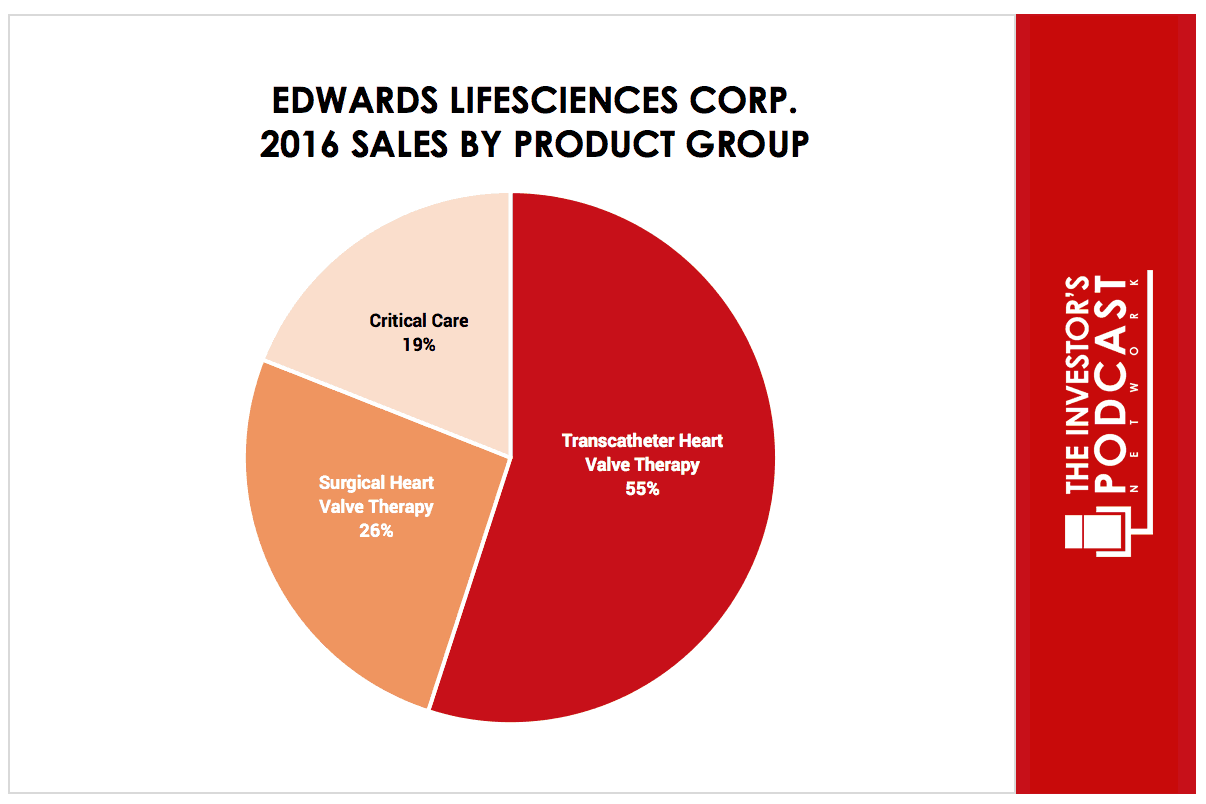

- First-mover advantage. Edwards Lifesciences Corp. possesses the first-mover advantage since it was the first company to develop an artificial heart valve replacement in the early 1960’s. The chart below illustrates how this has allowed the company to dominate multiple segments of the industry.

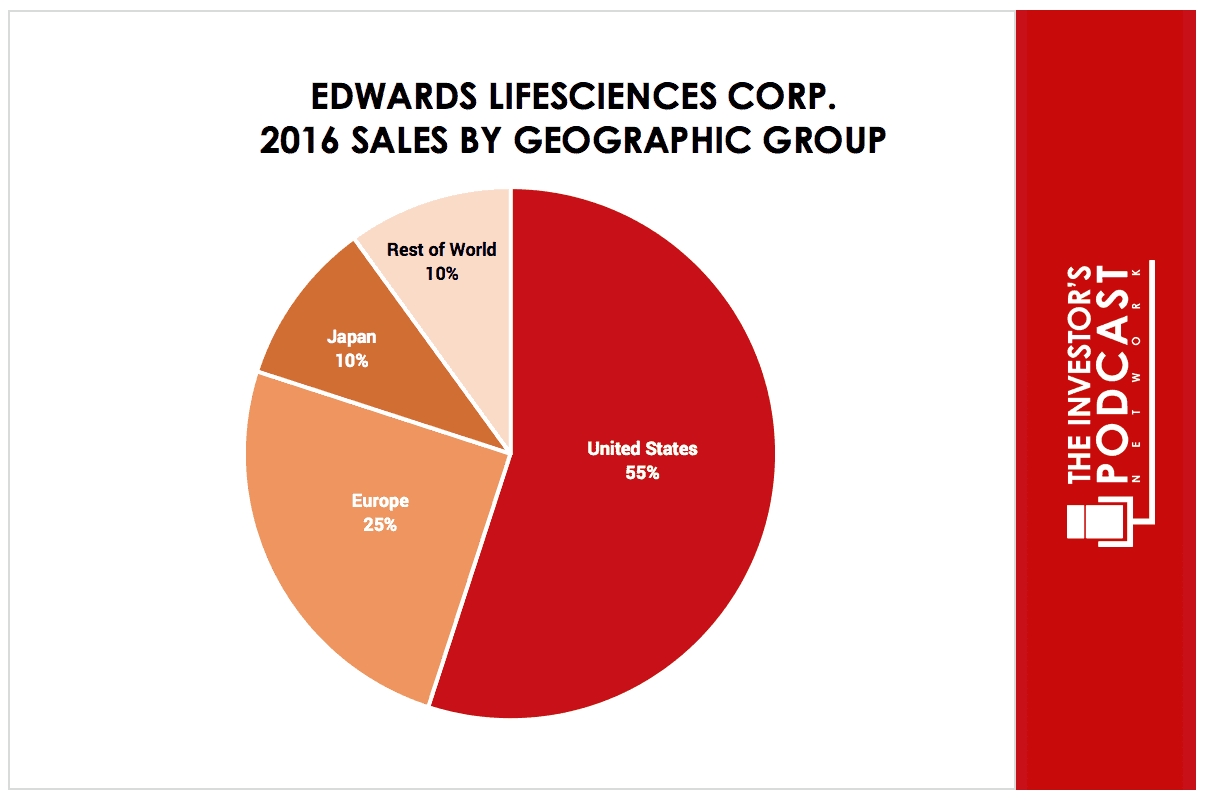

- Distribution advantage. The company possesses a global distribution network comprising of both direct sales teams and independent distributors which results in a diverse customer base. According to the company’s latest annual report, they “are not dependent on any single customer and no single customer accounted for 10% or more of our net sales in 2016.”

- High barriers to entry. Edwards Lifesciences Corp. operates in a highly regulated industry. This means that the sheer cost of both time and capital required to bring a product to market limits the number of new entrants likely to enter the space and challenge for market share.

EDWARDS LIFESCIENCES CORP.’S RISKS

Now that Edwards Lifesciences Corp.’s competitive advantages have been considered, let’s look at some of the risk factors which could impair my assumptions of investment return.

- While Edwards Lifesciences Corp. possesses multiple competitive advantages, there still exists a possibility that one of its rivals could mount a challenge to erode its competitive advantages and move on its market share. It should be noted that some of these competitors, such as Medtronic PLC, possess both their own competitive advantages and ample capital to mount a serious challenge.

- Changes in or failure to comply with government regulation could materially impact Edwards Lifesciences Corp.’s revenues and earnings. Amendments to the U.S. health care law passed in 2010 require the medical device industry to subsidize reforms via the imposition of a 2.3% excise tax. While this tax was suspended in 2016 and 2017, it is set to resume in 2018.

- The emergence of a serious economic crisis similar to that witnessed in 2008 could materially impact the company’s revenues and profits leading to lower growth in the coming years. Given the critical importance of the company’s products to patients, it is unlikely to see a significant decline in demand. Nevertheless, this risk is still worthy of considerations by investors.

- The risk of obsolescence could arise if the company fails to maintain its record of product innovation. Significant capital allocation is required for continued R&D to drive innovation of existing and new technologies and products. If Edwards Lifesciences Corp. wishes to maintain its position of dominance, it is important that the company reinvests its capital in an effective and efficient manner.

OPPORTUNITY COSTS

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At present, 10-year treasuries are yielding 2.16%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of x 30, meaning it is priced for an earnings yield of 3.3%. Edwards Lifesciences Corp., therefore, appears to offer a lower rate of return for investors at present, but other individual stocks may be found which offer a more favorable return relative to the risk profile.

MACRO FACTORS

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns. At present, the S&P is priced at a Shiller P/E of 30. This is over 85% higher than the historical average of 16.8 suggesting markets are at elevated levels. U.S. unemployment figures are at a 30-year low suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 199.6% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

The future for Edwards Lifesciences Corp. looks favorable if it can capitalize on the increasing demand for non-invasive heart surgery. At present, the company leads the $2.5 Billion Transcatheter Heart Valve Segment which is estimated to exceed $5 Billion by 2021. It is also projecting an increase in penetration rates for transcatheter aortic valve replacement (TAVR) from 18% in 2016 to 30% by 2021. This presents opportunities for the company to expand its presence in a growing market and thus increase its revenues and earnings.

Management has a strong track record of being both shareholder-friendly and shrewd capital allocators having grown book value at an annualized rate of over 14% during the last ten years. In 2016, the company repurchased 7.2 Million shares of their common stock at an aggregate cost of $646.5 Million. The current program authorizes the purchase of a further $1 Billion which is, according to management, dependent on numerous factors including cash capacity and the market price of the company’s common stock.

At present, Edwards Lifesciences Corp. appears overvalued with an estimated return of around 2%. While the company’s stock price is currently trading at a premium to fair value, it is certainly one to watch. Should its share price decline to a more reasonable level it would be worthy of serious consideration by investors.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.