Intrinsic Value Assessment Of Exco Technologies, LTD. (XTC)

By Christoph Wolf From The Investor’s Podcast Network | 28 January 2019

INTRODUCTION

Exco Technologies Ltd. is a Canadian company, which designs, develops, and produces dies, molds, and equipment for the die-cast, extrusion, and automotive industries. The company’s operations are divided into two divisions.

The Casting and Extrusion Segment focuses on die-casting and extrusion tooling, as well as parts for both die-casting and extrusion machines. Its operations are based in the Americas and Thailand, and its customers consist of global automotive and other industries. Exco is the leader in most of these markets. The Automotive Solution Segment is focused on interior trim components and assemblies both for passenger and light truck vehicles. The manufacturing facilities are primarily based in the Americas, and its main customers are automotive industries in North America and Europe.

Considering that Exco Technologies Ltd.’s stock price has fallen from its high of more than 17 CAD in 2015 to a price of only 9.30 CAD today, should investors now consider the stock?

THE INTRINSIC VALUE OF EXCO TECHNOLOGIES LTD.

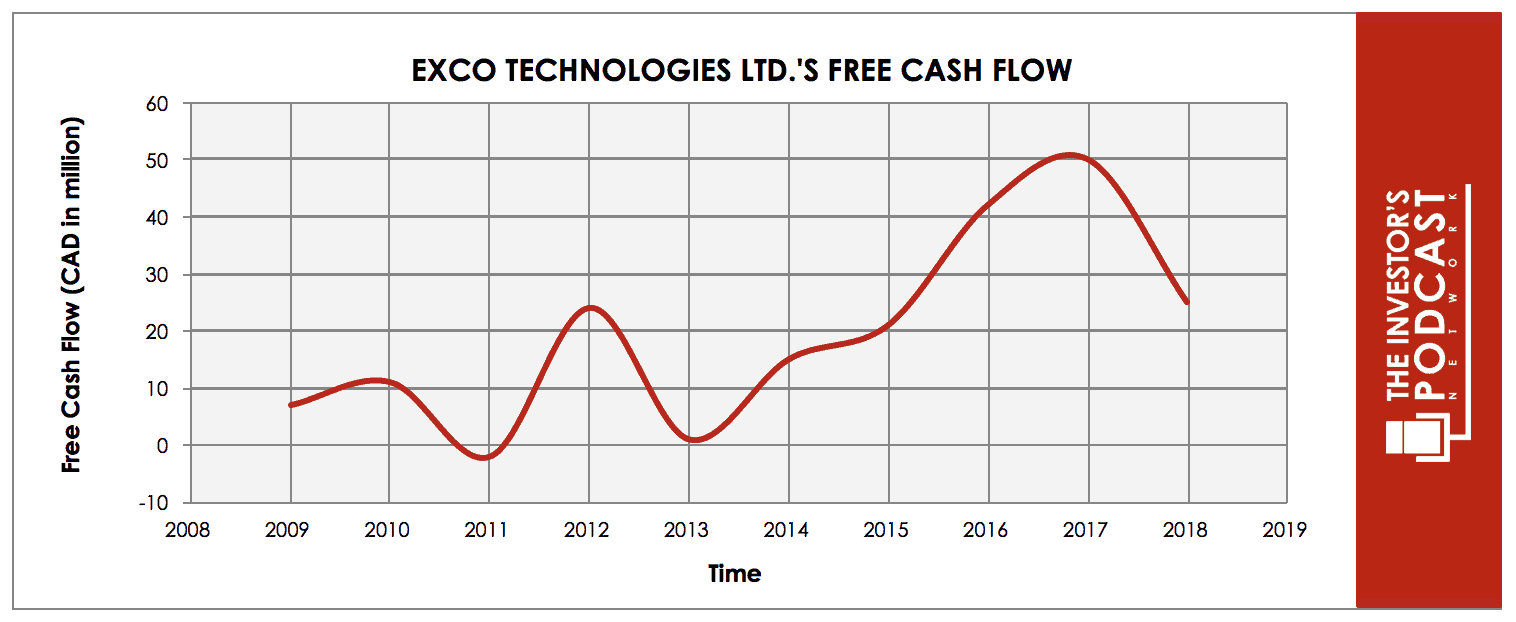

To determine the value of Exco Technologies Ltd., let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of Exco Technologies Ltd.’s free cash flow over the past years.

As one can see, the cash flows have been trending upward with high volatility. This is due to the cyclical business it is operating in. As a consequence of this additional risk, we will use a conservative estimate for Exco Technologies Ltd.’s future cash flows.

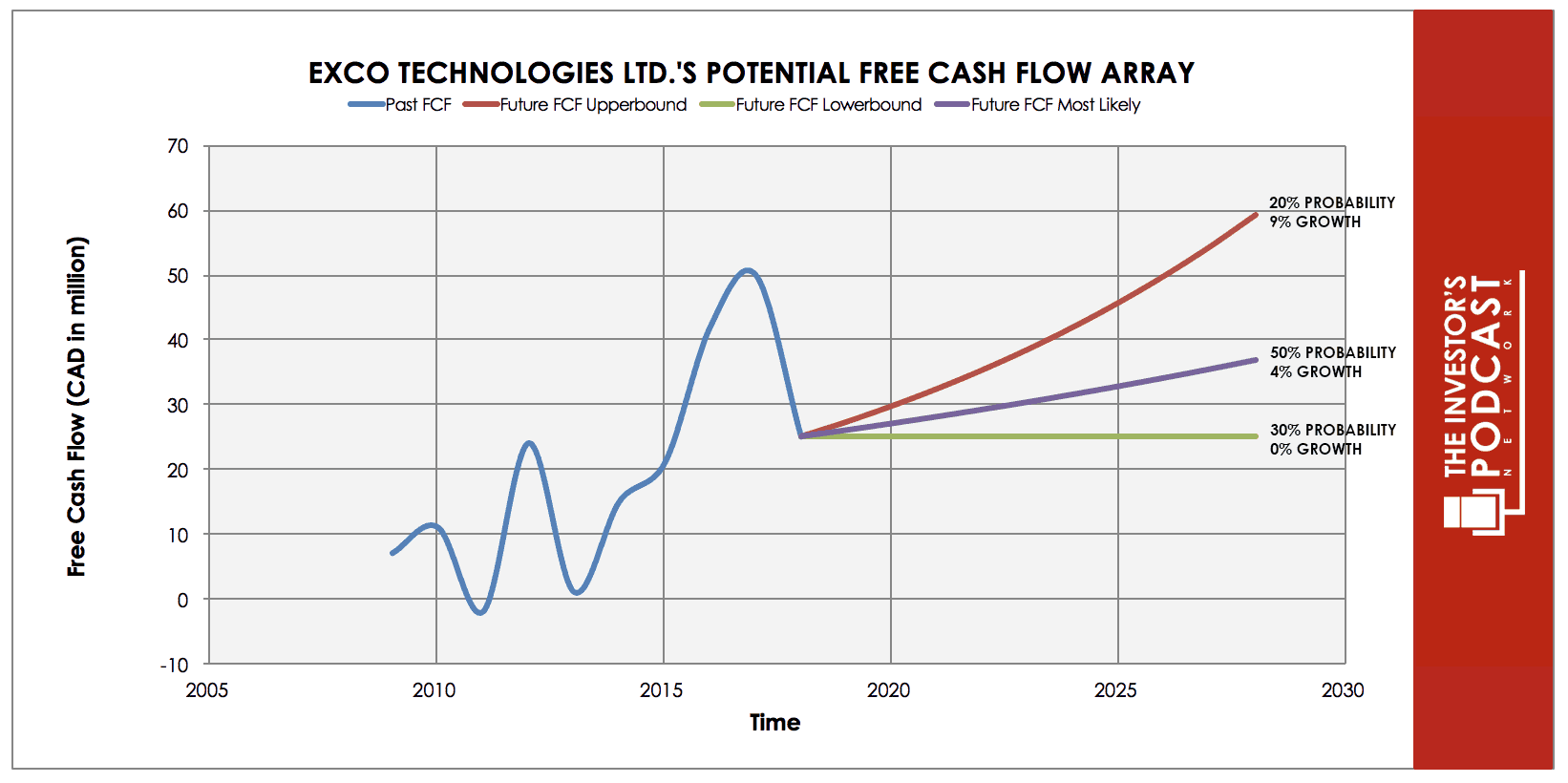

Each line in the above graph represents a certain probability for occurring. The upper growth rate of 9% is based on the approximate annual growth between 2009 and 2018 and is given a 20% chance. As most probably we consider a small annual increase of 4%, this medium growth rate is therefore assigned a probability of 50%. The worst case is assumed to be flat a cash flow, and we guess the chances for this scenario at 30%. Assuming these growth rates and probabilities are accurate, Exco Technologies Ltd. can be expected to give a 7.0 % annual return at the current price of 9.59 CAD. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF EXCO TECHNOLOGIES LTD.

Exco Technologies Ltd. possesses some unique advantages that should allow it to be successful in the future:

- Local Leader in many markets in casting and extrusion. Exco Technologies Ltd. is a leader in most global markets in the niche of die-casting and extrusion machines. Since the company has decades-long experience in this field and operates in a capital-intensive environment, the barrier for entry is high. This should shield the company from competitors.

- Crucial link in worldwide supply chains. Another reason for the company’s moat is its position in the global supply chains. Since these structures are highly complex and globalized, replacing Exco Technologies Ltd. with another company would result in high switching costs for a customer. This further stabilizes Exco Technologies Ltd.’s position.

- Vigilant leaders. Although Exco Technologies Ltd.’s business is very capital-intensive and management has acquired multiple companies over the years, its debt load is very low. This was possible due to consistently strong free cash flows. The business has grown nicely, but mostly organically.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of Exco Technologies Ltd. to other ideas. First, one could invest in the ten-year treasury bond which is producing a 2.7% return. Considering the bond is completely impacted by inflation, the real return of this option is likely only around 1%. Currently, the S&P 500 Shiller P/E ratio is 28.17. According to this valuation metric, the U.S. Stock market is priced at a 3.5% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

Exco Technologies Ltd. is deeply ingrained in the global car supply chains, which is a double-edged sword. On the one hand, the company is a vital part of the chain, which gives it a high barrier of entry. Its business is capital-intensive, relies on long-established connections and is also not large enough to attract serious threats from competitors. Exco Technologies Ltd.’s competitive advantage lies in the fact that it is simply not worth the effort to attempt to grab its market share.

But while Exco Technologies Ltd.’s position within the supply chain seems safe, the company is fully dependent on the health of the chain. Since globalization including free trade across borders is currently threatened on multiple fronts due to protectionism and populism, Exco Technologies Ltd. is highly vulnerable to a reversal of global free trade. Also, if the world economy tanks, a globally operating company like Exco Technologies Ltd. will feel the pressure.

RISK FACTORS

Several risks might limit the growth prospects of Exco Technologies Ltd.:

- The backlash against globalization. Exco Technologies Ltd. produces and sells in multiple countries and is very dependent on a smooth global supply chain. If free trade were restricted by other means, Exco Technologies Ltd. would be hit This risk is mostly political, which makes it very hard to assess and is out of the company’s hands.

- Dependency on global car sales. Car sales are very cyclical and closely connected to the state of the world economy. If another global recession strikes or if car sales drop because of other reasons, demand for Exco Technologies Ltd.’s products would fall.

- Currency risks. A global company like Exco Technologies Ltd. naturally buys and sells in multiple currencies. Especially the CAD/USD-conversion rate is very important for the profitability of its business. This complicates management’s decisions, especially regarding capital allocation and is a success factor that is out of the company’s hands.

SUMMARY

Exco Technologies Ltd. is an impressive company led by a trustworthy management, which has grown the firm organically to maximize long-term success. Exco Technologies Ltd.’s niche in the global supply chain seems sustainable and should guarantee that the company prospers in the future – as long as the health of this supply chain remains robust. A backlash against globalization or a slowdown of the world economy would hit the company hard.

In short, Exco Technologies Ltd. is a truly globalized company. So, buying a stake in the company is also a bet on free-trade and globalization to continue in the future. If the current prize of 9.59 CAD and an expected annual return of 7% adequately compensates for this, risk should be further investigated before buying this stock.

Discover other comprehensive Intrinsic Value Assessments like this on our FREE Intrinsic Value Index.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.