Intrinsic Value Assessment Of International Business Machine (IBM)

By Eoin O’Byrne From The Investor’s Podcast Network | 27 September 2017

INTRODUCTION

International Business Machine (IBM) is a significant component of the tech industry, but it is not part of the illustrious FANG stocks that propel this market segment’s growth. Three of these stocks were unpursued opportunities and major regrets of Charlie Munger and Warren Buffett. Meanwhile, investing in IBM was another regret of these investors.

Over the past 52-week period, the price band for IBM has been between $182.79 and $139.13. The stock currently trades at around $145 — above this low point recorded in August. This stock is languishing at some of its lowest levels since 2010.

IBM’S INTRINSIC VALUE

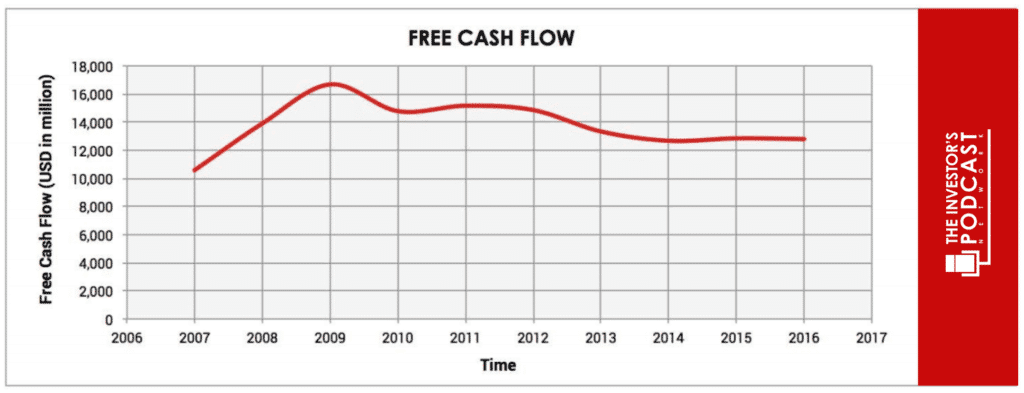

The company has maintained a steady cash flow over the last 10-year period. This consistency is essential for a potential stock pick as it shows a company that can maintain and control its earnings while keeping an eye on consistent growth. Free cash flow (FCF) per share was at its highest level in a decade in 2016 at $15.02 a share, showing steady and controlled FCF.

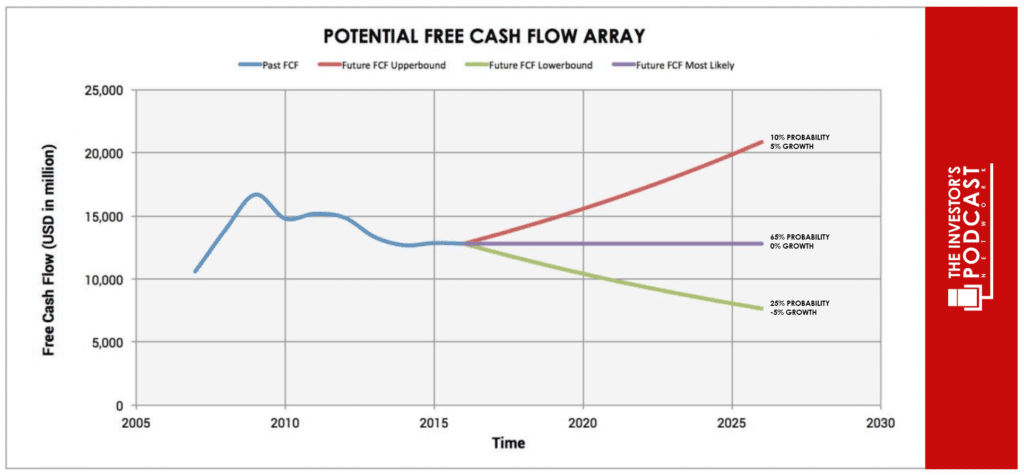

Using a projected cash flow, setting 2007 as the base, and following the theory of reversion to the mean, I have estimated a potential FCF.

Using an upper, middle, and lower band, we can potentially see the projected value of this stock. My projection of the upper band is 5% growth based on an increased trend of this remarkably consistent cash flow generating company. The likelihood of this band being achieved over the next ten years was set at 10%. This percentage was reached based on current macro climates in which we are in the second-longest bull market. Meanwhile, its probability of lasting another decade was in decimal percentages.

The middle band was calculated through reversion to the mean, and its likelihood was set at 65% with a level of growth of 0%. Finally, the lower band was set at -5% which was the largest level dropped over the period. A likelihood of 25% was given to this band. I gave such a likelihood based on how long this peak in the cycle has been driven by tech and how a potential recession could adversely affect this company.

The business has been stagnated for quite some time, and the largest revenue segments are under a lot of pressure – perhaps even facing a long-term decline. Having calculated this, I believe an Internal Rate of Return of 7.8% can be achieved over the next 10-year period.

IBM has a low P/E which makes it attractive to potential investors as the company is not overpriced. Currently, IBM has a P/E of 12.1 while the industry average is 18.1. This means IBM costs $12.1 to earn $1 based on the company’s earnings generated over the last 12-month period. As you can imagine, the lower this goes, the more attractive the ownership of this company’s shares are to a value investor as they are seen to be trading at a discount. Another attractive feature of IBM is the quarterly dividend, which is currently a 4% annual dividend yield. This can be quite a healthy yearly stipend for those investing in the stock for the long haul. The payout ratio of 43.5% translates to a $6 dividend per share. The growth of the dividend has been increasing for 17 years since 2007 and has been continuously paid since 1913.

IBM’S COMPETITIVE ADVANTAGE

A feature of IBM that has the potential to raise this company back up from its slow decline as a major player is Watson, the AI and sophisticated analytical software machine. This machine is aimed at enhancing companies and improving their overall performance. CEO Ginni Rometty says Watson will perform in a “vertical” fashion. In other words, it will be taught through algorithmic programming to work effectively and in a bespoke manner for the user, i.e. the company owner. So, Watson will not only be one product. It will act as a unique operating system and analytic problem solver for each company. This would essentially create a “my AI” type of product, as Rometty said during a recent interview. This creates a situation where companies can have an ever-evolving algorithm that they can grow and develop to detect any financial fraud in the case of a bank or select sites for potential drilling for oil companies. This one product can become the ultimate international business machine. The areas of cognitive solutions and cloud platforms show great returns for the company and amount to 43% of total revenue.

Another area where IBM could be a potential leader is in blockchain technologies. Currently, IBM is leading the charge and is seen as being better equipped and prepared than rivals like Microsoft. This market space is new and anything but certain. As a pioneer in this area, however, IBM has the opportunity to create and establish brand loyalty among future users of this potentially disruptive emerging market space. This brand loyalty is a major moat that the company currently possesses and continually maintains.

In focusing on where the company is heading, we must look at where IBM has come from as well. At the end of the day, IBM has a very strong moat, and that is its brand power. Traditionally, the name IBM is synonymous with reliability not only in its products but also with its reputation as a company. While the current slowdown in growth and the current management have not improved their reputation, IBM can still be considered a strong brand. The company has a strong presence in its core business of technology hardware among many large companies with mainframes and other office techs. The movement to cloud storage is still many years away from total dominance. At this moment in time, the majority of storage is still physical, and IBM has that area sewn up with a continued revenue source stemming from it. Yes, there was most certainly a reduction in revenue from hardware amounting to $2.1bn in 2016 down 9% for the year. Other areas such as global business solutions and cognitive solutions account for more than 50% of IBM’s revenue annually. This shows that this area of the business, where it is often criticized for being out of touch with the modern era of technology, is generating an enormous amount of revenue for them.

IBM’S DRAWBACKS

This company is not without its negatives. A major stumbling block in the way of IBM is what comes up as soon as you search the company on Google and that is Warren Buffett and Charlie Munger’s disappointment in their investment in the company and how they regret their investment. This is obviously not an image any company wants to be associated with.

The company is also aggressive in its pursuit of stock buybacks while creating stock in the form of compensation to employees. Since 1999, IBM has repurchased 75 million shares on average. This staggering amount of buybacks is constant and planned almost like a dollar cost averaging approach by an investor. This approach, however, has not yielded the desired returns as the value of the stock has not kept up with inflation and was more than 70% off in keeping track with the inflation rates from 1999 to 2016. This approach has been consistent across all three CEOs within this time frame. This lack of change from a plan that is not yielding the desired effect is a worrying trait within IBM. Their decision making can definitely be questioned in this instance.

The vast array of competitors across different market spaces that IBM works within are significant factors as well. In cloud computing, you have Amazon and Google. In analytics, there are Oracle and Microsoft. This level of competition can be great and spur ingenuity. However, it appears that IBM is coming out second best in these matchups. Moreover, this trend may continue unless they find a way to become the top dog. Meanwhile, competing in so many areas means that full attention cannot be given specific tasks. This can be a hindrance to excellence, meaning IBM gets caught between continuing their legacy tech hardware business and innovating in cloud/analytic services. This is getting reflected in their returns to date. Their total returns recently are languishing behind — Info Tech Services is up 5.73% while S&P is up over 18% YTD and IBM are -9.05%. These worrying figures are perhaps showing IBM’s lack of ability to compete with their major tech stocks rivals.

SUMMARY

The slow erosion of IBM’s core business aspects is an area of worry. Last year, earnings per share dropped 9%. This area of IBM is such a large revenue generator that such a fall is something to think about when appraising. With that in mind, returns will not be seen for a long time. However, it still has many features to make it a compelling buy and hold situation. With the short-term drawbacks and the long-term potential for this company in Watson along with their entry into the blockchain marketplace, I see this company being at a satisfactory level for future gains.

With the steady inflow created by the dividend, it lends itself well to a long-term investment. Let me explain it using this example: If you hold one share of IBM for 10 years and it falls to $90 a share (37.5% drop), you will have come out with a positive return due to the continuous dividend that has been increasing for the last 17 years, which included the tech bubble bursting and the financial crash.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.