Intrinsic Value Assessment Of Liberty Tax Service (TAX)

By Christoph Wolf From The Investor’s Podcast Network | 29 July 2018

Note: Liberty Tax, Inc. (TAX) has been rebranded as Franchise Group, Inc. (FRG) as of September 19, 2019.

INTRODUCTION

Liberty Tax is a small-scale company in the personal income tax industry. The company operates more than 4000 Liberty Tax Service offices in the United States and Canada. TAX provides retail federal and state income tax preparation services and related tax settlement products.

In contrast to most of its competitors, Liberty Tax is more strongly focused on running its business using franchise locations. This allows it to concentrate on marketing and franchise coaching. Also, capital expenditures and fixed costs are minimized using this franchise approach. The company has managed to grow revenue consistently from $85 million in 2010 to $175 million today. Considering that TAX’s stock price has fallen from a high of $38 in 2014 to only $10.50 today, should investors now pile in or is the company a value trap?

THE INTRINSIC VALUE OF LIBERTY TAX SERVICE

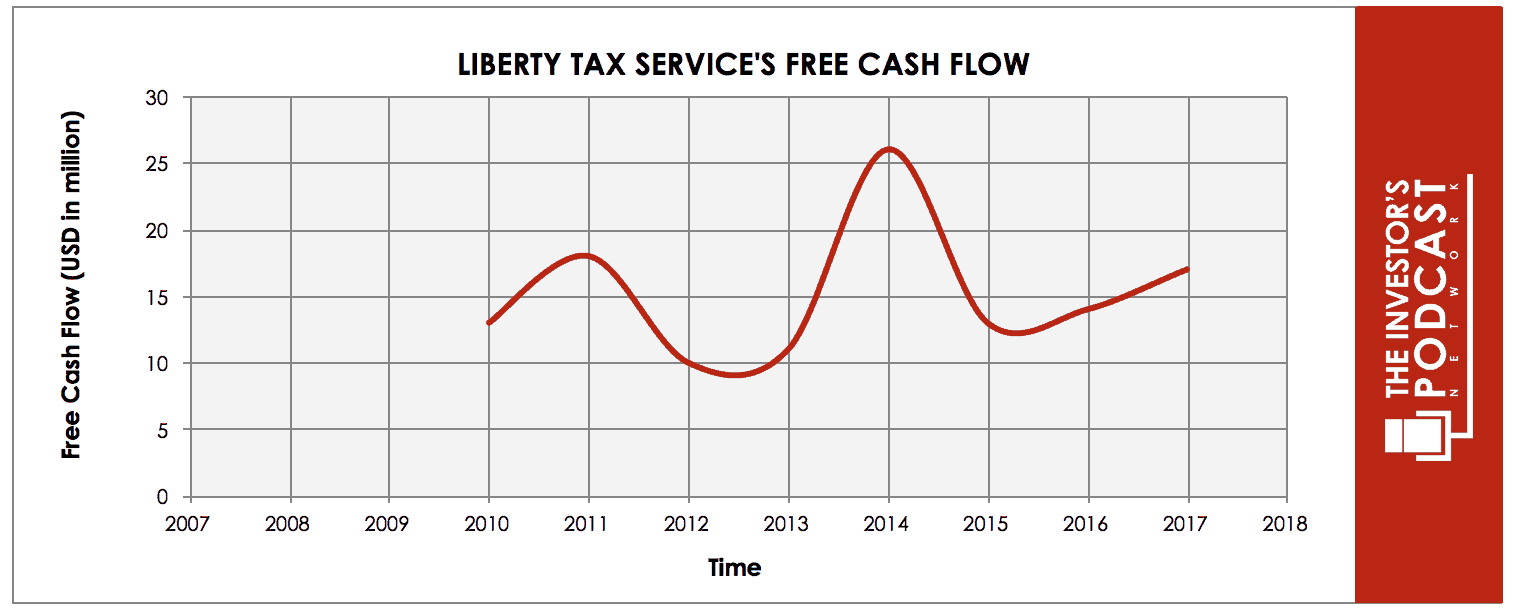

To determine the value of TAX, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of TAX’s free cash flow over the past years.

While the cash flow looks volatile, this is mostly due to margin fluctuations, not volatility in revenue. In fact, revenue has steadily increased throughout the whole time. Despite this, we’ll remain on the safe side and use a conservative estimate for TAX’s future cash flows.

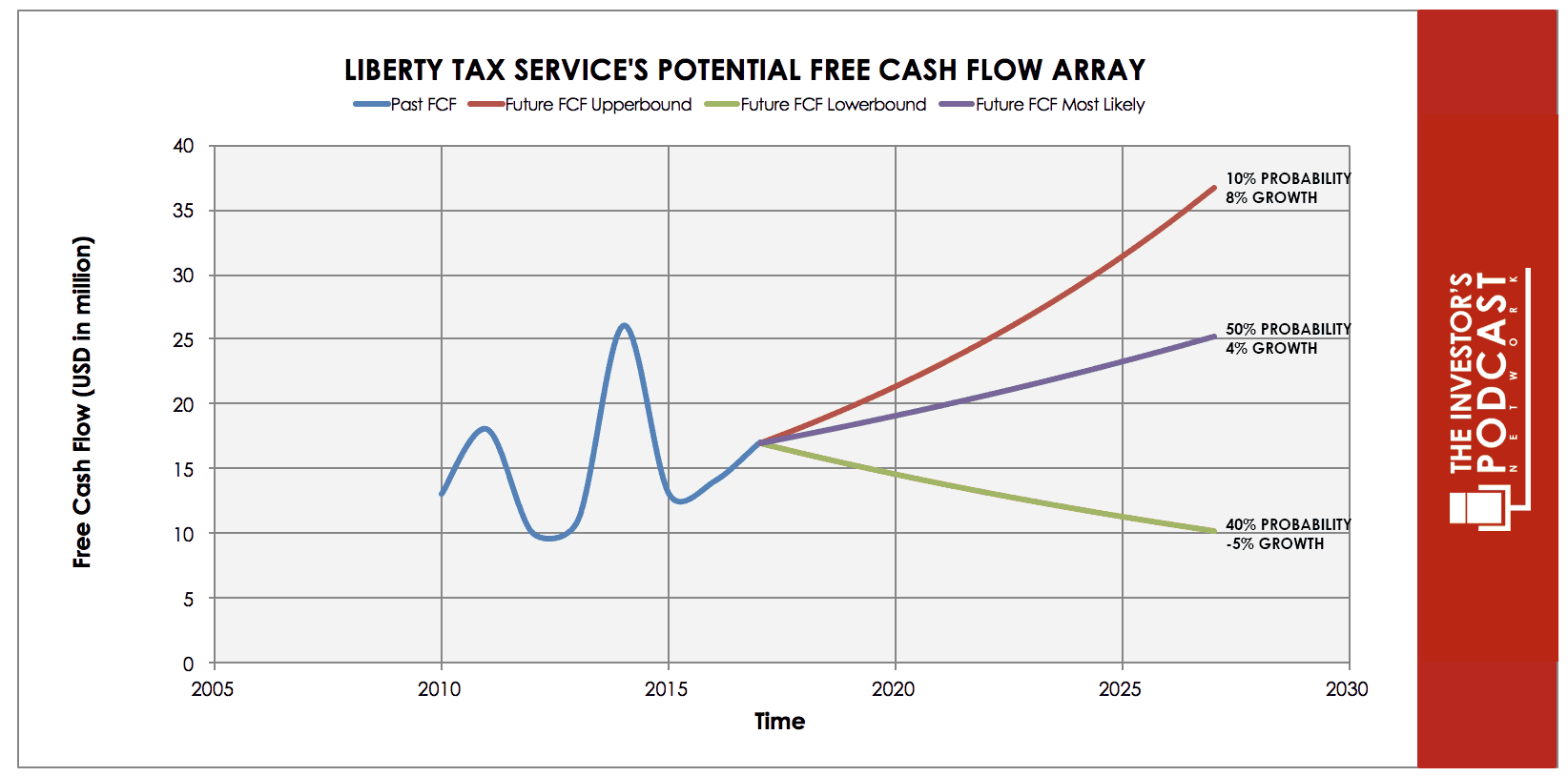

Each line in the above graph represents a certain probability for occurring. We assume a 10% chance for the upper growth rate of 8% per year. The most likely growth rate of 4% is based on the growth rate during the last seven years and is assigned a 50% chance. We assign a 40% chance to the possibility of a 5% annual contraction.

Assuming these growth rates and probabilities are accurate, TAX can be expected to give 12% annual return at the current price of $10.50. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF LIBERTY TAX SERVICE

TAX possesses some unique advantages that should allow it to be very successful in the future:

- Recession-Proof Business. Taxes have always been paid, also in a recession. Since 2001, the number of U.S. individual tax returns has grown steadily by an average annual value of 1% — from 130 million then to 153 million in 2017. Also, the percentage of taxpayers that paid for their tax preparation has remained at a constant level of 58%, which is the same value as in 2001.

- Focus on Franchise Business. By adopting mostly a franchise approach, the company can better focus its business on marketing and organizing while leaving the fiddly day-to-day work to the franchisees. This approach also reduces capital expenditure, making TAX a capital-light company – the type of investments favored by Warren Buffett.

- Multiple Domestic Growth Opportunities. With the new SiempreTax+ brand, the company focuses on the vast and large untapped domestic Hispanic community in the United States. Other possibilities to grow to lie in profiting from the consolidation of independent tax stores (which still prepare 64% of all paid returns), increasing the return per store, and raising the number of company stores.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of TAX to other ideas. First, one could invest in the ten-year treasury bond which is producing a 2.96% return. Considering the bond is completely impacted by inflation, the real return of this option is likely only around 1%. Currently, the S&P 500 Shiller P/E ratio is 33. As a result, the U.S. stock market is priced at a 3.03% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

As stated in a recent investor presentation of the company, there are only three certainties in life: death, taxes, and change. While overall tax returns might vary, taxes will always have to be paid. This business may change, but it will never vanish.

That said, regulatory tax rules are created by politicians, predicting the future tax environment very hard to assess. But this should not affect the business of Liberty Tax much. No matter the exact rules, people will continue paying for professional help.

A bigger issue is the large fragmentation of the personal income tax industry in the United States. The largest company, H&R Block, only prepares 16% of all paid returns, while Certified Public Accounts’ market share is also 16%. By far the largest number is done by independent tax stores, which account for 64%. Liberty Tax is with a share of only 2% much smaller. It is yet unclear if this industry will consolidate on a large scale. So, this fragmentation can be both a chance to grow and a threat to be overpowered by larger players.

RISK FACTORS

Several risks might limit the growth prospects of TAX:

- Strong Competitors. While Jackson Hewitt is about as large as TAX, H&R Block’s revenue is with $3.16 billion about 17 times that of TAX. Since in the tax preparation business, scale, trust, and visibility are crucial, this puts Liberty Tax at a big disadvantage.

- Strong Focus on the S. Despite a small contribution from its Canadian business, Liberty Tax operates exclusively in the United States. This makes the company highly dependent and vulnerable to regulatory changes in the U.S. Since every country has a different tax system, there are high barriers to entry to set foot in other parts of the world. This limits the company’s growth potential.

- Violation of SEC Compliance Rules. The company failed to timely file its 10-K (annual report) for the fiscal year ending in April 2018. As a reason for the delay, the company cited a new accounting firm. A NASDAQ hearing panel is currently considering this issue and will decide if Liberty Tax will still be allowed to list its common stock on NASDAQ.

SUMMARY

Liberty Tax is a solid company which operates in a sector of the economy that is bound to remain relevant. It has many important advantages going for it – but H&R Block is also a much larger competitor. While its international growth prospects are limited, the company can make up for this by growing in its domestic market. The failure to file its recent 10-K on time might be the biggest source of uncertainty. Since very little information has been provided by the company, it is very hard to determine if this was just a regrettable delay due to a change in accounting firms or if there is something bigger going on. Also, the threat of delisting on NASDAQ is surely a source of concern.

Before buying this stock, investors would be well-advised to further research the severity of this breach in SEC rules. If this turns out to be a minor issue, then the expected annual return of 12% seems to be very generous for such a solid company.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.