Intrinsic Value Assessment Of Medtronic (MDT)

By Christoph Wolf From The Investor’s Podcast Network | 07 December 2017

INTRODUCTION

Medtronic (MDT) is the largest standalone medical device company in the world. It has historically focused on cardiovascular devices such as cardiac pacemakers, implantable cardioverter-defibrillators, and artificial heart valves. In 2014, the acquisition of Covidien added minimally invasive therapies to its portfolio. Also, restorative therapies for the spine or brain, as well diabetes treatment are important parts.

While Medtronic’s market position is extremely dominant and its business is mostly recession-proof, the $50 billion takeover of Covidien also weakened its balance sheet. Does its current stock price of $82 offer an attractive entry price for investors?

THE INTRINSIC VALUE OF MEDTRONIC

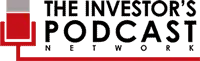

To determine the value of Medtronic, let’s consider its history of free cash flows. Happily, for investors, Medtronic’s business is rather capital-light and offers juicy margins. Combine this with constantly rising revenues, and one gets the free cash flow seen in the chart below: Steadily increasing and almost recession-proof. Another thing that is visible is the effect of the Covidien takeover. After an initial decline due to temporary integration friction, the cash flows have recently gathered pace because of the larger business.

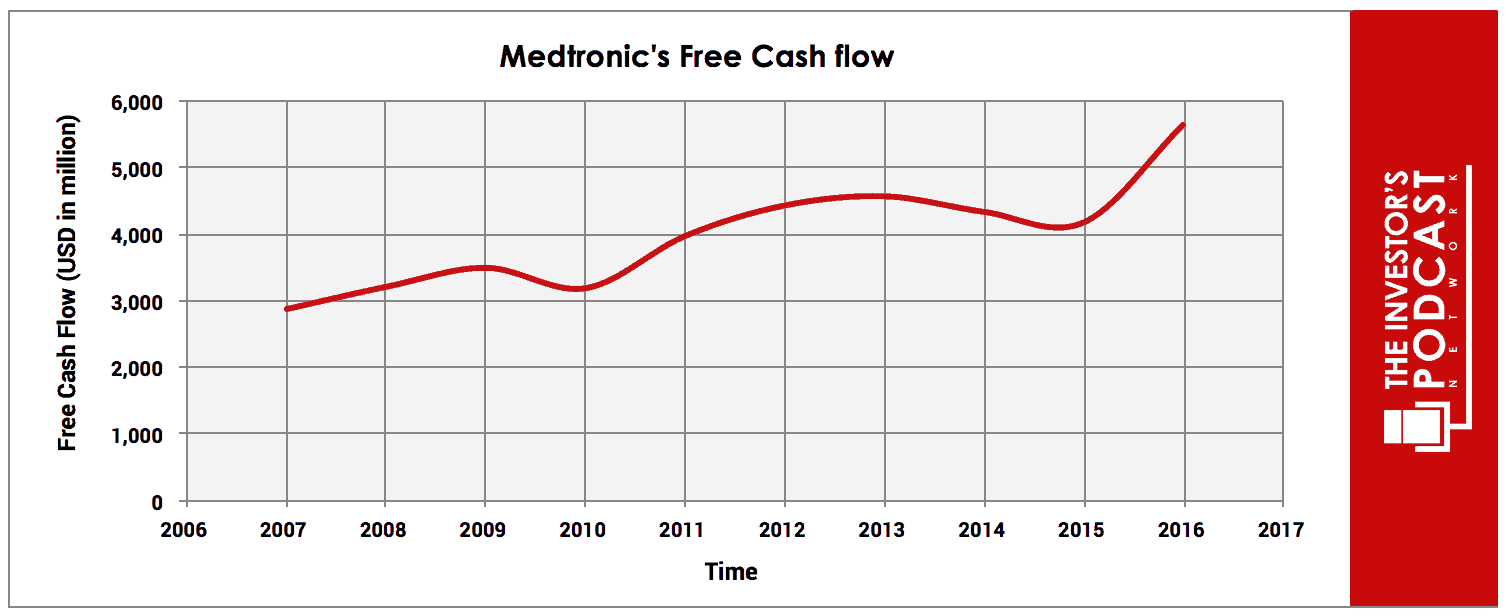

As one can see, the results in the past have been very impressive, but we should use a conservative estimate of the future free cash flow. To build this estimate, we make use of an array of potential outcomes for future cash flows.

Each line in the above graph represents a certain probability for occurring. We assume a 20% chance for the upper growth rate of 7% per year, a 50% chance for 4% growth, and a 30% chance for the worst-case scenario of no growth. This rather narrow band reflects the fact that Medtronic is operating in a business that is mostly independent of the overall economy and that its market position is extremely strong. Therefore, the future of Medtronic is relatively easy to predict – which is a huge advantage for investors trying to evaluate the business.

Assuming these growth rates and probabilities are accurate, Medtronic can be expected to give a 4.8 % annual return at the current price of $82. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF MEDTRONIC

Medtronic possesses some unique advantages that should allow it to be very successful in the future:

- Product Diversification. Medtronic has both high-margin products (like pacemakers or replacement hips) and lower-margin offers in its portfolio (e.g., its stent business). The former can act as a financial buffer if the less profitable business declines. Due to the acquisition of Covidien, Medtronic is now a major player in several complementary device segments, which further boosts its diversification.

- Economies of Scale. Developing, testing, and producing medical devices requires a vast and connected business. Medtronic possesses a dominant market share in several products. For example, it provides more than 50% of all implanted cardiac pacers worldwide. For some of its products, Medtronic can rely on a more than 30-year old clinical history. Smaller businesses cannot easily replicate this.

- High Switching Costs. Medical devices are often uniquely designed by each company. Since learning how to use a specific type of spine product or artificial hip requires much experience, training, and time, surgeons often stick to the product they know.

- Large Untapped Future Demand. People in both the rich and emerging world will become even older and numerous. This army of pensioners virtually guarantees an increased demand for medical devices in the future.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of Medtronic to other ideas. First, one could invest in the ten-year treasury bond which is producing a 2.4% return. Considering the bond is completely impacted by inflation, the real return of this option is likely below 1%. Currently, the S&P 500 Shiller P/E ratio is 31.4. As a result, the U.S. Stock market is priced at a 3.2% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

Medtronic’s business is mostly insulated from the state of the economy. If you need a heart surgery or have diabetes, you cannot wait until the economy improves. That said, the overall cost in the U.S. for a total knee replacement can be above $10,000, and a permanent cardiac pacemaker can even cost $50,000 or more. These high prices might be less affordable in a downturn – no matter how urgently they are needed. This is especially true because not all costs are covered by the health insurances.

RISK FACTORS

There are several risks that might limit the growth prospects of Medtronic:

- Weakened Balance Sheet. The Covidien acquisition blew a huge hole into the balance sheet. Now, an enormous amount of almost $40 billion goodwill is present, and the long-term debt has ballooned to over $25 billion. While the company remains financially stable, this poses a drag on its business.

- Despite its extremely dominant market position, Medtronic faces pressure both from high-end and low-end competitors. Intuitive Surgical (ISRG) is an example of a high-end rival, whose state-of-the-art robotic surgical system efficiently performs minimally invasive surgeries. Medtronic’s lower-margin business is also vulnerable to low-cost competitors. This is especially true in poorer countries where customers cannot easily afford costly procedures and often choose a cheap alternative.

SUMMARY

Medtronic is an impressive business with an extremely wide moat. Despite some challenges, it can be expected to successfully operate for a long time coming – even more so after the acquisition by Covidien, which further improved its position as market leader. With an expected annual return of 4.8%, the stock seems fairly valued taking the overall valuation of the stock market.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.