Intrinsic Value Assessment Of Mylan N. V. (MYL)

By Christoph Wolf From The Investor’s Podcast Network | 23 February 2020

INTRODUCTION

Mylan N.V. is a global pharmaceutical company with a portfolio of more than 7500 drugs. Its products cover all important health areas, such as cardiology, infectious diseases, anaesthesia, dermatology, oncology, and multiple more.

While the company also sells brand-name drugs and over-the-counter products (which are directly sold to consumers, without neither prescription nor reimbursement), its main focus is generics, which made up 57% of the company’s sales in 2018. The firm is operating globally. 37% of the revenue comes from Europe, 36% from the US, and 26% from the rest of the world. Mylan N.V. has consistently grown over the years – both organically and through acquisitions.

From a high of $72 in 2015, the stock has crashed to $21 today due to operational problems and investor pessimism. Does the current stock price of $21 offer an attractive entry price for investors?

THE INTRINSIC VALUE OF MYLAN N.V.

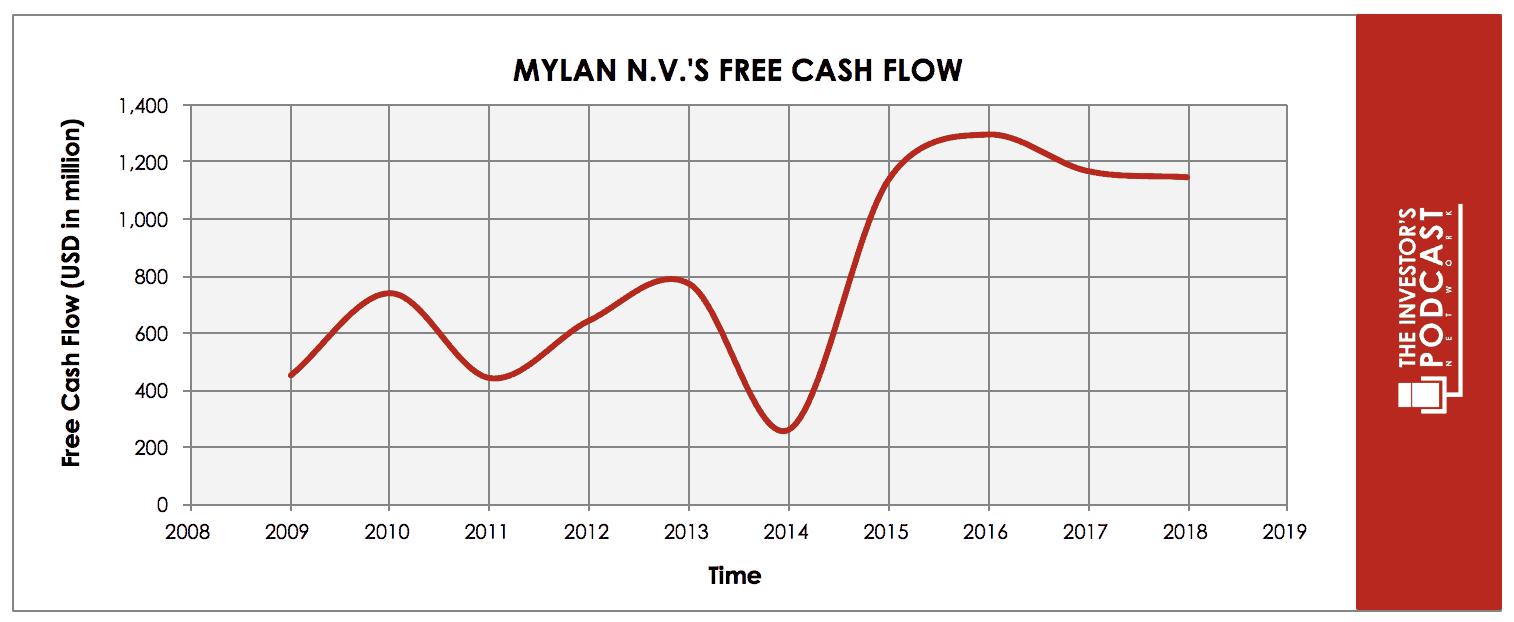

To determine the value of Mylan N.V., let’s consider its history of free cash flows. As one can see, the company’s cash flow has been quite volatile – with a large increase in 2016.

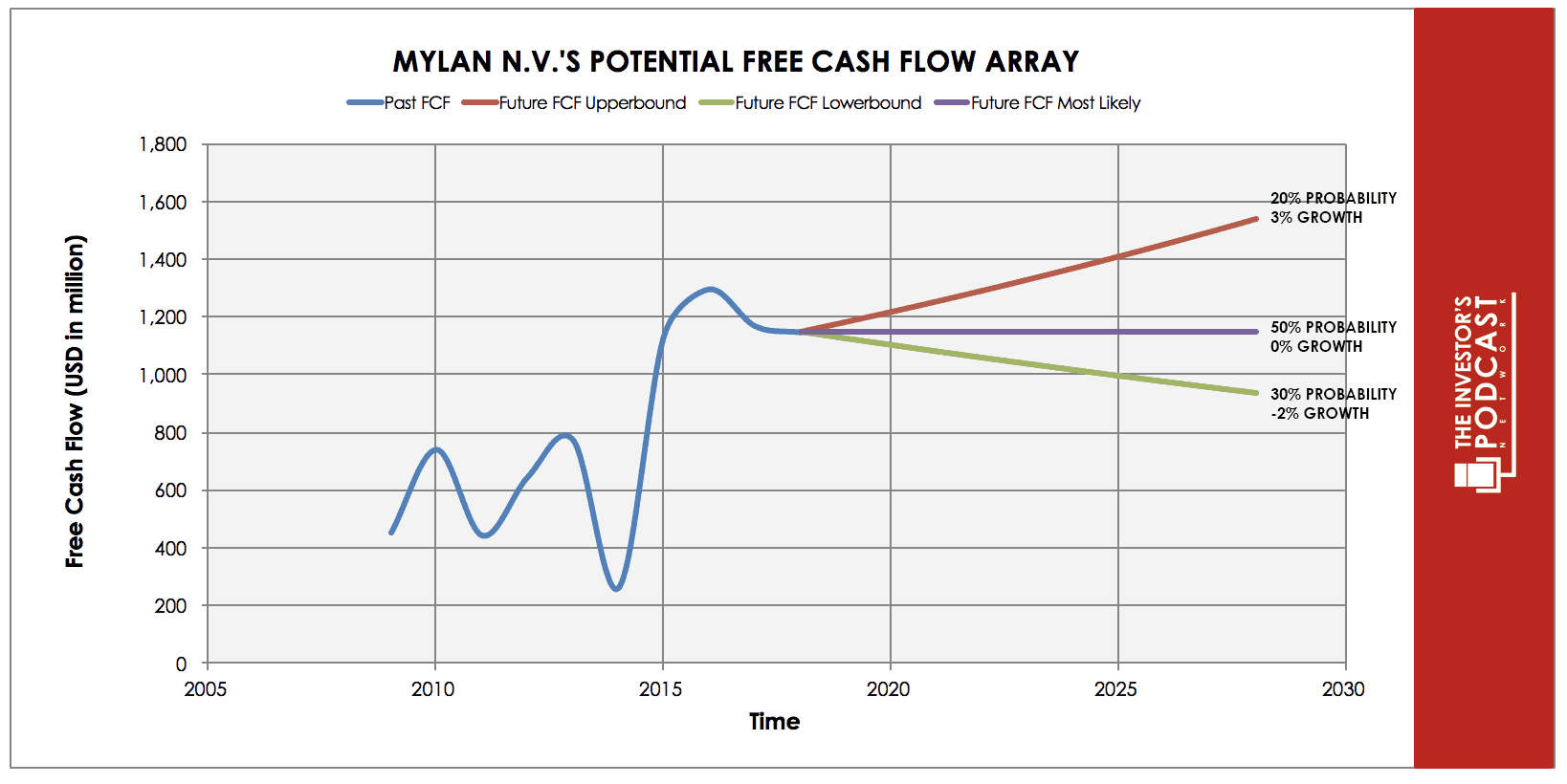

While the results in the past have been positive and growing, we will use a conservative estimate of the future free cash flow due to the high volatility. To build this estimate, we make use of an array of potential outcomes for future cash flows.

Each line in the above graph represents a certain probability for occurring. The best-case assumption of a 3% growth is based on approximately expected economic growth. We assign it a 20% probability. As the assumption of zero annual growth seems more realistic, we give this scenario a 50% probability of occurring. The worst-case scenario is modeled as an annual decline of 2%. This might happen if the political climate turns against the company and health companies in general. We estimate the change of this occurring at 30%.

Assuming these growth rates and probabilities are accurate, Mylan N.V. can be expected to give a 9.7 % annual return at the current price of $21. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF MYLAN N.V.

Mylan N.V. possesses some unique advantages that should allow it to be very successful in the future:

- Recession-Resistant Industry. Health is less price-sensitive than almost all other types of spending. People will keep spending money on health-related products, no matter the economic situation. This guarantees Mylan N.V. a strong demand for its products, even if the economy tanks.

- Cost-Advantage. Since most of the company’s products are generics, Mylan N.V. does not have to invest as much as other regular pharma companies in lengthy, risky, and expensive medical trials. This allows the company to reduce its costs. Also, its risks are significantly lower, since it does not rely too much on the outcome of such medical trials.

- Diversification in Products and Regions. The company’s pool of drugs covers over 7,500 products. Mylan N.V. has six areas of medical treatments with sales of over $1 billion, respectively –products for the central nervous system and anesthesia, allergy and respiratory system, infectious diseases (particularly AIDS), cardiovascular, gastrointestinal, diabetes, and metabolism. Furthermore, Mylan N.V. does not focus on a single geographical market, but operates worldwide, which adds to its diversification.

OPPORTUNITY COSTS

Let’s compare the expected return of Mylan N.V. to investing opportunities today. First, one could invest in the ten-year treasury bond, which is producing a 1.49% return. Considering the bond is completely impacted by inflation, the real return of this option is likely barely positive. Currently, the S&P 500 Shiller P/E ratio is 31.8. As a result, the US Stock market is priced at a 3.1 % yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

Mylan N.V.’s business is, to some extent, independent from the economy. If you urgently need a medical drug, you will not wait for better times. Since Mylan N.V. focuses on low-cost generics, the company should be even better shielded from decreasing revenue in an economic downturn.

On the negative side, there is huge political pressure to lower drug prices. Unfortunately, Mylan N.V. put itself in the headlines in 2017, because of the 400% price increase of its EpiPen drug. This vastly damaged the company’s image and could result in a harsh political backlash.

RISK FACTORS

There are several risks that might limit the growth prospects of Mylan N.V.:

- Political Pressure. Drug prices are a politically and socially sensitive matter- especially in the US, where prices are especially high. There is immense pressure on all drug companies to lower prices, thereby reducing revenue and margins. While this is a headache for all firms in the drug business, Mylan N.V. is especially vulnerable to a political backlash, since, in 2017, the company massively increased the price of its life-saving allergy drug EpiPen by over 400%. As a result, the company was viciously attacked by politicians, consumers activists, and the media.

- Producing and selling generic drugs is a highly competitive industry, and Mylan N.V.’s competitors are large and deep-pocketed pharmaceutical companies. For example, Mylan N.V.’s bone-marrow stimulating drug Fulphilia not only has to compete with Amgen’s original drug Neulasta but also with a Neulasta biosimilar from Novartis as well as Udenyca from Coherus Biosciences. This highlights the downside of operating in the generics business: While one can avoid lengthy and costly medical trials to develop a new blockbuster drug, a generic drug is not patent-protected. Therefore, the barriers to entry for competitors are much lower.

- High Debt. Mylan N.V. carries quite a large amount of $13 billion of long-term debt on its balance sheet. While this amount currently looks manageable, this large debt could lead to problems, if the company’s earnings ever decline materially.

SUMMARY

Mylan N.V. is a very solid company that operates in a recession-proof market segment. The firm is highly diversified both due to its large number of products in different medical fields and also due to its global reach. Operating mostly in the generic drug business, furthermore, comes with the huge advantage of avoiding long, risky, and costly medical drug trials for new drugs. All of this makes the firm very stable, predictable, and immune to economic shocks.

On the negative side, producing and selling generic drugs is prone to much competition from large pharmaceutical companies. But the most problematic issue is the risk of political pressure to lower drug prices. Since, in 2017, the company annoyed both politicians and the public by vastly increasing the price of one of its drugs, the political fallout on Mylan might be even larger than for the average pharmaceutical company. It is almost impossible to predict the effect of political pressure, which adds uncertainty and makes the future of Mylan N.V. harder to forecast.

While the currently expected annual return of 9.7% looks rewarding, investors are well-advised to evaluate Mylan N.V.’s risk and uncertainties further before investing in the stock.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.