Intrinsic Value Assessment Of Signet Jewelers Ltd (SIG)

By David J. Flood From The Investor’s Podcast Network | 16 March 2018

INTRODUCTION

Signet Jewelers Ltd. is the largest specialty jewelry retailer in the US, Canada, and the UK. The company currently operates around 3,600 retail outlets under the brand names of Kay Jewelers, Zales, Jared The Galleria of Jewelry, H. Samuel, Ernest Jones, Peoples, and Piercing Pagoda. Signet’s market cap currently stands at around $2.6 Billion and its revenues and free cash flows for the previous financial year were around $6.4 Billion and $0.4 Billion respectively. The company’s common stock has fluctuated between a low of $46 and a high of $78 over the past 52 weeks and currently stands at $49. Is Signet undervalued at the current price?

THE INTRINSIC VALUE OF SIGNET JEWELERS LTD.

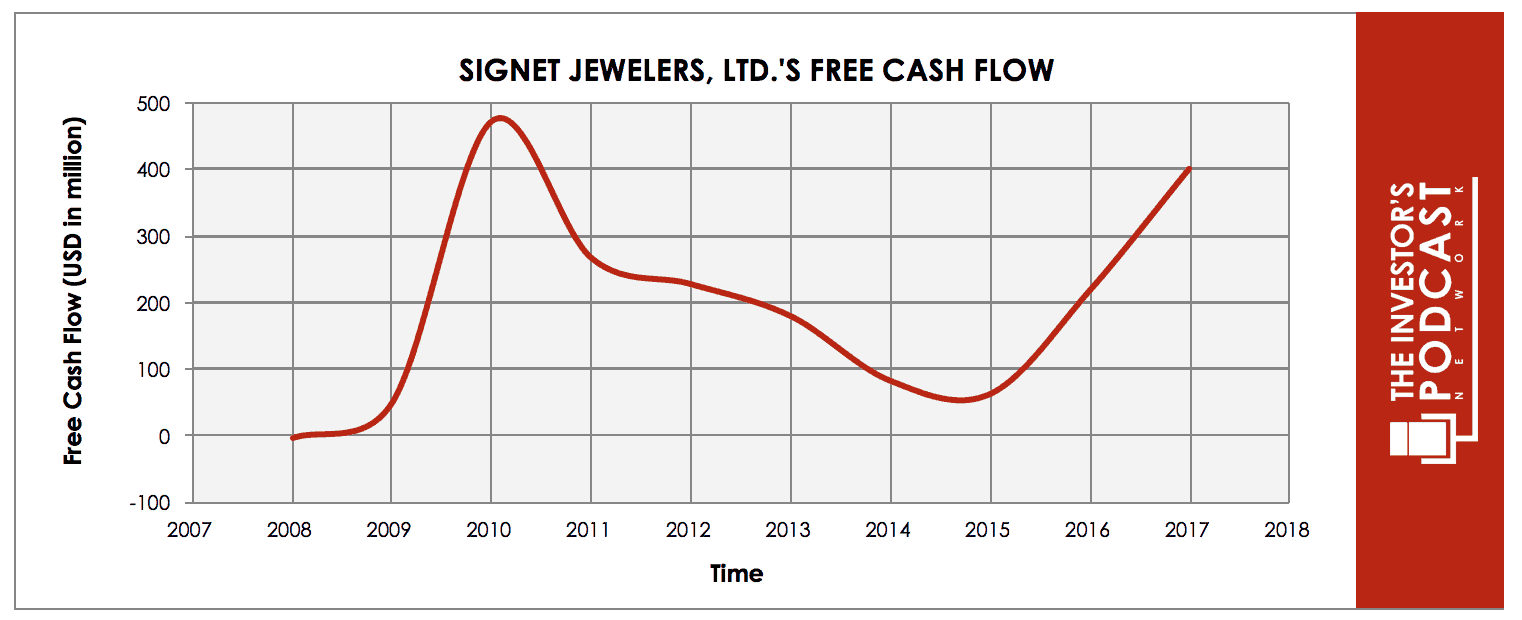

To determine the intrinsic value of Signet, we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Signet’s free cash flow for the past ten years.

As one can see, the company’s free cash flow has fluctuated quite dramatically over the past decade making an estimation of future cash flows difficult. To attain a clearer reading of the company’s long-term free cash flow growth, the author has used a longer time frame, 1997-2017, which results in a free cash flow growth rate of 8.67%. To determine Signet’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

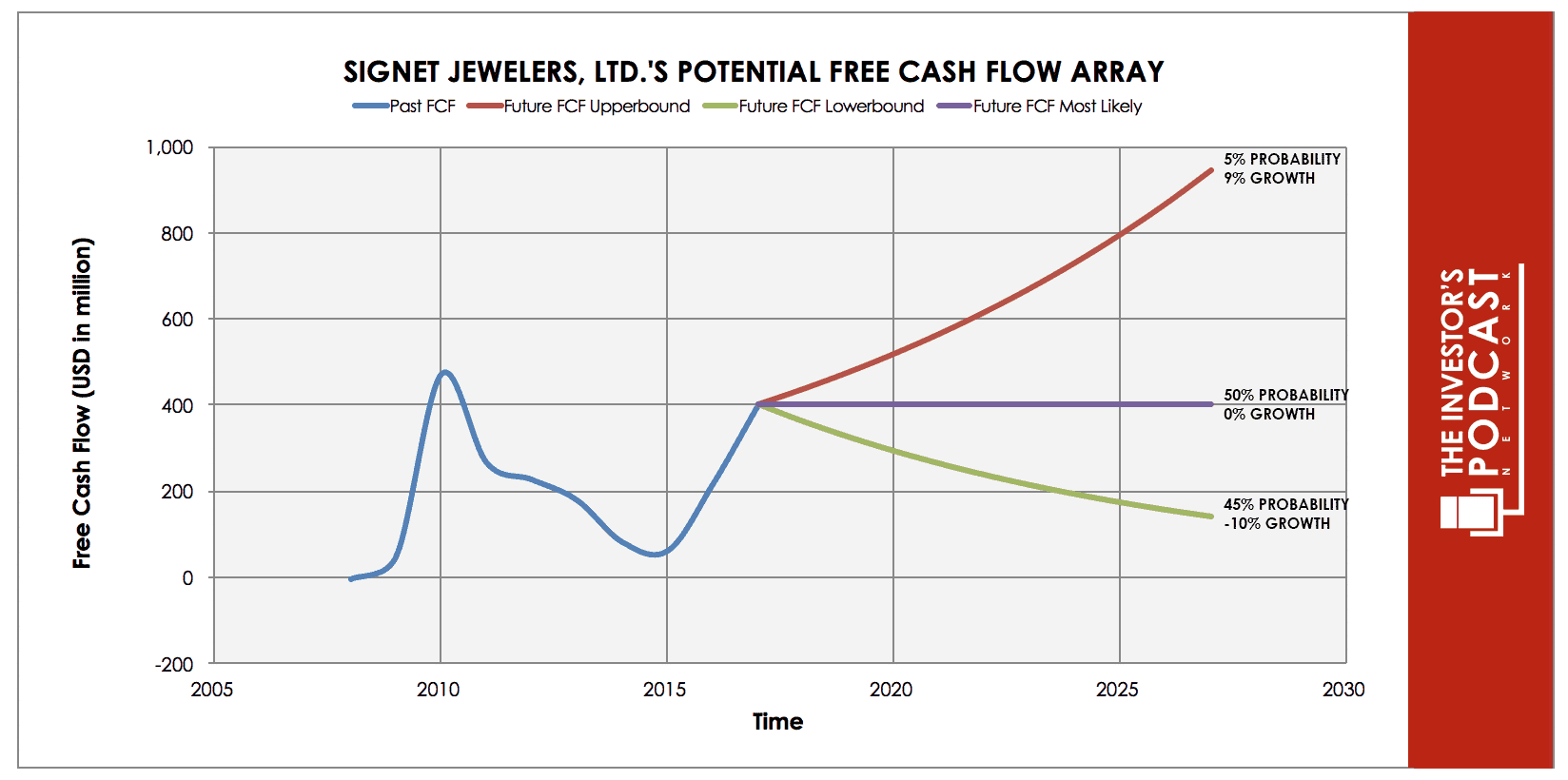

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents an 8.67% growth rate. This is based on the company’s historical free cash flow growth rate and has been assigned a 5% probability as the company is facing a number of challenges including increasing competitive pressure, changing consumer habits, regulatory pressure, and the threat of legal penalties arising from ongoing lawsuits.

The middle growth line represents a 0% growth rate and assumes that Signet’s free cash flow stagnates over the coming decade. In light of the numerous headwinds Signet is currently facing, this scenario has been assigned a 50% probability of occurrence. The lower bound line represents a -10% contraction in free cash flow growth and has been assigned a 45% probability of occurrence. This lower bound rate assumes that the company’s future free cash flow growth is impacted by falling consumer demand, regulatory and competitive pressure, and lower margins from the increasing proportion of online sales which make up the firm’s revenue. Assuming these potential outcomes and corresponding cash flows are accurately represented, Signet might be priced at a 9% annual return if the company can be purchased at today’s price at $49.

Looking at Signet’s current Earnings yield, which is the inverse of its EV/EBIT ratio, the company is projected to yield around 17%. This is above the firm’s 10-year historical median of 10.6% and the industry median of 5.27.% This is suggesting that the company may be undervalued relative to the historical and industry comparisons. Finally, we’ll look at Signet’s P/S ratio, a metric based on the firm’s market price relative to its sales, to see if it supports the assertion of the price attractiveness of Signet. At present, Signet trades at a P/S of 0.55 which is below the company’s 10-year historical median of 1.01 and the industry median of 0.71. This suggests that the firm may indeed be undervalued.

Taking all these points into consideration, it seems reasonable to assume that Signet may be undervalued relative to its peers and the market’s historical valuation for the company. Furthermore, the company may return around 9% at the current price if the estimated free cash flows are achieved. Now, let’s discuss how and why these estimated free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF SIGNET JEWELERS LTD.

Signet Jewelers Ltd. has various competitive advantages outlined below.

- Branding Power. Signet focuses on the development of branded, differentiated, and exclusive merchandise to strengthen the profile of its brands. This has enabled the company to become the No. 1 mid-market jewelry retailer in the U.S., Canada, and the UK, where the majority of such merchandise is typically unbranded and thus a commodified product. At present, Signet holds around 7% of the U.S. jewelry market share.

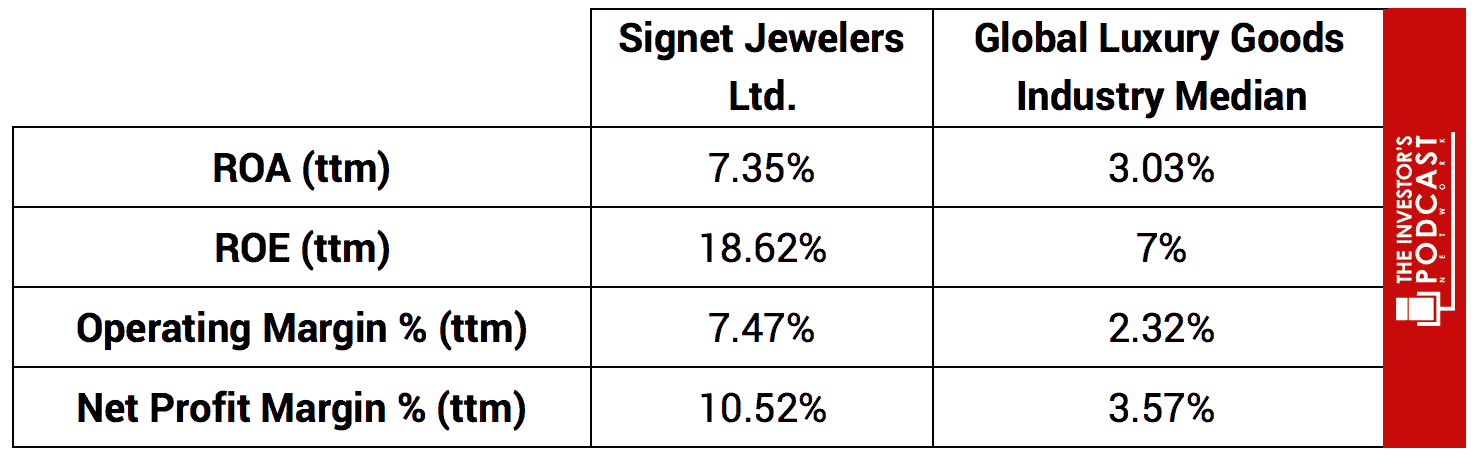

- Vertical Integration of The Supply Chain. Signet has developed a vertically integrated supply chain which includes preferential relationships with several leading mines, a diamond liaison office based in India, a diamond polishing factory in Botswana, and a design center in New York. This helps the firm outperform the global luxury goods industry on some key performance metrics seen below.

- Intangible Assets. Signet owns a portfolio of over 50 trade-marks and trade-names. These intangible assets are valuable as they assist the company in protecting its brands, reputation, and its competitive position within the industry.

SIGNET JEWELERS LTD.’S RISKS

Now that Signet’s competitive advantages have been considered, let’s look at some of the risk factors that could impair my assumptions of investment return.

- Increasing regulatory pressure has prompted Signet to outsource its formerly in-house credit program which was both a competitive advantage and a major driver of the company’s historical growth. It remains to be seen whether this outsourcing will prove detrimental or beneficial for the firm. Having sold its prime credit portfolio to Alliance Data Systems in October of 2017, Signet is now left with the challenge of the remaining subprime According to recent figures, credit accounted for around 60% of sales with 55% of those considered as prime accounts.

- Signet has taken steps to increase its online presence with the 2017 acquisition of R2Net, the owner of fast-growing online jewelry retailer JamesAllen.com and Segoma Imaging Technologies. While this may be beneficial in offsetting declining sales in the firm’s physical retail outlets, it comes at a cost. Due to the different business model which R2Net employs, it carries lower margins, and it seems reasonable to assume that lower margins will become the norm for the company going forward.

- The emergence of a recessionary environment would likely harm Signet’s economic performance given its business is centered around the sale of consumer discretionary products. The issue of the sub-prime credit portfolio, which the company owns, could further compound the problem if delinquency rates were to rise in the face of weakening economic growth.

- Rising prices for precious metals and diamonds would be detrimental to Signet. The company’s 2017 annual report states that ‘Diamonds account for about 45%, and gold about 14%, of Signet’s cost of merchandise sold, respectively.’ While Signet does employ hedging for a portion of its gold requirement, it is not possible to hedge against fluctuations in the cost of diamonds which constitute a much larger proportion of costs.

OPPORTUNITY COSTS

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At present, 10-year treasuries are yielding 2.89%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of x 33.3 which is 98.2% higher than the historical mean of x16.8. Assuming reversion to the mean occurs, the implied future annual return is likely to be -3.3%. Signet, therefore, appears to offer a much better return for investors at present, but other individual stocks may be found which offer a similar return relative to the risk profile.

MACRO FACTORS

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns.

At present, the S&P is priced at a Shiller P/E of 33.3. This is 98.2% higher than the historical average of 16.8 suggesting markets are at elevated levels. U.S. unemployment figures are at a 30-year low suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 199.6% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

The future of Signet looks uncertain at present, and the company is facing a number of headwinds. At present, there is regulatory pressure to open investigations on Signet’s credit and financing practices, and the company has taken steps to alter its business model by out-sourcing its credit portfolio. While this may appear to be a prudent step to take, the company’s critics believe the extension of in-house credit by the firm was a major driver of Signet’s historical growth. Thus, while the company may improve its image and alleviate some regulatory pressure, it may, in turn, weaken its future growth prospects. Signet is also currently facing some class action lawsuits from employees and shareholders relating to allegations of sexual harassment in the workplace. Since these investigations are ongoing, it is difficult to determine what impact they might have, but the negative publicity and possibility of financial claims cannot be ignored.

Signet has also seen a decline in sales, earnings, and margins over the past year which is a result of softening consumer demand, increasing competitive pressure, and changes to the firm’s business model. The future is perhaps not so bleak as some are suggesting though. Through the recent acquisition of R2Net, the firm has strengthened its online presence which may provide avenues for future growth, although this will likely yield lower margins. In its 3rd Quarter earnings call, Signet reported that e-commerce sales were up 56% thanks to the acquisition and the improved functionality of its websites. The company is also redirecting resources from traditional marketing towards digital marketing and recently announced its intention to close 125 stores in 2018 — most of which are based in malls, which typically carry higher rent costs. This suggests that management is reacting to changing consumer habits and reducing its bricks-and-mortar business in favor of the online marketplace which consumers are turning to. While it may be sacrificing a percentage of its margins, it will be better equipped to compete in the online market.

In summary, Signet is facing a number of challenges at present, and there are a number of uncertainties regarding its future. The author does, however, consider the market’s response to these issues as unduly pessimistic and the fundamental analysis in this article suggests that the company is being mispriced. It is likely that Signet may be less profitable in the future, but given the conservative assumptions used in the free cash flow analysis, it seems possible to assume investors may be able to earn a 9% return at the current market price.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.