Intrinsic Value Assessment Of Skyworks Solutions Inc (SWKS)

By David J. Flood From The Investor’s Podcast Network | 01 November 2017

INTRODUCTION

Skyworks Solutions Inc. is an American company involved in manufacturing semiconductors for mobile communications and radio frequency systems. The company is also developing a broad range of products within the field of the ‘Internet of Things.’ Skyworks Solutions Inc. is on the Fortune 500 list with a market cap of $20.9 Billion. Its revenues and free cash flows for the previous financial year were around $3.3 Billion and $0.9 Billion respectively. The company’s stock price has fluctuated between a low of $72 and a high of $112 over the past 52 weeks and currently stands at $113. Is Skyworks Solutions Inc. undervalued at the current price?

THE INTRINSIC VALUE OF SKYWORKS SOLUTIONS INC.

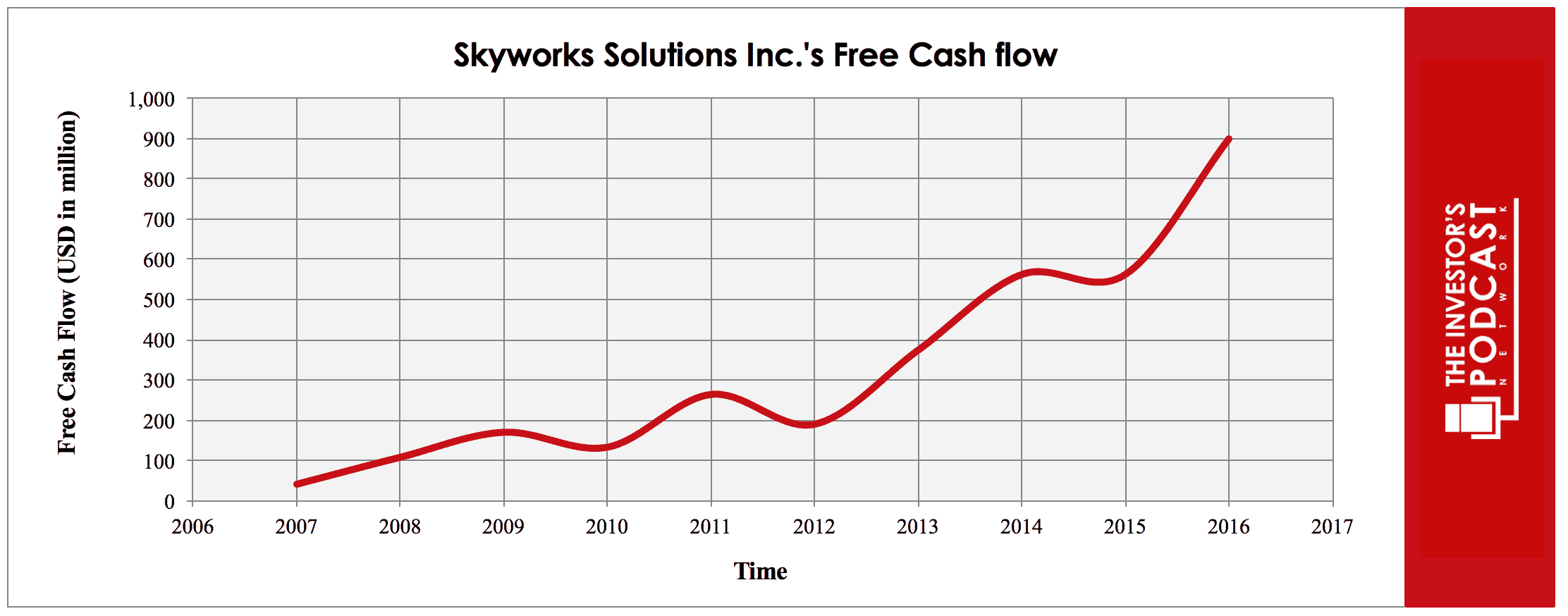

To determine the intrinsic value of Skyworks Solutions Inc., we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Skyworks Solutions Inc.’s free cash flow for the past ten years.

As one can see, the company’s free cash flow has been on a strong upward trend, growing at an annual rate of over 40% for the past ten years. Readers will note that this growth has increased significantly in the last few years as the popularity of smartphones has exploded. To determine Skyworks Solutions Inc’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

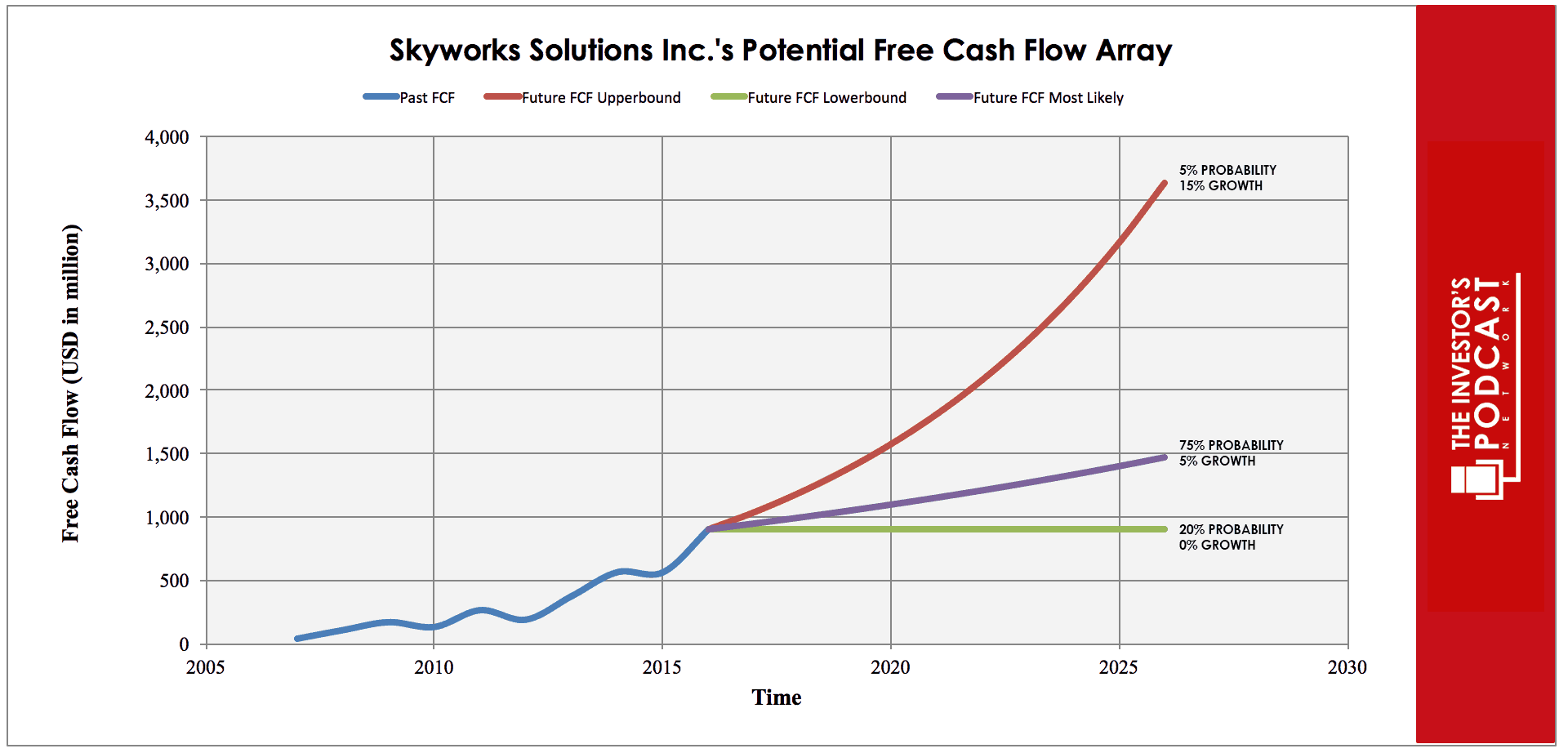

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents a 15% growth rate; this is based on the consensus among industry analysts for 5-year projected earnings growth. This has been assigned a 5% probability of occurrence due to the fact that Skyworks Solutions Inc. is facing increasingly fierce competition within its markets.

The middle growth line represents a 5% growth rate; this is based on the assumption that future growth will be marginally lower as the company continues to mature, it also accounts for the increasing competitive pressure emerging within the industry. For this reason, it has been given a 70% probability of occurrence.

The lower bound line represents a 0% growth rate in free cash flow growth and has been assigned a 20% probability of occurrence. This lower bound rate assumes that the company’s future free cash flow growth is impacted by competitive pressure and a failure to successfully diversify business segments to accommodate potential declines in key customer orders. Assuming these potential outcomes and corresponding cash flows are accurately represented, Skyworks Solutions Inc. might be priced at a 4.3% annual return if the company can be purchased at today’s price. We’ll now look at another valuation metric to see if it corresponds with this estimate.

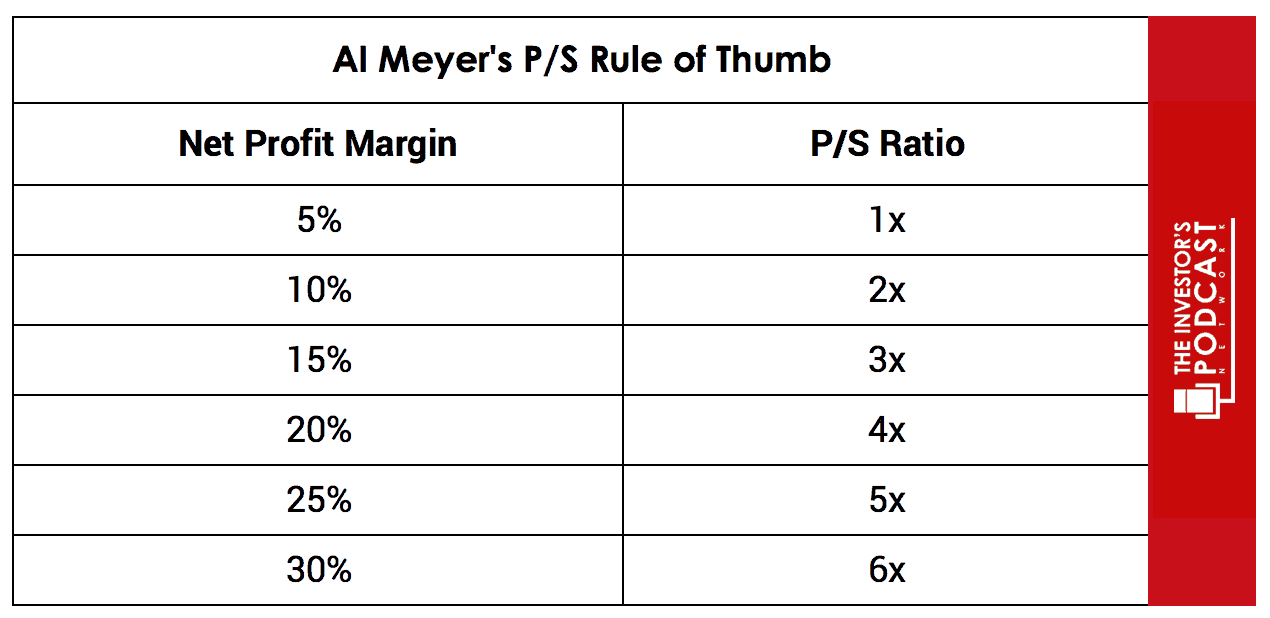

Based upon Skyworks Solutions Inc.’s current Earnings yield, which is the inverse of its EV/EBIT ratio, the company is projected to return around 6.5%. This is above the firm’s 13-year historical median average of 5.9% and the Industry median of 3.5%, suggesting that the company is marginally undervalued on a comparative basis. Furthermore, on a simple P/E basis, Skyworks Solutions Inc. currently trades at 20.7 versus an average of 25.5 for the semiconductor industry. Finally, we’ll apply Al Meyer’s P/S Ratio rule of thumb, a useful gauge for the price one should pay relative to a company’s profit margin, to see how the company fairs.

Skyworks Solutions Inc.’s current P/S ratio is 5.8, and its net profit margin over the last 12 months is 27.9%, meaning it is likely trading around fair value at the current price. Taking all these points into consideration, it seems reasonable to assume that Skyworks Solutions Inc. is around or only marginally below fair value at present. Furthermore, the company may return around 6-7% at the current price if the estimated free cash flows are achieved. Now, let’s discuss how and why these estimated free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF SKYWORKS SOLUTIONS INC.

Skyworks Solutions Inc. has various competitive advantages outlined below:

- Patents/Intellectual Property. Skyworks Solution Inc.’s product portfolio is protected by a library of approximately 2,600 worldwide patents and other intellectual property which they own and control. This includes 1,100 U.S. patents, 1,000 foreign patents, and the company has a further 1,200 applications pending.

- Pricing Power. Skyworks Solutions Inc. currently enjoys strong pricing power which is evidenced by the fact that the firm has achieved an average gross margin in excess of 43% over the last ten This competitive advantage appears to be durable given that gross margins have been growing at an annual rate of over 3% over the last ten years. For the company’s most recent quarter, its gross margin was 50% which dwarfs the industry median of 27%.

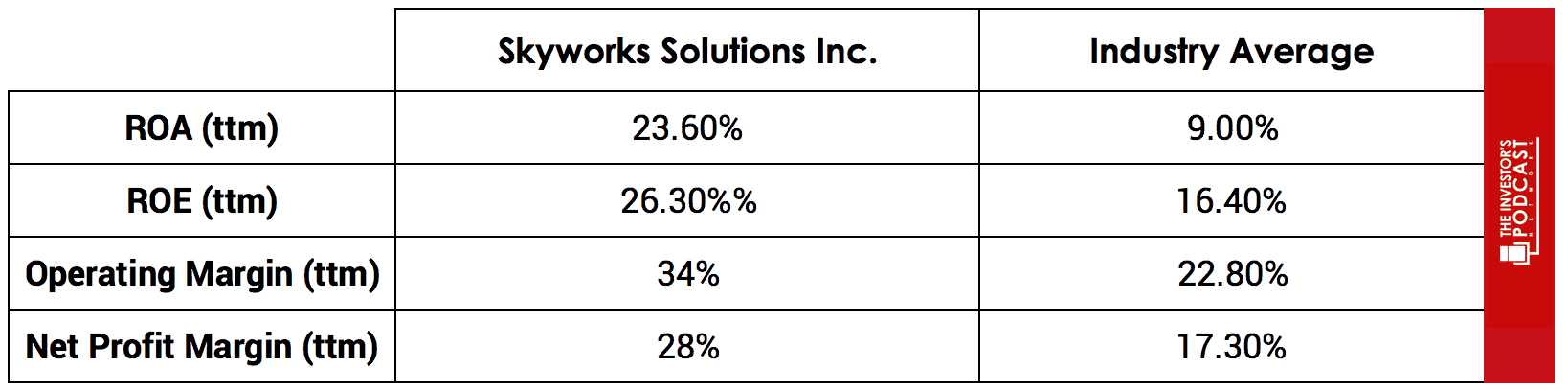

- Economies/Efficiencies of Scale. Skyworks Solutions Inc. employs vertical integration and strategic partnerships to achieve advantages of scale. According to the company’s recent corporate literature, these scale advantages have enabled the company to achieve “the industry’s shortest cycle times, highest yields, and ultimately, the lowest cost structure.” These scale advantages are evidenced by the fact that Skyworks Solutions Inc. outperforms the industry on some key performance metrics.

- Corporate Culture. Skyworks possesses a strong corporate culture. The company incentivizes employees with a pay-for-performance methodology, and its staff turnover is below the semiconductor industry average.

SKYWORKS SOLUTIONS INC.’S RISKS

Now that Skyworks Solutions Inc.’s competitive advantages have been considered let’s look at some of the risk factors that could impair my assumptions of investment return.

- While Skyworks Solutions Inc. possess multiple competitive advantages, there is still a possibility that one of its rivals could mount a challenge to erode its competitive advantages and move on its market share. Qualcomm’s recent joint venture with Japanese firm TDK is an excellent example of this, as the pair has teamed up to make greater strides into the radio frequency technology market.

- The loss of key customers could materially impact Skyworks Solutions Inc.’s revenues and earnings. According to the company’s latest annual report, Foxcomm (contractor for Apple) and Samsung accounted for more than 10% of the firm’s net revenues. Failure to maintain these business contracts would be a significant blow to Skyworks Solutions Inc.

- The emergence of a serious economic crisis similar to that witnessed in 2008 could materially impact the company’s revenues and profits leading to lower growth in the coming years. Skyworks Solutions Inc.’s historical performance suggests that it can weather these types of storms comfortably, but this risk is still worthy of considerations by investors.

- The emergence of some novel or game-changing technology could render the company’s products obsolete or less desirable. While this is unlikely, the rapid rate of change within technology markets requires constant innovation and investors must bear this in mind.

OPPORTUNITY COSTS

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At present, 10-year treasuries are yielding 2.16%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of x 30, meaning it is priced for an earnings yield of 3.3%. Skyworks Solutions Inc., therefore, appears to offer a higher rate of return for investors at present, but other individual stocks may be found which offer a more favorable return relative to the risk profile.

MACRO FACTORS

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns. At present, the S&P is priced at a Shiller P/E of 30. This is over 85% higher than the historical average of 16.8, suggesting markets are at elevated levels. US unemployment figures are at a 30-year low, suggesting that the current business cycle is nearing its peak. US private debt/GDP currently stands at 199.6% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

The future for Skyworks Solutions Inc. looks favorable if it can successfully implement its growth strategies ear-marked for autonomous automobiles and the Internet of Things. According to Cisco’s Annual Visual Networking report, between 2015 and 2020, the Internet of Things will grow faster than any other category of connected devices. In particular, the number of machine-to-machine connections is expected to grow from 4.9 billion in 2015 to 12.2 billion in 2020, with machine-to-machine connections representing nearly half of total connected devices. Technology experts are also predicting that there will be over 75 Billion connected devices operating worldwide by 2025. In dollar terms, connected device revenues are set to grow from $200 at present to $1.2 Trillion in 2020.

Management has a strong track record of being both shareholder-friendly and shrewd capital allocators, having grown book value at an annualized rate of over 15% during the last ten years. Their previous share buyback program of $400 Million has recently been expanded to $500 Million, and the firm has returned $532 Million in dividends over the past three years.

At present, Skyworks Solutions Inc. appears fairly valued with an estimated return of just above 4%. While the company’s stock price currently offers little in the way of discount to fair value, it is certainly one to watch. Should its share price decline, it would be worthy of serious consideration by investors.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.