Intrinsic Value Assessment Of Target Corporation (TGT)

By Preston Pysh From The Investor’s Podcast Network | 19 August 2017

INTRODUCTION

In the past year, Target has traded as high as $78 per share. Recently, however, there has been a crushing narrative that all retail is going to be destroyed by Jeff Bezos’s Amazon. Currently, the company is trading for $56, and it might be an opportunity if the company can defend its competitive advantage and market share. Here’s an analysis of the quantitative and qualitative factors.

THE INTRINSIC VALUE OF TARGET

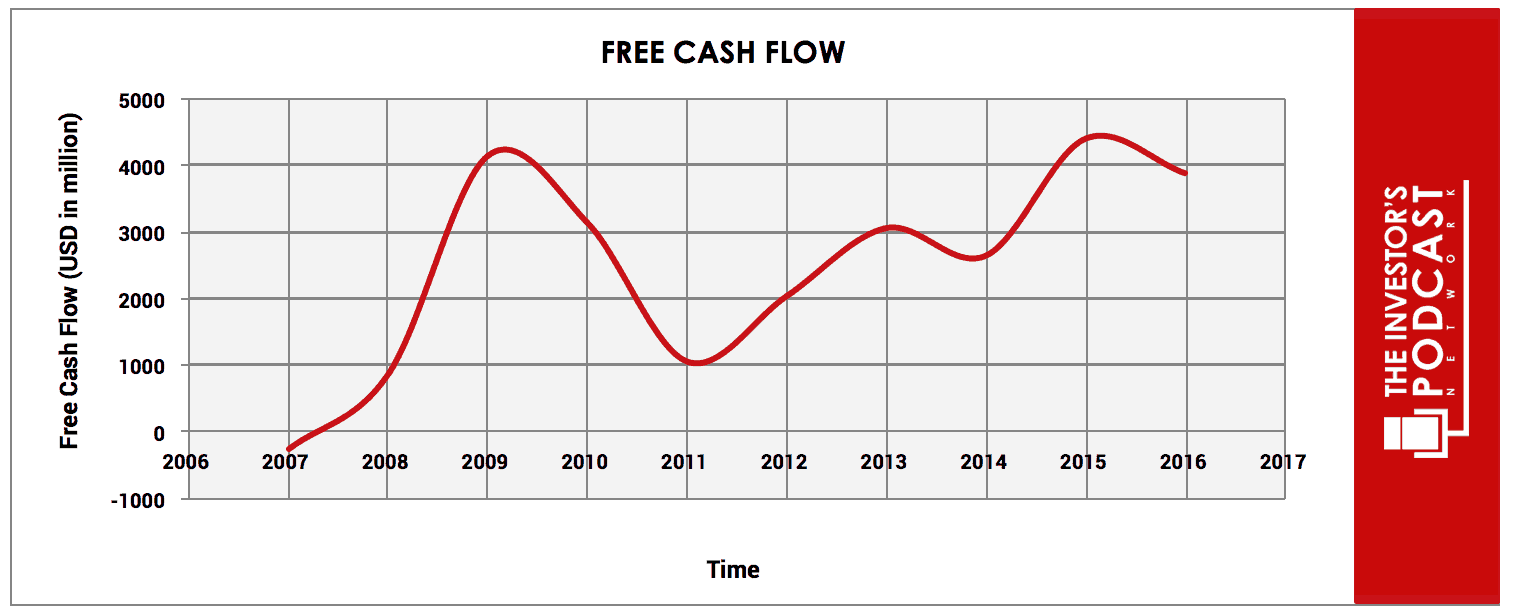

To determine the value of Target, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earning and grow the business. Most importantly, it demonstrates a return on the principal that might be reinvested into the ownership of other assets and growth of the business. Below is a chart of Target’s free cash flow over the past ten years.

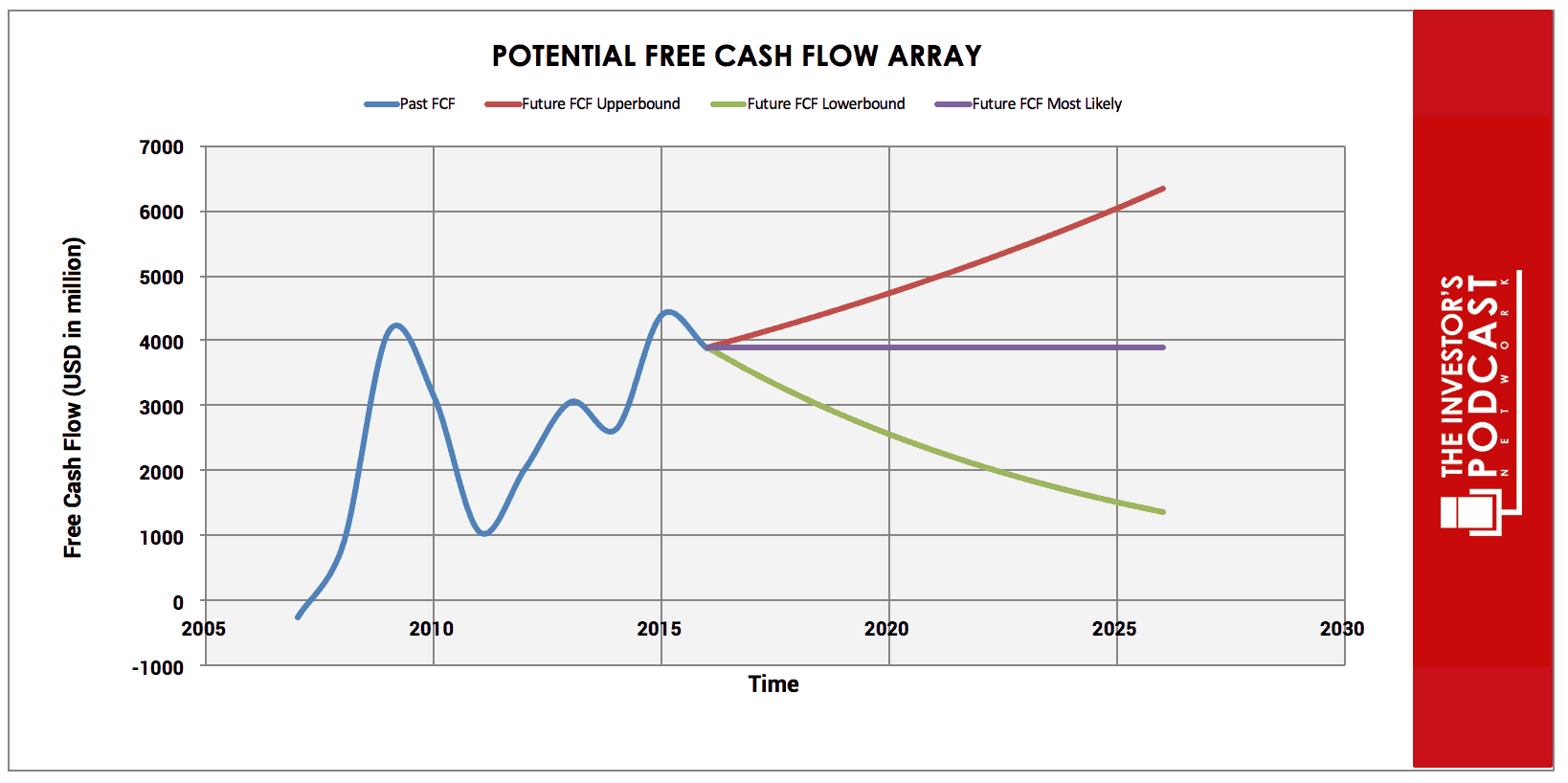

As one can see, the results in the past have been somewhat consistent and growth-oriented. To determine the intrinsic value of the business, it’s very important to determine the prospects of the company’s ability to earn into the future. To build this estimate, there is an array of potential outcomes for future cash flows listed in the graph below.

When looking at the array of lines moving into the future, each represents a certain amount of probability for actually occurring. There is a 10% probability for the upper growth rate of 5% per year. A 50% probability for no growth, and a 40% probability for a -10% annual growth rate. Assuming these potential outcomes and corresponding cash flows are accurately represented, Target might be priced at a 9% annual return if the company can be purchased at today’s price of $56. That’s an interesting result considering the consolidated estimates for free cash flow are contracting in this model. Additionally, the overall S&P 500 is priced at about a 3% return. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF TARGET

Target has some unique competitive advantages.

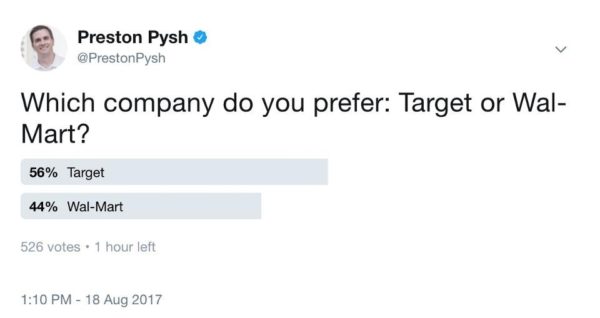

- A very strong brand and loyal customer. Although much of retail shopping has moved and will continue to move online, there is still a need for local brick and mortar businesses. People that shop at Target like the atmosphere and set-up of the store. When given a choice between Target and Wal-Mart, many people generally agree Target is a better experience. This is mostly due to the cleanliness of the stores and overall operations.

- Logistics and Supply Management. Target has a superior supply management system that runs efficiently and effectively. The company seems to manage their inventory levels effectively. The inventory turnover ratio has continued to improve over the past decade along with the cash conversion cycle. Although Amazon performs these efficiencies better than Target, Amazon is catering to the online community, whereas Target will continue to compete in the brick and mortar industry.

- Cost Advantage. When looking at the prices on Amazon and comparing them to Target, there isn’t much of a difference. This has been the case for the past few years, and Target seems to remain competitive with their ability to sustain revenues. Over the past five years, Target’s top line has contracted by 10%, but much of this can be attributed to Amazon’s growth. The most important piece to understanding this continued trend is how much more market share online business can continue to take from the brick and mortar retail industry. If it results in another 10% over the next five years, this will easily be accounted for in the intrinsic value model already discussed.

TARGET’S RISKS

Although the company has strong assets that appear to have an enduring competitive advantage, below are some of the risk factors that could impair my cash flow assumptions.

- Changing customer demands. If online shopping continues to grow at a faster pace than expected, this could negatively impact the company’s performance further than expected. With companies like Amazon pushing supply chain management further and closer to every customer, online shopping could continue its growth streak even further. Although this might be true, the more Amazon continues to work towards same-day delivery and logistics expansion, the costs to compete with a large brick and mortar store that only competes in largely populated hubs might be difficult.

- Securing Customer Data. In the past, Target was hacked, and countless amounts of customer data were exploited. If similar events happen in the future, this could dilute the company’s brand and also compromise their business.

- Failure to differentiate. As more and more shoppers shift to emotionless shopping, Target’s brand loyalty might be compromised.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of Target to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 2.1% return. Considering the bond is completely impacted by inflation, the real return of this investment is likely 1% or less. Currently, the S&P 500 Shiller P/E ratio is 30. As a result, the U.S. Stock market is priced at a 3.3% annual return. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return. Finally, investors could look for other individual stocks to see if they are priced for a similar return to the figures presented here.

MACRO FACTORS

When trying to understand how a company might perform within the next few years, it’s very important to understand the macroeconomic landscape. Today, numerous factors imply that the U.S. stock market is in its final phase of the business/credit cycle. The reason for this opinion is based on a few key factors. First, the unemployment rate is a key factor for understanding the position of the cycle. Today, unemployment numbers are at 30-year lows. This implies a change is afoot. Second, the Shiller P/E ratios are at the same level as the 1929 stock market crash. Third, business cycles usually last between five to seven years. Today, it has been eight years since the last recession. Due to the sheer mechanics of credit cycles, this means the economy is due for a contraction. Finally, the U.S. Federal Reserve is tightening interest rates and looking to start unloading large amounts of debt off their balance sheet. Altogether, these factors mean investors should be prepared for a market correction within the next three years. This also means that the 9% annual return for Target that we estimate for long-term ownership might be lower than expected within the next five years.

SUMMARY

Target is an interesting pick. The narrative surrounding any retail business today is not good. Because of that generalization, there might be overcompensation in the selling of good retail companies like Target.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.