Intrinsic Value Assessment Of United Therapeutics Corp. (UTHR)

By David J. Flood From The Investor’s Podcast Network | 28 March 2018

INTRODUCTION

United Therapeutics Corporation is an American based Biotechnology company whose business involves the development and commercialization of products for the treatment of chronic and life-threatening diseases. The company was founded in 1996 by Martine Rothblatt, an entrepreneur whose previous achievements include the cofounding of the American broadcasting company, Sirius XM. United Therapeutics’ market cap currently stands at around $4.8 Billion and its revenues and free cash flows for the previous financial year were around $1.72 Billion and $0.39 Billion respectively. The company’s common stock has fluctuated between a low of $107 and a high of $153 over the past 52 weeks and currently stands at the 52-week low of $107. Furthermore, the Health Care sector has recently surpassed Energy as the most hated industry in the stock market, and though disliked sectors are often disliked for a reason, as contrarians we’re bound to ask: Is United Therapeutics undervalued at the current price?

THE INTRINSIC VALUE OF UNITED THERAPEUTICS CORPORATION

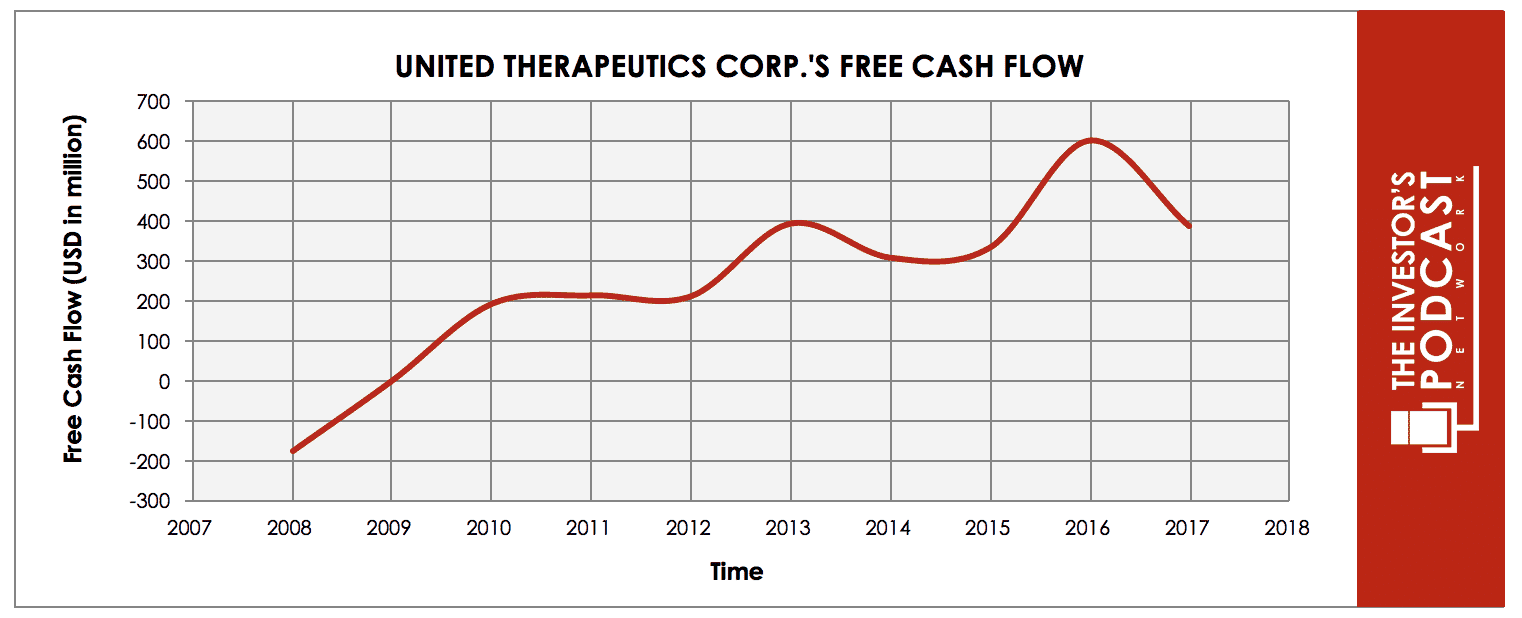

To determine the intrinsic value of United Therapeutics, we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of United Therapeutics’ free cash flow for the past ten years.

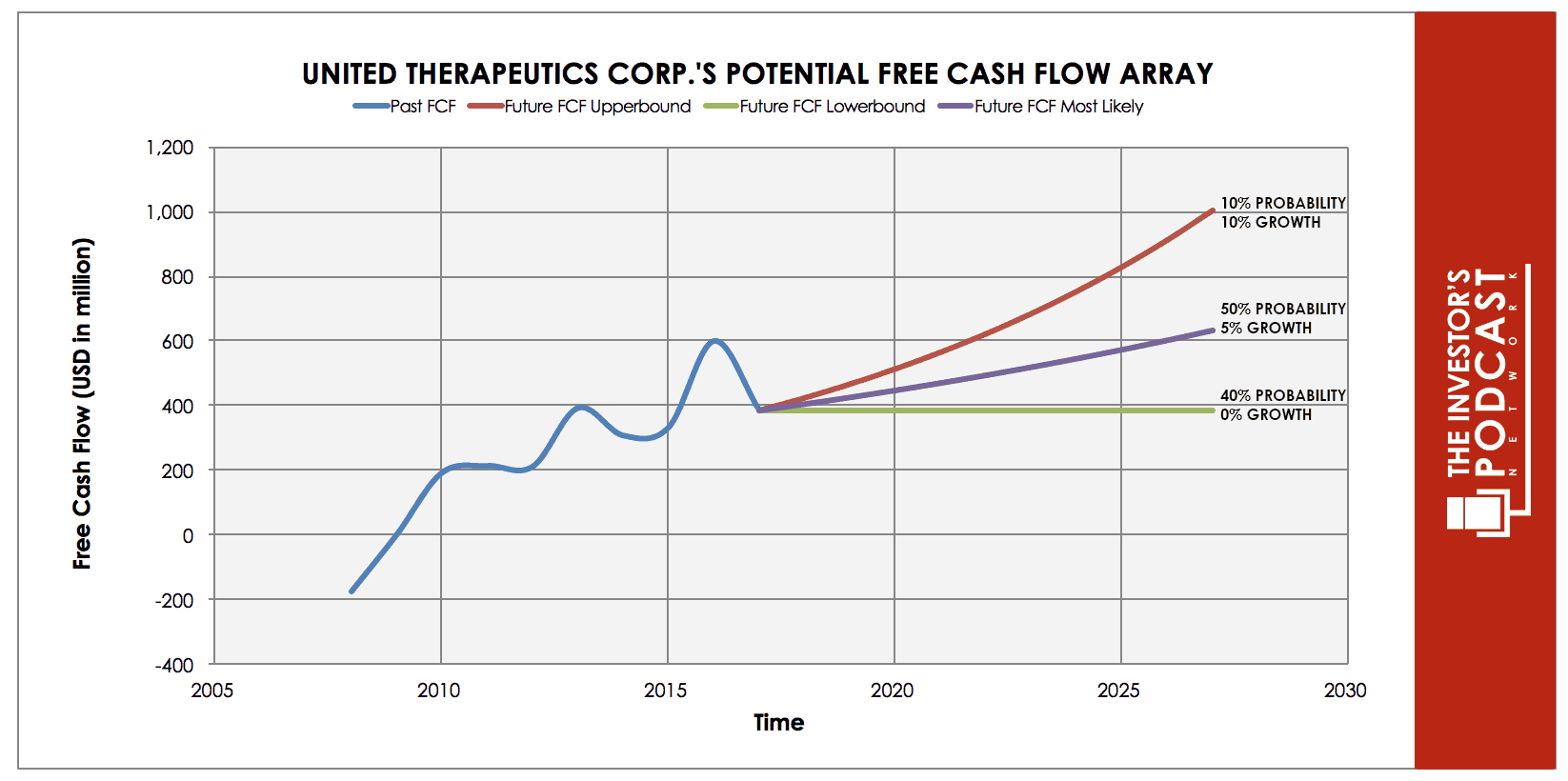

As one can see, the company’s free cash flow was negative in 2008 but has been on an upward trend since then. Young biotech companies require a large amount of capital investment to bring products to market, which means earnings and free cash flow can be negative in early-stage growth. In order to attain a clearer reading of the company’s free cash flow growth, the author has opted to measure cash flow growth for the period 2010-2017 which results in a free cash flow growth rate of 10.45%. In order to determine United Therapeutics’ intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents a 10.45% growth rate which is based upon the company’s historical free cash flow growth rate. This has been assigned a 10% probability of occurrence due to the fact that the company is facing a number of challenges including increasing competitive pressure and rising costs associated with product development.

The cost structure of stocks like United Therapeutics’ experience depends on the mix between licensing and R&D. In other words, if another has developed a drug of interest to United Therapeutics’, the cost is reflected in a lower gross margin, whereas if it’s developed in-house, which may or may not be cheaper, it’s reflected in a higher R&D cost and in turn a lower operating margin.

The middle growth line represents a 5% growth rate and assumes that United Therapeutics’ free cash flow growth weakens over the coming decade. In light of the increasing competitive generic pressure and rising costs the firm is facing, this scenario has been assigned a conservative50% probability of occurrence.

The lower bound line represents a 0% rate in free cash flow growth and has been assigned a 40% probability of occurrence. This lower bound rate assumes that the company’s future free cash flow growth stagnates due to competitive pressure, patent expirations, and unsuccessful approvals for products currently under development.

Assuming these potential outcomes and corresponding cash flows are accurately represented, United Therapeutics might be priced at a 9.7% annual return if the company can be purchased at today’s price. We’ll now look at another valuation metric to see if it corresponds to this estimate.

Based on United Therapeutics’ current P/FCF ratio, the company is currently priced by the market at 13.45x. This is below the firm’s 10-year historical median of 17.36x and the industry median of 33.20x suggesting that the company may be undervalued relative to the historical and industry comparisons.

Taking all these points into consideration, it seems reasonable to assume that United Therapeutics may be undervalued relative to its peers and the market’s historical valuation for the company. Now, let’s discuss how and why these estimated free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF UNITED THERAPEUTICS CORPORATION

United Therapeutics has various competitive advantages outlined below.

- Intangible Assets. United Therapeutics currently holds a portfolio of patents which protect its suite of products from being replicated by competitors. Investors should be aware that this type of competitive advantage is not as durable as other intangible assets such as brand names as all patents carry an expiration date. Once a patent expires, competitors can then challenge for market share with generic alternatives.

- Niche attribute. United Therapeutics has focused its efforts on the treatment of pulmonary arterial hypertension (PAH). The firm’s PAH franchise currently accounts for over 95% of revenues and the market for treatments are expected to grow by 5.5% annually over the next five years. By occupying a niche and focusing R+D spending on the development and commercialization of products targeting a specific health condition, the firm can out-perform Biotechnology Industry averages on a number of key metrics outlined below.

- Barriers to entry. The Biotechnology industry is heavily regulated, and as such, it is extremely difficult for new entrants to successfully bring new products to market and challenge for market share. This drastically limits the number of competitors United Therapeutics is likely to face since only large established companies are likely to have the sufficient resources to challenge the firm’s market share.

- Unique growth opportunity. United Therapeutics acquired in 2011 a subsidiary of the parent company that cloned the sheep, Dolly. Since then the company has had very ambitious goals of building an unlimited supply of certain transplantable organs and is today the leader in the industry expected to be worth more than $100B that is still in its infancy when it matures.

UNITED THERAPEUTICS CORPORATION’S RISKS

Now that United Therapeutics’ competitive advantages have been considered, let’s look at some of the risk factors that could impair my assumptions of investment return.

- United Therapeutics is facing patent expiration on a number of its key products including Remodulin, Tyvaso, and The expiration of these patents weakens the competitive advantage that the company derives from its intangible assets and it will have to successfully bring new patented products to market to maintain its competitive position.

- United Therapeutics currently has a pipeline of new products in development which are yet to be brought to market. These products are subject to trials and evaluations by the FDA. Should these trials be unsuccessful and FDA approval be denied, the company may struggle to find new revenue streams which would result in declining earnings.

- Management compensation has historically been very high, and though shareholders have twice lowered the compensation package, it can be a sign of a bad performance and ethics culture.

OPPORTUNITY COSTS

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At present, 10-year treasuries are yielding 2.78%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of 32.9 which is 95.8% higher than the historical mean of x16.8. Assuming reversion to the mean occurs, the implied future annual return is likely to be 3.1%. United Therapeutics, therefore, appears to offer a much better return for investors at present, but other individual stocks may be found which offer a similar return relative to the risk profile.

MACRO FACTORS

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns. At present, the S&P is priced at a Shiller P/E of x32.9. This is 95.8% higher than the historical average of 16.8 suggesting markets are at elevated levels. U.S. unemployment figures are at a 30-year low suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 199.6% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

The future for United Therapeutics looks uncertain at present, and the company is facing several challenges including patent expiration on a number of its key products and the likely emergence of generic alternatives from competitors in 2018. The firm also recently reported an 83% drop in 4th Q net income posting a quarterly profit of $19 million down from $110.3 Million a year earlier. The fall in profits was attributed to rising R+D expenses, cost of product sales, and royalty fees for its Adcirca drug. These lackluster results were somewhat tempered by the fact that total sales rose by 13.6% year over year and the firm saw sales of its drug Unituxin surge to $24.9 Million, up 88.6% on the previous year.

United Therapeutics has also recently settled with the U.S. Attorney’s office about claims that the company used a charity as a vehicle to illegally cover Medicare patients’ out-of-pocket drug costs in order to boost sales and mitigate price sensitivity.

There are, however, some positive signs on the horizon with fifteen new products in various stages of development which include seven phase III programs in the fields of cardiopulmonary diseases and oncology. Management has indicated that revenue growth in 2018 will be hampered by the emergence of generic alternatives but expect revenue growth to recommence in 2019. The firm is also expecting FDA approval of an implantable system for its drug, Remodulin, a device which has been developed in partnership with Medtronic.

In summary, United Therapeutics faces a challenging year with increasing competition and lower estimates for revenue and earnings. Despite this, it seems reasonable, given the conservative estimates used in the free cash flow analysis, to assume investors may be able to earn close to a 10% return at the current market price given the assumptions in our model.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclosure: One of the authors, Stig Brodersen, has a long position in UTHR.