Intrinsic Value Assessment Of Viacom (VIA)

By David J. Flood From The Investor’s Podcast Network | 20 October 2017

INTRODUCTION

Viacom is one of the largest media conglomerates in the world with business interests in cinema, cable television, and the production and distribution of content. The company’s assets include movie studios, television networks, and music labels. It currently operates around 170 networks in 160 countries, reaching an audience of 700 million people.

Viacom’s stock price has been in decline over the past few years due to pressure from emerging web-based competition and the consumer shift toward online content. From a high of around $77 at the end of 2014, the company’s stock now trades near a three-year low at around $35 per share. Is Viacom undervalued at the current price?

THE INTRINSIC VALUE OF VIACOM

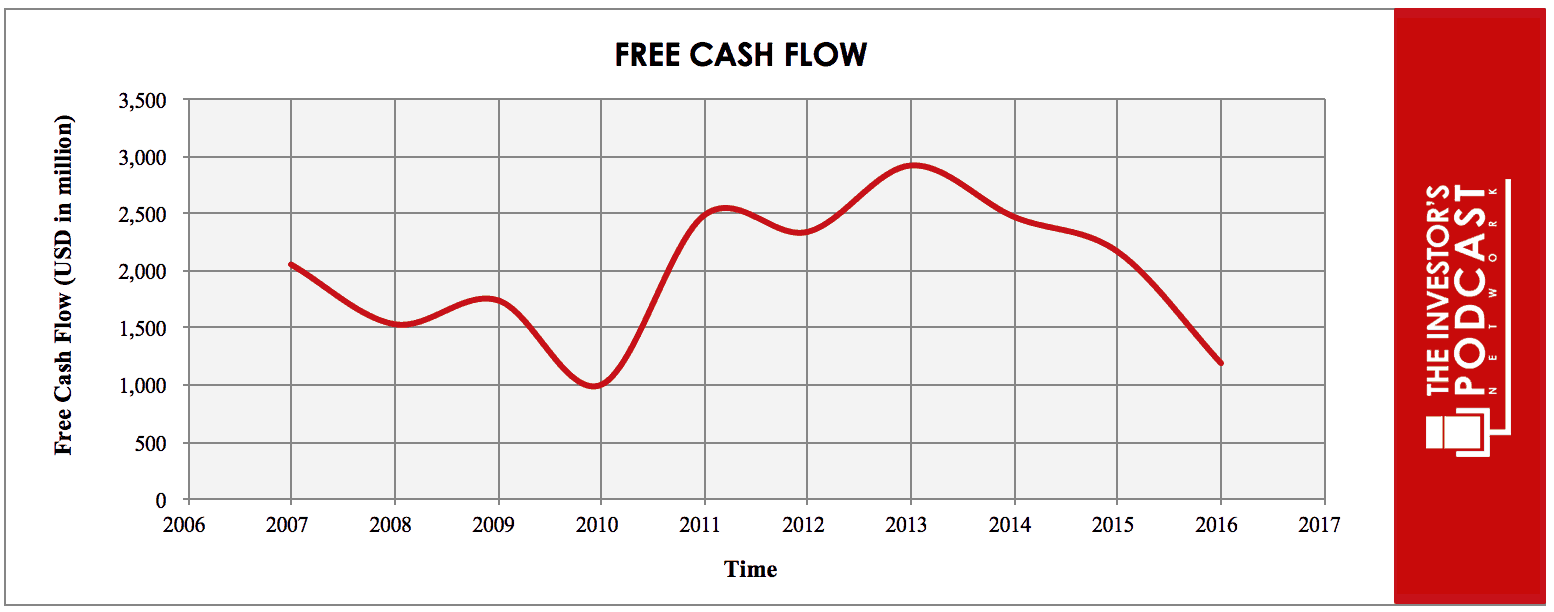

To determine the intrinsic value of Viacom, we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Viacom’s free cash flow for the past ten years.

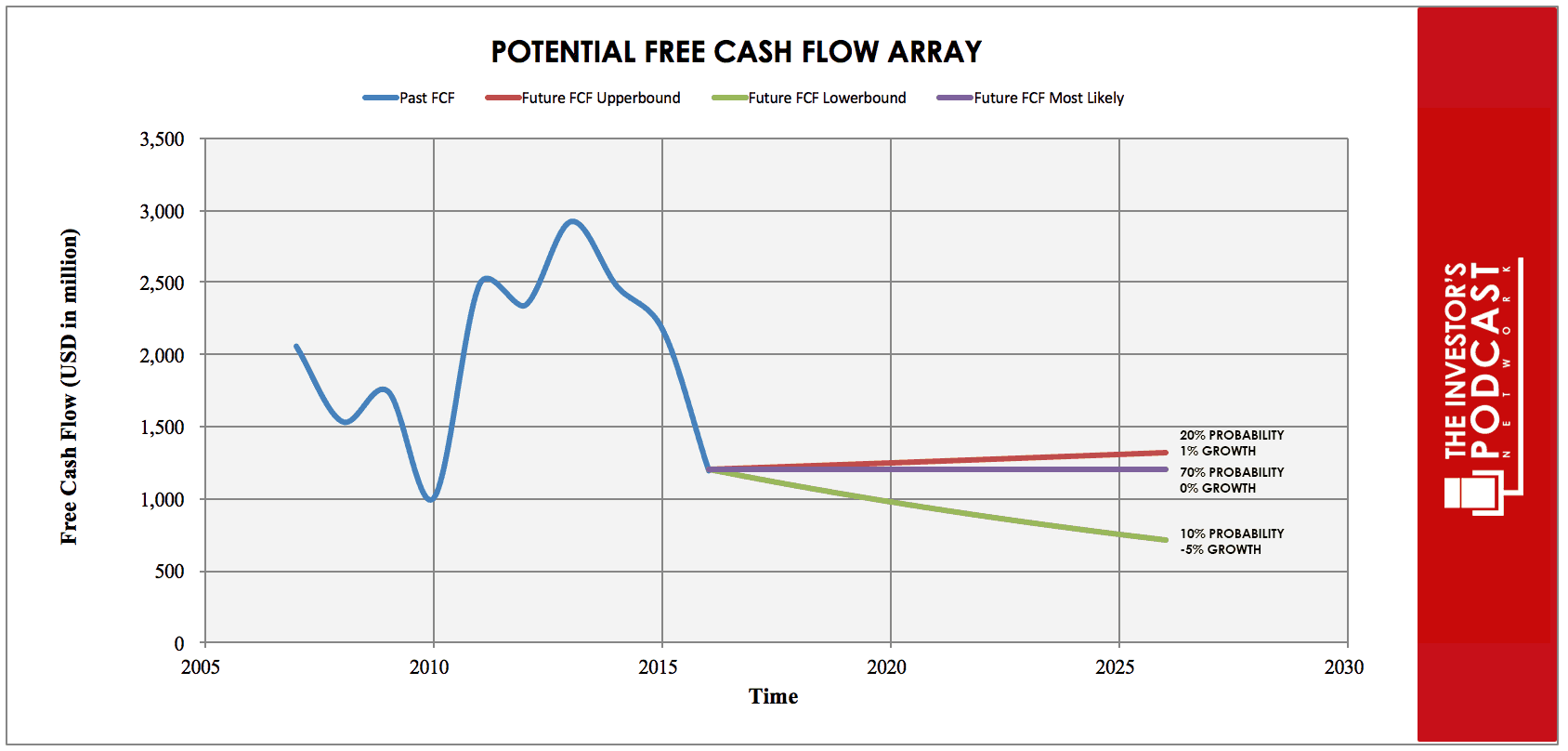

As one can see, the company’s free cash flow trend declined after the financial crisis of 2008 before rising again until 2013. Thereafter, it has since continued to decline due to the aforementioned rise in web-based competition and shift in consumer habits. To determine Viacom’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

When examining the array of lines moving into the future, each one represents a specific value. The upper-bound rate represents 1% growth and has a 20% probability of occurrence. This rate is below most analysts estimate as it is based upon the company’s 10-year historical revenue growth rate. The author has opted to use this in lieu of the standard EPS growth figures since revenues tend to be more stable over time and are not subject to distortions arising from share buybacks. In light of this conservative estimate, a probability of 20% seems reasonable.

The middle growth rate represents 0% growth and has a 70% chance of occurrence. A zero percent growth rate assumes that the continuing disruptive effects of online competition limit the company’s ability to expand its operations and thus grow its revenues and earnings. For this reason, it has been apportioned the greatest probability of occurrence. The lower bound rate represents a -5% contraction in free cash flow and has a 10% probability of occurrence. This lower bound rate assumes that the disruptive effects of what Professor Schumpeter termed as “creative destruction” intensify and that Viacom’s products and services become less desired over time. This rate has been allotted a 10% of occurrence as the author considers the company’s value as a creator of original content – a point many analysts appear to be overlooking as a mitigating factor worthy of consideration.

Assuming that these potential outcomes and corresponding cash flows are accurately represented, Viacom might be priced at a 7% annual return if the company can be purchased at today’s price. We’ll now look at another valuation metric to see if it corresponds with this estimate.

Based on Viacom’s current earnings yield, which is the inverse of it EV/EBIT ratio, the company is projected to return 8.10%. This is not within the reasonable range of our future free cash flow estimate. To further pin down a likely rate of return, we’ll look at Viacom’s historical average earnings yield to see how it corresponds.

THE COMPETITIVE ADVANTAGE OF VIACOM

Viacom has various competitive advantages outlined below:

- Portfolio of Brands. Viacom owns a large selection of brands which are specifically targeted to niche audiences. Nickelodeon is the market leader in content consumption for children aged 2-17. BET is the market leader in content aimed at the African-American community. Meanwhile, Logo TV is the market leader in content aimed at the LGBTQ community. Viacom also owns some mass-market brands such as Comedy Central and MTV. As of September 2016, the former reached 285 million households in more than 146 countries worldwide, and the latter reached 372 million households in 178 countries worldwide

- Proprietary Content. The wider investment community appears to be overlooking the fact that Viacom is a major creator of original content and is merely focusing on its distribution segment. The company’s filmed entertainment segment owns a library of around 3,500 motion pictures and a wide range of television programs which accounted for 21% of revenues in 2017. In dollar terms, that’s over $2.6 Billion. Considering Disney’s recent decision to pull its content from Netflix and open its own streaming service, it seems reasonable to assume that Viacom may make a similar move if present consumer trends continue. Indeed, the company has already established its online presence. Its Media Networks segment now operates branded content including channels on streaming services and social media platforms, such as DIRECTV NOW and Snapchat. The company’s 2016 10-K revealed that “during the quarter ended September 30, 2016, its online properties collectively averaged approximately 53.9 million unique visitors per month domestically and users spent an average of 853 million minutes per month with its branded apps.” It should also be noted that with the increase in online platforms comes an increasing demand for original content. This demand may allow Viacom to increase its pricing and bargaining power.

- Economies of scale. Thanks to the global reach of Viacom, it can distribute its content on various platforms around the world. While domestic revenues have been declining for the company in recent years, its international sales have been increasing. The year 2016 saw a 10% rise in revenue for the company’s International Media Networks. At present, global sales only account for 19% of total Media Networks revenues, but given the potential for future growth, it seems reasonable to assume that management will seek to exploit this fact. Further, the financial and infrastructure resources at the company’s disposal grant it the economies of scale to achieve this.

VIACOM’S RISKS

Now that Viacom’s competitive advantages have been considered, let’s look at some of the risk factors that could impair my assumptions of investment return.

- The continuing decline in cable TV subscriptions may well have an impact on Viacom’s revenues and earnings if the company cannot successfully establish a viable streaming platform, which can compete with emerging competition. This may prove increasingly difficult as the number of streaming platforms increases.

- If Viacom fails to exploit future growth potential in international markets, it will see further declines in its aggregate revenues and profits. Failure to exploit this opportunity could signal ineptitude on the part of management and would likely damage shareholder value

- Viacom’s proprietary content is arguably its most valuable asset, but the company is now faced with competition from both legacy media conglomerates and emerging online streaming platforms. Given that both Netflix and Amazon have begun to create original content, demand for and thus the value of Viacom’s assets may decline in the future. This will lead to lower sales and earnings.

- In recent years, Viacom has returned value to shareholders in the form of share buybacks. Under the authorization of a $20 billion buyback program, a total of 61.8 million shares were repurchased in 2014 and 2015. This program has stalled in the last few years with the company only buying back $100 million of stock in 2016 and none so far in 2017. The observation that cash reserves have depleted this is no great surprise, but if the stock price remains low and cash reserves grow, the company may well embark upon more buybacks.

OPPORTUNITY COSTS

Whenever an investment is considered, one must compare it to any alternative to weigh the opportunity cost. At present, 10-year treasuries are yielding 2.16%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of x 30, meaning it is priced for an earnings yield of 3.3%. Viacom, therefore, appears to offer a much better return for investors at present. However, other individual stocks which offer a similar return relative to the risk profile may still be available.

MACRO FACTORS

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns. At present, the S&P is priced at a Shiller P/E of 30. This is over 85% higher than the historical average of 16.8, suggesting markets are at elevated levels. US unemployment figures are at a 30-year low, suggesting that the current business cycle is nearing its peak. US private debt/GDP currently stands at 199.6% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

Viacom’s future is by no means a foregone conclusion, but the landscape in which it operates is rapidly changing. The disruptive effects of creative destruction will continue to threaten the position of legacy media conglomerates, such as Viacom, and those who fail to adapt will suffer the consequences. However, if the company can continue to drive international growth, build a viable online content platform, and focus on creating value through the development and distribution of its proprietary content, its future may be brighter than some anticipate.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.