Intrinsic Value Assessment Of Walgreens Boots Alliance (WBA)

By Christoph Wolf From The Investor’s Podcast Network | 20 March 2018

INTRODUCTION

Walgreens Boots Alliance (WBA) is an American company that operates as the second-largest pharmacy store chain in the United States with close to 120B in annual sales. The company, in its current form, was created in 2014 when US-focused Walgreens Co. acquired Alliance Boots, which gave the combined entity a strong international presence notably in Europe. Still, the U.S. remains the largest market for the company, where it is second to CVS Health Corp. in the US pharmacy market. Does its current stock price of $67 offer an attractive entry price for investors?

THE INTRINSIC VALUE OF WALGREENS BOOTS ALLIANCE

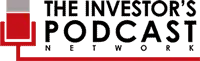

To determine the value of WBA, let’s consider its history of free cash flows. Happily, for investors, WBA’s business is mostly insulated from the economy, which is reflected in a slow and steady rise in free cash flow until 2014. The acquisition of Boots Alliance then visibly boosted this value.

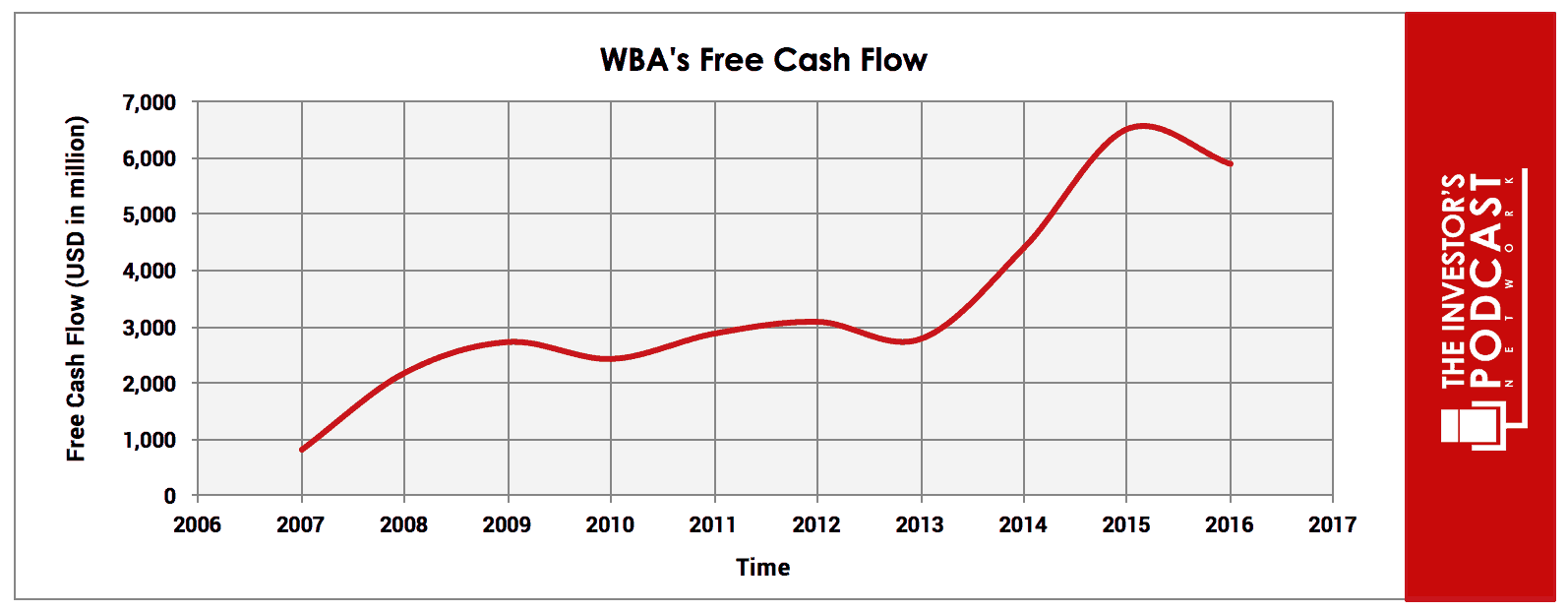

While the results in the past have been very consistent and impressive, we will use a conservative estimate of the future free cash flow. To build this estimate, we make use of an array of potential outcomes for future cash flows.

Each line in the above graph represents a certain probability for occurring. The best-case assumption of 13% growth is based on the previous growth between 2008 and 2016. Since this high growth was mostly achieved by the 2014 acquisition, we only assign it a 5% probability. As the assumption of 4% annual growth seems much more realistic, we give this scenario a 50% chance of occurring. Since it is hard to see the free cash flow of WBA decline over the long-term, we use a worst-case assumption of zero growth and give it 45% chance.

Assuming these growth rates and probabilities are accurate, WBA can be expected to give an 8.9 % annual return at the current price of $67. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF WALGREENS BOOTS ALLIANCE

WBA possesses some unique advantages that should allow it to be very successful in the future:

- Geographical diversification. By merging with Alliance Boots, the combined company gained a major foothold in Europe, which made it one of the largest operators in that region. Since people living in Europe tend to be older than in the U.S., this promises good growth opportunities, since older people require more drugs and health services.

- Recession-resistant industry. Health is one of the most important and precious good a person has, so people will keep spending money on health-related products no matter the economic situation. This guarantees WBA a strong demand for its products, even if the economy tanks.

- Besides CVS Health and Express Scripts, the company is one of the largest companies in the U.S. retail pharmacy market. This guarantees all of these player’s economies of scale and bargaining power with suppliers.

- Good at cost reduction. Due to its many international acquisitions, WBA enjoys immense operational synergies, which enables the company to slash costs vastly. This is especially important in this type of business since margins are low.

RISK FACTORS

Several risks might limit the growth prospects of Walgreens Boots Alliance:

- Politically sensitive business. Everything connected to healthcare is highly dependent on political decisions, which adds uncertainty. This is especially true in the big U.S. market, where the future of healthcare might go in completely different directions, depending on which political party is holding power.

- The retail pharmacy and pharmaceutical wholesales business are highly competitive, which can be seen in WBA’s rather low net profit margins of 3%. In the U.S., the company is dwarfed by CVS Health and also Express Script. Walmart is also another powerful competitor. Online competition is also likely to intensify in the future – especially since Amazon is rumored to enter this market.

OPPORTUNITY COSTS

When looking at various investment opportunities in the market today, let’s compare the expected return of WBA to other ideas. First, one could invest in the ten-year treasury bond which is producing a 2.8% return. Considering the bond is completely impacted by inflation, the real return of this option is likely below 1%. Currently, the S&P 500 Shiller P/E ratio is 33.2. As a result, the U.S. stock market is priced at a 3 % yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

WBA’s business is mostly insulated from the state of the economy. If you urgently need a drug or another medical service, you will not wait for better times. That said, prices are very high in the U.S., and so many people might not be able to afford them in a downturn. This is especially true because not all costs are covered by their health insurance – if patients have one at all. Healthcare in the U.S. is also a politically very sensitive topic, which increases regulatory uncertainty. On the plus side, the demographic trend of an even larger portion of older people in the world should guarantee a stable demand for WBA’s products.

SUMMARY

Walgreens Boots Alliance is a very solid company that operates in a recession-proof market segment that can be expected to grow due to demographic pressure. The acquisition of Boots Alliance gave the combined entity an international foothold, which should further shield it from the localized downturn. That said, the competition in this business segment is vast and the future political climate hard to predict. Considering these pros and cons, the expected annual return of 8.9% seems to adequately compensate for the risks.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.