Intrinsic Value Assessment Of Walt Disney Co. (DIS)

By David J. Flood From The Investor’s Podcast Network | 27 November 2017

INTRODUCTION

Walt Disney Co. is an American-based multinational mass media and entertainment conglomerate. The company operates through four business segments, namely ‘The Walt Disney Studios,’ ‘Parks and Resorts,’ ‘Media Networks,’ and ‘Disney Consumer Products and Interactive Media.’ Walt Disney Co. is currently a member of the Fortune 500 list with a market cap of $155 Billion. Its revenues and free cash flows for the previous financial year were around $55.1 Billion and $8.7 Billion respectively. The company’s common stock has fluctuated between a low of $96 and a high of $116 over the past 52 weeks and currently stands at around $102. Is Walt Disney Co. undervalued at the current price?

THE INTRINSIC VALUE OF WALT DISNEY CO.

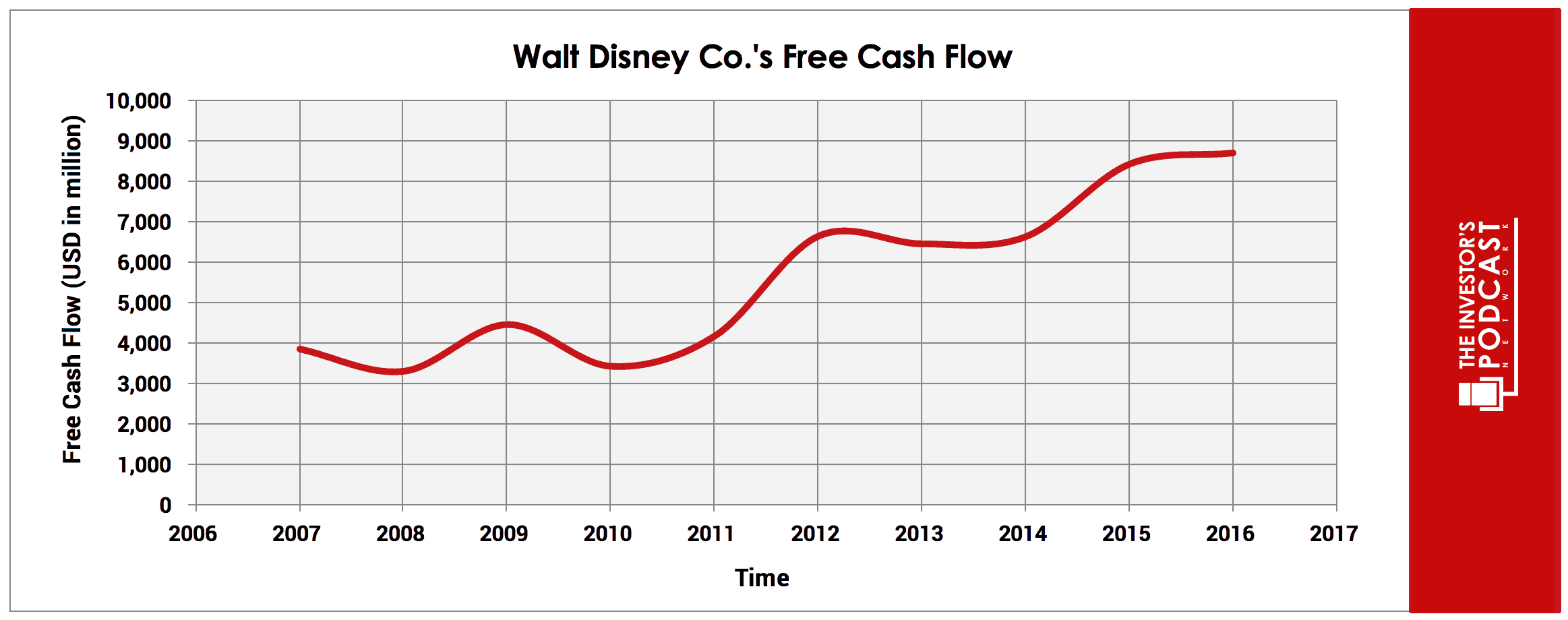

To determine the intrinsic value of Walt Disney Co., we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Walt Disney Co.’s free cash flow for the past ten years.

As one can see, the company’s free cash flow has been on a moderate upward trend over the past decade, growing at an annual average rate of 13%. To determine Walt Disney Co.’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

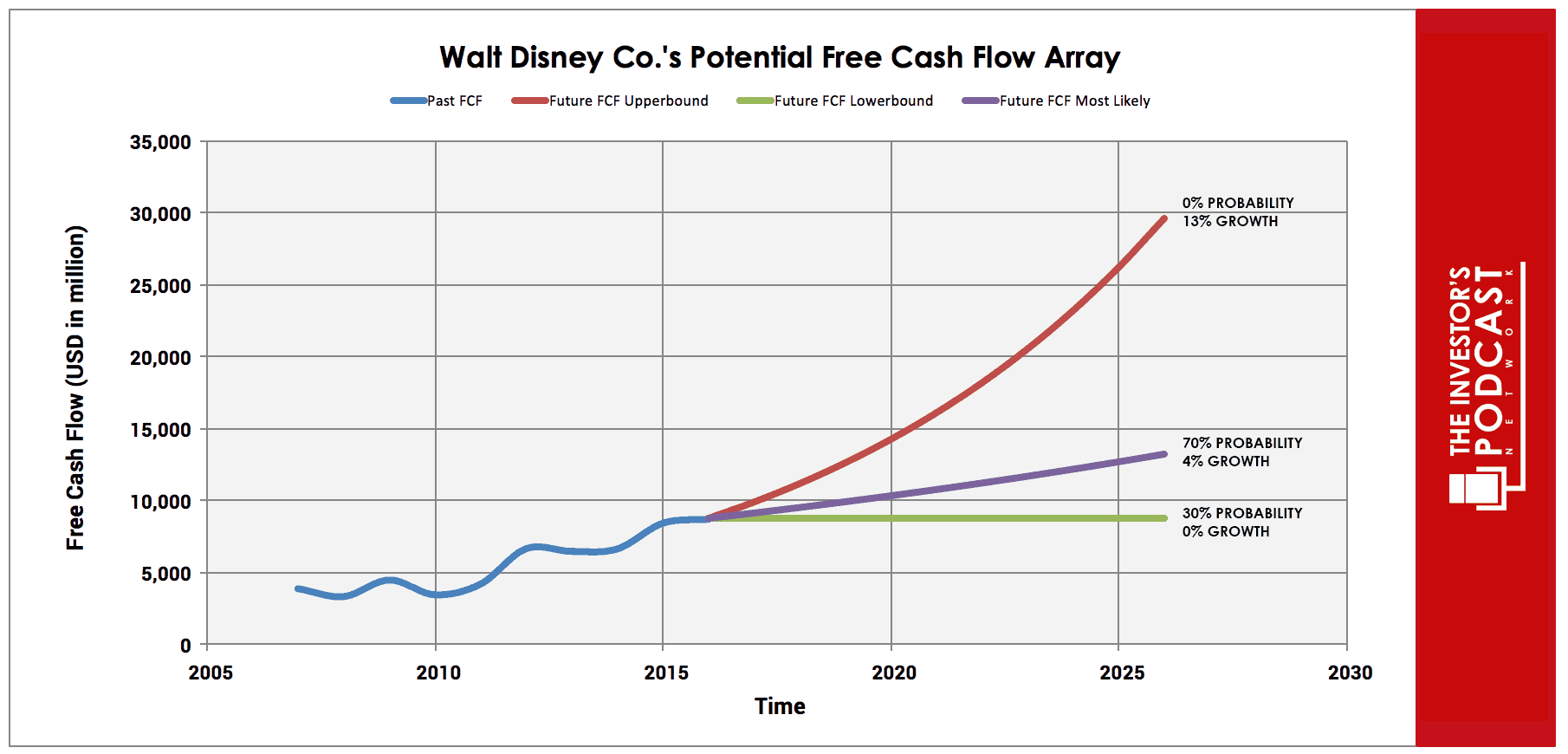

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents a 13% growth rate which is based on the historical rate of growth in free cash flow. Assuming Walt Disney Co. were to grow free cash flow at this rate for the next decade, it would be generating $30 Billion by 2027, more than triple its present level. This is an extremely optimistic assumption, and as such, it has been assigned a 0% probability of occurrence. The middle growth line represents a 4% growth rate. This is based on the 10-year historical revenue growth rate. Revenues tend to be far more stable than earnings, and as such, offer a more realistic assumption for estimates. For this reason, it has been given a 70% probability of occurrence. The lower bound line represents a 0% growth rate in free cash flow growth and has been assigned a 30% probability of occurrence. This lower bound rate assumes that free cash flow growth stagnates as consumers reject legacy media companies en masse in favor of emerging online players such as Netflix and Amazon. Walt Disney Co. has recently stopped publishing their content on Netflix and is working on their own platform for their own productions because they wish to fully control the entire distribution and to protect the brand.

Assuming these potential outcomes and corresponding cash flows are accurately represented, Walt Disney Co. might be priced at a 5.3% annualized return if the company can be purchased at today’s price. We’ll now look at another valuation metric to see if it corresponds with this estimate.

Walt Disney Co. currently trades at a P/FCF of 18x, which is close to the firm’s historical median average of 19X and above the Industry median of 13.3x. This suggests that the company is overvalued relative to the industry and in line with its historical average. If we invert Walt Disney Co.’s P/FCF ratio, we get its FCF yield which is currently around 5.4%. This is in line with our previous estimate. Finally, we’ll look at Walt Disney Co.’s PEG ratio, a metric useful for estimating the fair value of a company relative to its earnings growth rate, to see how it fairs. At present, the company’s PEG ratio stands at 1.35. This is above a fair value of 1, suggesting that the firm is marginally overvalued. Taking all these points into consideration, it seems reasonable to assume that Walt Disney Co. is trading at a marginal premium to fair value at present. Further, the company may return around 5% at the current price if the estimated free cash flows are achieved. Now, let’s discuss how and why these free cash flows could be realized.

THE COMPETITIVE ADVANTAGE OF WALT DISNEY CO.

Walt Disney Co. has various competitive advantages outlined below.

- Brand Value. Walt Disney Co.’s most powerful competitive advantage is its portfolio of brands. According to Forbes 2017 global brand value report, the value of Walt Disney Co.’s brand is $43.9 Billion. This portfolio includes Disney, Star Wars, Marvel, and ESPN. Warren Buffett is attracted to companies which earn high returns from branding power since these intangible assets are the hardest for a competitor to replicate. The power of these brands also allows the company to own what Buffett calls a ‘share of mind.’ A brand owns a share of a consumer’s mind when the latter associates positive experiences or emotions with it. This creates a sense of loyalty between the consumer and the brand which results in repeat custom and pricing power.

- Proprietary Content. Walt Disney Co. owns a huge catalog of proprietary content including the Disney cartoon franchise, the Star Wars franchise, and the Marvel franchise. This enviable library of nearly 500 films and 7,000 TV episodes allows the company to generate continuing revenue streams through direct sales and licensing fees.

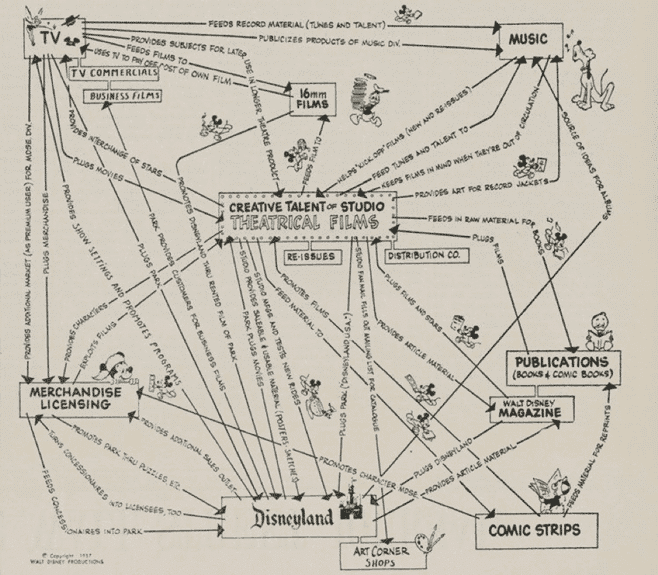

- Vertical Integration. Walt Disney envisaged the synergies that could be created through vertical integration way back in 1957. The chart below, known as the ‘Synergy Map,’ shows his vision for the company’s core strategy.

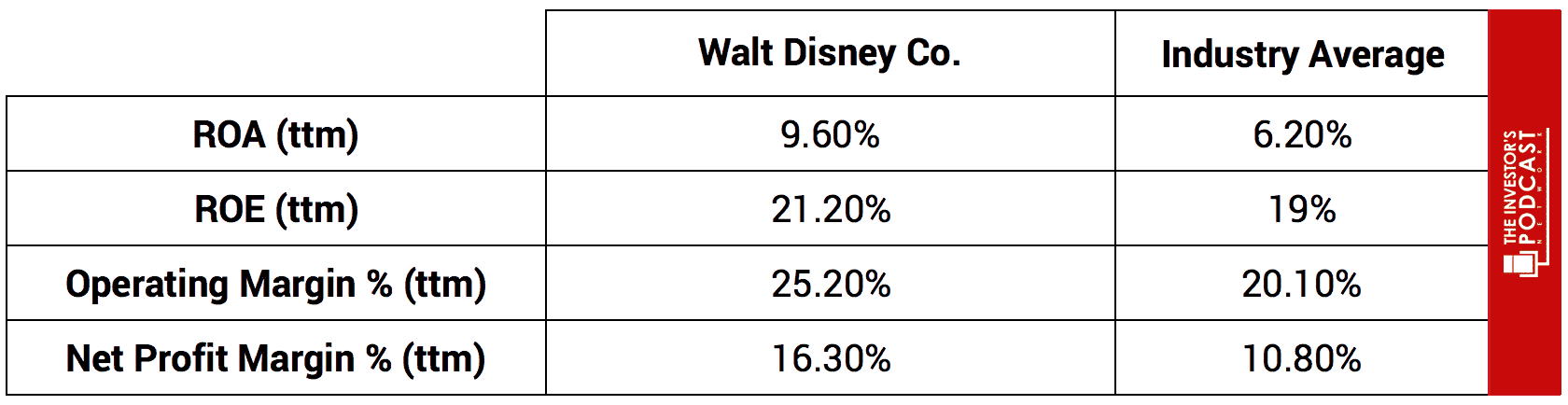

This chart is still a fairly accurate representation of Walt Disney Co.’s business model today. The company invests in creative talent to create original content, brands, and franchises. These can then be licensed and cross-sold through merchandise, upsold as physical experiences at theme parks and other events. Unlike a horizontal platform such as Netflix, which only has one method to distribute and monetize content, Walt Disney Co. can create and monetize a single character through movies, TV shows, toys, memorabilia, live shows, and theme parks. This means that for every dollar invested, the company gets more back in profit than its competitors. The chart below shows how these synergies translate into superior economic performance.

WALT DISNEY CO.’S RISKS

Now that Walt Disney Co.’s competitive advantages have been considered, let’s look at some of the risk factors which could impair my assumptions of investment return.

- While Walt Disney Co. possesses multiple competitive advantages, there still exists a possibility that one of its rivals could mount a challenge to erode its competitive advantages and move on its market share. These could include other legacy media firms or new entrants such as Netflix or Amazon.

- The emergence of a serious economic crisis, similar to that witnessed in 2008, could materially impact the company’s revenues and profits leading to lower growth in the coming years. While Walt Disney Co. possesses numerous competitive advantages, a fall in consumer confidence and spending would be detrimental to the company’s economic performance.

- The risk of obsolescence could arise if the company fails to address the risks posed by disruptive technology. If Walt Disney Co. wishes to maintain its competitive position, it is important that the company addresses the threats posed by online content providers such as Netflix and Amazon. It must, therefore, reinvest its capital in an effective and efficient manner to maintain its branding power, generate new and compelling proprietary content, and to adapt its business model to the changing habits of media consumption amongst consumers.

OPPORTUNITY COSTS

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At present, 10-year treasuries are yielding 2.37%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of x 31.4 and, at present, is likely to return around 2-3%. While Walt Disney Co. is trading at a marginal premium to fair value, it still appears to offer a higher rate of return than both U.S. treasuries and the S&P 500 Index. There are, however, other individual stocks to be found which may offer a more favorable return relative to the risk profile.

MACRO FACTORS

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns. At present, the S&P is priced at a Shiller P/E of 31.4. This is around 87% higher than the historical average of 16.8, suggesting that markets are at elevated levels. U.S. unemployment figures are at a 30-year low, suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 199.6% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

The future for Walt Disney Co. looks favorable if it can maintain its competitive advantages and adapt to the changes in media consumption by consumers. The company appears to be taking this issue seriously and has recently announced that it is pulling its content from Netflix and opening an ad-free ‘direct-to-consumer’ streaming platform. Walt Disney Co. CEO Bob Iger announced that the Disney, Star Wars, Pixar, and Marvel catalog would be moved to the platform along with a film library of 400-500 movies and around 7,000 TV episodes at the Bank of America Merrill Lynch 2017 Media, Communications & Entertainment Conference.

The company also plans to create four to five new original Disney branded films and a large volume of original short-form content which will be exclusive to its streaming service. The firm’s ESPN sports network will also be hosted on the platform, and this will continue to feature targeted advertisements. Walt Disney Co. is also in talks with 20th Century Fox over a possible major assets acquisition. Should the acquisition play out well, it would further grow the company’s portfolio of proprietary content and increase revenues and earnings.

In the past, the company has been criticized for not distributing enough earnings in dividends, but management seems to have taken note and acted accordingly. This is evidenced by the fact that dividend growth has increased from a 10-year growth rate of 21.10% to a 5-year and 3-year growth rate of 23.70% and 22% respectively. Furthermore, the company has grown dividends by 9.90% in the last year alone. In the fiscal year 2016, the company returned $2.3 Billion in dividends but allocated around 89% of its free cash flows on share buybacks. In dollar terms, the firm spent $7.5 Billion on buybacks and canceled around 73.8 million shares at an average cost price of $101.60 per share. There is plenty of room for dividends to continue to grow. If management scales back its buybacks in favor of greater dividend growth, the share price is likely to move up.

At present, Walt Disney Co. appears marginally overvalued with an estimated return of around 5%. While the company’s stock price is currently trading at a premium to fair value, it is certainly one to watch. Should its share price decline to a more reasonable level, it would be worthy of serious consideration by investors.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.