Intrinsic Value Assessment Of XCel Brands, Inc. (XELB)

By Christoph Wolf From The Investor’s Podcast Network | 17 September 2019

INTRODUCTION

XCel Brands Inc. is a media and consumer company with a novel approach to retail. The company is engaged in the design, production, marketing, and direct-to-consumer sales of branded apparel, footwear, accessories, and home goods. Its brands include Isaac Mizrahi, C. Wonder, Halston, Judith Ripka, and Highline.

Using its novel approach of a fast-to-market supply chain and using its integrated technology platforms, the company aims to give its retail partners an edge over existing fast fashion models. Its retail partners get exclusive rights of XELB’s brands, while XELB earns its revenues from royalties, design fees, margin participation, as well as marketing and other fees.

The company aims to address the problem of the disconnect between short-lead social media and long-lead supply chains. This is achieved by using an integrated technology platform using consumer insight testing, trend analytics tools, data science, 3D design, and AI. This allows XELB to react very fast to the market’s needs, while also maintaining a high quality of its products.

By applying both its novel fast-fashion model and working closely together with its retail partners, the company can operate on a capital-light approach. The firm does not need to rent huge areas for storage and selling of its wares – this capital-intensive part is done by its partners.

Although this approach has huge advantages, the company’s stock price has consistently declined during the last four years: From $9.10 in 2015, the stock has fallen to only $1.54 today. This is all the more surprising since XELB has consistently managed to raise revenue during this time, and also most of the time stayed profitable. Is XELB, therefore, a buy at its current price of $1.54?

THE INTRINSIC VALUE OF XCEL BRANDS INC.

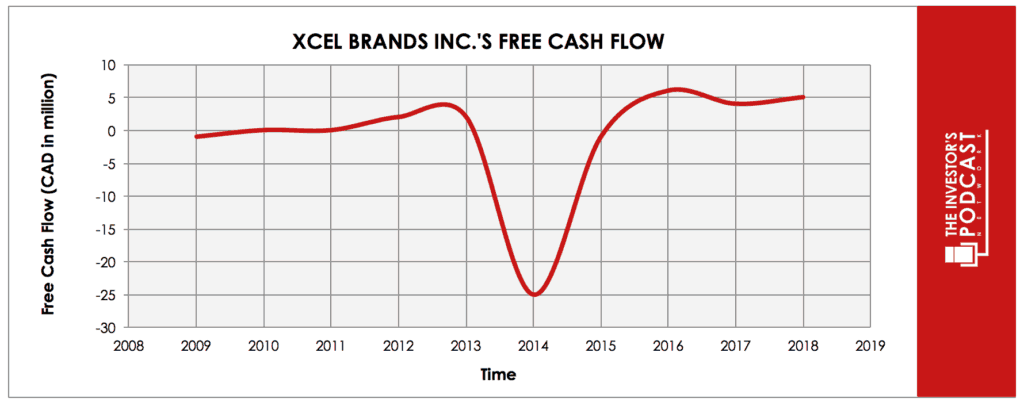

To determine the value of XELB, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of XELB’s free cash flow over the past ten years.

As one can see, the results have been quite volatile – but with an upward trend. The volatility is due to fluctuations in the operating and net margins – and not because of volatile revenue. In fact, revenue has consistently grown throughout the last decade.

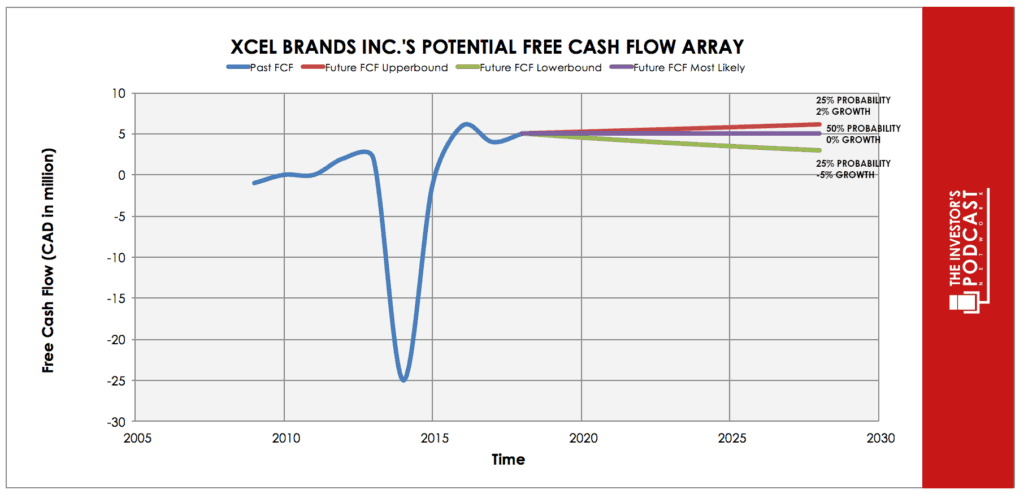

Although these numbers look quite good, we will use a very conservative estimate of its future cash flows.

Each line in the above graph represents a certain probability for occurring. We assume a 25% chance for the upper growth rate of 2% per year, a 50% chance for zero growth and a 25% chance for the worst-case scenario of a 5% annual decline.

Assuming these growth rates and probabilities are accurate, XELB can be expected to give a 17.1% annual return at the current price of $1.54. This return seems very rewarding. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF XCEL BRANDS INC.

XELB possesses several advantages:

- Innovative Company. XELB has a completely new approach to selling and marketing its products. By using social media and other tools, the company can always find out current trends and build its brands and products accordingly. This is not only done very fast, but also the high quality of its products can be maintained.

- Capital-Light Business. XELB’s business is mostly focused on the capital-light part of retail, such as designing or marketing. No heavy machinery or inventory has to be kept by the company – this part is mostly taken care of by its retail partners. This frees up cash and allows the company to act fast and remain flexible.

- By providing its retail partners with unique tools such as its virtual vertical platform, it enables these partners to be successful. This is a strong incentive for its partners to stay loyal to XELB.

RISK FACTORS

While XELB has been mostly successful so far, several issues also need to be included in the assessment of the company.

- Untested novel business approach. XELB’s approach is completely new and might work out wonderfully. But new and untested ideas also carry a high risk of uncertainty and failure.

- Multiple brands added recently. Except for Mizrahi, all of XELB’s brands have been acquired and launched within the last five years. The company, therefore, only has limited experience with the things it owns. Successfully integrating all into one company might still take some time and effort.

- Risk of a global recession. While an economic downturn would affect all global companies, XELB might be especially vulnerable due to two reasons: Firstly, the retail sector is quite sensitive to a recession. Secondly, XELB’s retail partners will all aim to slash costs when the economy tanks. The first things to go are often expenses for novel and untested experimental business operations – such as the collaboration with XELB.

OPPORTUNITY COSTS

When looking at various investment opportunities on the market today, let’s compare the expected return of XELB to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 1.47% return. Considering the bond is completely impacted by inflation, the real return of this option is hardly above zero. What about investing in U.S. stocks? Currently, the S&P 500 Shiller P/E ratio is 28.8. As a result, the U.S. Stock market is priced at a 3.5% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The retail sector currently experiences a major disruption– not only because of Amazon but also because of demographic factors and changed shopping behavior. Multiple retail companies have declared bankruptcy recently, and several others are struggling.

This is exactly the issue that XELB aims to address with its novel approach. While revenue is at best flat and margins are under pressure for most traditional brick-and-mortar retailers, XELB’s approach aims to react fast to customer’s needs and give them what they want. This allows the company to earn comparatively high margins.

SUMMARY

XELB is a very interesting company, which brings a novel and refreshingly new approach to retail. As the current retail environment experiences a major disruption, this might just be the right time for such an entry.

While the expected annual return of 17.1% seems very rewarding, investors are well-advised to further analyze the company before investing. Only if one is truly convinced by XELB’s novel approach to retail, the stock should be considered for purchase.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not currently hold any ownership in Vitamin Shoppe, Inc. (VSI) and has no intentions of initiating a position over the next 72 hours.