Crypto Hack

07 October 2022

Hi, The Investor’s Podcast Network Community!

Happy Friday and welcome back 😎

To kick off the weekend, we want to better optimize this newsletter for what you’re interested in reading.

Take 30 seconds and fill out this survey to tell us what topics you’d like to hear more about — Don’t pass up your chance to shape We Study Markets!

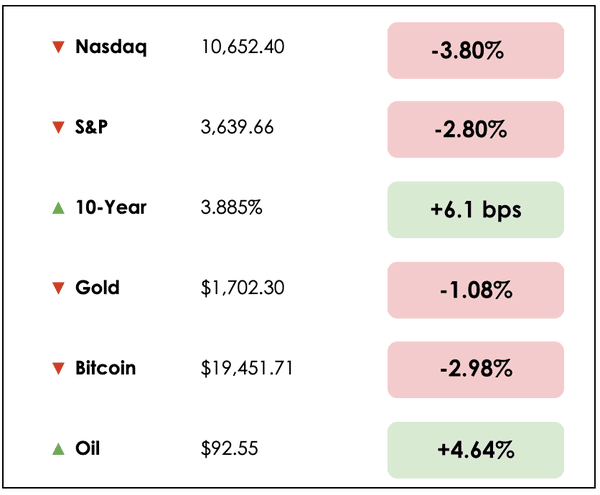

It was a brutal day for stocks. Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss a major crypto hack, the jobs report that sent stocks crashing, Credit Suisse’s latest financial moves, and how to invest in multifamily real estate projects.

All this, and more, in just 5 minutes to read.

Let’s go! ⬇️

IN THE NEWS

😵 $570 Million of Binance’s BNB Token Hacked (CNBC)

Explained:

- Cryptocurrency exchange Binance temporarily shut down its blockchain network after hackers withdrew 2 million BNB tokens from a cross-chain bridge linking with its BNB chain. A cross-chain bridge is a tool that allows the transfer of tokens from one blockchain to another.

- The hackers made off with approximately $570 million of BNB tokens.

- The value of BNB’s token sank 3% to $285.36 per coin. A total of $1.4 billion has been lost due to cross-chain breaches this year.

What to know:

- The hack was caused by a bug in the bridge’s open-source smart contract that allowed hackers to forge transactions and send money to their own wallets.

- A smart contract is code on a blockchain that allows agreements to execute automatically without human intervention.

- Binance said it worked with its network validators — entities or individuals who confirm transactions on the blockchain — to pause the creation of new blocks while a team of developers investigated the breach. The company said, “the issue is contained now. Your funds are safe.” BNB Chain has since resumed operations and says they have limited the total loss to $100 million.

💼 Stocks Fall On Jobs Report (Bloomberg)

Explained:

- Stocks were broadly lower, and Treasury yields climbed after the jobs report showed that U.S. employers added 263,000 jobs in September.

- Median estimates in a Bloomberg survey of economists called for a 255,000 increase in payrolls and for unemployment to hold steady at 3.7%. The unemployment rate fell to 3.5% from 3.7%, returning to a half-century low.

- The largest gains in employment were seen in the leisure and hospitality, and healthcare industries, while employment in transportation, warehousing, and financial activities declined.

What to know:

- A strong job market is typically great news for investors but will make the Fed more likely to keep pushing interest rates higher as they continue to wage war against inflation.

- The Federal Reserve’s next rate decision is scheduled for November 2nd. Minneapolis Federal Reserve Bank President Neel Kashkari said that the central bank has further work to do to bring inflation down and is “quite a ways away” from pausing on raising interest rates.

🇨🇭 Credit Suisse To Buy Back $3 Billion in Debt (Reuters)

Explained:

- Troubled bank Credit Suisse offered to buy back up to 3 billion Swiss francs of debt securities as it attempts to navigate a plunging share price and an increase in bets against its debt. The bank also confirmed it would be selling its famous Savoy Hotel in Zurich’s financial district as part of its plan.

- The bank’s shares briefly hit an all-time low of 4.22 Swiss francs earlier this week, and credit default swaps reached a record high amid the market’s uneasiness over its future.

What to know:

- A string of scandals has rocked the embattled lender. The most costly was the bank’s $5 billion exposure to hedge fund Archegos, which collapsed in March 2021.

- Credit Suisse has since overhauled its management team, suspended share buybacks, and cut its dividend as it looks to shore up its future.

- The Swiss lender’s stock shot up as much as 10% on the news.

WHAT ELSE WE’RE INTO

📺 Watch: The Little Book That Still Beats the Market plus an overview of the “Magic Formula” to investing, a video breakdown by Shawn O’Malley

👂 Listen: What to know from studying super investors, Millennial Investing podcast with David Rubenstein

📖 Read: President Biden pardons all Federal offenses of simple marijuana possession, from CNN

DIVE DEEPER: MULTIFAMILIY INVESTING

Shawn: Real estate investing broadly represents an opportunity set for investors that’s often overlooked for being too complicated, too difficult, or for requiring too much capital.

The truth is more nuanced, and for those serious about diversifying or building wealth, escaping the corporate rat race, or just taking more control over their financial future, it’s worth familiarizing yourself with property investing.

So, that’s what we did recently, or at least, that’s what I did. My co-writer Patrick is already quite an experienced real estate investor.

To close the knowledge gap between us, I’ve been listening to episodes of Robert Leonard’s Real Estate 101 podcast, and his discussion of multifamily property investing stood out to me.

Sterling White

In the podcast, Robert chats with self-made real estate entrepreneur Sterling White, who now owns over 500 multifamily units.

White moved to Houston recently from Indianapolis, to in part, tackle a new property market with a lower cost of living and more favorable deals.

He grew up in a rough inner-city neighborhood to a single mother, and he credits the book Rich Dad Poor Dad with inspiring him to become an investor, rather than a laborer who toils away as someone else’s employee.

So, with zero credit score and limited cash, White set out for success in real estate.

In his first deal, he had to find a partner to front the cash, and then from there, he was off to the races, doing 150 single-family home deals before transitioning to multifamily (apartments, duplexes, condos, townhouses, etc.).

Single-family to multifamily

White explains that it was tremendously stressful to oversee 150 single-family properties, even with a team helping him manage them.

The sheer volume of unique deals required a lot of administrative tracking, while the physical property management was no small responsibility to stay on top of either.

In other words, there’s simply less operating leverage in single-family homes that may be spread out geographically and have idiosyncratic issues, which reduces the amount of upside that can be earned without larger and larger management teams that raise costs.

Multifamily properties though, by definition, can have hundreds or even thousands of tenants in a single building, and this makes these strategies much more scalable.

What sounds easier to you — Managing one building with one hundred and fifty tenants, or managing one hundred and fifty different buildings each with only one tenant?

If you think the former, then we’d have to agree with you. And it’s also more lucrative, at least according to White.

The Strategy

To start out, White just drove around looking for dilapidated properties that needed work or looked very bland, so that he could make cosmetic repairs that dramatically boosted the property value.

He then worked on cold-calling property owners to gauge their interest in selling, and as his sophistication evolved, he began searching through databases offered by platforms like CoStar to find potential deals.

For White’s strategy, he targets older buildings constructed in the 1970s in secondary locations just outside of cities to find overlooked value. In one deal last year, he bought a 156-unit property in need of repair for $6.2 million that he invested another $2 million in fixing up.

Financing

To raise capital for these sorts of deals, he leverages his podcast and social network to market the fundraising.

And then from this funnel of potential partners, he finds people that he wants to go into business with who help him pull the deals off so that he’s not taking the entire financial risk of a multi-million dollar deal himself.

Despite rising interest rates, White still says he’s had no problem financing deals, as there are still plenty of people with saved-up funds looking for ways to invest them.

Outlook

That said, he’s been selling some of his properties over recent years to boost his personal cash levels. He believes a “buyer’s market” is approaching where prices and terms for properties will become much more favorable to investors than they have been in the past.

Basically, over the last two years, he thinks that many in the space have made aggressive bets premised on overly optimistic assumptions about the rates they could charge tenants and the management costs associated with multifamily properties.

So, as these investors realize that their projects are losing endeavors due to the steep prices they paid initially, they’ll want to bail out of the properties and sell them at a discount to him.

White actually keeps a list of all the properties that he thinks others overpaid for, such that in six to twelve months when they’re underwater on the deal, he can offer a bailout at a price that’s great for him.

Good Deals

For a deal to be desirable, he looks at both the cash-on-cash return and the internal rate of return (IRR).

The cash-on-cash return is a common metric in real estate that compares the amount of cash produced annually by a property relative to the cash invested into it (annual pre-tax cash flow / total cash invested).

The IRR can be thought of as the annual rate of growth that an investment is anticipated to generate.

He expects the cash-on-cash return for his properties to be at least in the double digits and for the IRR to be 20% or higher.

Wrap up

Don’t miss my video breaking down how to get started in commercial real estate deals like the ones we discussed above.

Or to dive right into multifamily and commercial real estate investing, checkout the catalog of deal available on Passiveinvesting.com

Let us know — Are you interested in learning more about real estate investing strategies?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.