David & Goliath

22 February 2023

Hi, The Investor’s Podcast Network Community!

More earnings to report: Shares for semiconductor giant Nvidia jumped after hours as it posted better-than-expected revenue and guidance, including a slight beat driven by A.I. chips 📈

Also: New Federal Reserve minutes came out today, with most officials favoring another quarter-point rate rise.

Mostly, they backed cooling the pace of rate increases at their recent meeting

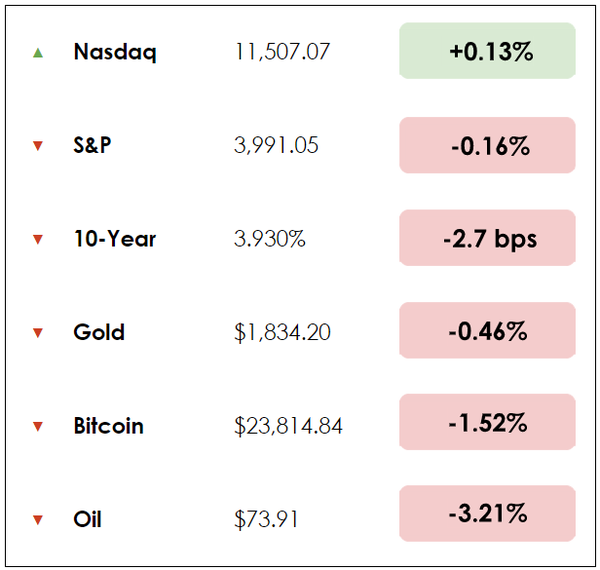

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- China to ditch the big four auditors?

- Why home sales keep falling

- Plus, our main story on the power of underdogs

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Simple setup for new Bitcoiners ✅

Advanced features for Bitcoin veterans ✅

The Bitcoin wallet for your every need ✅

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

🔎 China Wants to Ditch the Big Four Auditors (Bloomberg)

Explained:

- Chinese authorities are urging state-owned firms to phase out using the biggest international accounting firms, breaking from worldwide business norms after expressing concerns about data security.

- This comes not long after Beijing reached a deal with the U.S. to allow audit inspections of Chinese companies listed on American exchanges. China’s Ministry of Finance, among other government entities, encouraged state-owned enterprises to let their contracts with the “Big Four” auditing firms expire. No deadlines have been set for the changes, but replacements are expected to happen gradually.

- The U.S. Public Company Accounting Oversight Board completed its inspections of large Chinese firms listed in the U.S. in December, seemingly resolving tensions between American regulators, Chinese firms, and the Chinese government. However, some firms, including China Eastern Airlines Corp., China Life Insurance Co., and PetroChina Co. have opted to simply delist from American stock exchanges.

Why it matters:

- Bloomberg writes, “While the China-U.S. audit deal last year was hailed as a sign that the competitive superpowers can still work together on some issues, Beijing’s audit guidance is a reminder that decoupling is still proceeding in sensitive areas like state-owned enterprises (SOEs) and advanced technology.”

- Moves towards lesser-known auditing companies may raise risk premiums and, correspondingly, financing costs for China’s SOEs. One investment manager commented: “It builds in a further hurdle for Chinese SOEs in terms of appealing to international capital.”

- Adding further, “The Big Four have grown because of their perceived independence and size, and being global and subject to different regulators reinforces this perception of trust, on which the Western financial system depends.” In a world of increasing tension and competition between superpowers, matters like the optimal functioning of capital markets seem likely to be disregarded in the name of national security.

- For the Big Four auditing firms, a shutout from Chinese SOEs would be a costly blow after raking in around $3 billion from these clients in 2021.

🏠 Home Sales Fall for 12th Straight Month (WSJ)

Explained:

- The U.S. housing market weakened for the 12th straight month in January as higher mortgage rates have sidelined buyers. Sales of previously owned homes fell 0.7% from the prior month to a seasonally-adjusted rate of four million, the slowest pace since October 2010. Year-over-year sales were down 36.9%.

- A surge in mortgage rates, record home prices, and rising economic uncertainty have weighed heavily on prospective buyers. The average rate on a 30-year fixed mortgage rose to 6.32% last week, marking the biggest weekly increase in four months.

- CoreLogic’s chief economist commented, “I think the worst is behind us, (but) it really all depends on mortgage rates.” Home shopping has picked up a bit recently, though, with the real estate brokerage firm Redfin suggesting that its measures of home-buying demand have hit the highest level since September.

Why it matters:

- One analyst remarked, “A lot of people that gave up on the housing market in maybe spring and summer of last year are now like, ‘OK, I feel like I can breathe and get in again.'” With homes sitting on the market longer and a gradual acceptance that rates are unlikely to return to the incredibly low levels of 2021, home buyers may feel pressured to bite the bullet, even at the limits of their budgets.

- One challenge for a housing recovery is that many prospective sellers are sitting on mortgages below 4%, so they’re less than enthusiastic about moving homes to start again with a much higher mortgage payment.

- Yet, this hesitancy to sell is keeping prices elevated because the inventory of homes for sale remains relatively low, acting as a double-whammy to affordability with high rates and prices for potential buyers.

WHAT ELSE WE’RE INTO

📺 WATCH: Steve Jobs on the value of taking a long-term view.

👂 LISTEN: Our writer, Shawn O’Malley, on investing philosophies.

📖 READ: How hybrid work is changing offices of the future.

By some measures, 2022 was the year of the underdog.

Morocco’s World Cup run.

The St. Peter’s basketball team’s NCAA Tournament Cinderella story. Ukraine’s perseverance against Russia. The energy sector’s continued outperformance.

One expert on the subject is Malcolm Gladwell, who in 2013 penned the bestseller David and Goliath.

It’s an intriguing look at how we’ve framed and misrepresented underdogs and misfits. Compellingly, Gladwell asks us to reassess our assumptions about strengths, weaknesses, advantages, and disadvantages.

Underdogs have advantages

Sometimes, underdogs win in situations where the odds are stacked unfavorably against them. In markets and investing, many people seek the underdog, in a way — the undervalued or overlooked company.

Gladwell draws on historical events and the psychology of highly successful people to illustrate that underdogs have advantages:

- Living in a privileged environment might hinder your success.

- You can turn your learning difficulties into advantages in other fields.

- Even if you’re the underdog, you can win against big competitors by relying on your unique skills.

Sometimes, he argues, growing up with obstacles strengthens us. Whether it’s sports, business, or investing, there are countless examples of people persevering through turbulence.

As author Ryan Holiday has written, the obstacle becomes the way. “What stands in the way becomes the way.”

Nietzsche once said, “That which does not kill us makes us stronger.”

Examples

Gladwell says disadvantages such as a learning disability can help over-develop our skills in other areas, which will make far more than up for it.

For example, when Princeton University changed the font in their intelligence test to a harder-to-read style, the average score went up from 1.9 to 2.45 out of 3 points.

Forcing people to read slower made them think longer and better about the questions, increasing their scores.

Gladwell also shares a study about underdog armies, which states that underdogs that use guerrilla tactics in battle win 63% of the time.

If an underdog tries to fight fire with fire, it wins in only 29% of battles.

Gladwell’s point: Underdogs tend to win when they play to their strengths. Gladwell uses the story of David, the Biblical shepherd boy, who uses a simple sling to overcome the heavily armored and physically imposing warrior, Goliath.

His other examples: An unskilled girls’ basketball team that wins games with the full-court press, and T. E. Lawrence and his Bedouin guerillas, who use sabotage and surprise to defeat the Turkish army during World War I.

Other lessons

Gladwell writes about several people who grew up with dyslexia. Dyslexia forced trial lawyer David Boies to become an unusually good listener, and it forced film producer Brian Grazer to become an exceptional negotiator.

For IKEA founder Ingvar Kamprad and investment banker Gary Cohn, dyslexia fostered a willingness to be “disagreeable” or to do things others disapprove of, such as doing business in a communist country or lying your way into a job.

In other words, a weakness, challenge, or hindrance can lead to strength.

Takeaways

It’s clear that, at times, underdogs have won and will continue to win. Improbable things happen all the time, in markets and life.

It may sound counterintuitive to make something difficult even harder than it needs to be, however, humans thrive on being stretched.

A smooth sea never made a skilled sailor.

The takeaway for investors? A great investor often learns crucial lessons from bear markets or losses.

There’s a good reason Warren Buffett and Charlie Munger are so open about their mistakes and shortcomings: They’re always learning and course-correcting as they go.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.