Financial Contagion

11 November 2022

Hi, The Investor’s Podcast Network Community!

On this Veterans Day, we want to thank all the service men and women in our audience for their sacrifices.

If you had the day off, enjoy the long weekend.

🐂 Bond markets celebrated the holiday, but the stock market was open, and bulls kept the momentum going from yesterday when the Nasdaq logged its third-largest gain since 2008.

China’s recent move to lessen its harsh Covid restrictions sparked optimism that the country would soon fully “re-open.”

This hope pushed commodities like copper higher on the expectation that its economy would begin to pick up steam again and may even help the world avoid a sharp recession 💪

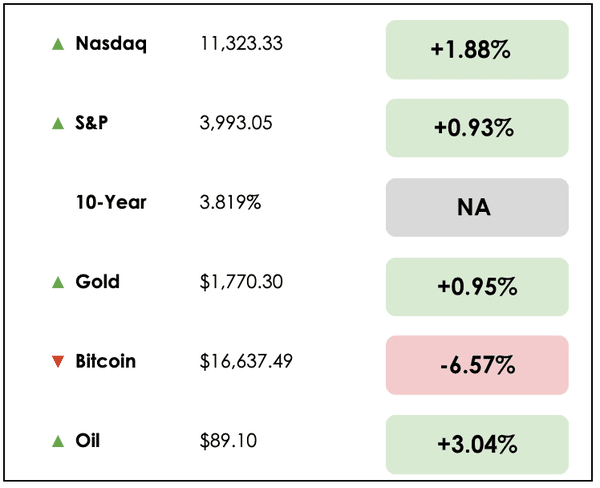

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Another shocking chapter in the crypto crisis and the newest meme stock, plus our main story on private equity’s future.

All this, and more, in just 5 minutes to read.

Do you want to write for this newsletter? Apply here.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

💩 FTX Files For Chapter 11 (Bloomberg)

Explained:

- The ongoing saga with FTX and Sam Bankman-Fried (SBF) continues in what Bloomberg has called “one of history’s greatest-ever destructions of wealth.” The 30-year-old billionaire was once worth $26 billion, but in just a few days, his fortune has plummeted to zero.

- The beleaguered CEO resigned from his position, and his company has announced it’ll be filing for Chapter 11 bankruptcy.

- Bankman-Fried will stay on to assist with the transition as John J. Ray III takes over in an unenviable position.

How it happened:

- The week-long drama began with a liquidity crunch on an FTX affiliate and an abandoned takeover deal by rival Binance.

- SBF blamed poor internal record keeping for a false accounting of leverage and liquidity on the exchange. He was seeking to raise as much as $9 billion to save the company as many prominent investors, including venture capital firm Sequoia, marked down their equity stakes in FTX to zero.

- Now, the world watches for the second-order effects of FTX’s collapse, such as financial contagion risk to other firms. On this front, the popular digital asset lender, BlockFi, is the first domino to fall after announcing it’s halting customer withdrawals.

🚗 Carvana Shares Surge (CNBC)

Explained:

- Shares of Carvana (CVNA) soared 31.6% on Thursday. They were up an additional 10% Friday afternoon, representing a small yet notable increase after major declines for the troubled used-car retailer.

- Despite the rally, the heavily shorted stock remains off by over 96% for the year. The shares were trading at nearly $300 a year ago and, as of this afternoon, were down to $11.

Why it matters:

- Carvana grew rapidly during the pandemic as consumers moved towards online purchases rather than buying at a dealership.

- The promise of hassle-free selling and purchasing used cars at the customer’s home fueled speculation that the company would capture much of the fragmented used car market.

- Analysts are concerned, though, about the company’s liquidity, rising debt levels, and lack of growth post-pandemic.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: A conversation with investing guru Mohnish Pabrai, hosted by Rohun Jauhar.

👂 LISTEN: Should CEOs have term limits? Trey Lockerbie chats with Bill George.

📖 READ: U.S. colleges talk green, but they have a dirty secret.

THE MAIN STORY: HOW HIGHER INTEREST RATES ARE RESHAPING PRIVATE EQUITY

Overview

We often write at length about how interest rates influence the stock market and real estate, and these are important things to consider, but the effects are felt throughout the entire financial system.

Private equity, for example, faces a new paradigm in this higher interest rate world, which will impact many businesses and investors.

We turned to Ted Seides, former President and co-CIO at Protege Partners and now host of the Capital Allocators podcast, to learn more.

Diving in

In a recent post, Seides provides some context on how the modern private equity industry came to be.

It was catalyzed by Michael Milken in the 1980s, who facilitated so-called leveraged buyouts (LBOs) by pioneering the “junk bond” space, which enabled purchases of companies to be funded with below-investment-grade bonds.

Types of LBOs

A private equity company may do LBOs to take a struggling, currently public stock private with the help of newly issued debt or loans so as to make operational/managerial/

Other times, the purchasing firm may split up the underlying businesses if the company has formed a messy conglomerate and sell it for parts to the highest bidder.

LBOs can also happen in competitive markets where one company hopes to acquire a peer, so it uses leverage (debt) to fund the purchase. However, this can be risky if the costs of its invested capital exceed its returns on capital.

What to know

While they may occur for a variety of reasons, the point, Seides says, is that junk bonds “supported a surge in private equity activity over the last thirty years.”

According to BlackRock, private equity markets tripled over the last decade to reach over $6 trillion.

In recent months, though, he explains that the “L” in LBO has gone away in private equity. He states: “What was once an LBO with 40% equity/60% debt now is buyout financed with 60% equity/40% debt.”

In other words, with higher interest rates making debt financing more expensive, private equity transactions increasingly rely on less leverage, which means lower returns.

Leverage

Seides explains, “Financial leverage works both ways in magnifying operating results. When a business performs, higher leverage enhances returns, and conversely, lower leverage decreases returns.”

In this new environment, private equity firms will have to rely more on underlying business growth and operational improvements than in the past to generate returns for investors since their performance is less magnified by debt.

Thirty years ago, corporate raiders using junk debt, as embodied by the fictional Gordon Gekko in the movie Wall Street, inspired a generation of dealmakers to use leveraged buyouts to reshape thousands of companies.

And with these strategies came hundreds of billions of dollars from capital allocators like pension funds and university endowments in search of returns outside traditional markets.

Takeaways

Seides argues that higher financing costs combined with slowing economic growth present meaningful headwinds to private equity managers (the “sponsors” who invest the capital their funds raise in private market deals such as LBOs).

This will, at a minimum, lower returns while raising the possibility that many businesses can no longer support their debt burdens at higher interest expenses.

He says private equity fund managers need to “pull yet another rabbit out of their hat” to avoid being “left dealing with a pile of junk.”

The implications of higher interest rates on the private equity space will weigh heavily on billions, if not trillions, of dollars of investments held by large institutions and wealthy individuals, in addition to the very real economic consequences for businesses across the globe.

Dive deeper

For more from Ted Seides, we recommend his interview with Trey Lockerbie on We Study Billionaires. And you can read his full post on the topic here.

To learn more about private equity, Clay Finck’s interview with Sachin Khajuria is an excellent resource.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.