Global Barter System

29 December 2022

Hi, The Investor’s Podcast Network Community!

A few thematic reversals have come to define 2022.

To summarize: the IPO market froze and produced the lowest fundraising since 2003, SPACs stumbled en masse to find acquisition targets and have largely liquidated, options traders’ enthusiasm for bullish bets using calls eased considerably, “crypto” crashed, and meme stocks lost their magic.

The year hasn’t just been harsh on Wall Street, though 🏦

Higher rates have made mortgages a lot more expensive on Main Street. Just a year ago, to buy a $500,000 home with a 20% down payment over thirty years, a borrower could expect to pay $207,000 in interest on their mortgage.

Today, a similar mortgage’s interest costs ($503,000) would exceed the house’s entire value, which, to make things worse, would have likely fallen since 🏡

Mortgage rates moved higher in 2022 at a faster pace than any other calendar year.

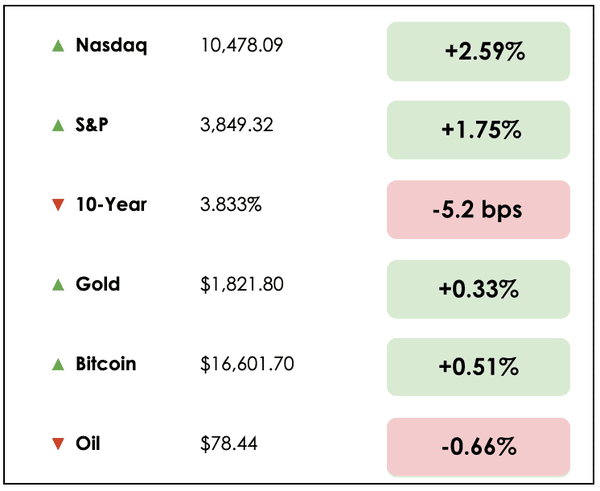

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: why “defensive” stocks have held up so well this year and details on the best-performing sector in the S&P 500, plus our main story on the financial challenges that the developing world faces.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more by visiting PassiveInvesting.com.

IN THE NEWS

⚔️ Defensive Stocks Become Hideout (WSJ)

Explained:

- Shares of utility, consumer-staple, and healthcare companies have held their own in 2022, while the benchmark S&P 500 has posted its first negative year since 2018. Amid the Federal Reserve’s aggressive fight against inflation, investors in these defensive areas have generally been rewarded with at least modest gains.

- A defensive stock demonstrates relatively stable performance, regardless of the state of the economy. Defensive stocks are also called non-cyclical stocks, sometimes even “recession-proof” stocks, as they are less prone to the economic cycle.

- Defensive sectors are also shielded from a slowing economy due to their inelastic demand. In other words, consumers must still pay for their products and services, such as electricity, groceries, and prescriptions, even with rampant inflation.

Why it matters:

- For instance, mature healthcare and auto parts companies can offer dividends to give shareholders a steady income stream and offset falling share prices. If the Federal Reserve keeps raising rates in 2023, some investors see these stable businesses as good places to hide.

- Companies in the S&P 500 utility and consumer-staples sectors offer a dividend yield of roughly 3% and 2.6%, respectively, among the highest payout percentages in the index, according to FactSet.

- Defensive sectors have been a safe haven all year, with utility stocks down 1.2%, consumer staples down 3.1%, and healthcare stocks down 4.2%. The S&P 500, meanwhile, is down about 20%.

⛽ Oil & Gas Shines in 2022 (FT)

Explained:

- While defensive areas of the market have generally held up well as described above, energy, in particular, provided the greatest outperformance. Of the 25 top performers in the S&P 500, as many as 15 will be fossil fuel operators.

- Occidental Petroleum (OXY), a Berkshire favorite, is likely to top the list, with its shares up about 120% this year. Overall, the energy sector has climbed almost 60%, outpacing all other sectors.

- In what has been the worst year for U.S. equities since 2008, oil prices have recovered since the start of the pandemic, and operators have been stingier with their capital spending despite impressive free cash flow growth.

Why it matters:

- The war in Ukraine boosted the surge in energy prices. U.S. oil and gas companies recorded $200 billion in net profits in the two quarters following Russia’s full-scale invasion.

- Uncertainty around energy supplies from the war has fostered greater price volatility, driving speculators and hedgers out of the market and reducing liquidity, which has only further fueled wild price swings and contributed to elevated price levels.

- Correspondingly, asset managers flooded back into energy stocks, helping the sector’s share of the S&P 500 more than double to about 5%. Wall Street expects high oil prices again next year, which could add to the sector’s momentum.

A MESSAGE FROM

Have gold and silver shipped directly to your door for you to hold at your home.

Get BullionMax‘s Gold Investor Kit today — 3 ounces of the world’s most desirable gold coins, including the Gold American Eagle and Canadian Maple Leaf.

THE MAIN STORY: AN UNEQUAL GLOBAL FINANCIAL SYSTEM

Overview

Suppose you lived in a developing country with an unstable currency and authoritarian government that could freeze your bank account at its discretion.

How might you stash away your life’s savings?

More specifically, if you wanted to buy a house in two years, how could you safely store that money while trying to protect its purchasing power?

Since most of our readers are based in the U.S. and Europe, these are likely questions that you’ve never had to consider seriously.

What to know

The financial systems in these developed, Western countries are comparatively secure — most people have access to well-regulated and insured bank accounts, and the currencies are the most stable on earth (even with recent bouts of inflation).

For North Americans, Europeans, the Japanese, and Australians, it’s rather easy to take the (relative) stability in our financial system for granted.

In her thoughtful, analytical writing, Lyn Alden explores “The world’s money problem” further.

The problem

To understand the challenges that most people worldwide face in saving for the future, Alden highlights Egypt. In this country of 100 million people, 74% don’t have a bank account.

In Nigeria, that figure is 55%, 50% in Indonesia, and 23% in India.

And for those who can access banking services, storing their savings in strong currencies like the U.S. dollar or euro requires foreign bank accounts, which tend to be ripe with extra fees.

For Nigeria, a country of over 200 million people, inflation (as measured by the country’s consumer price index) has risen almost 5x since 2010, while interest rates to compensate savers have been dramatically lower than inflation rates.

In Egypt this year, the local currency has lost 35% of its value against the dollar, which, as we know, has also lost purchasing power (i.e., $1 today buys less food, energy, housing, etc. than it did a year ago.)

No easy solution

Alden explains that in developing countries, which collectively face ongoing financial instability risks to a degree unknown to those in the West, it’s often very expensive to access dollars.

And storing any savings in poorly regulated banks, where authoritarian regimes can confiscate wealth at a moment’s notice, only complicates the picture further.

The trend here isn’t very inspiring, either.

Since 2005, the nonprofit organization Freedom House’s classification of “Free” countries has declined from 46% to 20%. In less free societies, restricting people’s assets and their money is a common tool for oppressing their populations into compliance.

Assuming you can convert your local currency to dollars/euros, holding these monies as physical cash is one solution. However, this is far from ideal, given that burglary or fire could destroy years of hard-earned savings.

The dollar, and to a lesser extent, the euro, are global reserve currencies that can hold their value almost anywhere. But most currencies aren’t as robust.

A global barter system

In fact, most of the world’s 180 fiat currencies endure extremely volatile fluctuations in value, which makes it difficult for entire populations to effectively preserve the purchasing power of their savings over time.

Alden continues, “nobody in the rest of the world particularly wants to hold or accept these monies, either, because they frequently devalue, or because they’re small with low liquidity and low recognizability outside of their home jurisdiction…

The global monetary system is, therefore, ironically, a big barter system. Rather than having one or two forms of money that we all use, there are 180 different monies, each with their local monopolies.

Only a handful of them, such as dollars and euros, are globally salable to a decent degree.”

Grasping the alternatives

To people in developed countries, especially those in the upper and middle classes, the preponderance of digital currencies derived from blockchains in the past decade is seemingly inexplicable and mind-numbing.

That’s at least one reason many see Bitcoin as a solution in search of a problem.

However, to billions across the developing world, digital assets like Bitcoin or stablecoins pegged to the U.S. dollar represent outlets for saving and sending money outside the local currency system, which governments would like to keep them shackled to.

The point isn’t necessarily to encourage you to buy Bitcoin or any other “crypto” token, though.

Takeaways

Instead, the aim is to reflect on the reality that, beyond the crypto euphoria that consumed the public domain in 2021, financial technology innovations offer hope and optionality in various forms to much of the developing world.

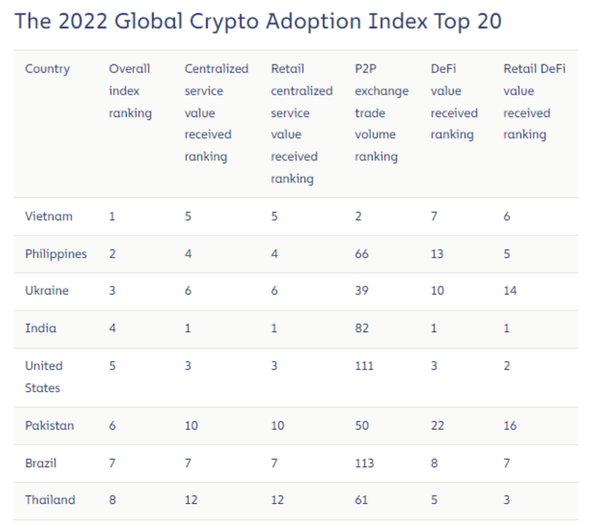

If you don’t believe me, check out the 2022 Global Crypto Adoption Index. 18 of the top 20 countries for digital asset adoption are developing countries.

The first few are Vietnam, the Philippines, Ukraine, and India, followed by the U.S., Pakistan, Brazil, and Thailand.

The real story about digital assets extends well beyond the controversies of FTX, “Yolo” trading on Robinhood, and even the United States, for that matter.

Dive deeper

For the full context, we encourage you to read Lyn Alden’s entire post.

And to round things out, if you missed our newsletter two weeks ago on the roles that money plays in economies and how that affects society, you can read it here.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.