Hindenburg Strikes Again

Hi, The Investor’s Podcast Network Community!

If you’re looking for some good news while talk of banking system issues continues to dominate, U.S. companies reshored 364,000 jobs from overseas last year — a 53% increase from the previous year.

And Congressional lawmakers grilled TikTok’s CEO over the app’s ties to China. Criticizing the app was a bipartisan fair, with the questioning running for over five hours ♨️

The whole thing felt less about TikTok specifically, and more reminiscent of increasingly tense relations between the U.S. and China generally.

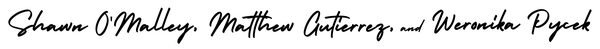

Here’s the market rundown:

MARKETS

Today, we’ll discuss two items in the news:

- Hindenburg strikes another prominent company with a scathing report

- The SEC’s pending lawsuit against Coinbase

- Plus, our main story on what we can learn from Ray Dalio’s principle of radical transparency

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

History of positive returns ✔️

Inflation-hedging potential ✔️

Resistance to market volatility ✔️

Land has helped investors preserve wealth for generations, and AcreTrader makes it easy to diversify with farm and timberland assets online — Find out how.

IN THE NEWS

📢 SEC to Sue Coinbase (Bloomberg)

Explained:

- The crypto exchange, Coinbase (COIN), has received a notice from the Securities and Exchange Commission (SEC) informing the company that enforcement action is pending over its offerings of unregistered securities, in the form of various crypto tokens, on its platform.

- Securities must be registered with the SEC before being offered publicly, which has been a thorny issue for crypto exchanges, particularly when the underlying blockchains are insufficiently decentralized.

- The Howey Test, which refers to the Supreme Court case for defining what constitutes a security, or in legal parlance, an “investment contract,” has four criteria:

- An investment of money

- In a common enterprise

- With the expectation of profit

- To be derived from the efforts of others

- The SEC is arguing that an unspecified number of cryptocurrencies traded on Coinbase pass this test. People invest money in tokens, often with a central organization making decisions about the blockchain, while expecting to profit from increased adoption.

Why it matters:

- While Bitcoin isn’t considered a security by the SEC due to its decentralization, making it more like a digital commodity, most other cryptocurrencies, perhaps all of them, depending on who you ask, are securities. And this notice from the SEC confirms that generally, at least in the eyes of regulators, without declaring which tokens are in violation.

- For a business built on enabling people to trade digital assets, the SEC’s notice is potentially devastating, and Coinbase’s stock sold off more than 14% on the news.

- The company suggested it would continue normal operations for now. Its chief legal officer commented, “We are prepared for this disappointing outcome and confident in the legality of our assets and services.”

🥊 Block Hit by Short-Seller Report (WSJ)

Explained:

- Hindenburg strikes again. No, not the famous airship disaster. Rather, Hindenburg Research, the short-selling firm that famously wiped out $140 billion in market value from the Indian conglomerate Adani Group and exposed Nikola Corp., the electric truck maker, whose founder was later convicted of securities fraud.

- This time, it’s Jack Dorsey’s payments company Block (SQ), formerly known as Square. The firm said it had conducted a two-year investigation into Block and found that the company “obfuscates” its Cash App service’s real number of users by reporting misleading figures “filled with fake and duplicate accounts.”

- Dorsey founded Square after co-founding Twitter, yet now faces accusations of “predatory loans and fees” toward lower-income people and minorities. Block pushed back on the report, calling it “factually inaccurate and misleading.” Still, the company’s stock fell as much as 22% after the news broke.

Why it matters:

- Block is best known for its white credit-card readers that let businesses accept payments with a smartphone or tablet — you’ve almost certainly used them while visiting a local coffee shop or restaurant. But Cash App, its peer-to-peer payment service similar to Venmo, has been a key driver of the company’s growth.

- Block made it easy for people to accept stimulus checks and unemployment benefits during the pandemic, which turbocharged its usage to 51 million active monthly users as of December, about double its pre-pandemic reach.

- On Cash App, users can do everything from sending money to friends, purchasing things with a prepaid debit card, receiving paychecks, buying Bitcoin and slices of individual stocks, and even filing taxes — it’s a true finance super app.

- But Hindenburg suggests many Cash App accounts are potentially fake or linked to fraud, with the app being particularly popular among criminals moving drug money or paying for sex trafficking.

“While concealing the truth might make people happier in the short run, it won’t make them smarter in the long run.”

— Ray Dalio

Same old same old

Surrounding ourselves with positive people cheering us each step of the way can be satisfying and convenient. Yet, surrounding yourself with smart people who disagree with you and challenge your viewpoints might be a door opener to success.

It’s not easy to be challenged by others, but avoiding criticism can be limiting.

Knowing what we’re good at and what we should improve makes us smarter. Hanging around people who are not like-minded allows us to seek the best outcomes, boost our performance, and keep our organization from declining.

Ray Dalio, an iconic thinker, legendary investor, and founder of the famous Bridgewater hedge fund, says that when we don’t embrace criticism from people with opposing opinions, we’re more likely to make the same mistakes repeatedly.

Bad is stronger than good

Neuroscience helps to explain why we tend to ignore and avoid criticism, and why negative feedback is difficult to accept.

Dalio describes a part of our brain called the prefrontal cortex, which is responsible for our thoughts, reasoning, and problem-solving, and it tends to be more logical.

On the other hand, there’s another part of our brain called the amygdala, which controls emotions, detects threats, and triggers our survival instincts.

When we receive criticism, it can be challenging to take it to heart because our brain might detect it as a threat and become defensive.

Dropping the critics

Scientists from Florida State University concluded from a study that we remember negative emotions much more strongly and vividly— it takes our brain five positive events to make up for one negative event.

Another insightful study conducted by Francesca Gino, a professor at Harvard Business School, discovered that employees tend to drop relationships with those who provide more negative feedback, choosing to surround themselves with people who validate their positive qualities.

Unsurprisingly, the study showed that employees who avoided negative feedback performed much worse in the subsequent year than those who held back from confirmation-seeking behavior.

Criticism avoidance is a common trap, but the associated costs are considerable.

Radical truth and radical transparency

Ray Dalio shares his philosophy on how being radically honest is key to learning faster, adapting easily, and making more objective and fact-based decisions that impact organizations’ performance.

Some people are uncomfortable with such transparency, but as Dalio claims: “honesty — however brutal — makes for a more effective, meritocratic work environment, one in which the best ideas surface, and rigorous debate can flourish.”

He makes it clear that the concept of being radically honest and transparent with your feedback should:

- Come from a place of good intentions

- Apply to everyone equally — employees, managers, and executives

- Should not be abused and should stick to the merit only

Radical truth and transparency are fundamental to building an organizational culture of innovation and mutual trust.

Dalio shares that this approach is also invaluable for continuous improvement, as “learning is compounded and accelerated when everyone has the opportunity to hear what everyone else is thinking.”

Lead by example

When people feel safe to ask questions, challenge others’ opinions, or share their game-changing ideas, the organizational culture and business performance benefit.

As Winston Churchill said, “There’s no worse course in leadership than to hold out false hopes soon to be swept away.”

In other words, we should expect our leaders and colleagues to tell the truth because only then we create an environment of mutual respect, transparency, innovation, and adaptivity.

To start practicing radical transparency, consider these points:

- Realize that you have nothing to fear from knowing the truth

- Have integrity and demand it from others

- Create an environment where everyone has the right to understand what makes sense, and no one has the right to hold a critical opinion without speaking up

- Meaningful relationships and meaningful work are mutually reinforcing

Dive Deeper

If you’re eager to learn more about how to deal with criticism, read Principles by Ray Dalio.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.