Inflation-Fighting Robots

15 November 2022

Hi, The Investor’s Podcast Network Community!

Welcome back, We Study Markets readers 📖

Despite reports that Russian missiles landed in NATO-ally Poland and killed two civilians, stocks pushed higher.

💭 This was apparently on hopes that U.S.-China tensions were easing after President Biden and Xi Jinping’s meeting and that inflation had peaked following the second month of slowing price increases for suppliers

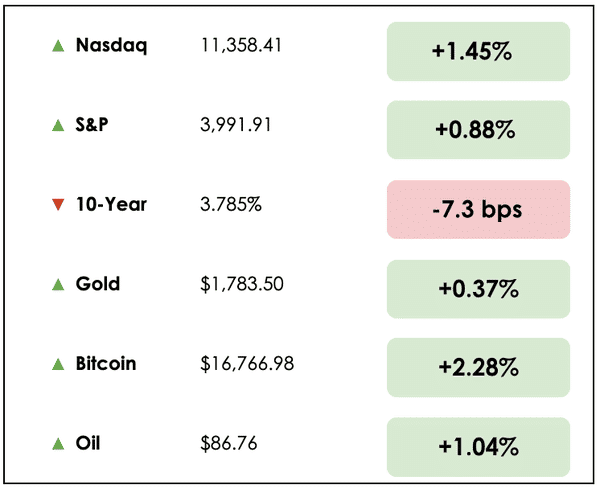

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: More details on Warren Buffett’s surprising investment in Taiwan and Walmart’s big buyback announcement, plus our main story on whether robotics can save us from lasting high inflation.

All this, and more, in just 5 minutes to read.

(Do you want to write for this newsletter? Apply here.)

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🇹🇼 Berkshire Buys New Stake in Taiwanese Chip Giant (Bloomberg)

Explained:

- As we mentioned yesterday, Berkshire Hathaway (BRK.A) bought nearly $5 billion of stock in Taiwan Semiconductor Manufacturing (TSM), a rare and significant move into the technology sector by Warren Buffett’s conglomerate.

- The news sent shares in the world’s leading chipmaker surging as much as 9.4%. The Taiwan-based company had recently seen its shares hit a two-year low and wipe out roughly $250 billion in market value.

Why it matters:

- Taiwan Semiconductor produces computer chips for clients such as Nvidia (NVDA) and Qualcomm (QCOM), in addition to being the exclusive supplier of Apple’s (AAPL) Silicon chip. And Apple remains Berkshire’s largest holding, comprising roughly 42% of the portfolio.

- Chipmaking is poised for sustained growth over the coming years since it’s essential to high-tech industries like self-driving cars, artificial intelligence, smartphones, connected home applications, and cloud services.

- The move is out of character for Berkshire, which typically avoids the tech space, yet TSM’s monopoly power in the industry and discounted price appear to have outweighed other concerns.

🛒 Walmart Shares Jump on Buyback Announcement (Reuters)

Explained:

- Walmart (WMT) said Tuesday that sales rose by nearly 9% in the third quarter, as Americans across all income levels bought its low-priced groceries.

- The company posted a third-quarter loss of $1.8 billion due to $3.3 billion in legal settlements to resolve U.S. state and local lawsuits accusing them of mishandling opioid pain drugs. Despite this, it beat Wall Street expectations and raised forward guidance.

- The retailer also announced a $20 billion share buyback program, which pushed its shares to a six-month high.

Why it matters:

- Walmart’s results boosted the share prices of other major retailers, including Target (TGT), Costco (COST), and Macy’s (M), providing hope for sustained consumer spending.

- John David Rainey, Walmart’s Chief Financial Officer, said, “In this period of macroeconomic uncertainty, we’re well-equipped to continue gaining market share in an environment where consumers need to stretch their dollars further.”

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

THE MAIN STORY: CAN ROBOTS SAVE US FROM INFLATION?

Overview

The convergence of geopolitical tensions (the “chip war” between the U.S. and China) and the Covid-19 pandemic illuminated the fragility of our global supply chains, dramatically reshaping them and expanding the urgency for advanced industries like robotics to develop.

More automation would boost production efficiency in response to the global shortages and inflation that have dominated headlines for the past two years.

As developed economies deal with labor shortages and rising manufacturing costs while trying to “re-shore” (opposite of offshoring) their supply chains to mitigate political/economic risks, automation offers an effective remedy.

To understand this trend better, we dove into research from HC Andersen Capital.

What to know

They write that the addressable market for robotics has increased meaningfully in recent years, with everything from artificial intelligence and 3D visualizations to “cobots” (production spaces shared between human workers and robots) relying on automation.

HC Andersen sees this market potentially reaching $230 billion in size.

They also see robots playing a significant role in transitioning to more “green” economies.

One study of robotics companies in Denmark found that more than 80% of them implicitly supported the green transition because they could generate less waste than traditional production lines while using less energy with minimal human involvement.

How Have Robotics Stocks Performed?

Over the past five years through October, the Global X Robotics ETF (ROBO) has notably underperformed other speculative growth areas like cloud computing (SKYY), clean energy tech (INRG), and the Nasdaq more broadly.

ROBO has returned just 7.4% over this period, while SKYY returned 48.4%, INRG 131.8%, and the Nasdaq 64.8%.

The researchers argue that, while the 2010s saw digitalization offer the highest return, large investments in the physical world will be needed to address today’s supply imbalances that’ll pay off for the robotics space over the rest of this decade.

How to value robotics stocks

The report continues by offering a simple four-part framework for assessing robotics companies.

1. Technology: Investors should consider the technological solutions being offered by a company

- Companies with simpler technologies and no patents can be easily copied by larger companies or new entrants, meaning they should carry a lower valuation.

- Overly-complex technologies may not be ready for market or easily commercialized.

2. Commercialization phase: How commercialized is the company? Do they have scalable production and financials to review?

3. Geographical presence: Are the company’s products regionally concentrated, or do they offer solutions that can be applied broadly across diverse production lines globally?

- More simply, how many countries is the company currently selling its products in?

- Countries that only generate sales in their home countries should be seen as less proven and more speculative.

4. Market and accessibility: Robotics companies typically aim to disrupt and replace existing technologies, but some are on the cutting edge of new industries, so the target market must be considered.

- Companies entering established markets looking to displace existing players may succeed quicker than companies investing in growing a new type of industry.

They then use this framework to evaluate three Nordic-based robotics companies as potential investments. The pitches are pretty interesting and represent opportunities outside of the crowded Silicon Valley world — check them out here.

Summary

The argument for robotics firms makes sense to us generally.

If globalization is reversing due to increasing tensions between global powers (i.e., Russia’s invasion of Ukraine, Chinese tensions with the U.S. over Taiwan), then countries need to be more self-reliant going forward.

They can do this by bringing back production to places like the U.S. and Europe, but that necessitates a huge adjustment to their current labor forces.

For example, in the U.S., we saw inflation moderate for decades because the production of most of our goods and services, including everything from T-shirts to electronics and medications, relocated to countries that could pay their workers considerably lower wages.

This enabled companies to increase profits without raising prices by lowering their input costs.

Takeaways

It appears, though, that we’ve made ourselves overly dependent on countries like China, whose harsh and extended Covid-19 lockdowns rippled through Western economies resulting in shortages of key goods.

To restore domestic supply chains and production capabilities, large swathes of the American labor force would have to be re-trained for previously outsourced jobs, and these workers will come at a much higher cost than their developing-world peers.

Greater automation and robotics, then, can fill this void.

Companies looking to diversify their operations out of places with high political risks and struggling to find workers in developed countries at a modest cost may find automated solutions increasingly enticing.

Dive Deeper

It’s a topic we’re just dipping our toes into, but the thesis is compelling.

To invest in the space more broadly, the ROBO ETF we mentioned enables you to own 81 leading companies driving innovation in robotics and automation.

For those interested in other research from HC Andersen, they have an interesting report on opportunities in the Green Tech space.

A MESSAGE FROM SHORT SQUEEZ

PrIvate equity has gone mainstream — it’s no longer just “alternative.”

Private markets, including private equity, credit and other investment strategies, are a $12 trillion industry — and through the next decade, this figure could exceed $20 trillion.

In his book Two and Twenty, Sachin Khajura looks under the hood of private markets to deliver an examination of how some of the best dealmakers think, act, and organize to keep winning.

The first 50 people to sign up using this link get the free book and 3 months free insiders membership.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.