Insight Information

12 January 2023

Hi, The Investor’s Podcast Network Community!

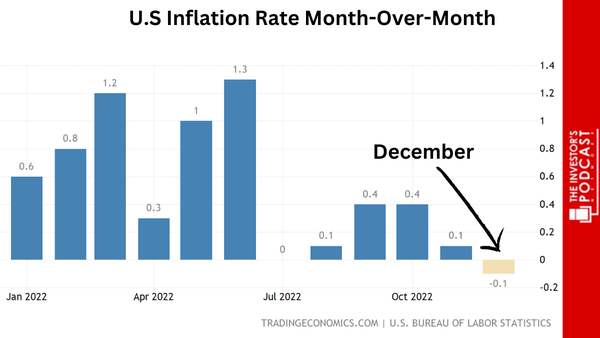

For the sixth straight month, inflation has decelerated in the U.S. after today’s report on December revealed a 6.5% year-over-year increase in the Consumer Price Index (CPI).

On a month-over-month basis, which is most important for understanding the current rate of change in prices, CPI fell 0.1%, due primarily to a sharp drop in energy prices 📉

The Fed is expected to hike rates by just 0.25% at its next meeting, as it reduces the size of rate hikes to allow past hikes to ripple through the economy while inflation cools ❄️

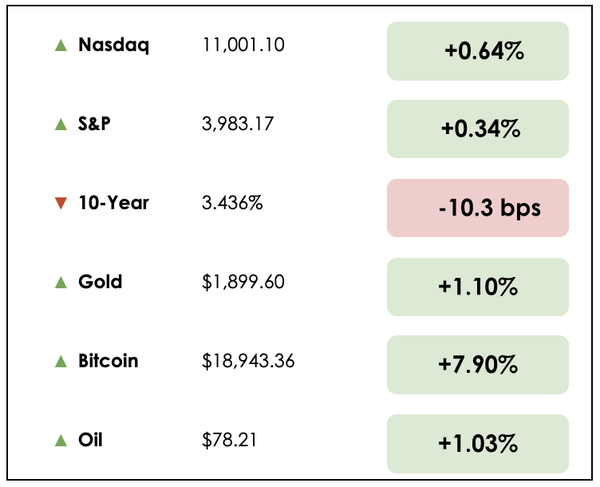

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: One major sandwich brand shakes up the dealmaking space, and Apple considers a major change to its Macs, plus our main story on leveraging “insight information.”

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

History of positive returns ✔️

Inflation-hedging potential ✔️

Resistance to market volatility ✔️

Land has helped investors preserve wealth for generations, and AcreTrader makes it easy to diversify with farm and timberland assets online — Find out how.

IN THE NEWS

- The largest restaurant chain in the U.S. by number of locations, Subway, is exploring a sale. While in the early stages, a possible deal attracting corporate buyers and private equity firms could value the closely held private company at more than $10 billion.

- Subway, known for its foot-long sandwiches and quick-service restaurants, has been owned by its two founding families for over five decades.

- The company became pervasive globally by aggressively building new locations, though it has stumbled in the last decade after sales peaked in 2012. Since 2019, John Chidsey, the first chief executive officer from outside of Subway’s founding families, has been organizing a dramatic turnaround for the company.

- With approximately 21,000 U.S. locations and $9.4 billion in sales in 2021, Subway is a corporate giant with an even bigger brand reputation.

- While mergers, acquisitions, and other dealmaking activity were squashed by the shock of rapidly rising rates in 2022, falling 41% in the U.S., a sale of such a prominent brand could help ignite deals again in 2023 as the rate of change in interest rates slows.

- However, a private-equity buyout of Subway could be complicated by a challenging market for leveraged loans, which many firms use to support such deals, as banks have pulled back on riskier lending activities.

- Apple Inc. (AAPL) is working on adding touch screens to its Mac computers, a move that defies the company’s long-held belief, as espoused by its co-founder Steve Jobs, that such products are “ergonomically terrible.”

- While a launch hasn’t been finalized, Apple engineers are seriously engaging with the project. For over a decade, the company argued that touch screens don’t work well on laptops. Instead, it pushed customers towards purchasing its iPad products.

- Steve Jobs’s successor, Tim Cook, maintained a commitment against touch-screen computers, comparing Microsoft’s (MSFT) blending of tablets and laptops to combining a toaster with a refrigerator in 2012. Now, it’s thought that the first touch-screen Macs could be revealed in 2025.

- As rivals have increasingly added touch screens to computers and refined the technology, Apple must now contend with cannibalizing sales of its iPads. In recent years, a resurgence in demand for Macs has been a bigger moneymaker for the company than iPads, and this move could reflect their intentions to double down on Mac sales growth.

- Apple has famously reversed course in other areas previously, with Jobs at one point arguing that Apple wouldn’t sell phones or tablets. Evidence for a touch-screen Mac pivot began surfacing in 2018 when the company started bringing iPad apps to the Mac.

- At a conference this past October, Apple’s chief software engineer struck an ambiguous but less hostile to tone in response to a question on the matter, remarking, “who’s to say?”

RECOMMENDED READING: THE STEAL CLUB

The Steal Club is a creator-focused newsletter. Alex breaks down the tactics and strategies that the best creators use to grow their audience and business, so you can ‘steal’ them for your own journey.

The Steal Club is insightful, actionable, and easy to read.

Join 4,500+ creators getting better at content now!

Overview

Today, we welcomed back my former co-writer and friend, Patrick Donley, who now hosts our Real Estate Investing podcast, to share his thoughts on “insight information.”

He writes the following:

What to know

William Green recently sat down for an outstanding Richer, Wiser, Happier interview with John Spears, a legendary investor who spent nearly 50 years at the iconic investment firm Tweedy, Browne.

As a managing director and member of the firm’s investment committee, Spears helps to run the flagship Tweedy, Browne International Value Fund, which has beaten the MSCI international stock index by roughly 600 percentage points over three decades.

The Early Years

Like many of the greatest investors, Spears became fascinated by the stock market at a young age and bought his first stock at twelve. He had a grandfather who was an investor who taught him how to read the newspaper’s financial pages.

Just like Buffett, he delivered newspapers and had several entrepreneurial ventures, including selling cold Coca-Cola to construction workers during the summer. One part-time business selling expensive Christmas cards netted the equivalent of $40,000 during his high school years.

Independent Learner

As a kid, Spears studied the biographies of successful investors, including Joseph Kennedy and John Paul Getty. He wrote to one of his heroes, Charles Allen, who wrote back and invited him for a visit to his office in New York City.

John played hooky from school to visit his investment idol, who advised him to learn the language of business — accounting and finance. He signed up for a correspondence course in Security Analysis taught using Benjamin Graham’s “bible of investing.”

Graham’s work convinced him it was possible to buy bargains in the stock market and do very well.

Spears dropped out of college because he was in a hurry to enter the investment world. Many of the successful investors he had studied had also ended their formal education to become self-learners focused on their core interests.

A Winning Strategy

Recently, Spears has been studying empirical work on cloning C-suite or top executive insider trades for companies not only in the United States but throughout the world.

Interestingly, copying the trades of top insiders has tended to beat the market over time.

Tweedy, Browne produced an exceptional study called What Has Worked in Investing, which evaluated investment approaches that have historically produced exceptional returns.

The study explained that insiders often buy their own company’s stock when it’s depressed relative to its intrinsic value. Insiders often have “insight information” — knowledge about new marketing programs, product price increases, cost cuts, increased order rates, changes in industry conditions, etc. which they may believe will increase the company’s underlying value.

Breaking it down

Insight information is an informed opinion on a company and industry, in contrast to material, non-public insider information that’s illegal to trade on.

Other examples of insider insights are: knowledge of ‘hidden assets,” such as the potential value of a money-losing subsidiary with a few strategy tweaks, the value of excess real estate not required for a company’s operation, or familiarity with the expected earnings power derived from large expenditures on product development.

It’s common to see significant insider buying in companies after large contractions in the stock’s price-to-earnings (PE) or price-to-book ratios, especially if these ratios become cheap compared to industry competitors.

The Results

In the Tweedy, Browne study, they ranked top executive purchases based on price-earnings ratios.

The companies with significant insider buying and the cheapest relative stocks tended to have exceptional excess returns above the S&P 500 benchmark, producing an average alpha of more than ten percentage points.

As Spears has argued, tracking C-Suite insider buying of low PE stocks is one of the best ponds in which to fish.

Dive Deeper

For a wealth of investment and life wisdom, listen to the Richer, Wiser, Happier episode with John Spears.

And for even more insight on market-winning approaches that have produced exceptional returns, spend some time with the Tweedy, Browne study.

Be sure to also check out Patrick’s first interview on our Real Estate Investing podcast!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.