Maybe bear markets aren’t so scary?

13 July 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

If you thought your 20% portfolio decline so far this year is bad, it’s even worse when you account for inflation, which came in hot at an annualized rate of 9.1% 😅 More on that below.

Today, we’ll also be discussing Bill Ackman’s SPAC, red flags in real estate, what to know about bear markets, how to calculate intrinsic value, and much more, in just 4.5 minutes to read.

Read on 📖

In The News

🚨 June’s CPI report shows a 40-year record high in inflation (Reuters)

Explained:

- Another month, another record-breaking inflation report. This time inflation came in at 9.1% annualized, while forecasts were expected a bit lower at 8.8%. Even excluding volatile food and energy prices, this measure, known as core CPI, still increased 0.7% month-over-month in June. With this report, and a strong jobs report showing that 372,000 jobs were created in June, the pressure is increasingly on the Federal Reserve to respond with more aggressive interest rate hikes. As we’ve written about recently, the Fed is in a dilemma where it needs to induce a recession, or at least slow the pace of economic and job growth, so that consumer spending can fall enough for inflation to be reined back in. This is no easy task, and one fear is that they will respond too aggressively and trigger a harsh recession.

What to know:

- Investor attention now turns to the Fed’s next rate hike set for later this month, as they brace for another likely 75 basis point increase. Overnight interest rates have risen 150 basis points since March already. While the Fed is swooping into action now, critics would highlight that they spent much of 2021 turning a blind eye to accumulating inflation warnings while maintaining quantitative easing programs and extremely low interest rates.

In some sense, there’s a perfect storm of factors here contributing to these inflation levels, including the incredible disruptions in the global economic system stemming from the pandemic and the war in Ukraine, made worse by extended loose monetary policies and government stimulus aimed at fueling a recovery. Things are ugly right now, and consumers and investors are feeling the full force of it.

🏘️ Mortgage giant warns of an accelerated downturn in housing after cutting thousands of jobs (Forbes)

Explained:

- With mortgage demand sinking from higher interest rates, LoanDepot is the latest company to take drastic action to prepare for harder times. In a filing, the company announced that it had already cut 2,800 jobs, with plans to cut another 2,000 by the end of the year. The company’s CEO had this to say: “After two years of record-breaking volumes, the market has contracted sharply and abruptly in 2022.”

What to know:

- LoanDepot’s stock (LDI) is down around 88% on the year, and if their turmoil is any indication of what more is to come, then there’s good reason for concern. Wells Fargo and JP Morgan have also laid off thousands of employees in their home-lending departments, so LoanDepot isn’t the only large firm in the space downsizing. These sorts of stories raise alarms about the depth of a pending recession, though long-term, the flurry of home buying that’s transpired over the past two years was surely unsustainable. Some amount of cooling off is well deserved, and probably even healthy, for many housing markets.

🗑️ Bill Ackman to close his $4 billion SPAC (WSJ)

Explained:

- The famed hedge fund manager was unable to find a target to acquire through his special-purpose acquisition company (SPAC), as it approached its two-year deadline for a deal, after launching on the New York Stock Exchange in July 2020 and raising $4 billion. A SPAC is a shell company that raises money from external investors, typically trades publicly, and has a fixed period that it must successfully acquire a private company. With the downturn in markets this year, fewer companies are seeking to go public though, and those that are have chosen more traditional routes like IPOs. The fund will now return its capital to shareholders.

What to know:

- After attempting to orchestrate a deal that would allow him to invest the SPAC’s funds in Universal Music Group last summer, SEC scrutiny pressured Ackman to step away. Now, in a blow to those hoping SPAC markets could return to their 2021 glory, the largest-ever SPAC has failed to live up to investor hopes. Ackman’s not giving up yet though, as he’s said he’s now working on a new investment vehicle called a SPARC, or special-purpose acquisition rights company, that would allow investors to buy ownership shares in a company after they’ve merged with the vehicle. He hopes this new structure will ensure that deals are more likely to be completed – we’ll wait to see what the SEC thinks of this plan though.

Sponsored By

How do you make sure that you are investing with a “good” operator?

Dan Handford and his wife are currently invested in 54 different passive real estate syndications with 16 different operators in 10,000+ doors.

They use this exact list when deciding whether or not to invest with a particular group. Get access to the “7 Red Flags for Passive Real Estate Investing” to be confident in your next investment!

Dive Deeper: The truth about bear markets

To gain some perspective on recent market declines, we turned to none other than the great value investor Bill Nygren of Oakmark Funds, to hear his latest commentary.

He points out there’s no beating around the bush, it’s been a bad year for stocks, as sentiment among the American Association of Individual Investors fell to its lowest level since 2009.

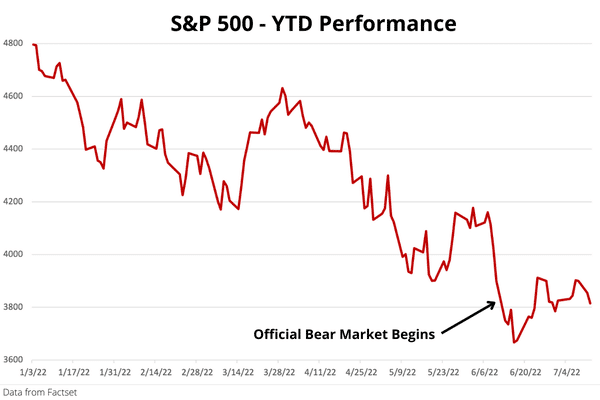

When equity indexes drop 20% from their recent high, they’re known to be in a bear market, and for U.S. stocks, this happened officially last month.

But what are the actual implications of this – should we be afraid?

According to Nygren, over the last 77 years, there have been twelve bear markets in the U.S., including this current one. In those, the longest it took for a market to bottom after entering a bear market was two years, and the median additional decline was just 10% before bottoming, while the median gain over the next two years was 33%.

So, after just two years from the mark of an official bear market, returns have been quite strong.

Some might be quick to highlight that we aren’t just experiencing a decline in markets, but rather, there are corresponding weaknesses in the real economy warning of a recession that’s driving the sell-off.

To which Nygren says, “we looked at the twelve recessions that have occurred since 1945, to see the price change in the S&P 500 during the two years after it was known that a recession had begun. The median two-year price increase in the S&P 500 was 25%, and only one of the twelve periods showed a negative return.”

Does this mean that long-term investors shouldn’t be phased by recessions or bear markets?

Well, for the most part, if history is any guide, then yes. As Nygren explains, “if the late July announcement of the second-quarter real GDP turns out to be negative, don’t be bothered: There is no evidence that below-average investment returns are likely to follow.”

The elephant in the room here is inflation, which at elevated levels, is surely bad for stocks, as it indicates disruptions throughout the economy (if there were no disruptions and supply/demand were balanced, there likely wouldn’t be high inflation).

While painful for investors and consumers, bouts of inflation above 8% (its current levels) have not necessarily spelled doom for equity markets over time. In the five times that inflation has previously hit 8% or higher, S&P 500 returns over the next two years had a median price increase of 17%.

So what?

While it’s tempting to panic in light of current circumstances, historic data would suggest otherwise. This is because stock prices anticipate future events, meaning by the time they’ve already happened, such as high inflation readings or an official GDP decline that marks a recession, prices have already accounted for them.

This means we may already be through the worst of it.

The takeaway?

There are a lot of reasons to be pessimistic in the short term about stocks, but American equity markets have proven to be exceptionally resilient over time.

While we’re currently in a bear market, a possible recession, and a state of quite elevated inflation, with a two-year grace period, stock returns have actually been quite strong since the onset of any of these fear-invoking events.

If anything, now might be a good time for patient investors to consider allocating more to equities.

Disagree? Let us know by replying to this email.

Quote of the Day

“Stocks we own that raise eyebrows for being “too growthy” for a value investor, such as Alphabet, Booking, Meta and Netflix, all sell at lower P/Es than the average electric utility.

Value investing shouldn’t mean limiting one’s portfolio to below-average businesses. A value investor should be willing to buy any business, but only at a significant discount to its intrinsic value.

When businesses like Alphabet, Booking, Meta and Netflix are priced as if they weren’t as good as electric utilities, the question should be, “How can a value investor not own them?””

Meaning

After reading Nygren’s reflection on the second quarter, we were inspired to share this quote from it. This year, many of investors’ favorite picks from the last decade have been crushed, and some value investors are starting to think they look appealing.

For years, we’ve heard though that Alphabet (Google), Netflix, and Meta (Facebook), among others, are supercharged growth stocks, while the stereotype of value investors is that they typically invest in safe and boring companies like electric utility providers.

Much of this perception is attributable to Warren Buffett, who is known for frequently saying that he will not invest in businesses he doesn’t understand, which are typically tech companies.

Nygren is a great investor in his own right though, and if he’s eyeing these stocks, that at least piques our interest.

So let us know, are you buying beaten-down tech stocks?

For more Bill Nygren, check out our recent interview with him, where Bill explains further why he thinks Facebook is a value stock.

If you like our industry leading podcasts like We Study Billionaires, Bitcoin Fundamentals, and Richer, Wiser, Happier, you can subscribe to listen to them without ads through Apple Podcasts (just $2.99/month).

The meaning of intrinsic value

The key to effective investing is purchasing stock below its intrinsic value.

If a company is worth $20 per share, and you buy it for $15, you received a 25% discount. And the larger the discount, the higher your margin of safety, which hedges your risk of being wrong and reduces your potential losses. Always remember though that price is what you pay, while the intrinsic value is what you get.

Discerning a company’s intrinsic value is the hardest part to investing, but we do have an intrinsic value course for you to employ.

What to know

As a shareholder, you’re entitled to the company’s equity value. So, once all of the company’s debts are paid off, whatever’s left belongs to you, at a value proportional to your ownership share.

If the company’s equity (the difference between assets and liabilities) is worth $100, and you hold 1 share out of 100, you’re entitled to $1. But that doesn’t mean the shares are only worth $1, because that company isn’t likely to sell all of its assets (i.e. real estate, equipment, factories, patents, etc.). Rather, companies seek to continue operating profitably so that equity value will rise in the future.

This means that the intrinsic value equals the current equity value plus the expected future increases in equity value discounted to today.

Those future increases (cash flows) to equity are discounted due to the time value of money. In other words, a dollar today is worth more than a dollar in a year from now, partially because of inflation and also because you could invest a dollar today to have more than a dollar in a year.

If you’re looking for help estimating a stock’s intrinsic value, you should check out our intrinsic value calculator (sign-up for free).

See You Next Time!

That’s it for today on We Study Markets!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.

We’ll see you back here again tomorrow – same place, same time 😉

P.S The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more! Join our subreddit r/TheInvestorsPodcast today!