Price Caps

2 September 2022

Howdy, The Investor’s Podcast Network Community!

Happy Labor Day weekend and welcome back to We Study Markets!

We won’t be on to cover the news Monday, but we’ve got a special edition planned for you all. Stay tuned!

Not-so-fun fact: As measured by the S&P 500 and Bloomberg U.S. Aggregate (Bond) Index, the conventional 60/40 portfolio is down almost 14% for the year, which represents the worst showing for the strategy since 1976. The same portfolio would have lost around 8% in 2008.

Stocks were mixed today, moving higher this morning following a “goldilocks” job report only to pull back after news broke that Russia will shut down the Nordstream gas pipeline for extended repairs, as it’s widely believed Russia is weaponizing energy flows.

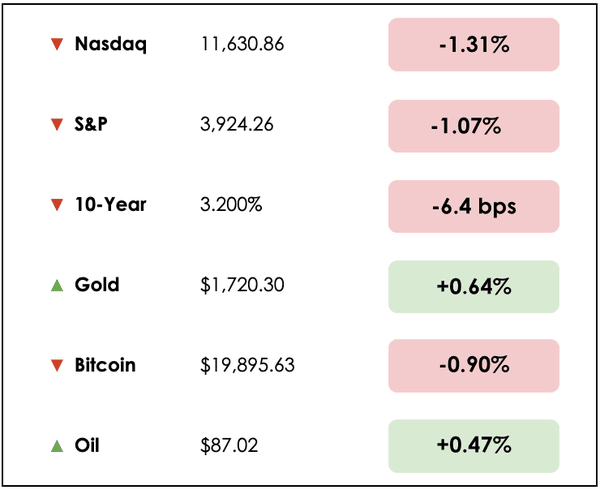

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss the August jobs report, price caps on Russian oil, more bad news for Europe, and the biggest myths in investing.

All this, and more, in just 5 minutes to read.

Let’s dive in! ⬇️

IN THE NEWS

❗August Jobs Report Posts Increase (WSJ)

Explained:

- U.S. employers added 315,000 jobs in August, and the unemployment rate rose to 3.7%, indicating a slower but solid pace in a tight labor market. The stock market opened higher on the news giving hope to investors that a soft economic landing by the Fed may be possible and that continued aggressive rate hikes may not be necessary.

- U.S. employers have averaged adding 378,000 jobs in the past three months. Job gains were strong in professional and business services, healthcare, and retail. Job growth has been resilient this year, despite a contraction in the overall economy in the first half of the year and aggressive rate hikes by the Fed.

What to know:

- It’s a strange time to interpret economic data. Some signs point towards a rapidly slowing economy due to the weight of high inflation. As the Fed increased interest rates to slow the economy and curb inflation, Jerome Powell gave a warning in late August that he expected the Fed’s moves would hurt the labor market and the overall economy. Gross domestic product shrank in the first two quarters of the year.

- There is still pent-up demand for workers, as the Labor Department said there were 11.2 million job openings, which amounts to two vacant jobs for every unemployed person.

🛢️G7 Countries Set To Put Price Cap On Russian Oil (FT)

Explained:

- The G7 nations have announced a plan to cap the price of Russian oil on global markets, committing to novel sanctions aimed at reducing Russia’s oil revenues as its invasion of Ukraine continues.

- The G7 finance ministers announced a plan to ban the insurance and financing of shipments of Russian oil and petroleum products unless they are sold under a set price cap.

What to know:

- The G7 finance ministers said in a joint statement, “the price cap is specifically designed to reduce Russian revenues and Russia’s ability to fund its war of aggression whilst limiting the impact of Russia’s war on global energy prices.”

- The agreement is a political victory for the U.S., which first privately suggested a price cap in April as a means of punishing Russia, but several European countries were skeptical of its viability.

- The actual level of the cap will be decided in future talks, and non-G7 nations are invited to join the plan.

⛽ Russia To Keep Pipeline Shut (WSJ)

Explained:

- The Kremlin-controlled energy company Gazprom said it would suspend the Nord Stream natural gas pipeline to Germany until further notice, which increases the pressure on European governments as they race to avoid energy shortages this winter.

- Gazprom said a technical fault was found today during routine maintenance of the pipeline which connects Russia with Germany under the Baltic Sea. The pipeline will remain shut down until the issue is fixed and no timeline has been given on when that will occur.

What to know:

- Prior to the maintenance, the pipeline was operating at just 20% of its capacity which Russia claimed was due to technical issues. European governments, however, have dismissed those issues as an excuse by Vladimir Putin to use its gas exports to punish Europe for supporting Ukraine.

- A complete shutdown of the pipeline provides an impetus for European governments to accelerate their push to become independent of Russian gas and may force them to ration energy. Such a move would hurt industrial companies and tip the continent’s already fragile economy into a recession.

FEATURED SPONSOR

Are you worried about inflation? There are few better ways to beat inflation than real estate, but even real estate isn’t all sunshine and rainbows. Learn about the 7 Red Flags for Passive Real Estate Investing from PassiveInvesting.com.

DIVE DEEPER: THE BIGGEST INVESTING MYTHS

Cullen Roche, founder of Pragmatic Capitalism, is a fan favorite on our podcasts, so today we wanted to highlight some of his great work.

Roche is an excellent and unconventional thinker who seldom hesitates to challenge the, sometimes, flawed narratives that define the status quo.

Recently, we read over his series on the biggest myths in investing, so let’s go through our takeaways.

Myth: Buying stocks makes you an “investor”

While we, like most others in the space, loosely throw around the word “investing’ to reference those who invest in stocks, in reality, most of us aren’t really investing in the most technical sense. Rather, Roche explains that it’s more accurate to describe our actions, in say buying Apple stock on the New York Stock Exchange, as reallocating our savings, not “investing.”

In this sense, investing refers to its use in economics, where it means to invest directly in capital projects that expand output and boost productivity. Entrepreneurs, then, are the real investors, as they stake both time and money into new ventures. Or those who directly provide financing to businesses can also be thought of as investors.

For most of us, when we buy stocks, we’re doing so on the secondary market, meaning that we’re exchanging our currency for shares in a company that are currently held by another individual investor or institution. But none of these funds directly go towards financing the underlying business that’s participating in the real economy.

Myth: The stock market is a place to get rich

Building on his logic above, if we think of “stock investing” in this alternative manner, this is really just a strategy for how we allocate our savings.

Buying stocks and bonds, then, represent a higher risk alternative to bank savings accounts with higher potential returns, but in aggregate, people aren’t getting rich quickly in the stock market.

At a generous 7% real rate of return, it’ll still take you decades to compound your wealth into a large sum. This is a long endeavor more akin to patient saving than getting rich quickly so act accordingly.

By the time stocks have been listed on public exchanges, much of the value creation that would make one rich quickly has already transpired.

The business’s founders and early investors may have made a fortune, but you’re now stepping into things much later in the game. That’s okay, but we ought to temper our expectations accordingly.

Myth: Gold is a good portfolio hedge

Roche asks whether we’ve ever seen those commercials with fear-mongering messages about inflation or a collapse in the financial system that inevitably end in them selling you on buying gold.

Isn’t it strange, then, that they want to be paid in the very thing they’re telling you to be afraid of? That is, dollars.

Roche argues that, since 1970, adding gold to a portfolio of bonds and stocks has typically lowered your returns while introducing greater volatility.

For free-market purists, gold’s market capitalization represents less than 1% of all global financial assets, so why disproportionately invest in something that’s value fails to meaningfully carve out a place in the investment world?

Roche actually says that in recent history, during times of economic crisis and uncertainty, U.S. Treasury bonds have been a far safer and better performing hedge than gold.

And lastly, because gold is a commodity, it produces no cash flows.

Buying it better reflects a speculation, or a hope and belief that its price will rise, than an investment. That’s because its price isn’t necessarily tied to intrinsic value assessments, such as discounting expected cash flows for a stock.

Myth: Fees are a small price to pay for expert advice

For this one, Roche explains that it’s pretty well documented by now that most professional investors fail to outperform the market averages. Many hedge funds, wealth advisors, and 401(k) plans charge exorbitant fees, yet they fail to, in aggregate, add any value.

In fact, the differential in fees between more expensive wealth management/investment products and low-cost index funds can be quite a sizable gap over time.

An investor who chooses a 0.1% low-fee index fund will likely realize over decades tens of thousands, if not hundreds of thousands, of dollars in superior performance relative to the same investor that chooses a more expensive mutual fund with 1% fees or more.

That fee differential compounds over time and can lead to dramatic results. Unlike in most of our shopping experiences, paying a higher price tag in investing doesn’t equate to greater quality (higher returns), and doing so can be financially devastating comparatively.

Although some advisors certainly add value, Roche says that on average, we shouldn’t be paying higher fees with the expectation of getting a greater return — there are plenty of excellent low-cost advisory services and index funds that’ll get the job done.

Myth: Forecasts are useless

For this last myth, Roche highlights that in portfolio construction, what matters more than being precisely right, is not being hugely wrong.

Great investors think in terms of probabilities, and while we’ve collectively grown to shun expert analysis and forecasts in recent years, particularly following their failures in the 2008 financial crisis, such a decision isn’t entirely prudent.

Technology has enabled us to test unimaginable amounts of past economic and market data which, combined with a sound understanding of the underlying realities and concepts, should enable investors to generate probability forecasts that are directionally correct enough such that they’re useful in avoiding catastrophic errors.

In other words, past returns don’t guarantee or even always predict future performance, but they create a track record of evidence for us to reflect on and learn from when interpreted in the right spirit.

We can use data and forecasting to continually test and prove or disprove our assumptions. This is hugely valuable.

While we shouldn’t blindly follow complex models or the advice of supposed experts, we can use these learnings as a piece to plug into our larger puzzle of understanding financial markets.

Roche concedes that most short-term forecasts are worthless, but the process of using past data to make forecasts and test our hypotheses is quite logically sound.

Wrapping it up

To read his full list of investing myths, you can do so here.

And don’t miss our most recent interview with Cullen Roche to better understand his thinking.

Let us know — Do you disagree with any of Roche’s investing myths?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to the email.