Securities Fraud

13 January 2023

Hi, The Investor’s Podcast Network Community!

We’ll be hitting your inbox Sunday to share some of our favorite insights from Jim Collins, but we’re off Monday to observe the Martin Luther King Jr. holiday. Markets will be closed, too 🏖

Looking back, 2022 was a unique year in markets. We saw a hit to the 60/40 portfolio (60% stocks, 40% bonds) that was truly rare.

Negative returns to both stocks and bonds over any 12-month window, as we saw last year, have only occurred 2% of the time since 1926 🤯

While the 60/40 portfolio has generated 8% annualized nominal returns over the last decade, analysts at Goldman Sachs are predicting annualized returns to be about 20% lower over the next one.

Here’s the rundown:

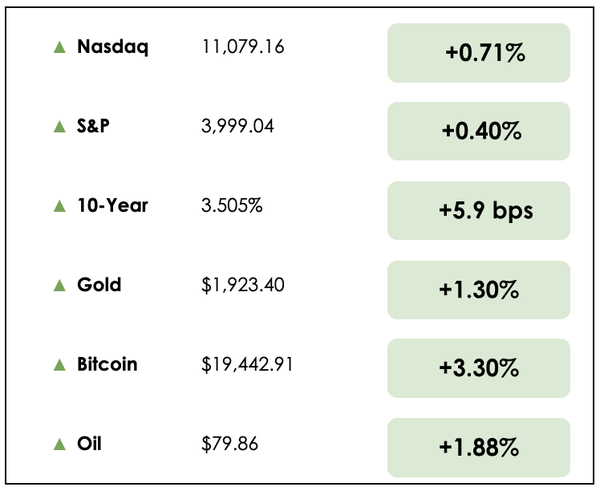

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: A major SEC lawsuit against two prominent crypto firms, and bank earnings arrive, plus our main story on the importance of temperament over intellect in markets.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

📄 Genesis and Gemini Sued by SEC over Lending Product (WSJ)

- The Securities and Exchange Commission (SEC) sued Genesis and Gemini yesterday over a $900 million crypto-lending program that allegedly violated investor-protection laws.

- Under a program called Gemini Earn on Gemini’s crypto exchange, the company raised billions of dollars worth of digital assets from hundreds of thousands of investors without properly registering the product, according to the SEC’s civil lawsuit filing.

- Customers could deposit their digital assets onto Gemini to earn yields as high as 8%, as Gemini then lent the funds to Genesis while taking a fee for arranging the loans. Following the FTX collapse, the two companies have been feuding after Genesis abruptly paused withdrawals in November.

- Genesis apparently holds up to $900 million in assets from 340,000 Gemini Earn customers, as the SEC’s lawsuit seeks to impose fines and recover illegally earned profits. In a similar lawsuit, Blockfi settled the dispute by paying a $100 million fine for its digital asset lending products.

- After laying off 30% of its staff last week, Genesis is said to be considering bankruptcy.

- As this crisis in the crypto world unfolds, the SEC and other regulators are proving woefully reactive rather than proactive. They must now dig through the ashes of collapsed businesses to try and protect investors.

🏦 Bank Earnings Arrive (WSJ)

- Banks are important bellwethers of economic health, given their critical role in facilitating growth through loans. Bank earnings are here, and profits were up at America’s two largest banks.

- Profits at JPMorgan (JPM) rose 6% as revenue surged 18%, though the bank set aside $1.4 billion for protection against loan losses in a mild recession. Bank of America (BAC) saw 2% profit growth, while Wells Fargo (WFC) continued to struggle with regulatory woes after paying a $3.3 billion fine from the Consumer Financial Protection Bureau last quarter.

- Capital market activity remained in dire straits, with JPMorgan and Citigroup (C) posting a 58% decline in investment-banking fees.

- Banks typically have a variety of different ways to make money. Although lending is at risk with an expected recession pending and investment banking fees dropping off a cliff, traders on Wall Street have taken advantage of volatile markets, providing a silver lining for major banks. JPMorgan booked $5.67 billion in revenue from its trading of stocks, bonds, currencies, and commodities.

- Interestingly, we also learned that JPMorgan made a “huge mistake” in paying $175 million for a startup that apparently was a fraud and fabricated its customer base.

- Overall, the big banks face a tough lending environment, and investors will continue to watch their quarterly earnings for insights into the economy’s health. Goldman Sachs (GS), for example, has lost over $3 billion in its consumer lending endeavors since 2020.

WHAT ELSE WE’RE INTO

📺 WATCH: Investing guru Mohnish Pabrai’s principles for success

👂 LISTEN: Top takeaways from 2022, with Trey Lockerbie

📖 READ: Estimates show that net migration over the last year added over a million people to the U.S. population

Warren Buffett has said, “Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.”

The late global investor Sir John Templeton relocated from New York to the Bahamas, where copies of The Wall Street Journal arrived days late. By reading the news a week late, Templeton could put it in perspective and prevent himself from overreacting, his way of combatting behavioral biases.

This is the same investing pioneer who once noted, “The four most expensive words in investing are, ‘This time it’s different.'”

Unlike the macro environment, earnings, and the Fed’s actions, temperament is entirely in one’s control.

Overcoming oneself

The great financial analyst Benjamin Graham believed that becoming an intelligent investor depends more on “character” than on intelligence as it’s conventionally defined.

Graham, Buffett’s mentor, said an investor’s “chief problem, and even his worst enemy, is himself.”

Many bad investment decisions are good ideas taken too far. “The key to making money in equities,” Peter Lynch has said, “is not getting scared out of them.”

Over the past 40 years, there have been major declines, bubbles, wars, inflation, and endless uncertainty. Yet human behavior repeats itself.

To Buffett’s point, doing well in markets isn’t necessarily about how much you know. It’s about how you behave. Our upbringing, temperament, worldview, ego, and ability (or inability) to remain calm in downturns all factor into how we invest and think about risk.

Consider advice from psychologist Daniel Kahneman, known for his work on the psychology of judgment and decision-making, as well as behavioral economics, for which he was awarded the 2002 Nobel Memorial Prize in Economic Sciences: He said the key to investing is having “a well-calibrated sense of your future regret.”

Staying disciplined

Some studies have shown that investment biases, including the reluctance to realize losses and performance chasing, are human in the sense that we’re born with them.

Genetic factors explain up to half of the variation in these biases across individuals. In short: Sound investing isn’t really about extraordinary intelligence. A genius who cannot handle risk or emotion can lose a lot of money quickly, just as ordinary folks with no formal education can become quality investors with baseline investment knowledge and excellent behavioral skills.

Morgan Housel writes about this in The Psychology of Money, telling the story of a janitor who stowed away money each month. He let it compound in the stock market and didn’t interrupt the compounding.

Over decades, the sum had grown to be over $1 million.

Housel’s point: Investing is a soft skill more than anything else, with many human variables involved.

Advisory Group CXO tracked the results of 6,582 predictions from 68 investing “gurus” made between 1998 and 2012. Despite having some well-known names in the sample, the average guru’s accuracy (47%) didn’t beat a coin toss. Forty-two of the 68 gurus had accuracy scores below 50%.

“All the conditions for extreme overvaluation or undervaluation absolutely exist the way they did 50 years ago,” Amazon founder Jezz Bezos has said. “You can teach all you want to the people, you can tell them to read Ben Graham’s book, you can send them to graduate school, but when they’re scared, they’re scared.”

Extra work doesn’t equal reward

One of the juxtapositions of investing is that extra time spent researching stock picks or trading in and out of positions doesn’t mean higher returns.

It’s difficult to foresee how fear, uncertainty, and anxiety can seep in when a portfolio grinds lower. In other pursuits, you log the hours and often see the results.

As Housel explains, if you want to improve your free-throw shooting, you might stay after practice for extra shots. If you want to do well on a finance or biology exam you might ask questions in class, study each night, and organize a review session with classmates.

But investing is ruthless. Extra work doesn’t necessarily provide any marginal benefit. What’s needed is an awareness of one’s temperament, attitudes, feelings, and tendencies.

In an interview with Charlie Rose, Charlie Munger and Buffett offered the following exchange:

Munger: “We’ve learned how to outsmart people who are clearly smarter (than we are).”

Buffett: “Temperament is more important than IQ. You need reasonable intelligence, but you absolutely have to have the right temperament. Otherwise, something will snap you.”

Munger: “The other big secret is that we’re good at lifelong learning. Warren is better in his 70s and 80s, in many ways, than he was when he was younger. If you keep learning all the time, you have a wonderful advantage.”

Buffett: “And we have a wonderful group of friends, from whom we can learn a lot.”

Dive deeper

If you’re looking for some deep reading on temperament and Buffett, check out Alice Shroeder’s bestseller, The Snowball: Warren Buffett and the Business of Life.

And don’t miss Clay Finck’s latest podcast on Warren Buffett’s money mind.

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.